Summary:

- Tesla’s recent quarterly earnings showed impressive revenue growth amid the current harsh environment but a notable decline in profitability metrics.

- Despite the decline, Tesla remains more profitable than industry leaders, and my analysis suggests that profitability decline is temporary and not secular.

- According to my valuation analysis, the stock is substantially undervalued.

Wirestock/iStock Editorial via Getty Images

Investment thesis

My previous bullish thesis about Tesla, Inc. (NASDAQ:TSLA) was not as successful as the initial one, as the stock underperformed the broader market over the last quarter. The latest earnings release was full of disappointment as the company missed consensus estimates, and the management indicated concerns over the current harsh environment. But I consider these challenges temporary and not secular. Revenue is still growing, and production volumes are moving in line with the company’s long-term goals. Contraction in margins is also not a secular trend but is mainly caused by discounts for Tesla’s vehicles, which are implemented to address the softening demand as consumers are becoming more price-conscious. Even though profitability metrics declined, Tesla is still ahead of the competition from the financial efficiency perspective, and the company’s balance sheet is a fortress. This makes the company well-positioned to weather the storm without sacrificing or postponing its innovation and growth initiatives. According to my valuation analysis, the stock is substantially undervalued. That said, I reiterate my “Strong Buy” rating for TSLA.

Recent developments

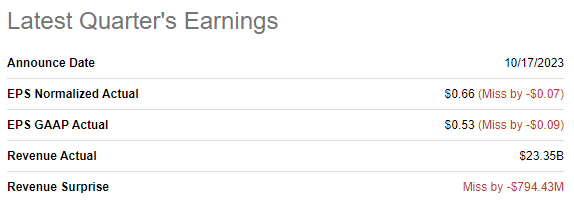

The latest quarterly earnings were released on October 17, when the company missed consensus estimates. Revenue grew by 9% YoY, which is impressive given the high interest rates for car loans and leases.

Seeking Alpha

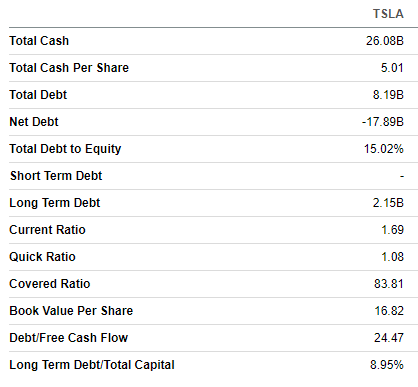

Despite revenue growth, profitability metrics narrowed significantly. The gross margin dropped YoY by more than seven percentage points, and the operating margin shrank from 17.2% to 7.55%. While many investors were disappointed in the profitability decline, I would like to underline positive moments as well. Tesla’s levered free cash flow [FCF] was positive at $647 million, which allowed the company to continue improving its fortress balance sheet with low leverage and strong liquidity.

Seeking Alpha

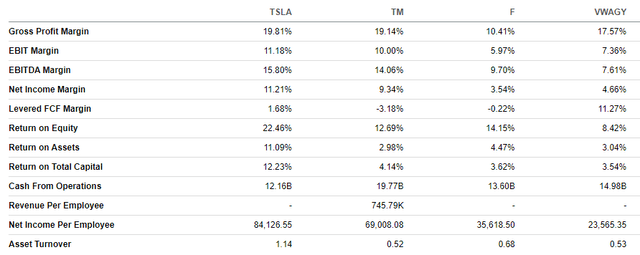

Despite the decline in profitability metrics, Tesla is still more TTM profitable than the industry’s largest players operating at a much bigger scale. Even Toyota Motor Corporation (TM) and Volkswagen AG (OTCPK:VWAGY), selling around 10 and 8 million cars per year, fall behind Tesla across the board of key profitability metrics. This means that Tesla’s operations are much more efficient compared to the automotive industry’s global leaders, which will be a great asset over the long term to help the company gain the overall automotive market share.

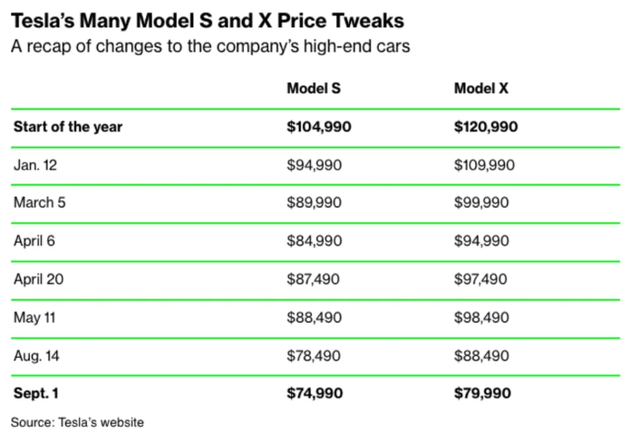

Let us also not forget that the main reason for the decrease in profitability was the massive selling price discounts across models, especially higher-end products like Model S and Model X. This sounds to me because, in the current relatively early stage of the fierce EV race, physical volumes of vehicles delivered should prevail, especially given the fact that Tesla’s profitability is still unmatched.

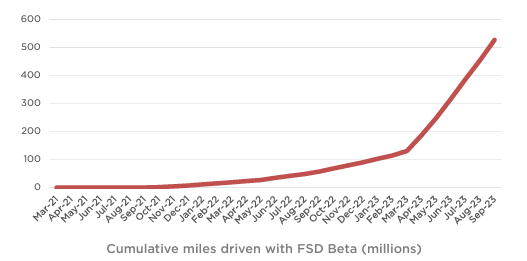

I believe that at the current stage of the company’s lifecycle, prioritizing deliveries of vehicle growth over profitability is crucial because of the nature of the EV industry. The electric car is not just a means of transportation nowadays, but a big computer on four wheels, and upgrades to make this “computer” smarter can be installed easily on air. That said, a “land and expand” business model, which works well for software companies, is also highly likely to be successful in the automotive industry in the long run. Tesla invests billions of dollars per year in R&D to develop its software, which will likely disrupt the automotive industry multiple times in the future. During the latest earnings call, Elon Musk emphasized Tesla’s progress in autonomous driving technology, FSD, which has over 500 million miles of “experience” and continues to grow exponentially. This emphasized Tesla’s unmatched positioning in real-world artificial intelligence [AI].

Tesla’s latest earnings presentation

Another reason for the profitability shrinkage was substantial operating costs related to the Cybertruck development and production. There is a lot of skepticism around this highly anticipated product, primarily due to numerous release delays. The pessimism has also been amplified by recent news that just ten Cybertrucks will be delivered during the upcoming Event. But to me, the most crucial point is that the Delivery Event is finally coming next week, on November 30. This means that the company is ready to compete in a massive U.S. light truck market, where around 11 million units are sold annually. The market has been dominated by stalwarts like the Ford F-150 and Chevrolet Silverado for decades, and Tesla obviously needs to introduce a truly extraordinary product to secure a lasting foothold. The company’s strong track record of innovation and evidence of its ability to disrupt the automotive industry gives me a strong conviction that the upcoming event will be a pivotal moment. Rather than viewing the delays negatively, I interpret them as the management’s commitment to packing the product with unparalleled features, which will be revealed during the upcoming event.

I also consider the company’s Supercharger Network a formidable asset for the long term as more and more of the largest automakers like Ford, Mercedes-Benz, GM, Hyundai, and Volvo are adopting Tesla’s standard. This recognition from leading legacy automakers says a lot about the strength of Tesla’s energy infrastructure, which also contributes to Tesla’s competitive advantage. As the global EV market is poised to continue strong growth, Supercharger’s client base will also grow rapidly, which will unlock a new predictable revenue stream resilient to macroeconomic conditions.

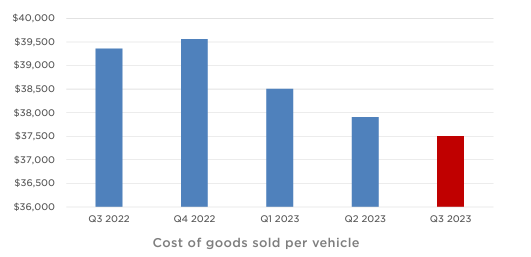

Tesla’s latest earnings presentation

Finally, I greatly appreciate how Tesla balances between disrupting the automotive industry and rigorous financial discipline. During the Q3 earnings call, Vaibhav Taneja, the CFO, underlined that reducing costs is the management’s top priority. The substantial and consistent decrease in the cost of goods sold per vehicle serves as a tangible validation of the CFO’s commitment. That said, as the scale is expected to ramp up over the long term, there is a strong likelihood that Tesla will continue enjoying the economies of scale effect, which will build more value for shareholders.

Valuation update

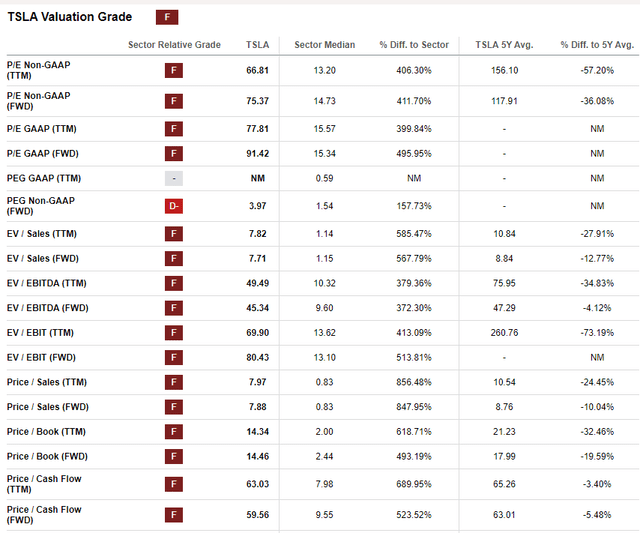

The stock significantly outperforms the broader U.S. market in 2023 with a 117% year-to-date rally. Seeking Alpha Quant assigns TSLA the lowest possible “F” valuation grade because the company’s valuation ratios are multiple times higher than the sector median across the board. However, considering the company’s unmatched growth and profitability profile and its unique brand, I think comparing current valuation ratios to historical averages is more appropriate. From this perspective, the stock looks very attractively valued.

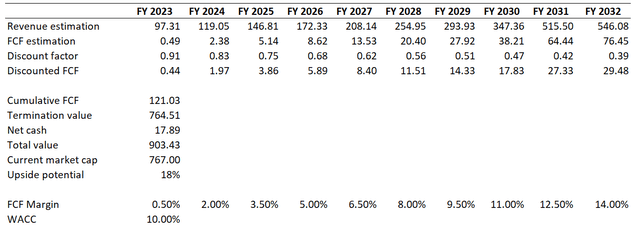

I want to proceed with the discounted cash flow [DCF] simulation. As inflation in the U.S. is cooling down at a notable pace, the Fed’s monetary policy pivot is likely to be approaching. Therefore, I use a lower 10% WACC for discounting, compared to my previous valuation analysis for TSLA with an 11% rate. I use consensus revenue estimates, projecting a 21% CAGR for the next decade. For the base year, I incorporate a shallow 0.5% FCF margin and expect a 150 basis points yearly expansion for the years beyond.

According to my DCF simulation, the business’s fair value is slightly above $900 billion, which is 18% higher than the current market cap. That said, the stock is substantially undervalued, and my target price is $275.

Risks update

Tesla’s stock price is highly volatile, and investors tend to overreact to any news about the company or its iconic CEO. We have seen last year how the stock price plummeted after Elon Musk started focusing more on Twitter after the social network acquisition. History suggests that the TSLA stock price reacted adversely to any of Elon Musk’s controversial tweets or public speeches. Last December, the company’s CEO sold TSLA shares worth billions of dollars to meet his personal financial liabilities, which also led to adverse reactions from investors. As the year’s end approaches, Mr. Musk might start selling off the company’s shares again, which can lead to another wave of investor panic.

Cybersecurity threats are elevated with the increasing integration of software and connectivity features in Tesla vehicles. A successful cyberattack could undermine vehicle safety, damage the brand’s reputation, and result in financial losses.

Bottom line

To conclude, TSLA is still a “Strong Buy”. The company continues to demonstrate unmatched profitability even after offering massive discounts across its automotive product portfolio. Tesla’s strong financial position makes it firmly positioned to invest heavily in its innovation initiatives which will highly likely build substantial value for shareholders over the long-term. The valuation is attractive and the upside potential outweighs all the risks and uncertainties, in my opinion.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.