Summary:

- Nvidia Corporation released impressive Q3 earnings, with revenues increasing by 205.6% YoY to $18.12 billion.

- The demand for AI chips continues to accelerate, with Nvidia’s data center revenues surpassing Intel and AMD combined.

- Nvidia is powering the ongoing generative AI revolution and is ahead of its competition in terms of GPU technology.

Justin Sullivan

NVIDIA Corporation (NASDAQ:NVDA) has released a stellar Q3 earnings report and announced an upbeat guidance in recent days. Despite this, its shares depreciated after the results were revealed and currently trade below the $500 per share level. While some might think that even at the current price the shares are overvalued, I continue to believe that Nvidia’s growth story is far from over and the company is already making a profound impact on our society as a whole by powering the ongoing generative artificial intelligence (“AI”) revolution.

Although certain risks are associated with Nvidia’s stock, there are also more than enough reasons to believe that the company’s growth opportunities will continue to outweigh all the potential challenges in the foreseeable future. That’s why I believe that the latest depreciation of Nvidia’s shares is not justified and reiterate my BUY rating for the stock.

The Demand For AI Chips Continues To Accelerate

Impressive Performance

Nvidia reported impressive earnings results for Q3 a few days ago. During the quarter, its revenues increased by 205.6% Y/Y to $18.12 billion, and were above the estimates by $2.01 billion, while its non-GAAP EPS was $4.02, also above the expectations by $0.63. As expected, the bulk of revenues were generated by the data center business, the sales of which stood at $14.51 billion, up 41% M/M and up 279% Y/Y. Nvidia’s data center revenues are now bigger than the data center revenues of Intel (INTC) and Advanced Micro Devices (AMD) combined, as the company’s GPUs serve as the backbone of the current generative AI revolution.

Powering The Ongoing Generative AI Revolution

The biggest upside that Nvidia has going for it is the broader adoption of generative AI by major enterprises around the globe. Platforms and tools like OpenAI’s ChatGPT, Adobe (ADBE) Firefly, and Microsoft (MSFT) 365 Copilot are all already running mostly on Nvidia’s H100 GPUs that are more efficient than the traditional CPUs for AI-related tasks. At the same time, Nvidia’s GPUs also make it possible for companies like Meta Platforms (META) to run their own large language models, which are aimed at helping advertisers better optimize their campaigns to improve their conversions and result in a lower churn rate for the company’s advertising platforms.

What’s also important to note is that countries are also becoming interested in building their own sovereign AI infrastructure in order to continue to innovate and not be left behind by those who have access to the greater processing power. In the latest transcript call, Nvidia’s leadership noted that it’s already helping governments of countries like India and France to boost their sovereign AI infrastructure, and believes that serving the sovereign AI infrastructure market could become a multi-billion dollar opportunity in the following years for the company.

In addition to all of that, the biggest upside for the company is that as the demand for the deployment of generative AI by enterprises and countries for their own needs has skyrocketed, Nvidia is the only one so far that can satisfy those needs. The competition is trying to catch up and capture some portion of the market share from Nvidia, but it’s unlikely that that’s going to happen anytime soon. While AMD and Intel are preparing to launch their own GPUs for generative AI that are similar to the H100 series, Nvidia has already started to ship its GH200 superchip for supercomputers in Q3 and is about to release its next-generation GPU for generative AI called H200 next year. The first major clients of the newest GPU are expected to be all the major cloud providers such as Microsoft, Amazon (AMZN), Google (GOOG, GOOGL), and Oracle (ORCL), which indicates that Nvidia is significantly ahead of its competition.

What’s Next?

Considering all of this, it’s safe to assume that Nvidia has a decent chance to exceed expectations once again in Q4 and beyond. It already increased its guidance for Q4 and expects to generate ~$20 billion in revenues during the quarter, which is above the previous expectations of $17.82 billion and already includes the China-related risks. It also expects its GAAP and non-GAAP gross margins in Q4 to be 74.5% and 75.5%, respectively.

Given its performance in recent quarters and the never-ending increase in demand for its chips, it’s safe to say that Nvidia would be able to achieve those targets relatively easily. As such, the only question that remains at this stage is whether its stock also offers a significant upside and would grow along with the business.

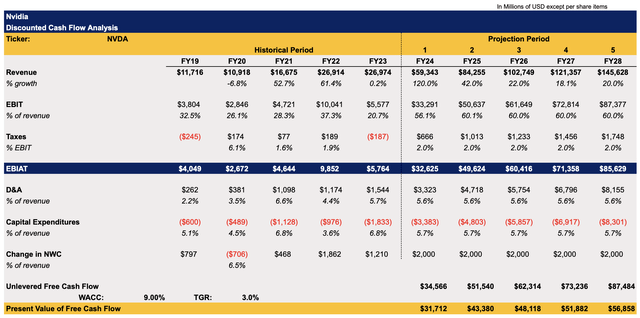

Below is my updated discounted cash flow (“DCF”) model from the previous article. The only thing that has been changed in the updated model is the revenue assumption for the current fiscal year, which was increased due to the new upbeat guidance. All the other metrics in the model are mostly the same and align closely with the Street estimates. The WACC in the model is 9%, while the terminal growth rate is 3%.

Nvidia’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

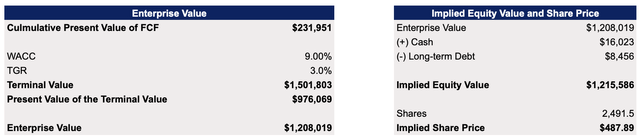

The model shows that Nvidia’s enterprise value is $1.2 trillion, while its fair value is $487.89 per share, which is close to the current market price. Despite this, I remain bullish about the stock since the company has momentum going for it due to the high demand for its chips. As a result, there’s a possibility that Nvidia once again exceeds expectations, which would lead to an upward revision of my assumptions and a greater fair value.

Nvidia’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

What’s more is that I would even call my calculations pretty conservative considering that the consensus on the Street is that Nvidia’s fair value is $655.33 per share, which represents an upside of nearly 40%. That’s another reason why I decided to reiterate my BUY rating for Nvidia.

Nvidia’s Consensus Price Target (Seeking Alpha)

Major Risks To Consider

The Rising Sino-American Tensions

There’s no denying that there are several risks that could undermine Nvidia’s growth story and result in a potential depreciation of the company’s shares. The geopolitical risk is probably the biggest one at this stage as it was discussed several times during the latest conference call.

Let’s not forget that back in October, the Biden administration announced new chip curbs to China and several other countries that could negatively affect Nvidia’s performance in the future. After all, around 20% to 25% of data center revenues come directly from the Chinese market and the inability to ship advanced chips there could certainly lead to a disappointing earnings report in the future. Nvidia’s management itself stated in the call that sales to China will decline significantly in Q4. We also already see Chinese companies like Alibaba (BABA) acknowledging that the new export rules would have a material impact on their businesses and limit their technical capabilities.

The good news, though, is that Nvidia believes that the decline in China will be offset by other markets, as it seems that the demand is not decreasing while the backlog remains robust. What’s more is that there’s a possibility that China could circumvent the curbs by purchasing the chips indirectly through other countries, which in the end would boost Nvidia’s sales as well. Even the latest Congressional report on export curbs acknowledged that the chipmaking export curbs are not properly working right now. Considering this, it’s safe to say that the numbers in Q4 would be impressive, but after that, the China-related risks could play a greater role and undermine the bullish thesis.

Competition On The Horizon?

The rising competition is another risk that could undermine Nvidia’s dominance in the GPU market in the future. However, as was noted earlier in this article, that’s unlikely to become a threat in the short to near-term given Nvidia’s advantageous spot in the market. Considering that AMD expects its MI300A and MI300X AI GPUs to generate only $2 billion in revenues next year, it becomes obvious that Nvidia will continue to dominate the market, especially as it expects to generate $20 billion in Q4 alone mostly thanks to the sales of its own AI GPUs. At the same time, the upcoming launch of H200 next year and the ability to offer the full CUDA stack to its clients make Nvidia the only company that could truly power the ongoing generative AI revolution at this stage.

A New “Crypto Winter” Scenario?

One risk that could undermine the bullish thesis is the inability of Nvidia to continue to increase its guidance in the coming quarters. After the successful performance in recent quarters and the latest upbeat guidance that expects Nvidia to increase its revenues at a triple-digit rate in the current fiscal year, it would become significantly harder for the company to impress the market, especially once the demand slowly fades in the future. We’re not at that point yet, but things could start changing in a year or two.

A similar thing happened to the company a few years ago, when it was beating expectations and increasing guidance thanks to the surge in demand for its GPUs that were used to mine Ethereum. Once the crypto winter arrived – the performance suffered. That’s why it’s important to acknowledge that even if the demand for its AI chips continues to accelerate in the next year or two, it likely will dissipate at some point in the future and could result in a significant depreciation of Nvidia’s shares. The good news, though, is that it appears that we’re far away from such a scenario happening anytime soon.

The Bottom Line

There’s nothing not to like about Nvidia at this stage. The increased demand for its chips is likely going to offset the geopolitical risks, while the upcoming launch of its next-generation GPU next year would make it nearly impossible for the competition to present a decent alternative. As such, Nvidia is likely going to continue to exceed expectations, and that’s the main reason why the shares likely have more room for growth despite the recent depreciation in the last few days.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Bohdan Kucheriavyi and/or BlackSquare Capital is/are not a financial/investment advisor, broker, or dealer. He's/It's/They're solely sharing personal experience and opinion; therefore, all strategies, tips, suggestions, and recommendations shared are solely for informational purposes. There are risks associated with investing in securities. Investing in stocks, bonds, options, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Loss of principal is possible. Some high-risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including greater volatility and political, economic, and currency risks and differences in accounting methods. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Brave New World Awaits You

The world is in disarray and it’s time to build a portfolio that will weather all the systemic shocks that will come your way. BlackSquare Capital offers you exactly that! No matter whether you are a beginner or a professional investor, this service aims at giving you all the necessary tools and ideas to either build from scratch or expand your own portfolio to tackle the current unpredictability of the markets and minimize the downside that comes with volatility and uncertainty. Sign up for a free 14-day trial today and see if it’s worth it for you!