Summary:

- Nike and Target were among the worst performers in the retail sector at times in Q3, but both saw improvement as the holiday season approached.

- Nike is the premier global athletic footwear and apparel company, with a significant market share.

- Nike’s recent Q1 2024 earnings report showed positive signs, including a dividend increase, but its gross margin and valuation are areas of concern.

- I highlight key price levels to watch ahead of its December earnings report.

code6d

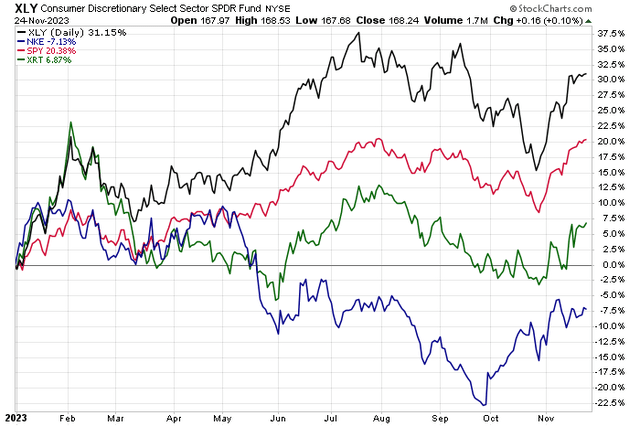

Retail endured a tough Q3. NIKE (NYSE:NKE) and Target (TGT) were two of the worst large-cap performers, but both names caught a bid as the holiday season approached. Later this week, we’ll hear same-store sales figures from Costco, and Nike reports full-quarter results a few weeks later.

I have a hold rating on Nike. I see shares near fair value while the chart situation is not overly compelling yet. Still, after reporting a solid Q1 2024 and hiking its dividend, there are some hopeful signs.

Year-to-Date Returns: NKE Underperforming the S&P 500, Discretionary Sector, Retail Industry

According to Bank of America Global Research, Nike is the premier global athletic footwear and apparel company with roughly 40% of the global athletic footwear market share. It also sells brands Jordan, Converse, and Nike golf shoes and athletic apparel. It produces through independent contracts and sourcing abroad.

The Oregon-based $164 billion market cap Footwear industry company within the Consumer Discretionary sector trades at a somewhat high 29.0 forward non-GAAP price-to-earnings ratio and pays a small 1.4% forward dividend yield. Ahead of earnings due out in a few weeks, shares trade with an elevated 32% implied volatility percentage, and short interest on the stock is modest at just 1.5% as of November 24, 2023. Analysts expect $0.83 of operating EPS in the upcoming quarterly report, which would be a slight decline from $0.85 of non-GAAP per-share profits from the same quarter a year ago. NKE has topped analysts’ EPS estimates in 11 of the 12 past instances.

Back in September, NKE reported an upbeat Q1 2024 earnings report. EPS on a GAAP basis verified at $0.94, topping analysts’ estimates of just $0.76. Revenue, up 2% from year-ago levels, missed the consensus just modestly. What was concerning, however, was that its gross margin dipped 10 basis points – that is a key metric investors must monitor later this month. The good news was that its North America segment saw gross margin expansion due to higher full-price average selling prices and improvements in Nike Direct.

The DTC segment indeed was a bright spot with Nike Direct sales jumping 6%, including a 2% rise in digital sales. Also an encouraging trend, its Greater China geographic segment reported a 12% currency-adjusted sales increase, albeit with a softer EBIT figure as a result of margin pressures and higher product costs. Overall, with inventory slimming by 10% from the same period a year earlier (down 20% in North America), there’s reason for hope heading into the holiday season. Such optimism was voiced in a few words via a dividend increase.

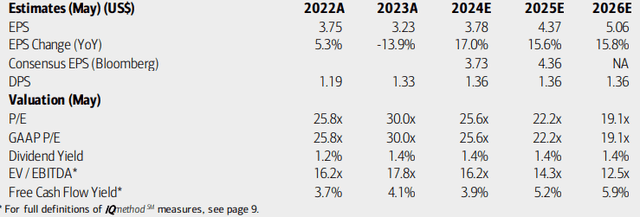

On valuation, analysts at BofA see earnings snapping back positive this year (FY 2024) with continued per-share profit growth through 2026. The current consensus estimate, per Seeking Alpha, shows operating EPS rising above $4 next year and approaching $5 by FY 2026 with sales growth rising at a mid-single-digit pace.

Dividends, meanwhile, are expected to hold where they are, though NKE did just raise quarterly payout by 8.8% to $0.37 ($1.48 annualized) earlier this month, a positive sign for profitability looking ahead. With ample free cash flow, further shareholder accretive activities are possible in my view. But with a lofty EV/EBITDA valuation for a consumer firm, the valuation is not all that cheap.

Nike: Earnings, Valuation, Dividend Yield, Free Cash Flow Forecasts

If we assume $4 of the next-12-month EPS and apply a 26x non-GAAP forward P/E, then shares should be near $104. I arrive at that above-market earnings multiple by assessing its EPS growth trajectory. Considering a 16% EPS growth rate and a PEG near 1.6, above that of the S&P 500 but below NKE’s 5-year average, I assert that a valuation premium to the market is appropriate amid ongoing shifts in domestic consumer preferences and uncertainty with the Chinese economy. Thus, the stock is near fair value in my estimation.

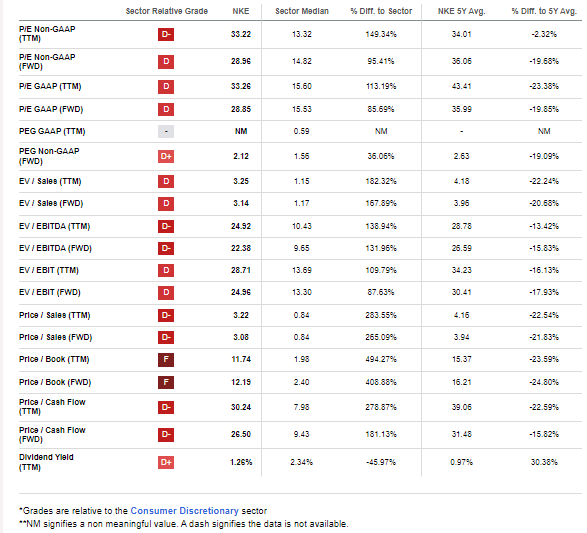

NKE: Historically Trades with a Large Valuation Premium

Seeking Alpha

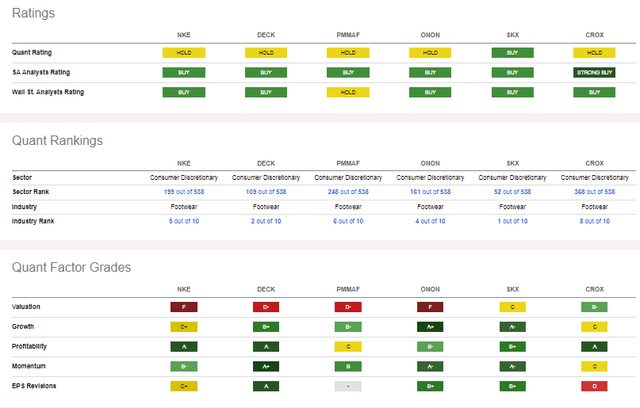

Compared to its peers, NKE features a poor valuation Quant Factor Grade by Seeking Alpha and a lukewarm growth rating. But with very strong historical and forward-looking profitability trends, it’s no surprise that the company almost always features a premium valuation to the S&P 500 and broader Consumer Discretionary sector. Share-price momentum has been decent lately, though I will note some key price points the NKE bulls must bear watching. EPS revisions, meanwhile, have been unimpressive despite a decent run of bottom-line beats since late 2020.

Competitor Analysis

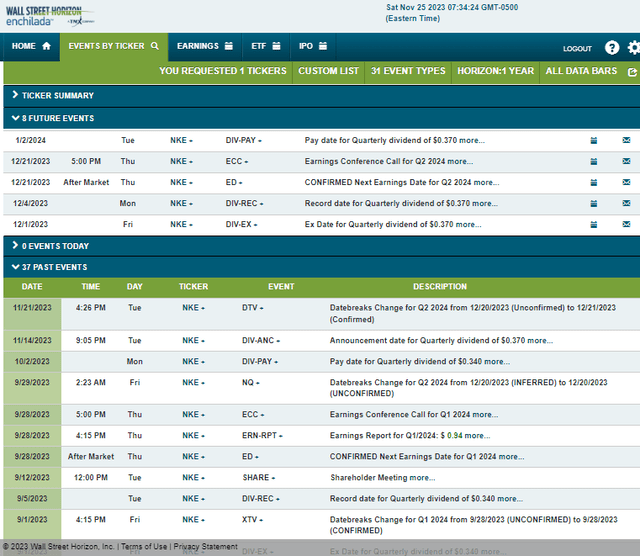

Looking ahead, corporate event data provided by Wall Street Horizon show a confirmed Q2 2024 earnings date of Thursday, December 21 AMC with a conference call immediately after the numbers cross the wires. Shares trade ex a $0.37 dividend on Friday, December 1.

Corporate Event Risk Calendar

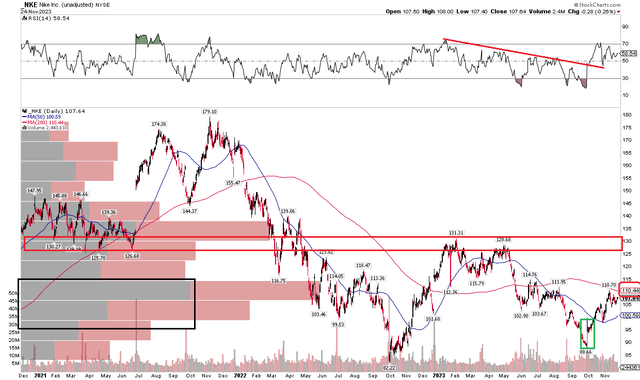

The Technical Take

NKE’s chart is one of the more simple ones I have analyzed lately. Notice in the graph below that there is a clear resistance zone in the $126 to $131 range. So long as the stock is below that area, it’s hard to be too excited about owning shares. What’s encouraging, though, is that NKE’s RSI momentum oscillator at the top of the chart broke out from a year-long downtrend just a few weeks ago. Technicians commonly believe that momentum turns before price, so this could be a bullish harbinger.

But with a flat to slightly negatively sloped long-term 200-day moving average, the bulls have their work cut out for them to reverse some negative sentiment seen in price. What’s more, I spot ample volume by price in the $95 to $115 range – that will make the next 5%-plus tough sledding for those long, too. There is also a price gap from its late-September earnings report that looms near $89.

Overall, I would be on the sidelines with NKE so long as it’s below key resistance near $130.

NKE: $130 Resistance, Mind the Earnings Gap, Momentum Breakout

The Bottom Line

I have a hold rating on NKE. I see the stock near fair value while the chart is somewhat neutral having traded sideways since Q2 2022.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.