Summary:

- Consumer discretionary stocks, including Nike, have performed well in the recent market rally.

- Nike’s stock is potentially in an uptrend, but there are signs of declining bullish momentum.

- The fundamental picture for NKE is not particularly impressive, with no significant progress in margins and questionable long-term earnings growth potential.

Wirestock

Consumer discretionary stocks have come alive since this most recent market rally started, as you’d expect given it’s one of the more aggressive sectors in the market. A rising tide raises all ships, as the saying goes, and in this article, we’ll take a look at one of the largest stocks in the consumer discretionary universe, Nike (NYSE:NKE).

I see Nike as fairly valued and with a somewhat murky path to sufficient earnings growth to justify the current price, and as such, I’m placing a hold on the stock. In short, I think there are better options out there if consumer discretionary exposure is what you’re after.

Uptrend started?

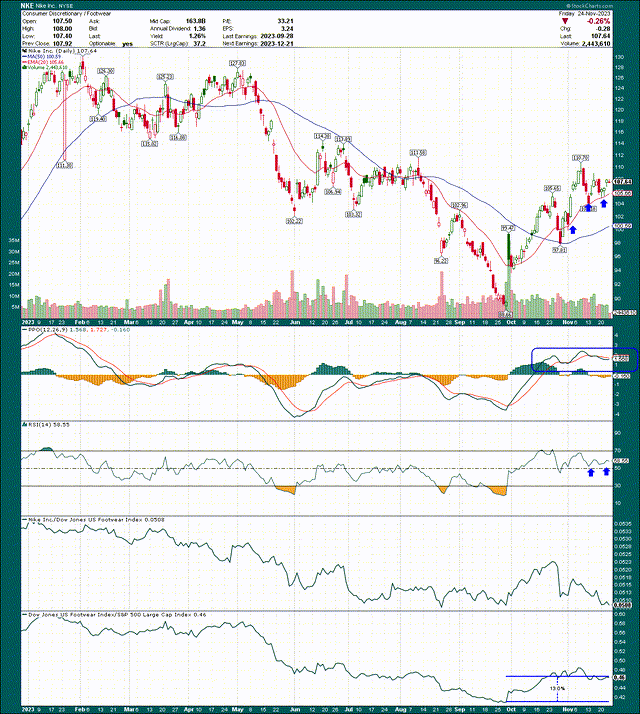

Let’s start with the price chart, which shows that Nike is potentially already in an uptrend. Whether that continues or not remains to be seen, but for now, it looks good.

We can see the stock has successfully tested the rising 20-day exponential moving average a few times already, and so long as that line holds, it is a potential trading candidate on the long side. However, if we look longer-term, I see some cracks in the façade here.

I’ve placed a box on the PPO that shows there’s been declining bullish momentum in the past few weeks, simply meaning that the thrust of the original rally has waned significantly. That does not guarantee the rally is over, but it does mean the bulls are getting tired and that the market for this stock is more balanced. We see the same thing with the 14-day RSI just below the PPO.

From a relative strength perspective, we can see in the bottom two panels that Nike has been flat against its peer group, but that the peer group has been extremely strong in the past two months. Consumer discretionary stocks have outperformed the S&P 500 by 13% since the end of September, which is absolutely massive outperformance. We want outperforming stocks in outperforming sectors, and for Nike, we are getting just the latter.

Let’s now turn our attention to the fundamental picture, which looks okay, but again, nothing special from where I’m sitting.

Where’s the growth coming from?

Before we get into the fundamental picture, I recognize that Nike is a legendary consumer discretionary stock, and it’s one of the largest in the group for a very good reason. This is a great business, and that’s unlikely to change in the foreseeable future. However, that’s only one piece of the puzzle when it comes to investing, and I simply don’t see long-term fundamental case at the moment for longs. Let’s begin with margins, which we have plotted below on a trailing-twelve-months basis for the past several years.

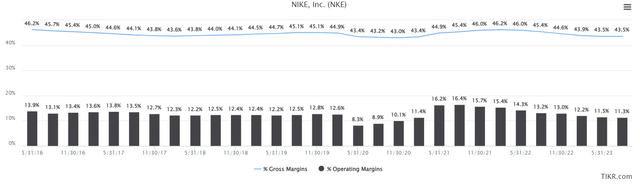

If we ignore the anomalies produced during the height of COVID, we can see that gross margins have generally been 44%/45% of revenue, and operating margins have generally been 12% to 14%. Those numbers are fine, but there’s been absolutely no progress anywhere. We’re not talking about a single year that was flat; this is just how Nike operates. I’ve been saying for many years that Nike spends too much money on things like advertising and SG&A because it’s produced massive sales growth over time, with essentially zero leverage to margins and profitability. So, if we look forward, why would we expect anything different? Can Nike do better than the most recent value of 11.3% of revenue? Probably. But is there a long-term margin growth story here? You simply cannot convince me of that, so I don’t see margins as a source of earnings growth.

Seeking Alpha

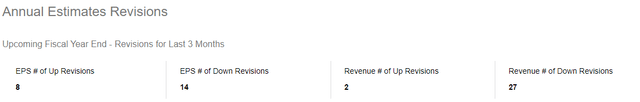

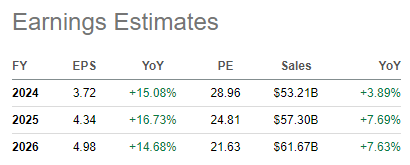

That makes this table quite interesting, as sales growth is expected to be less than half of projected EPS growth in the coming years. There are only three ways to grow EPS: revenue growth, margin growth, and share repurchases. If revenue growth is ~7%, margin growth is essentially nothing and share repurchases have been good for perhaps ~1% annually, where is that additional growth coming from? In other words, how would Nike get to 15% EPS growth unless margins suddenly start flying higher? To my eye, it isn’t, and I think these estimates are subject to downward revisions as a result.

As it turns out, that’s already been underway, as we can see revenue estimates are overwhelmingly moving lower, while most EPS estimate revisions have come down as well. The bottom line here is that unless Nike suddenly figures out how to boost margins – an outcome I have zero confidence in given the company’s history – these EPS estimates for 2025+ are too high.

Is it at least cheap?

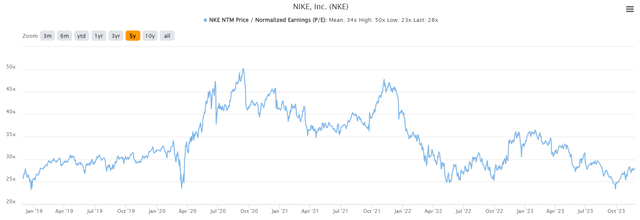

No, no it isn’t. Before we look at the valuation, let me reiterate that I’m looking at this chart with an eye toward EPS estimates potentially being too high for the reasons I outlined above. Right now, the stock is roughly in line with its pre-COVID valuations. Once again we have to ignore the valuations we saw during COVID because earnings plummeted, meaning the stock was pricing in a rebound. That led to valuations of 40X+ earnings, which is unsustainable. For now, we’re at 28X forward earnings, and if the company can achieve 15% EPS growth, that’s probably a fair valuation.

If I’m right, however, that EPS estimates are simply too high, the risk here is for a lower valuation, not a higher one. So if we wrap all of this up, my view of this stock is that the short-term trading outlook is positive so long as the stock remains over the 20-day EMA. However, from a fundamental perspective, I don’t see much to like here.

Nike has been proven incapable of growing margins over time. The problem is that sales growth and share repurchases are nowhere near enough to hit 15% EPS growth over time, so I think there’s a significant risk to EPS estimates, and for that reason, I think your consumer discretionary investment dollars are better used elsewhere.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you liked this idea, sign up for a no-obligation free trial of my Seeking Alpha Marketplace service, Timely Trader! I sift through various asset classes to find the best places for your capital, helping you maximize your returns. Timely Trader seeks to find winners before they become winners, and keep you out of losers. In addition, you get access to our community via chat, direct access to me, real-time price alerts, a model portfolio, and more.