Summary:

- UnitedHealth is our top Long Idea for 2024.

- We selected UNH based on its potential for providing the best overall risk-adjusted return of any stock next year.

- UNH has a strong financial track record, with consistent growth in net income and revenue, driven by megatrend tailwinds and a value-based care model.

- The stock is attractively valued.

- As headwinds abate and the stock looks to break out, the time is now to enter this potential 2024 winner.

Hiraman/E+ via Getty Images

When it came to selecting our top Long Idea for 2024, there were a number of different ways that we could have approached the topic.

Should we have focused on the stock that would produce the most absolute returns?

While simple in theory, in practice, the top performing stocks in 2023 YTD are the following: SLNO, ACIC, AAOI, CVNA, and NPCE. Of these 5 stocks, 4 of them come in below the $1 billion market cap mark; under which we typically avoid publishing analysis.

Additionally, many of these stocks experienced wildly unpredictable swings and catalysts, from FDA approvals to short squeezes that would have been hard to foresee on January 1st of this year.

So, that approach is out.

What about if we picked the stock that we thought would have the highest potential chance to earn a positive return in 2024?

While an interesting exercise, our forecasts predict that the markets will likely have a positive year in 2024, which means that simply buying the market already has a decent chance of earning a positive return.

Thus, that probably wouldn’t be the best way forward, either.

Ultimately, we decided to go with a blend of the two, selecting our top pick based on a balanced collection of the following criteria:

- Highest potential return

- Highest chance of beating the market

- Highest potential for a positive year

- Lowest amount of risk

When you look across the board, there’s one stock that fits these criteria, in our mind, better than any other: UnitedHealth (NYSE:UNH).

Today, we’re doing a deep dive on UNH in order to explain why we think this stock could be one of the best names to own in 2024.

Sound good? Let’s dive in.

The Company

In case you’re new to the markets or haven’t heard of UnitedHealth before, UNH is a diversified healthcare & insurance company operating in the US and international healthcare markets. The company operates through two units: Optum and UnitedHealthcare.

UnitedHealthcare: UnitedHealthcare stands as the nation’s largest health insurance provider, serving over 50 million members. Their extensive portfolio of health insurance includes plans tailored to individuals, employers, and government agencies.

These plans offer a wide range of benefits, including medical, dental, vision, and pharmacy coverage. UnitedHealthcare’s network of over 1.2 million healthcare providers nationwide provides members with access to care.

Optum: Optum is a leading health services company that provides a broad spectrum of services to the healthcare industry. Its three main service areas are Pharmacy Benefit Management, Care Coordination, and Data Analytics, under the brands Optum Rx, Optum Health, and Optum Insight.

- Optum Rx, the PBM arm, manages prescription drug benefits for over 100 million people, making it one of the largest PBMs in the country.

- Optum Health, the care coordination arm, plays a pivotal role in improving the quality and efficiency of care. It coordinates care among multiple providers, manages chronic conditions, and prevents hospitalizations, ensuring patients receive seamless and effective care.

- Optum Insight, the data analytics arm, uses healthcare data to improve care outcomes. It provides data and analytics solutions to help healthcare organizations identify trends, develop targeted interventions, and make informed decisions about resource allocation, leading to data-driven improvements in care delivery.

Financial Results

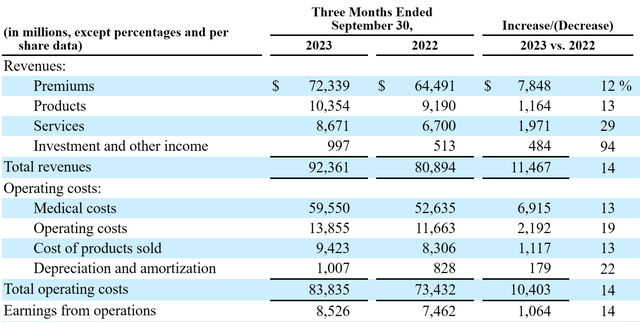

Now that you’re caught up on the company, let’s have a look at the group’s consolidated financials:

As you can see, the company is highly profitable and growing quickly.

The 14% YoY net income growth from Q3 is mirrored by 14% YoY growth in top line sales, which indicates that margins are stable and increases in revenue are finding their way to the bottom line, which is a positive sign.

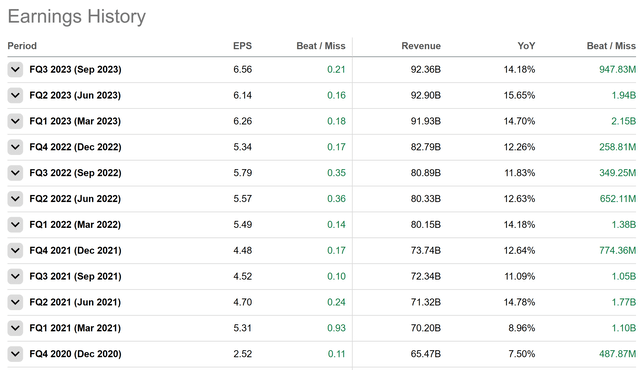

Zooming out, we can see that UNH has a long track record of beating on both the top and bottom lines, as shown below:

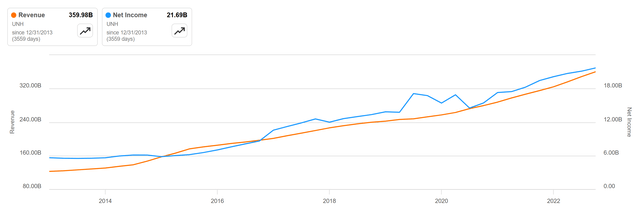

This track record extends out more than a decade, as TTM sales and TTM net income have been growing quickly, and in tandem, for quite some time:

Between 2013 and 2023, revenue increased from $122 billion to $359 billion, which represents a CAGR of more than 11%.

In that same span of time, profit skyrocketed from $5.6 billion to more than $21.6 billion, which represents a CAGR of roughly 14.4%.

All told, this is unbelievable growth, especially at UNH’s scale.

Driving these results are a few megatrend tailwinds which are unlikely to abate anytime soon.

First, as the large cohort of baby boomers in the US continue to age, they will demand more healthcare services.

Why is this? In short, higher age is often correlated with an increased prevalence in ongoing health issues, decreased physical and cognitive function, and increased social isolation. All of these can affect health outcomes, and thus, healthcare services demand.

Second, UNH is the big dog in the room. The company has a healthcare network that is second to none that provides a serious moat around the business.

Combined with UNH’s strong financial position that allows the company to continually invest in internal projects with high projected IRR%, and the scale advantage is a serious profit tailwind for UNH investors.

Finally, UNH operates on a value-based-care model.

Value-based care is a healthcare delivery model in which providers are paid based on patient health outcomes, rather than the volume of services they provide.

While there are challenges with a value-based-care model around measuring outcomes, as well as aligning the incentives of insurance, providers, and payers, many agree that it is likely the path forward for the healthcare industry.

Given than UNH has been implementing this in their business for some time, the company has built a kind of ‘early mover advantage’ in gathering data and improving product quality. This should continue to pay dividends going forward.

The Valuation

So, demand for shares in UNH has been increasing in momentum over time, as company revenues and profits have been strong due to a combination of powerful business trends, as well as solid management execution.

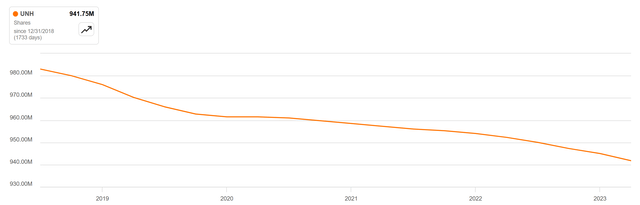

In addition, the company has been buying back shares; retiring nearly 5% of the float over the last 5 years:

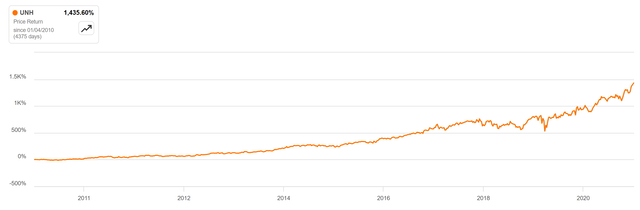

Thus, as demand for shares increases and the supply of those shares decreases, one would expect to see rising prices for UNH shares over time. This was true across the last decade, as the stock price went from $25 in 2010, to ~$490 by the end of 2021, earning investors a return of more than 1,400%:

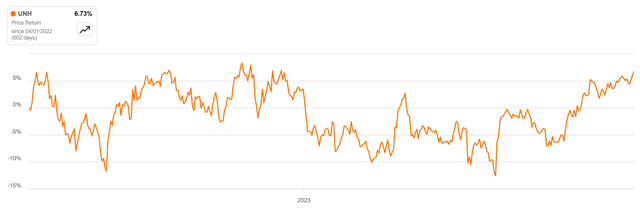

However, prices have stalled over the last year and a half:

Shares haven’t advanced an inch, despite continued success on the business front.

This slowdown in price appreciation is likely due to a weak environment of risk taking as interest rates have gone up. Luckily, this hasn’t led to a massive loss like the drawdowns that some other companies experienced in other sectors, but it has stifled price growth.

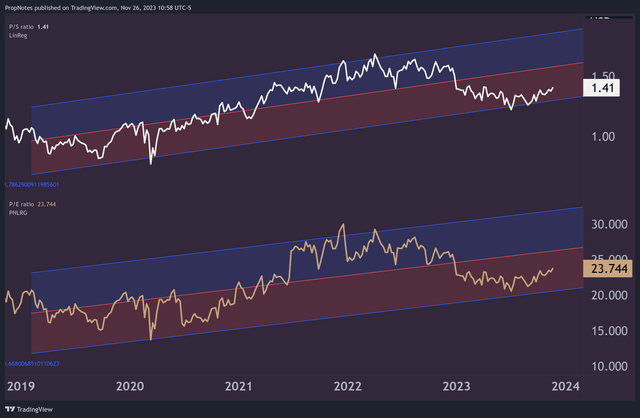

As financials have improved but prices haven’t moved, the value proposition for buying shares has become more attractive:

Above, you can see the current multiples for UNH. It’s currently trading at 1.4x sales, and 23.7x net income. Nominally, these are in line with a company of this quality and size.

Historically, however, they represent quite a deal. When a linear regression and standard deviations are overlaid onto the valuation, one can see that the present multiples are at the lower end of the historical range.

When it comes to investing, there’s only two main elements to focus on:

- The quality of the ‘box’ you’re investing into.

- The price of the ‘box’.

In this case, the quality is top tier, as we’ve described. It’s also looking like the price is rather historically attractive. That’s both boxes checked.

Additionally, the historical trend regarding UNH’s top and bottom-line multiples has been up, as you can see from the slope of the channels above. This suggests that the market, on average, is rewarding UNH with a higher valuation over time due to its advantages.

This is another powerful engine of wealth building that is beneficial to have on your side.

Why 2024?

In short, we think that 2024 is the right year for UNH investors because the macro headwinds that the stock experienced in late 2022 and FY2023 are set to improve in 2024. Leading economic indicators are improving, and the PMI is now back above 50, which is a closely-followed gauge of ‘organic’ economic sentiment.

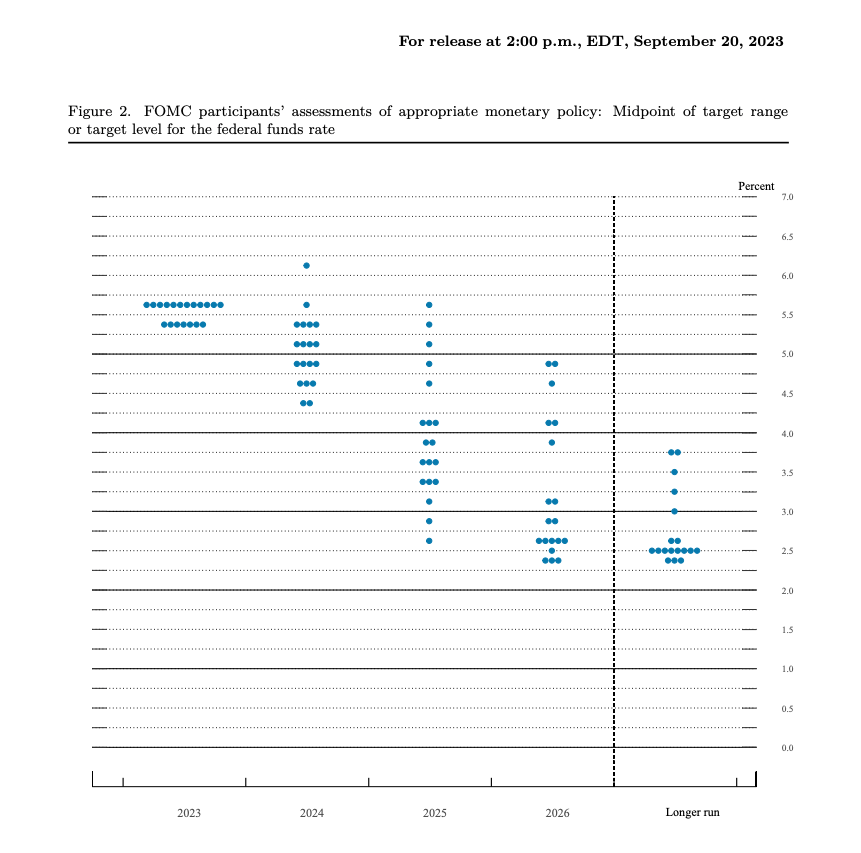

Additionally, the federal reserve dot plot shows that FOMC members are expecting the trend of rates to head lower over FY24, 25 and 26, which would be a reversal of the quick rise we’ve seen since 2021:

Federal Reserve

This could improve risk-taking sentiment and allow UNH’s multiple to expand once again to stay on pace with the business’s growth.

This expectation is underscored by the recent CPI reading, which showed inflation coming in at effectively 0%, MoM, and only 3.3% YoY.

All in all, we think UNH is the best stock to hold in 2024, given the company’s solid long term business dynamics & execution, the attractive valuation, and the potential reversal of headwinds that have been stifling price growth up to this point.

Risks

That said, there are some risks.

The chief risk to be concerned about is on the regulatory side of things:

- Changes in healthcare regulations: The healthcare industry is highly regulated, and changes in these regulations can have a significant impact on UNH. For example, changes to Medicare or Medicaid reimbursement rates could severely impact UNH’s revenue. More broadly, political changes, especially those favoring the political left, could pose an existential risk if a single-payer system were to be implemented. A Republican win in 2024 would also likely buttress the stock price.

- Changes in drug pricing: UNH is a large purchaser of drugs, and changes in drug pricing can have a significant impact on its costs. For example, if the government implements new measures to control drug prices, UNH’s profit margins could be negatively impacted.

- Increased scrutiny of data privacy: UNH collects a large amount of data about its customers, and this data is subject to a number of privacy regulations. If UNH is found to be in violation of these regulations, it could face fines and other penalties.

Aside from these risks, there’s also the usual set of risks that face large public companies, including management turnover, macro conditions, and liquidity risk.

That said, many of these risks we feel UNH is well prepared to overcome or mollify. Thus, the risk is still worth the reward, so to speak.

Summary

Overall, UNH is our favorite stock for 2024. The company has done fantastically well, and the shares are priced at a relative song. As the stock looks to breakout higher and headwinds potentially abate, we think a position in UNH could be the highest-Sharpe opportunity in the market through next year.

Cheers!

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2024 Long/Short Pick investment competition, which runs through December 31. With cash prizes, this competition — open to all contributors — is one you don’t want to miss. If you are interested in becoming a contributor and taking part in the competition, click here to find out more and submit your article today!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in UNH over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.