Summary:

- Merck’s stock has seen a sustained pattern of lower highs and lower lows, with a long-term MACD indicator delivering a ‘sell’ signal.

- Forward dividend yield is slightly below the company’s 5-year average, and dividend growth rates have been declining.

- Merck’s cash dividend payout ratio is approximately 56%, higher than the sector average, but the dividend remains well covered with potential for more growth.

Erik S. Lesser

Intro

We wrote about Merck & Co., Inc. (NYSE:MRK) back in March of 2021 when we assessed the strength of the dividend of the drug manufacturing company. Merck’s one-year dividend growth rate at the time came in at an above-average 10% which is exactly the message we like to see management send due to its clear intent concerning the company’s forward-looking growth intentions and the strength of the pipeline.

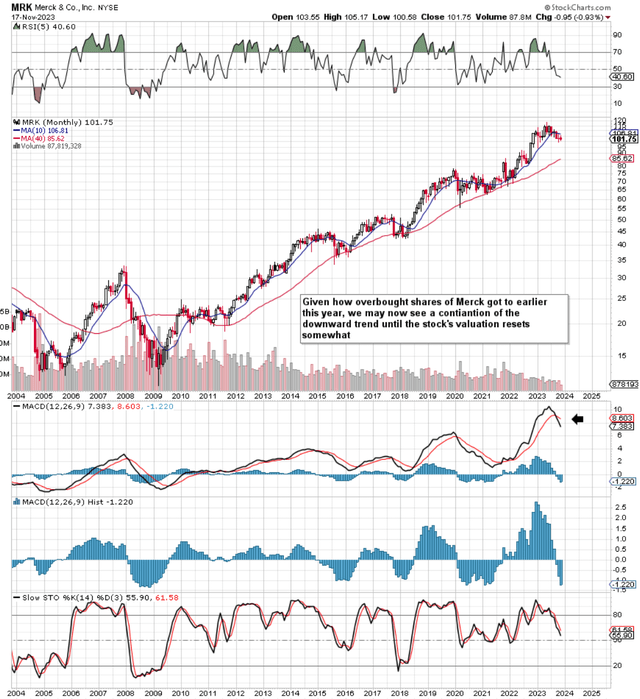

When we coupled the strong dividend metrics at the time with the encouraging technicals (shares of MRK were about to bounce off long-term support), we ended up stamping a BUY rating on the stock. Our long call worked out well as Merck’s return over these 30+ months equates to almost 56% (when dividend payments are included) which is a sizable gain over what the S&P500 has returned over the same timeframe (15%). Shares managed to rally to $117 by May of this year but since then, we have seen a sustained pattern of lower highs & lower lows in the share price. Furthermore, the gradual decline in MRK stock over the past almost 7 months now has resulted in the stock’s long-term MACD technical indicator delivering a convincing ‘sell signal. Long-term MACD signals demand attention due to the amount of information that gets digested in the analysis & the dual role of the indicator (momentum and trend). Moreover, the ‘height’ of the sell signal is noteworthy as it demonstrates how far shares remain above their longstanding moving averages (overbought).

Being chartists, we believe that every piece of known information (be it industry-related or fundamental, etc.) has been digested by Merck’s share price at this stage. Long investors may find this bemusing given how MRK has now rattled off 9 consecutive earnings beats taking into account the company’s recent Q3 beat. However, we maintain that Merck’s bullish forward-looking fundamentals such as the collaboration with Daiichi Sankyo (which will improve Merck’s oncology position), sotatercept’s potential, late-stage trials (MK-0616) & recent Keytruda approval have all been embedded into the share-price at this stage.

Suffice it to say, that investors looking to put money to work in Merck on the long side must be prepared to weather lower prices over the near term. As we see below, the cycles (between long-term MACD buy & sell signals) many times can exceed 18 months which means one is mostly relying on the dividend to prop up returns. Speaking of the dividend, healthy analysis can determine whether it is essentially getting stronger or weaker and how it expresses Merck’s profitability & valuation at present.

MRK Long-Term Chart (Stockcharts.com)

Dividend Yield

Merck’s forward-dividend yield of 2.87% only comes in slightly below the company’s 5-year average of 2.99%. Many dividend-orientated investors use the dividend yield as a barometer of whether the stock is expensive or not. Although there is only a marginal difference between Merck’s forward dividend and the historic average, we must delve deeper.

What must be pointed out also is that the current 2.87% dividend yield comes in below the prevailing inflation rate which means (assuming inflation remains at least at its current level) one would need sufficient capital gains in the share price to report real gain in this investment.

Dividend Growth

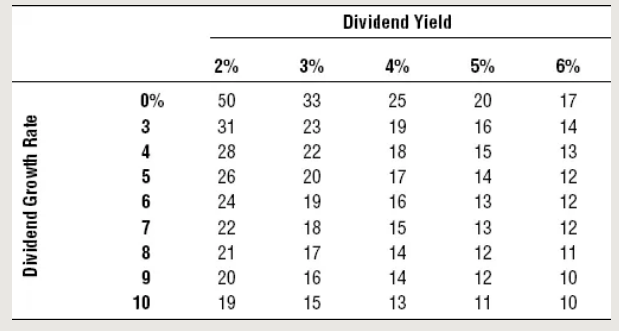

Dividend growth is important because it protects one’s purchasing power (especially pertinent in today’s times) & enables shareholders to earn a percentage of the company’s profits. Merck’s dividend growth rate has been declining somewhat when we compare the stock’s 12-month growth rate (5.88%) to its 5-year average CAGR dividend growth rate of 9.79%. When we round up these figures and consult the payback chart below, it becomes apparent how much growth affects an investment. At present (Roughly a 3% yield growing @ 6%), it would take a full 19 years (as opposed to 15 years if the average annual growth rate averaged 10%) for one to recoup their initial investment.

Dividend Payback Chart (‘The Little Book Of Big ‘Dividends’)

Payout Ratio

One of Merck’s long-term strengths has been its ability to generate high levels of cash flow. Over the past four quarters, free cash/flow per share comes in at a very healthy $5.19 a share. Dividing the company’s forward dividend of $2.92 into this amount, we get a cash dividend payout ratio of approximately 56% (the 5-year average comes in at 69.26%). Although 56% comes in well higher than the sector’s 37.3%, the dividend is well covered with plenty of scope for more growth going forward.

We like payout ratios up around the 60% level as it guarantees that shareholders will get a sizable percentage of the company’s free cash flow on offer. Low payout ratios many times mean shareholders are relying on buybacks (which are less dependable) and management’s ability to allocate capital efficiently.

Balance Sheet

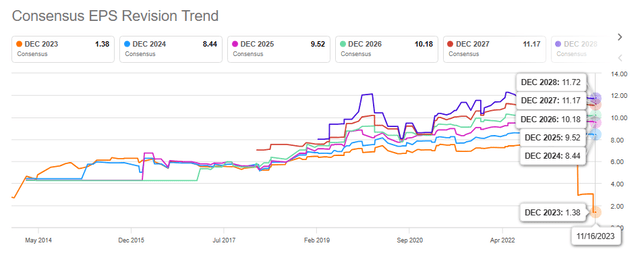

Although rising debt ($33.98 billion at the end of Q3) has lent itself to rising interest expense on the income statement (trailing interest coverage ratio of 8.62 compared to a 5-year average of 18), Merck’s equity continues to grow which means the debt-to-equity ratio has remained in check (0.84). A lower interest coverage ratio however means sustained high single-digit increases in the dividend is unlikely going forward. We state this because of how earnings revisions have disappointed in recent months ignited by the $4+ per share charge in the recent $11 billion Prometheus buyout deal.

Merck Consensus EPS Revisions Trend (Seeking Alpha)

Conclusion

To sum up, there seems to be nothing to worry fundamentally in Merck as the company continues to generate significant cash flow where dividend payments remain well covered. Shares look to have gotten ahead of themselves here which is why we foresee maybe a return to the stock’s 40-month moving average of $85+ at worst before bottoming in earnest. Therefore, Merck remains a ‘Hold’ for us at present where we recommend long investors retain a long-term horizon. We look forward to continued coverage.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.