Summary:

- JPMorgan Chase & Co. reported a significant increase in net income and total net revenue in Q3 2023.

- The bank’s success was driven by a surge in Net Interest Income and a rise in noninterest revenue.

- JPMorgan’s stock maintains a robust bullish trend, with expectations for upward momentum.

danielvfung

JPMorgan Chase & Co. (NYSE:JPM) showcased an impressive financial performance in Q3 2023, marked by a significant increase in net income and a robust growth in total net revenue. The bank’s success was primarily driven by a surge in Net Interest Income (NII), attributed to higher interest rates and increased activity in Card Services. Additionally, the firm experienced a healthy rise in noninterest revenue, driven by gains across various sectors, though partially offset by an impairment in the Payments segment. This article extends the discussion initiated in the previous piece, offering fresh insights into JPM’s financial stability and an updated technical analysis of its stock price. The findings suggest the stock maintains a robust bullish trend, with expectations for upward momentum.

JPMorgan Significant Financial Growth in Q3 2023

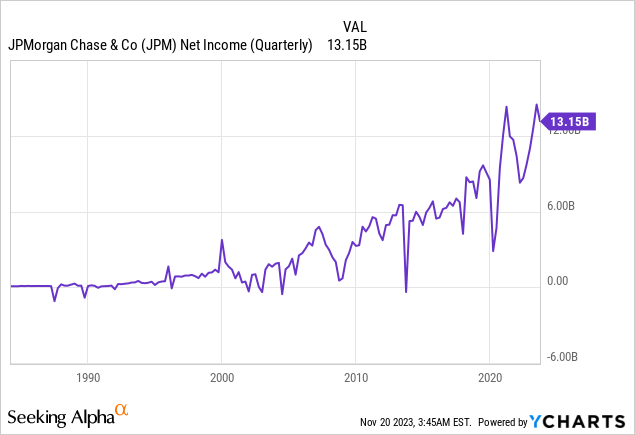

JPMorgan reported a robust increase in its financial performance in Q3 2023. The chart below shows that the company’s net income soared to $13.15 billion, marking a substantial 35% increase compared to Q3 2022. When adjusted for the impact of the First Republic, this growth rate still impressively stands at 24%. The firm’s net revenue witnessed a notable uptick, reaching $40.7 billion, a 21% increase year-over-year, or 15% when excluding First Republic’s contributions.

The bank’s NII was a significant driver of this quarter’s success. NII surged to $22.9 billion, registering a 30% growth. This rise in NII was primarily fueled by higher interest rates and an uptick in revolving balances in Card Services, although tempered somewhat by a decline in deposit balances. Notably, NII excluding Markets escalated to $23.2 billion, a remarkable 37% jump, or 28% when factoring out the First Republic, underscoring the solid performance across various segments.

Noninterest revenue also showed positive trends, climbing to $17.8 billion by 12%. This increase was primarily driven by heightened noninterest revenue in CIB Markets, increased asset management fees, and reduced net investment securities losses in the Corporate sector. An impairment in an equity investment within the Payments segment slightly offset these gains. Meanwhile, noninterest expenses rose to $21.8 billion, a 13% increase due to higher compensation costs and legal expenses.

The provision for credit losses was reported at $1.4 billion, reflecting a complex interplay of net charge-offs and reserve releases. Net charge-offs totaled $1.5 billion, with a notable increase in Card Services. The bank saw a net reserve release in Wholesale, primarily driven by net lending activity in CIB, and a net reserve build in Consumer, primarily in Card Services, but offset by a release in Home Lending.

JPMorgan’s earnings were also bolstered by its acquisition of First Republic, which contributed $1.1 billion to net income for the quarter. This performance included $1.5 billion in net interest income and $761 million in noninterest revenue, among other financial metrics.

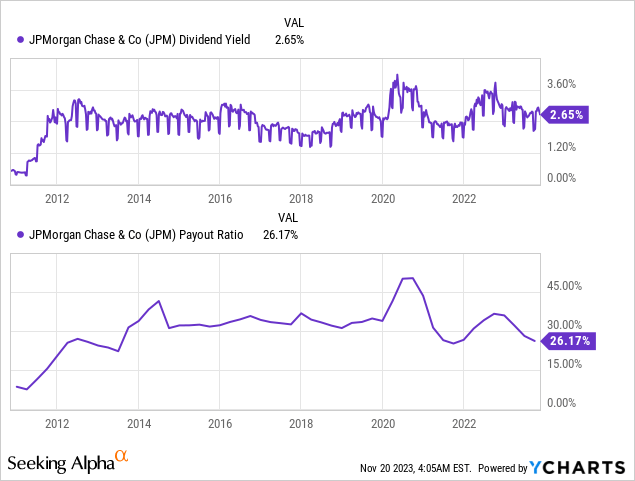

Since the end of the 2008 financial crisis, JPMorgan has consistently raised its dividend, contributing notably to its outperformance. The chart below presents a dividend yield of 2.65%, indicating potential for further growth, while the payout ratio stands at 32.79%. This combination of a healthy dividend yield and a sustainable payout ratio underscores JPMorgan’s strong financial position and commitment to delivering value to its shareholders.

JPMorgan’s financial results for Q3 2023 paint a picture of a robust and well-managed institution, effectively navigating the complexities of the current financial landscape. Even when adjusted for external factors like the First Republic acquisition, the significant net income and revenue growth highlight the bank’s ability to capitalize on favorable market conditions and strategic initiatives. The consistent dividend increase since the 2008 crisis reflects the bank’s financial health and demonstrates its dedication to shareholder value. Looking forward, JPMorgan appears well-positioned to maintain its growth trajectory and continue its strong performance, underpinned by solid fundamentals and a strategic approach to market opportunities.

Technical Outlook

Recap

The previous article presented a highly optimistic view of the stock market, concentrating on the emergence of an ascending broadening wedge and an inverted head and shoulders pattern. This analysis suggested that the stock price was preparing for a significant uptrend, making it a suitable time for investors to consider buying shares. A crucial support level was identified at $120, followed by the stock reaching a low of $120.43. Following this point, the stock price experienced an upward surge and appeared poised for further gains. The presence of a bullish divergence further emphasized this bullish trend. Additionally, the stock was trading within a long-term channel, with its RSI hitting the midpoint of 50, signaling strong potential for price appreciation.

What is Next?

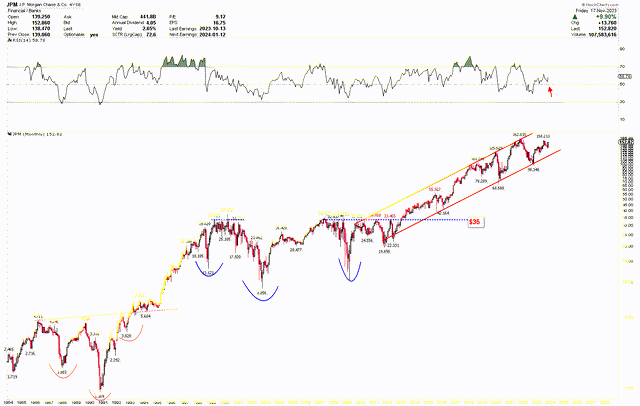

The revised monthly chart below illustrates a rising trend in JPM stock price. Notably, the stock’s historical lows are highlighted by the inverted head and shoulders pattern marked by the red and blue arcs in the chart. Additionally, the stock is currently trading within the confines of a red channel, indicating its recent price trajectory and potential future path. The stock price of JPM bottomed in 2009, primarily due to the global financial crisis that severely impacted banking institutions worldwide. This crisis, triggered by a collapse in the housing market and a liquidity crunch, led to massive write-downs in mortgage-related securities and a crisis of confidence in the financial sector. JPM saw its stock price plummet as investors feared the worst.

However, from 2009 onwards, the stock continuously rallied, driven by several key factors. Central banks’ aggressive monetary policy response, including the U.S. Federal Reserve, injected liquidity into the markets and lowered interest rates, helping stabilize and revitalize the banking sector. Additionally, JPMorgan’s strong management under Jamie Dimon navigated the bank through the crisis more adeptly than many of its peers, allowing it to emerge stronger and capitalize on opportunities, including acquiring distressed assets and expanding its market share. The bank also benefited from a gradually improving economy, which boosted its core businesses like consumer banking and investment services. Moreover, its focus on improving operational efficiency and embracing digital banking trends further strengthened its market position, contributing to the upward trajectory of its stock price.

JPM Monthly Chart (stockcharts.com)

The October 2022 market low, precisely hitting $98.348, aligns seamlessly with the support line of the red channel, while the November 2023 monthly candle’s strength hints at a potential upward swing in the market.

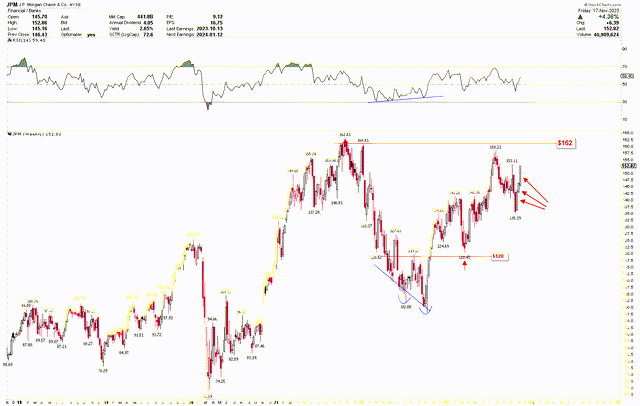

Delving deeper into this optimistic scenario, the weekly chart below showcases a bullish price pattern through a divergence, as indicated by the blue arrows. This bullish divergence, coupled with the formation of a double bottom at $102.08 and $98.348, points to a positive price trend. The previously discussed crucial $120 mark, deemed a solid support for investors, was tested, and the stock subsequently surged from this level, reaching a low of $120.43. The last three weeks have been marked by weekly solid candles, underscoring the vigorous upward movement in price. This rally’s immediate aim is the $162 red line. Surpassing this threshold could trigger a significant upward surge.

JPM Weekly Chart (stockcharts.com)

Market Risk

Despite JPMorgan Chase’s strong financial performance in Q3 2023, the bank faces significant market risks from broader economic and geopolitical challenges. The global economic landscape is currently marked by uncertainties such as labor market tightness, high government debt levels, and persistent inflation concerns. These factors can impact consumer spending and borrowing, affecting JPM’s key revenue streams. Moreover, the ongoing Ukraine conflict presents geopolitical risks that could further destabilize the financial markets. While CEO Jamie Dimon expressed confidence in the firm’s preparedness, these external factors remain primarily unpredictable and can adversely impact JPM’s future performance.

Additionally, regulatory changes pose a significant risk. The bank’s operational and strategic flexibility may be constrained by new regulations, potentially affecting its ability to capitalize on market opportunities or adapt to changing environments. The bank’s provision for credit losses and the complex interplay of net charge-offs and reserve releases point to underlying credit risk concerns, particularly in segments like Card Services. From a technical standpoint, if the price falls below $98, it would invalidate the bullish outlook and suggest a further decrease in price.

Bottom Line

In conclusion, JPMorgan Chase & Co.’s financial results for Q3 2023 underscore the bank’s strength and adept management in a complex financial landscape. The significant growth in net income and revenue demonstrates JPMorgan’s ability to leverage favorable market conditions and strategic initiatives for growth. The consistent dividend increase further reflects the bank’s robust financial health and commitment to shareholder value.

The technical analysis of JPMorgan’s stock reveals a promising outlook. The stock’s price movement within a rising trend and the formation of a bullish inverted head and shoulders suggest the potential for continued upward momentum. The recent performance aligns with this optimistic view, with the stock rebounding from a crucial support level of $120 and exhibiting bullish solid signals. Investors may consider increasing long positions in anticipation of the upcoming rally.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.