Summary:

- Mastercard is a superior business with a simple and widely used business model in the cashless society.

- The stock has outperformed the S&P and has a strong track record of growth and resilience.

- The company offers a safe dividend with low payout ratios and a history of dividend growth and has promising future growth prospects.

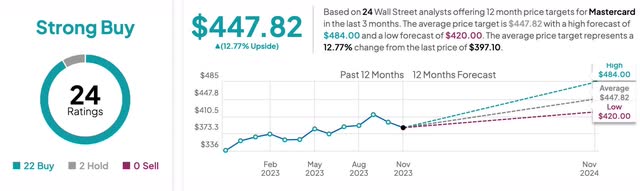

- Although the stock’s price has appreciated consistently over the past year, it still offers investors a double-digit upside to its price target of $447.

- The business could face a slowdown in the near term due to surging credit card debt and a recession due to fewer transactions.

jbk_photography

Introduction

I recently wrote an article on Mastercard’s (NYSE:MA) peer Visa (V) earlier this month and I opened a position in the stock soon after. As a dividend investor, I instantly thought to myself, Why didn’t I buy this sooner? We’ve been transitioning to a cashless society for years now and what better way to take advantage than by holding a position in a payment processing company? I really enjoy their simplistic business models and I think these are the types of stocks you can hold forever. As I mentioned in my Visa article, 82% of adults hold at least one credit card in their wallets, usually a Visa or Mastercard. I personally don’t hold any Mastercards; I hold all Visa with the exception of my two American Express (AXP) cards. In this article, I get into why Mastercard is a dividend grower that you should consider holding.

Superior Business Model

Because everyone uses a credit card, right? Or will at some point in their life. Every single day throughout the world people are swiping their credit cards and making transactions. If you’re reading this and looking into your wallet, there’s a good chance you have a credit, debit, or some kind of card that has the name Mastercard or Visa on it. A business model that’s so simple, yet so superior. The reason why I think MA has a quality business model is because consumers use it every day without thinking about it.

It’s in the fabric of our everyday lives and something that we will continue to use in the future. Unlike their peer Discover (DFS) which is both a payment processor & issuer, this mitigates risk as they hold no responsibility for consumer credit card debt. As a result, this protects them during economic downturns or when credit card debt tends to be high like now. In some parts of the world, I’m sure they still use cash but in most places, credit or debit cards are the payment of choice.

Additionally, many consumers prefer to shop online nowadays whether it be ordering their favorite items from Amazon (AMZN) or any other retailer. And the only way to do that is with some type of card. So, you have to ask yourself: Is this something that will be around in 20-30 years? Of course, no one knows for certain but I think it’s safe to say the answer is yes.

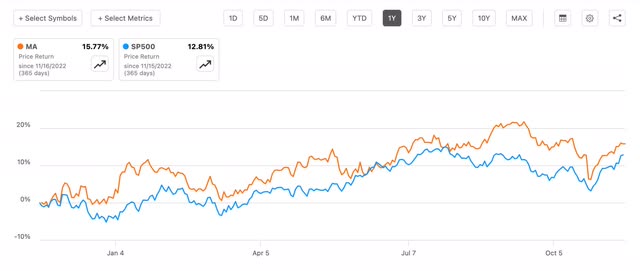

Performance Vs. The S&P

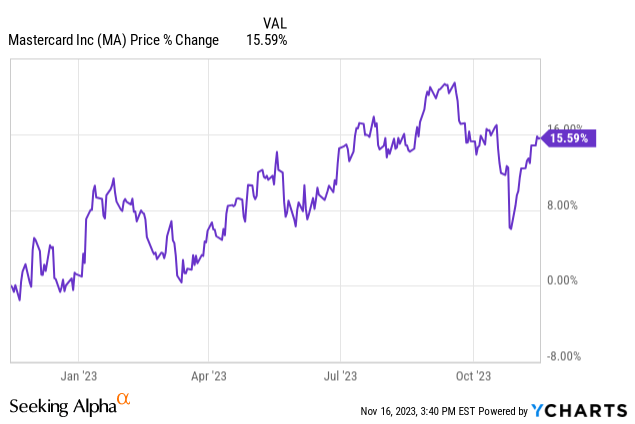

While many stocks have seen a lot of volatility in the past year, especially the lower-yielding ones, MA has been performing well up nearly 16%. The stock has a 5-year dividend yield of less than 1%, yet it has outperformed the S&P. I think that’s because of their high-quality business model as I mentioned earlier. Businesses with excellent models typically show their resilience and financial strength during downturns or times of uncertainty. And Mastercard has done just that.

During the same time, the S&P is up nearly 13%, above you can see they’ve outperformed the index by roughly 3%. I mean who wouldn’t want to beat the S&P. Especially if you’re a dividend investor? 2023 has not been a great year for us as many dividend stocks have been pummeled by higher interest rates. Before 2022, rates were at historic lows and many dividend-paying companies flourished. Especially REITs. But with many thinking the days of 0% interest rates are gone, how will these fare going forward? For those like MA with sustainable business models & growing dividends, I think they’ll do just fine and remain resilient.

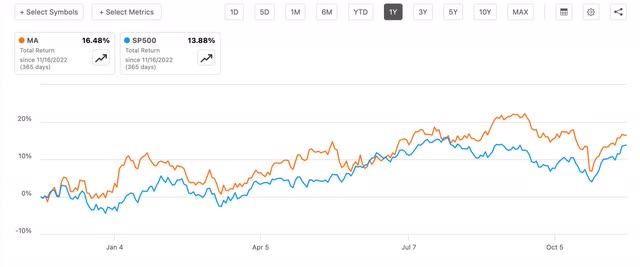

Here is how MA did in total returns vs the S&P over the last year:

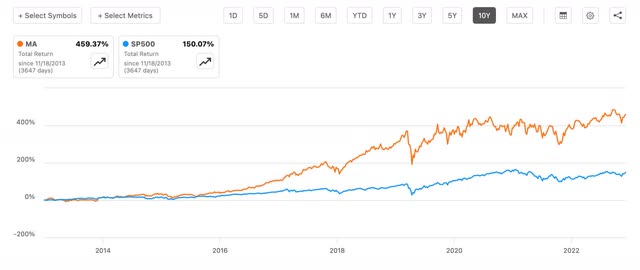

And below is how they’ve done in the last decade against the index. So, you have to ask yourself, would a stock that didn’t have a superior business model outperform the S&P over a 10-year period? Stocks that aren’t of high quality might have a good year or two and may even outperform the index over a short period of time but not over the long term. I remember in 2020 & 2021 there were several low-quality businesses having a great year because investors were jumping in treating the market like a casino. I’m sure those investors are now gone. That’s why it’s important to pick high-quality businesses that you think are going to grow over time and be worth more.

Short Term Thinking

Many Seeking Alpha readers have commented about placing their money into bonds because they’re more attractive at the moment. Again, everyone has their preference but that’s a short-term mindset in my opinion. Investors with that mentality who are scared of volatility may not base their judgement on or trust company fundamentals. Or maybe they didn’t do their due diligence and heavily relied on articles posted here. It takes a lot of emotional control to look at your account balance go down week after week feeling like it will never end. But when you’re invested in high-quality companies like Mastercard you know it will not stay down forever.

I remember watching a video from Warren Buffett a while ago. In it, he stated:

People think when the stock is going down the stock is telling them something. What it’s telling me is I can get more for my money.

I honestly say I’ve done this in the past because I didn’t do my due diligence or look deep into the company’s fundamentals. Yes, I’ve sold some stocks to take advantage of valuations in other positions, but now generally I buy my stocks with a forever hold mentality.

Super Safe Dividend

Collecting dividends is great and all, but it’s almost pointless if the dividend is not sustainable for the long term. We saw that earlier this year when Medical Properties Trust (MPW) cut its dividend. I’ll admit I was an investor in this stock but managed to sell out before the dividend cut. I saw the writing on the wall when the fundamentals started to deteriorate but it was indeed a heavily touted stock here on Seeking Alpha. But that’s why it’s important to do your due diligence. Fundamentals can change within companies, but the higher-quality ones usually don’t change over a short period.

I prefer a safe dividend. Low earnings & FCF payout ratios are key. Manageable debt also plays a part in dividend investing as well. And the best is when a stock has all those attributes and is growing the dividend as well. Since the last stock split, Mastercard has grown its dividend over 418% from $0.11 to the current $0.57. In nearly the last decade they’ve had an annual dividend growth rate of roughly 20%.

And while they’ve grown the dividend at an annual rate of 20%, they also increased earnings and maintained healthy, conservative payout ratios. Even during COVID, the free cash flow & earnings payout ratio both were well below 60%, considered safe for most dividend stocks. As you can see from the chart below their ratios are expected to drop even lower to 17% in the next 12 months. Stocks like MA that have very low payout ratios are able to reinvest back into the business to fund future growth projects. It’s also important because these companies tend to fare better during unexpected downturns or recessions. With payout ratios this low the company could literally double their dividend and still be within a safe range.

What Does The Future Hold?

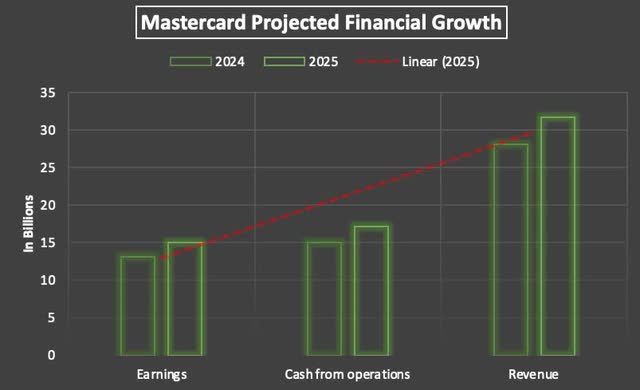

For stocks like Mastercard that have performed so well you have to wonder:

What does their growth look like a couple of years from now? Will the stock stagnate? Or will they continue their growth trajectory?

Earnings, CFO, and revenue are expected to grow double-digits over the next two years. Cash from operations is expected to grow the least, but still impressively at 13.7%. Revenue and earnings are both expected to grow 13% and 15%, respectively. Free cash flow is also expected to grow at double digits over the same period as well.

During Q3 earnings in October MA showed some impressive numbers beating on both the top & bottom line. Revenue of $6.53 billion beat analysts’ estimates by $5.88 million while EPS of $3.39 beat by $0.18. In this current macro environment, those are some impressive numbers. Especially with inflation still a headwind and consumer credit card debt at record numbers.

Management stated during earnings they saw a substantial runway for growth through long term potential of in-person to merchant payments in fast-growing service capabilities. They also saw future growth opportunities in open banking and digital identity. Additionally, they agreed to a long-term partnership with Citibank (C) to forge a global commercial card partnership covering more than 60 markets.

They also recently partnered with Live Nation music, the world’s leading live entertainment company, expanding to 19 markets in Europe & Asia. This will give more than 100 million Mastercard users access to concert presale tickets, seats, etc. This will be huge going forward for the company. In Q3, gross dollar volume internationally was 13% compared to 11% in the U.S. so expanding into more markets outside of the country I think will bode well for the business.

Headwinds

Quality businesses like Mastercard don’t face as many risks as others but as the saying goes, “No business is without risk.” A recession in 2024 or 2025 is still on the horizon so I think this poses the biggest threat to MA. Job losses and lower consumer spending will result in lower transactions. These contribute to the company’s revenue so this will likely be a factor.

There’s also the surging American credit card debt. In the third quarter, this reached a new record of $1.079 trillion, up from $1.031 trillion in Q2. This shows consumers are still spending but eventually I see this affecting the business of Mastercard as well. Higher balances will also likely lead to fewer transactions. And if the Fed decides to hike rates more in the future, this will only continue to be a headwind in my opinion.

Valuation

As previously mentioned, Mastercard has seen its price appreciate double digits since the start of rate hikes. Although they are low-yielding, consumers flocked to the stock causing the share price to rise a good amount. But even with this I still think the stock has room to grow. Of course, we all want great margins of safety but with stocks like MA, those come a dime a dozen. Their P/E of 34x is higher than their peer average of 26.3x when you compare them to Global Payments (GPN), Fiserv (FI), PayPal (PYPL), and Visa.

But I think the reason for this is MA’s business model and global brand. Economic uncertainty plays a factor as well. Most investors know when there’s a lot of uncertainty in the economy, stocks like MA, or other high-quality business models tend to become overvalued. Analysts currently rate them a strong buy and it does offer some upside to its price target of $447. If the economy does fall into a recession next year the stock could see the price fall, similar to during the GFC. But to be fair Mastercard was a much smaller business back then.

Investor Takeaway

Mastercard is a premier business and global brand that all long-term dividend investors should consider holding. The stock offers everything a dividend investor can think of. A low, conservative payout ratio, a growing dividend, and increasing healthy financials. Furthermore, the stock has outperformed the S&P over the short and long term in price and total returns. Due to the economic uncertainty in the past year, this has caused the stock’s price to appreciate double-digits. Even with this the stock has room to continue to appreciate and offers investors nearly 13% upside to its price target at the time of writing.

Some headwinds Mastercard faces is if the economy does slip into a recession next year. This could cause the stock to lose some of its luster and share price appreciation as investor confidence could take a hit due to lesser consumer spending, causing lower transactions for the business. This will likely affect the company’s revenues and may sour investor sentiment in the stock, sending it lower. However, due to their superior business model and long-term growth prospects, I think this would present investors an opportunity to pick up a great stock at a good price.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.