Summary:

- Tesla, Inc. labor challenges in Sweden, followed by better terms for German workers, could be a sign of things to come in the U.S. after other automakers recently have faced strikes.

- This risks adding to Tesla’s already shrinking margins and slowing revenue growth as it cuts prices to sustain demand in a challenging economy and beat competition, too.

- While Tesla has made significant price gains YTD, the softening financials, worker-related issues, and elevated market multiples stack the odds against it for now.

Дмитрий Ларичев

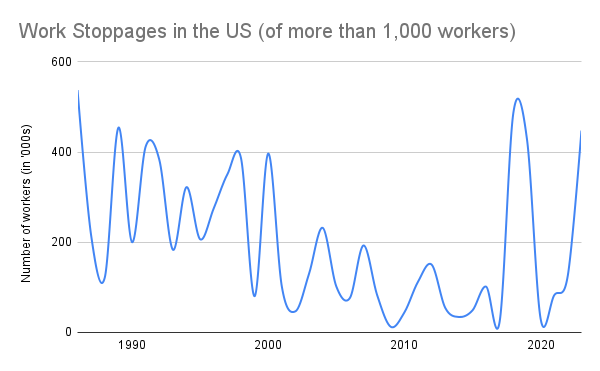

Here’s a statistic to chew on: up to October, 447,000 workers have gone on strike in the U.S. this year. This means that 2023 could well be the year when the previous high of 485,000, seen in 2018, could be surpassed. This, in turn, would make 2023 the biggest year of strikes in close to four decades.

Source: Bureau of Labor Statistics

What might this have to do with the electric vehicle (“EV”) poster company Tesla, Inc. (NASDAQ:TSLA), you might well ask. After all, it has seen an exceptionally healthy 124% price return year-to-date [YTD]. It has also far outstripped the performance of its biggest peers by market share and by market capitalization.

As it happens, the spillovers of sky-high inflation experienced over the past two years have come knocking on Tesla’s door after other EV biggies like General Motors (GM) and Stellantis (STLA), the joint venture of Chrysler and PSA Group, apparently have reached agreements with labor unions on better terms very recently.

A battle of ideologies in Sweden

The difference between other automobile companies and Tesla, however, is that while the former have histories of dealing with unions, the latter has been in ideological opposition to unionization for a while now. So, it remains to be seen how the issue finally gets put to bed, or not.

For now, the risks of it becoming bigger can’t be ignored. It started with a relatively small affair, with mechanics in Sweden withdrawing their cooperation with the company after failed attempts at getting a collective bargaining agreement through. Now, the country’s postal and dock workers have joined in, which threatens to disrupt the delivery of components for repairs.

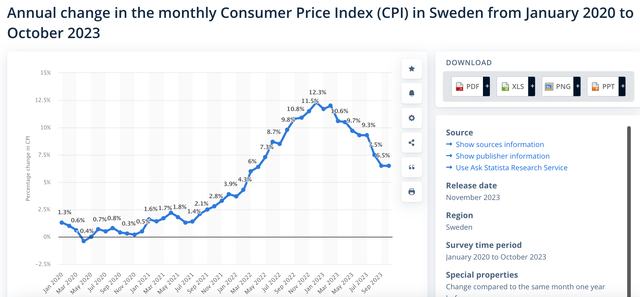

The macroeconomic context of the country is of significance here. Inflation in Sweden was at 6.5% in October 2023, a significant come-off from the levels last year (see chart below), but still much higher than the 2.8% seen two years ago. The impact of a cost-of-living crisis, coupled with a weak economy seen in a contraction in the latest quarter, is quite likely to have contributed to the situation, in no small part.

Tesla, on its part, sticks to its guns. On the Sweden issue, it is quoted as saying:

“We already offer equivalent or better agreements than those covered by collective bargaining and find no reason to sign any other agreement.”

Now, Sweden is far from being a key market for Tesla, which obtained 72% of its revenues from the U.S. and China in 2022, while all other markets contributed to the remaining 28%. The company doesn’t manufacture in the country, either.

The Germany risk

It does so, however, in Germany, its only major international manufacturing location (currently) besides China (though it has or plans to have facilities in The Netherlands and Mexico as well). And its current challenges in Sweden now risk spilling over into this important geography. According to reports, workers in Germany were being made aware by IG Metall, a union of German metalworkers, about unionization as well. From a macroeconomic standpoint, the conditions in the country are red hot for labor unrest, too, with inflation not quite back to entirely acceptable levels and a shrinking economy as of the latest quarter as well.

Tesla has been one step ahead so far, in that it has increased pay in Germany by 4% and also provided annual additional rewards for production workers of EUR 2,500. However, it remains to be seen whether the increase will prove satisfactory, since IG Metall points out that in 2022, the wages were 20% lower for Tesla workers as compared to those achieved through collective bargaining with other auto manufacturers.

Germany is, of course, a far more important country for Tesla, where it’s estimated to produce 250,000 vehicles a year. This is 18% of the company’s total production in 2022. Further, it plans to expand production to 1 million units there, which is a huge 73% of 2022’s production.

Unionization and the U.S.

That Tesla could now face an uphill battle with labor unions in the U.S. as well. This was already predicted by The Guardian newspaper back in September, with a headline that said: “Tesla is the next biggest union target in the United States. Sorry, Elon Musk,” following industrial action against other auto manufacturers in the U.S. The latest developments for Tesla in Europe only add to this.

Of the biggest five battery EV manufacturers by market share – which are Tesla, BYD Company Limited (OTCPK:BYDDY), General Motors, Volkswagen (OTCPK:VWAGY) and the Chrysler-PSA Group joint venture, Stellantis, in that order – GM and Stellantis have recently had their own labor challenges recently, as earlier mentioned.

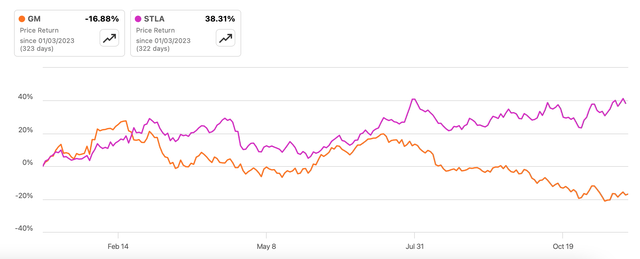

After six weeks of strikes starting in mid-September by the United Auto Workers [UAW] trade union demanding better terms, an agreement was reached. But it comes with its costs. The most apparent is the decline in share price for GM, which was just a little 3% over its price in 2023 beginning when the strikes commenced. It has now lost almost 18% since.

Price Returns, GM and STLA, YTD (Source: Seeking Alpha)

It doesn’t help that the company has decided to slow down EV production and has withdrawn its 2023 guidance in light of the strikes in the meantime as well. From a financial perspective, it lost USD $200 million because of the strikes, which is some 9% of its operating expenses in the third quarter (Q3 2023).

Stellantis has fared better, with share price gains of 4.8% since mid-September, and has also seen a healthy price rise YTD (see chart above). But it has hardly come out unscathed, with an estimated USD 800 million hit on profits, which is 13.4% of its latest quarter’s net earnings.

The key takeaway here is that there’s a good risk that Tesla might have to contend with unions sooner rather than later, which adds to mounting pressures for the company discussed below.

The margins can narrow further

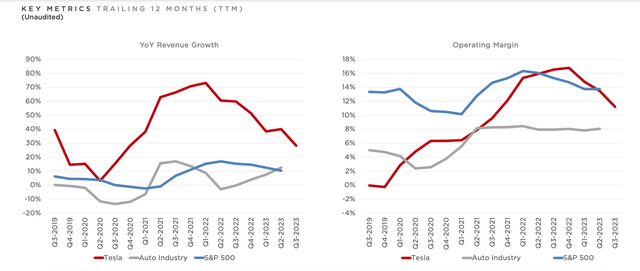

In Q3 2023, the company reported a low revenue growth rate of 9% year-on-year (YoY), which is a fraction of its compounded annual growth rate [CAGR] over the past 10 years of 49.6%. The scepter of a challenged macroeconomy looms large over these figures too, as higher inflation and rising rates led to price cuts by the company, in turn affecting revenue growth.

Shrinking profits and smaller margins have followed in tow, with the operating profit margin falling to 7.6% in Q3 2023, less than half the levels reported a year ago. The company’s trailing twelve-month [TTM] operating margin is now lower than the average for the S&P 500 (SP500) (see chart below). The gap is narrowing for both margins and revenues with other auto manufacturers, too.

As competition heats up in the EV space, Tesla’s margins can narrow even further going forward. Added to this are potential costs from labor disturbances. Already, the increased payouts for German workers will add to its costs, and if labor troubles visit it on the U.S. shores as well, a bigger financial drag is possible.

The company already saw a 43% rise in operating expenses in Q3 2023. To be fair, its TTM operating cost increase has been a far more acceptable 10%, but in light of the current situation, the latest increase needs to be borne in mind.

Still ahead of peers

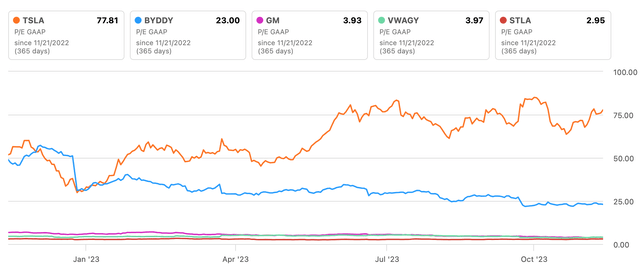

The stock’s performance, though, is quite another matter. When compared with the biggest EV companies by market share, Tesla has outperformed all of them YTD, with General Motors and Volkswagen actually declining. But Tesla has far exceeded China’s BYD Company and Stellantis as well, which have risen by 21.4% and 38.3% respectively.

Unsurprisingly though, the TTM GAAP price-to-earnings (P/E) ratio at 77.81x is way ahead of its biggest peers as well (see chart below). BYD Company comes a very distant second at a P/E of 23x. But it can’t be guaranteed that it will stay this way. Three years ago, Tesla was trading at a P/E of an eye-popping 936x. It can be argued, though, that at that time, the company had seen just one year of profits, and investor optimism on future growth was driving the share price forward.

Comparison with Peers, GAAP, TTM P/E (Source: Seeking Alpha)

What next?

But what was true in the past might not be true now. A challenged macroeconomy has had multiple ripple effects for Tesla, Inc., not the least of which is the latest labor issue in Sweden. It might seem small, tucked away in Sweden, but going by the current mood, it has the potential to spill over, most significantly in the U.S. itself. How Tesla handles the situation, if it arises, remains to be seen.

If the German solution is anything to work with, more generous payouts for the U.S. counterparts cannot be ruled out. But if it happens, it will be at a time when the company’s margins are already shrinking. Demand softening and higher competition are making it tougher to stay ahead in the EV space already.

Some solace can be found in the inevitable turn in the macroeconomic cycle. Inflation is already softening, and a growth pickup is possible from 2025 onwards. This can steady financials, not to mention serve to ease the current squeeze that both consumers and its workers are experiencing, especially if it takes steps to support both groups.

But a turn of the macrocycle isn’t a short-term solution. For now, it’s best to wait and watch how Tesla resolves the labor challenges while its price has already made big gains YTD. That they may well arise is evident from the recent experience of its peers like GM and Stellantis. I’m going with a Hold on Tesla.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

—