Summary:

- Nvidia reported impressive Q3 results with a 206% YoY jump in revenue and expects a 230% YoY increase in Q4’s revenue.

- The company showed operating discipline and margin power with a 16% YoY increase in operating expenses and a 70% increase in cost of revenue.

- Long-term concerns include law of large numbers and multiple compression.

- Short-term concerns include a 117% increase in accounts receivable, overbought stock levels, and potential slowdown in sales in China.

Justin Sullivan

Nvidia Corporation (NASDAQ:NVDA) released its FY 2024 Q3 results a few days ago as Seeking Alpha has covered here. Although Nvidia reported some impressive numbers, the market’s reaction was a little muted, at least in comparison to the frenzy seen after the last few reports. Does that mean expectations have finally leveled off? Or will Nvidia continue to grow at its current scorching pace and continue being rewarded with rich valuation?

My previous coverage on Nvidia was after the company’s Q2 blowout where I had rate the stock a “Hold”. Since then, the stock has returned about 3% compared to the market’s 4%. With that background out of the way, let us now review The Good, The Bad, and The Ugly from Q3.

The Good

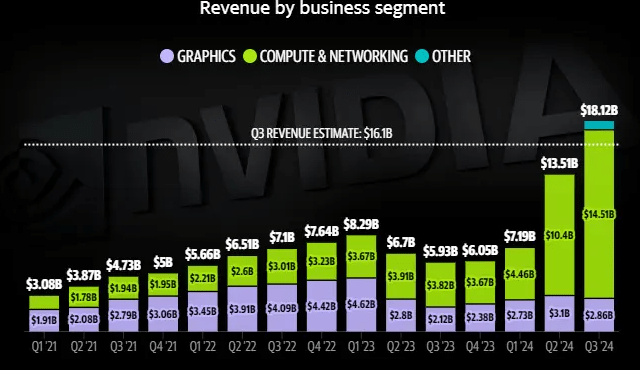

- Nvidia reported some astounding numbers in Q3, especially on the sales front as Q3 saw a 206% YoY jump in revenue. I will leave it to the chart shown below to convey more than my words could. However, to put the company’s mindboggling growth over the last three years into context, the “Other” segment, which includes Professional Visualization and Automotive, and is an “also-ran” in the chart below, contributed about $750 million in Q3 2024. Nvidia’s overall revenue in Q1 2021 was $3 billion.

NVDA Revenue By Segment (Yahoo Finance)

- Q3’s revenue beat also marks the 16th consecutive time that the company has beaten revenue estimates, which is impressive given the ever increasing expectations, especially over the last few quarters.

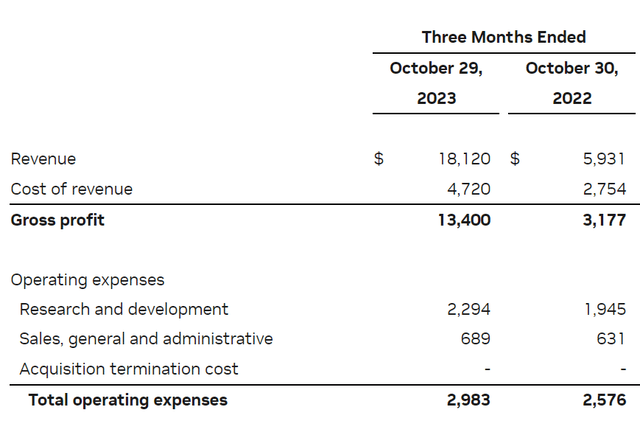

- Quite often, companies overindulge in good times or are forced to shell out more to sell more (COGS). Obviously, both have a negative impact on the bottom line. Fortunately for Nvidia investors, Nvidia appears immune to both effects for now. In a quarter where revenue more than tripled YoY, Nvidia showed both its operating discipline and margin power as it reported just a 16% YoY increase in operating expenses and a 70% increase in cost of revenue.

NVDA Q3 Expenses (nvidianews.nvidia.com)

- To round up the good section, Nvidia expects $20 billion in FY 2024 Q4’s revenue, which would mean a 230% YoY increase compared to the $6.05 billion reported in Q4 2023.

The Bad

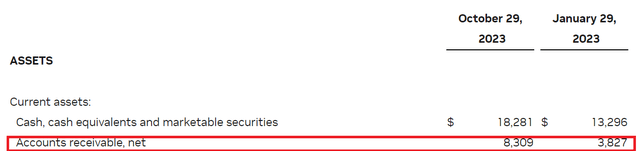

- As highlighted in this Seeking Alpha article, Nvidia’s balance sheet at the end of Q3 reported a 117% increase in accounts receivable at $8.3 billion. This does bring into question whether customers are having a trouble paying their bills, or whether the nature of business projects things healthier than they are? For example, license revenue is recognized upfront but actual payment may be subject to the work product/deliverable in the future. This brings write-offs into question for the future.

NVDA AR (nvidianews.nvidia.com)

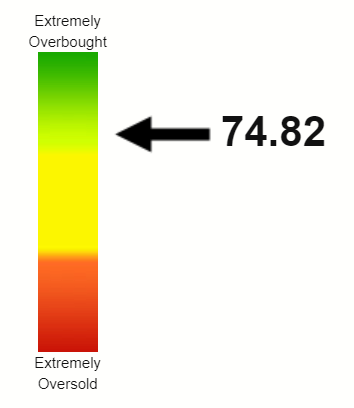

- In what might be the understatement of the year, Nvidia’s stock has been on a tear all through the year. Hence, it is not surprising that the stock is technically sound as well. Its Relative Strength Index [RSI] has just breached the overbought level of 70 even though the 200-Day moving average is nearly 25% below the current trading price. I interpret this as follows: I don’t expect the stock to rip higher without fundamental good news but it should see pretty strong support at its 100-Day moving average (~$450) as long as the general market does not weaken or if the China situation does not deteriorate. If either of those two scenarios give out, I expect the stock to fall further towards its 200-Day moving average, which currently stands at $375 but will likely push up to at least $400 over the next few weeks.

NVDA RSI (stockrsi.com)

The Ugly

- The “China Risk” remains at large and was acknowledged by the company when the CFO said the sales in the region is likely to slow over Q4. With nearly 1/4th of the company’s revenue coming from China, it is a risk worth acknowledging and one that the company has no power to control. As I am writing this article, I see this news item on Seeking Alpha that Nvidia is delaying the launch of its “export regulations abiding” AI chip for China.

- This is not directly related to Q3 but needs to be acknowledged. Expectations from Nvidia have grown so much that a simple beat may no longer be sufficient for the stock to move meaningfully. The stock is already trading at more than 6 times 2033‘s revenue estimates, which is nearly 4 times FY 2024’s revenue estimate.

Conclusion

Nvidia’s Q3 was great. As is its Q4 guidance, China concerns notwithstanding. However, for the long-term, my two biggest concerns with Nvidia’s stock can be summarized as below:

- Law of large numbers

- Multiple compression

Let’s look at the law of large numbers concern first. This wonderful article by David Trainer highlights some of these concerns. For example, to justify the current market price, Nvidia should double its revenue for FY 2024 (easily on track), grow at 50% in FY 2025, and grow at 25%/yr till FY 2038! Should Nvidia meet those numbers, Nvidia would be larger than all but 13 countries in the World based on their 2023 GDP. In addition, as volume and competition grow, it’d be much harder for Nvidia to retain its current profit margin. The market is known to punish even small margin compression excessively and as a long-term Apple, Inc. (AAPL) investor, I recall this (not too fondly) many times.

Investopedia defines “Multiple Compression” as “an effect that occurs when a company’s earnings increase, but its stock price does not move in response”. In short, the market may have already rewarded Nvidia stock and its investors for what the company may produce in the future. When expectations are sky-high, merely meeting or even beating by a decent margin may not cut it for the stock anymore. Cisco Systems, Inc. (CSCO) remains my favorite stock for comparison in this category as while the company has continued to be enormously profitable, the stock never reached its 2000 valuation/highs ever since. Cisco was trading at 120 times its trailing twelve months’ [TTM] Free Cash Flow [FCF] at its valuation peak. Nvidia’s market cap of $1.2 trillion means the stock is trading at ~70 times its TTM FCF of ~$18 billion. While it may seem like Nvidia has ways to go before catching up with Cisco’s overvaluation, I am pretty sure Nvidia investors of today would also not want to go close to Cisco’s abysmal returns since 2000.

Overall, Q3 was great but the stock may already be priced for many more quarters and even years being beyond perfect at this point. I am sticking with my “Hold” rating for now.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.