Summary:

- PayPal’s unit economic metrics are declining due to competition, but it continues to generate good cash flow. I believe that PYPL’s fair value has been boosted in Q3. Read on.

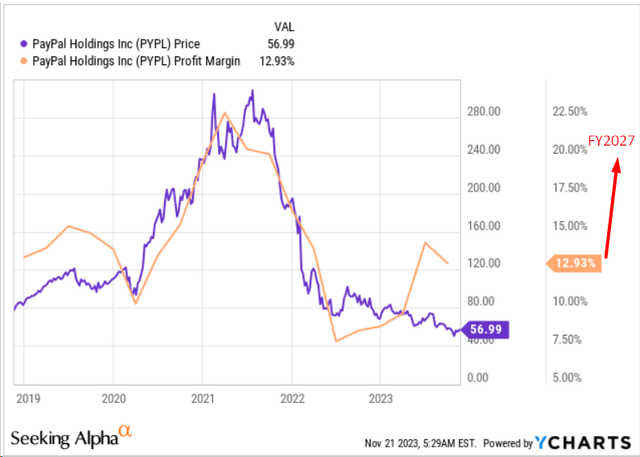

- As management focuses on qualitative growth, PYPL’s net profit margin should also increase – I believe it could reach 20% again by FY2027.

- In the last 11 years, the company cut shares by 0.79% yearly. I expect PYPL to double this rate to 2% in the next 5 years, given its cheapness.

- So the stock now looks undervalued and has the potential to grow at a CAGR of ~20% over the next 4+ years.

- Therefore, I’m upgrading the stock from ‘Hold’ to ‘Buy’.

chameleonseye

Introduction

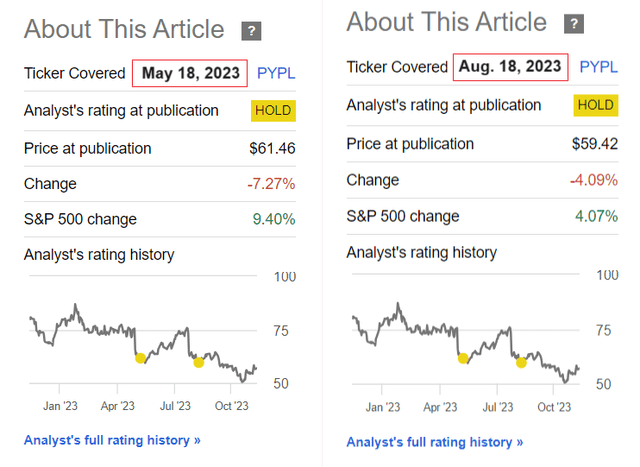

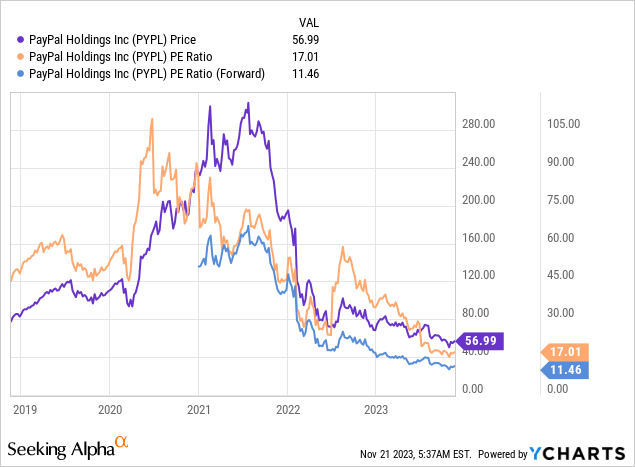

I initiated coverage of PayPal Holdings (NASDAQ:PYPL) in May 2023 when one share was trading at $61.46. While the broad US stock market continued to recover from its correction in 2022, PYPL stock was slow to follow, falling further and becoming cheaper and cheaper in the eyes of retail investors.

Seeking Alpha, PYPL, author’s coverage

In my second article, I wrote that PYPL did not have a sufficient margin of safety at the time, although its TTM P/E ratio was 16.4x, which is considered low across the Fintech industry. The thing is, the forecast of future transaction volume and revenue led me to conclude that the discounted PYPL flows resulted in a fair share price of $83.1 (by FY2027), giving a CAGR of ~6.3% – only slightly more than what could have been obtained with government bonds.

However, since my last article, the company has managed to report its operating results for the new quarter – what if PYPL now has the margin of safety it lacked last time? Let’s try to find out.

PayPal’s Q3 FY2023: Key Trends And Implications

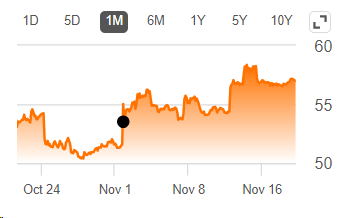

In the third quarter of 2023, PayPal reported adjusted EPS of $1.30 (up from $1.08 in Q3 FY2022), surpassing the consensus estimate of $1.23. Revenues experienced an 8% growth, reaching $7.4 billion (9% on an FX-adjusted basis), while adjusted net income rose by 14% to $1.43 billion. The market reacted quite positively to this beat:

Seeking Alpha, PYPL stock’s reaction

Note: However, the outlook for Q4 earnings fell short of the average analyst estimate – hence the slight post-release movement.

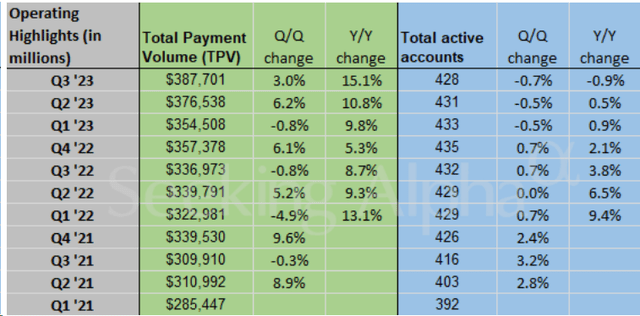

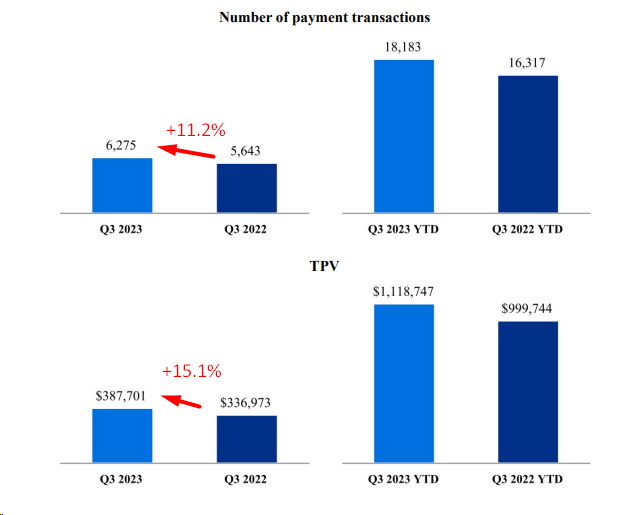

The total payment volume for Q3 increased by 15% (13% FX-adjusted) to $387.7 billion, playing a significant role in the revenue growth. Despite a slight decrease in the number of active accounts from 432 million to 428 million compared to the prior year, the number of payment transactions rose by 11% to ~6.28 billion.

Seeking Alpha PYPL’s 10-Q, author’s notes

Last time I suggested that the problem with PYPL is its weakening unit economics metrics amid the initially high valuation that investors gave (back in 2021) in the hope of quickly conquering the market in new segments.

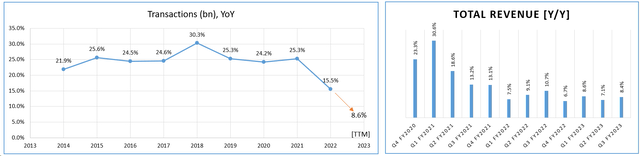

Let’s take a look at the growth rates of PYPL’s transactions, which will most likely go below the low double-digit range for FY2023 as a whole compared to being steadily higher 20% for the past few years:

Note: The TTM figure above is calculated as YTD 2023 plus Q4 FY2022

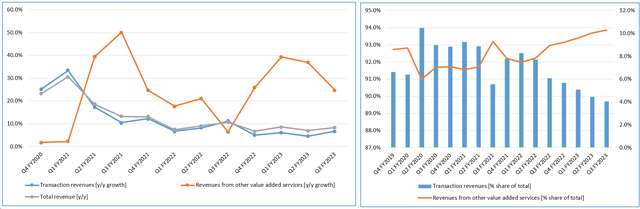

I think the relatively low diversification of PYPL’s revenues is putting pressure on growth rates: The high level of competition in the transaction segment leads to PYPL losing active users and is also systematically losing “revenue per transaction”.

| Year | Users [M] | Transactions [B] | Sales [$M] | Revenue-per-transaction |

| 2013 | 143 | 3.2 | 6727 | 2.10 |

| 2014 | 161 | 3.9 | 8025 | 2.06 |

| 2015 | 179 | 4.9 | 9248 | 1.89 |

| 2016 | 197 | 6.1 | 10842 | 1.78 |

| 2017 | 227 | 7.6 | 13094 | 1.72 |

| 2018 | 267 | 9.9 | 15451 | 1.56 |

| 2019 | 305 | 12.4 | 17772 | 1.43 |

| 2020 | 377 | 15.4 | 21454 | 1.39 |

| 2021 | 426 | 19.3 | 25371 | 1.31 |

| 2022 | 435 | 22.3 | 27518 | 1.23 |

| Q1 FY2023 | 433 | 5.835 | 7040 | 1.21 |

| Q2 FY2023 | 431 | 6.074 | 7287 | 1.20 |

| Q3 FY2023 | 428 | 6.275 | 7418 | 1.18 |

Source: Author’s work, PYPL’s fillings

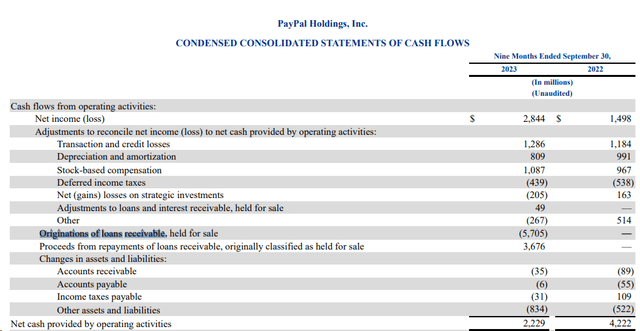

At the same time, however, the company continues to generate a good cash flow. In Q3 PYPL’s adjusted free cash flow improved to $1.91 billion compared to $1.57 billion in the same period a year ago. But net cash provided by operating activities was $1.26 billion in Q3 FY2023, a decrease from $1.76 billion in Q3 2022 (primarily due to the originations of loans receivable):

During the earnings call, the new CEO outlined plans to become a more efficient platform company, leveraging data and scale for innovation. The company aims to provide consistent metrics for better modeling and communication, focusing on profitable growth and operating leverage.

I now propose, as last time, to pay more attention to the operational forecast using the available factual data. Quarter after quarter, active users have declined, as has the average check per user.

Judging by the new Q4 guidance, which cooled the eagerness of the bulls after the publication of strong Q3 results, the unit economic metrics will most likely continue to trend downwards because of high competition. Let’s further assume that the new management team will find a solution to turn around the user base amount next year and that the long-term growth rate will be 2%. Transaction growth will be in the low teens (+12% annually).

| Year | Users [M] | Transactions [B] | Sales [$B] | Revenue-per-transaction |

| 2023 | 430.67 | 24.22 | $ 28.33 | 1.17 |

| 2024 | 439.28 | 27.12 | $ 31.10 | 1.15 |

| 2025 | 448.07 | 30.38 | $ 34.13 | 1.12 |

| 2026 | 457.03 | 34.02 | $ 37.47 | 1.10 |

| 2027 | 466.17 | 38.11 | $ 41.12 | 1.08 |

| Assumptions [YoY] | +2% | +12% | -2% |

Source: Author’s work

We also see that PYPL is very good at generating FCF. Let’s assume that this characteristic of the company remains, which in turn allows us to assume that PYPL will be very active in buying up its shares from the market.

Over the last 11 years, the company has reduced its outstanding shares by an average of 0.79% (annually). I predict that PYPL will more than double its pace [to 2%] in the next 5 years given how “cheap” its shares have become.

As management focuses on qualitative growth, PYPL’s net profit margin should also increase – I believe it could reach 20% again by FY2027:

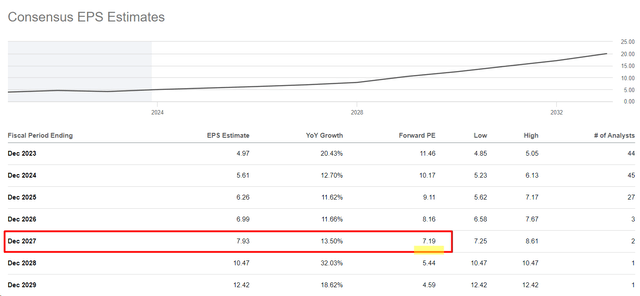

At the moment, PYPL shares are trading at 11.5 times next year’s P/E ratio – this is due to the lack of growth and the modest margins (by historical standards).

However, if we assume that PYPL’s net margin will rise, the P/E ratio must also rise. I think it would be fair to assume a P/E of 15 by FY2027 (vs. 7.2x implied today).

Incidentally, my thoughts on the company’s margins and my assumptions about more active buybacks have led me to a more optimistic EPS forecast for FY2027 compared to what we see in the consensus data ($8.26 vs. $7.19). So 15x of P/E the implied stock price should be ~$124:

| FY2027 forecast | |

| Revenue [$B] | 41.12 |

| Net profit margin [%] | 20.00% |

| # of sh. | 995.65 |

| Implied EPS | $8.26 |

| P/E | 15x |

| Implied stock price | $123.91 |

Source: Author’s work

The result will vary as we change the key assumptions:

Source: Author’s work [sensitivity table]![Source: Author's work [sensetivity table]](https://static.seekingalpha.com/uploads/2023/11/21/49513514-1700563356196285.png)

However, this is not the fair value of PYPL today, as we would have found in a classic valuation analysis. This is the share price at the end of FY2027, based on EPS and the exit multiple. PYPL’s share price at the time of writing was $56.99. Given this, the stock’s growth potential should be ~20.05% annually, as we have 4 years and 1 quarter separating us until the end of FY2027. So Q3 FY2023 results and their implications have given the stock the margin of safety that it did not have last quarter.

The Verdict

First off, you should be aware that investing in PayPal stock comes with its set of risks. The fintech sector faces regulatory uncertainties, and strong competition could impact both market share and profitability. Concerns also linger about potential cybersecurity threats and technological vulnerabilities. Economic fluctuations might influence consumer spending, affecting transaction volumes. The success of PayPal relies on key partnerships, and any breach of consumer trust due to security issues could be detrimental. Additionally, the company is exposed to currency exchange rate fluctuations, as well as integration challenges with acquisitions and the potential departure of key personnel add to the risk landscape.

But despite this string of various risk factors, to which a number of points can be added, I believe that PYPL’s fair value has been boosted by the Q3 FY2023 results. Even if we take into account the decline in unit economic metrics, we see that PYPL’s long-term EPS (currently expected by Wall Street) appears underestimated, which with potential margins and multiple expansion leads to an undervaluation today. My calculations show that PYPL stock should grow at a CAGR of ~20% [annually] over the next 4+ years – that’s my base case. Therefore, I’m upgrading the stock from ‘Hold’ to ‘Buy’.

Thanks for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in PYPL over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!