Summary:

- Lucid Motors slashes guidance for 2023, expects lower level of deliveries than previously guided for.

- Slow rate of delivery growth and production slump raises concerns about the company’s valuation and future prospects.

- Lucid Motors faces deep losses, potential capital raises, and declining sales estimates, making its stock less attractive.

hapabapa

Lucid Group, Inc. (NASDAQ:LCID) keeps disappointing its investors: The electric vehicle company slashed its guidance for 2023 again after its production plummeted in the third quarter and Lucid Motors now expects a far lower level of deliveries than previously guided for.

Lucid Motors is now on track to deliver a rather pitiful amount of 8,000-8,500 electric-vehicles in 2023, compared to a 10K plus guidance before. The new guidance for deliveries implies that Lucid Motors might only deliver 820 vehicles more than last year which would translate to an embarrassing YoY growth rate of just 11%.

Yet another production and delivery slump is hard to swallow, even in light of Lucid Motors announcement that its second model, the Gravity SUV, will start production next year.

Given the slow rate of delivery growth, my patience is worn out and I think that the slow pace of production growth no longer justifies Lucid Motors’ premium valuation multiple and even the risk of a reverse stock split is on the horizon if the present down trend continues.

My Rating History

I must confess that I have slowly, but steadily soured on my investment in Lucid Motors which at some point was my largest portfolio holding. With that being said, the slow rate of production growth has been a thorn in my side for a while, despite the electric-vehicle company starting assembly in Saudi Arabia recently.

In light of such woes I feared that Lucid Motors was headed for penny stock territory and I think that the electric-vehicle startup may even have to conduct a reverse stock split in order to save its stock listing. Since my first recommendation, Lucid Motors’ value has plummeted more than 90%. I have now liquidated my position entirely.

Deep Losses Related To Production Ramp And It Is Only Going To Get Worse

Lucid Motors is light years away from profitability and the slashed guidance as well as the cost trajectory imply that the company faces considerable obstacles in the near future which may result in new capital raises from the company’s main backer, Saudi Arabia’s sovereign wealth fund.

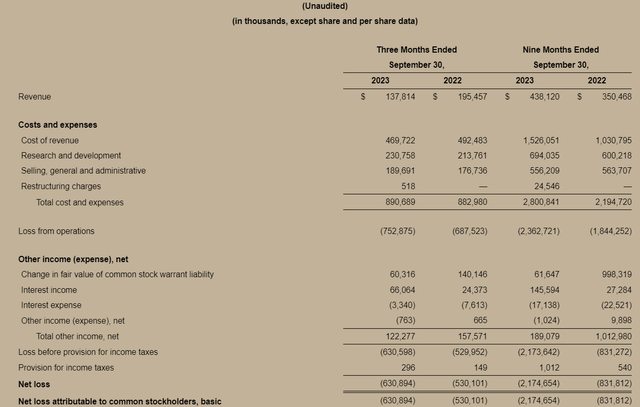

The company racked up $630.9 million in losses in the third quarter, reflecting an increase of $100.8 million compared to the year ago period. The rise in losses is due to rising production costs as the company scales production of its Lucid Air Pure, but also because sales are behind expectations.

Lucid Motors’ 3Q-23 sales actually fell 30% YoY which is a rather stunning decline and indicates that higher production costs are not the only concern here. However, with the launch of the Gravity SUV (see further below for a discussion), the profit picture is likely going to get worse before it gets better.

Profit And Loss Statement (Lucid Motors)

Lucid Motors Slashed Its Guidance Again

Lucid Motors is unable to follow through on its previous guidance which called for the production of 10,000 electric-vehicles this year. The electric-vehicle company scaled back its guidance to a new range of 8,000-8,500 which was an enormous disappointment.

For reference, Lucid Motors produced 7,180 EVs in 2022, meaning that the startup might see only an 11% production increase YoY, or a total delivery increase of 820 electric-vehicles. This is a huge disappointment and most certainly not worthy of a huge premium that Lucid Motors’ stock is still selling for.

Positive News

Lucid Motors launched its latest electric-vehicle model, the Lucid Gravity SUV, at the LA Auto Show on November 16. The Lucid Gravity is the second development of Lucid Motors and is expected to come to market at the end of 2024, has an estimated driving range in excess of 440 miles and will have an estimated MSRP of around $80K. The launch was rare positive news coming from Lucid Motors’ headquarters, but it didn’t do much to lift the company’s stock up.

Sales Estimates Continue To Fall, Premium Valuation No Longer Sustainable

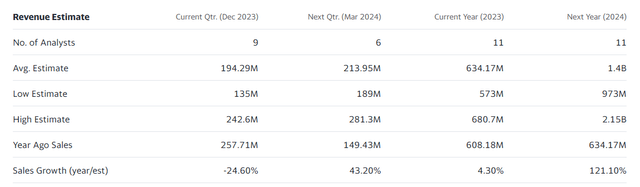

The market models substantially lower sales for Lucid Motors following the slashed guidance. The average sales estimate for Lucid Motors for next year is down to $1.4 billion compared to $1.9 billion at the beginning of October. This means that the market has shaved off a cool half a billion of expected sales for 2024 within 6 weeks.

Of course, with estimates declining this rapidly, the stock becomes more expensive and given the clouds that are now hanging over the company’s delivery ramp, I think that the sales multiple as such is too high.

Lucid Motors is presently valued at 7.1x next year’s sales and the beginning of production of the Gravity model is likely to, at least in the short-term, raise the company’s production costs substantially. In short, Lucid Motors is still years away from profitability. Tesla Inc. (TSLA) has a sales multiple of 6.4x (based on next year’s sales), but Tesla is much bigger and generates a boatload of profits already.

Revenue Estimate (Yahoo Finance)

Why Lucid Motors Could See A Lower/Higher Valuation

I don’t see bankruptcy on the horizon given Lucid Motors’ strong balance sheet and repeated financial backing of Saudi Arabia’s sovereign wealth fund.

With that being said, the business as well as the stock trend are deeply concerning and the latest cut to the company’s guidance only exacerbates those fears. Thus, Lucid Motors may tap its financial sponsor again, particularly with the Lucid Gravity going into production next year.

Lucid Motors is a highly shorted stock (28% of its float is shorted), so there is, theoretically, a potential for a short squeeze. The overall business arc, however, is less than convincing.

My Conclusion

I am done. I stuck it out for a while and believed that Lucid Motors could execute much better, scale faster and produce higher sales. However, the company has repeatedly let investors down, particularly as it relates to production growth.

Lucid Motors cut its guidance to 8,000-8,500 which is a gut punch, to be honest. The new estimate implies just 11% YoY growth in the worst-case scenario which is not worthy of a 7.1x sales multiple.

I don’t see a valid upside case at the moment, particularly with sales estimates falling off a cliff. I am deeply disappointed and humbled and have decided to cut my losses here.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.