Summary:

- Mastercard’s strong fundamentals over the next five years build a more substantial foundation for upward momentum and stock price.

- As financial services evolve, Mastercard will most likely stay ahead of the competition as new financial innovations will be upon us in the next few years.

- For the short term, one might be interested in investing with some trepidation at the start but should quickly scale up more positions as stock price improves.

yalcinsonat1

Introduction

Mastercard (NYSE:MA) is one of the largest credit card processors on the planet. This financial services company shows strong forward guidance and decent-looking dividend income over the next few years. Currently, some questions might be asked if a short-term investment should take place for this company.

Fundamentals very strong with decent guidance estimates and dividend growth

Mastercard recently added new cryptocurrency options that banks can deploy as new digital offerings. This should significantly enhance MA stock price as new service offerings are found for the company.

With the recent earnings announcement, Mastercard benefits from rebound travel as the world opens up after the pandemic. Added spending on travel, restaurant, and entertainment, has helped boost the stock.

The results were mostly in line with the forecasts of analysts surveyed by FactSet, who expected the company to turn in GAAP earnings of $2.58 per share from $5.6 billion in revenue. Mastercard’s revenue climbed 23% from the year-ago quarter on a constant-currency basis, while net income increased 4% to $2.5 billion.

There might be some risks, as hinted:

Outside of travel, customers appear resilient even in the face of recession worries. Bank earnings earlier this month showed that spending on credit cards increased 10.6% from a year ago.

Ratios

Like direct competitors, including Visa (V), Mastercard shows similar growth among its current and quick ratios. Last year appears that it was the weakest year coming out of the pandemic.

|

Unnamed: 0 |

2017 |

2018 |

2019 |

2020 |

2021 |

|

Period |

FY |

FY |

FY |

FY |

FY |

|

Current ratio |

1.569 |

1.395 |

1.420 |

1.613 |

1.288 |

|

Quick ratio |

1.265 |

1.131 |

1.108 |

1.262 |

0.928 |

|

Cash ratio |

0.675 |

0.576 |

0.587 |

0.854 |

0.564 |

Source: Financial Modelling Prep

Growth

According to the last five years, 2021 represents the most substantial year for revenue and gross profit growth.

|

Unnamed: 0 |

2017 |

2018 |

2019 |

2020 |

2021 |

|

Period |

FY |

FY |

FY |

FY |

FY |

|

Revenue growth |

0.160 |

0.196 |

0.129 |

-0.094 |

0.234 |

|

Gross profit growth |

0.147 |

0.196 |

0.137 |

-0.137 |

0.250 |

Source: Financial Modelling Prep

Data

The simple moving average of 20 days is strong, with a decent performance for 50 days. The simple moving average for 200 days was not too severely hit on the negative side compared to other similar stocks in the same category.

|

Unnamed: 0 |

Values |

|

SMA20 |

10.17% |

|

SMA50 |

6.97% |

|

SMA200 |

-1.81% |

Source: FinViz

Enterprise

MasterCard’s stock price has been firm, as it has more than doubled in the last five years. The number of shares has been the same, while the market cap has more than doubled. Historically this is a powerful momentum-based stock one should be aware of.

|

Unnamed: 0 |

2017 |

2018 |

2019 |

2020 |

2021 |

|

Symbol |

MA |

MA |

MA |

MA |

MA |

|

Stock price |

167.190 |

204.020 |

324.460 |

316.290 |

382.510 |

|

Number of shares |

1.067 B |

1.041 B |

1.017 B |

1.002 B |

1.002 B |

|

Market capitalization |

178.392 B |

212.385 B |

329.976 B |

316.923 B |

383.275 B |

Source: Financial Modelling Prep

Estimate

Despite Mastercard’s recent strong momentum over the years, one would expect revenue growth estimates would be just as robust. When you look at dividend yield, it may grow by nearly 300% over the next five years while keeping its earnings price per share manageable. One concern is that net profit might not be as substantial as in the last five years.

|

YEARLY ESTIMATES |

2022 |

2023 |

2024 |

2025 |

|

Revenue |

22,193 |

25,136 |

28,995 |

32,222 |

|

Dividend |

1.84 |

2.03 |

2.08 |

4.53 |

|

Dividend Yield (in %) |

0.57 % |

0.63 % |

0.65 % |

1.41 % |

|

EPS |

10.54 |

12.19 |

14.77 |

17.31 |

|

P/E Ratio |

30.55 |

26.42 |

21.81 |

18.61 |

|

EBIT |

12,557 |

14,548 |

17,177 |

20,110 |

|

EBITDA |

13,338 |

15,398 |

18,111 |

20,848 |

|

Net Profit |

10,272 |

11,567 |

13,734 |

16,361 |

|

Net Profit Adjusted |

10,280 |

11,553 |

13,717 |

16,361 |

Source: BusinessInsider

Technical Analysis shows temporary mean reversion downturn

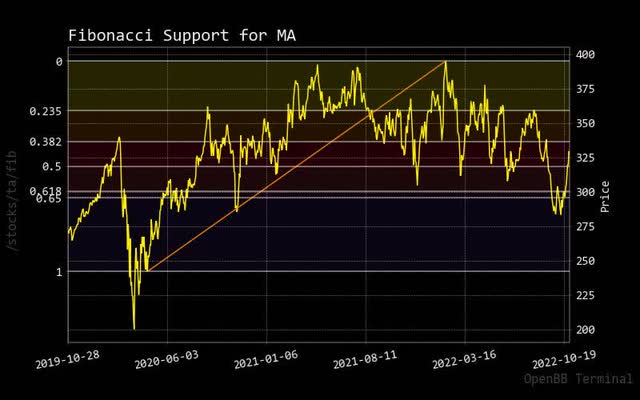

Fibonacci

As well as a direct competitor of Visa, there is an apparent pricing pattern similar to its stock price. As stock price does increase in a similar volatile wave, it is expected that the price should trend back down to revert to its mean.

finonacci mastercard (custom platform)

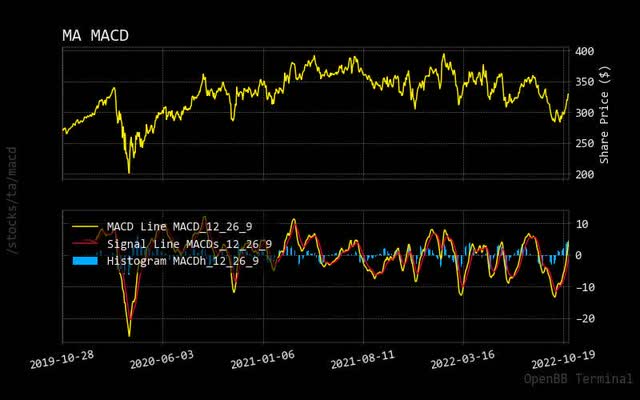

MACD

The MACD compressed price line shows a slight decline in the stock price of Mastercard. Based on historical patterns in the last few months, MA could slowly trend back to reverting to its mean of the current price line trend since the spring.

macd mastercard (custom platform)

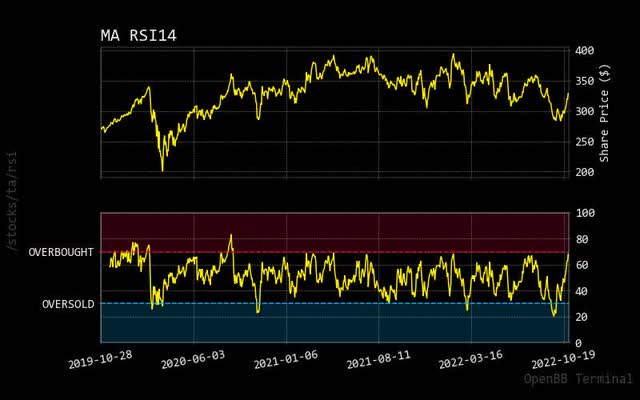

RSI

The relative strength indicator is essential to gauge a current stock price condition. The current price of Mastercard is reaching the overbought market condition. Usually, when this is approached, one can expect a price decline to say it reverts to its mean in a downward trend, as explained in the other technical indicators sections.

rsi mastercard (custom platform)

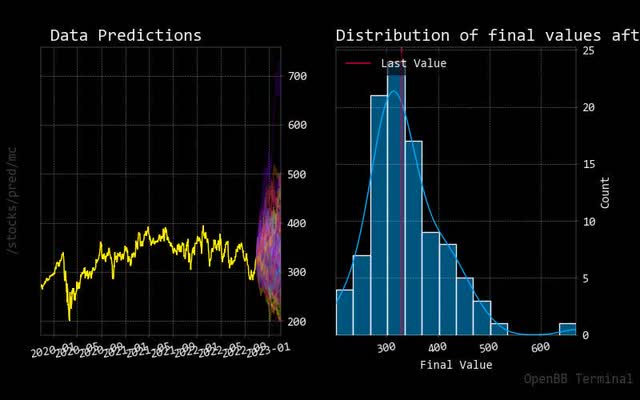

Prediction via AI

Monte Carlo

Compared to similar companies in this financial services sector, the Monte Carlo simulation does not overwhelmingly predict higher prediction paths. One would need to see extreme price expectations to be convinced of a higher forecasted price to be confirmed.

Also, in the normalized distribution chart, the expected price increases are like the Monte Carlo simulation. This means they could be stronger and more convincing than similar financial services competitors.

monte carlo mastercard (custom platform)

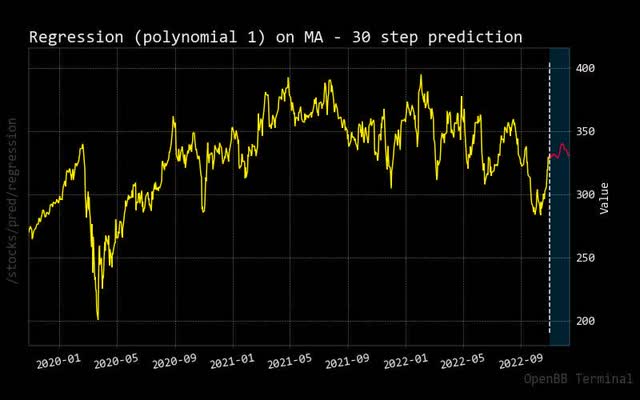

Regression

The forecasted red regression line over 30 days shows a rangebound stock price motion. For the short term, there is no upward momentum in the stock price. This is only important for short-term day traders.

regression mastercard (custom platform)

Risk should remain short term

Insider Stats

There has been some recent selling action from executives, but it is relatively low, so this should not be a concern. If this continues, we can expect the price to fall, which this activity can impact.

|

Unnamed: 0 |

X |

Filing Date |

Trading Date |

Ticker |

Insider |

Title |

Trade Type |

Price |

Quantity |

Owned |

Delta Own |

Value |

|

0 |

D |

2022-11-01 16:44:36 |

2022-10-28 |

MA |

Kirkpatrick Linda Pistecchia |

Pres, North America |

S – Sale+OE |

$320.00 |

-7,064 |

11,207 |

-39% |

-$2,260,480 |

|

1 |

D |

2022-08-16 16:19:20 |

2022-08-15 |

MA |

Sachin J. Mehra |

CFO |

S – Sale+OE |

$360.00 |

-5,000 |

15,723 |

-24% |

-$1,800,000 |

|

2 |

M |

2022-08-12 16:23:46 |

2022-08-11 |

MA |

Mastercard Foundation |

10% |

S – Sale |

$352.40 |

-354,425 |

102,743,258 |

0% |

-$124,900,486 |

|

3 |

M |

2022-08-10 16:25:51 |

2022-08-08 |

MA |

Mastercard Foundation |

10% |

S – Sale |

$351.43 |

-531,633 |

103,097,683 |

-1% |

-$186,829,871 |

Source: Open Insider

Sustainability

As one can see, the sustainability performance is underrated, meaning some controversies are holding back this stock. Personally, it is essential that any company wanting to move up to the ‘next’ investment level needs to raise its ESG rating to get top-level institutional investment from the most significant asset managers in the world.

|

Unnamed: 0 |

Value |

|

Social score |

8.1 |

|

Peer count |

105 |

|

Governance score |

8.57 |

|

Total esg |

16.98 |

|

Highest controversy |

4 |

|

ESG performance |

UNDER_PERF |

|

Peer group |

Software & Services |

|

Environment score |

0.32 |

|

Military contract |

False |

Source: Yahoo Finance

Recommendation

Based on solid fundamentals, one can see why some market analysts will put a buy rating recently on Mastercard.

|

Interval |

RECOMMENDATION |

BUY |

SELL |

NEUTRAL |

|

One month |

NEUTRAL |

7 |

9 |

10 |

|

One week |

BUY |

13 |

4 |

9 |

|

One day |

BUY |

15 |

5 |

6 |

Source: Trading View

Conclusion

This article indicates Mastercard’s solid fundamentals and relatively decent technical indicator signs. I can see why these recommendations exist, as other market analysts call out a buy now. As a result, it might be wise to call for a ‘buy’ with some price-level expectation challenges in the short term. There are promising signs for long-term investment for higher dividend strength and better stock price improvement.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.