Summary:

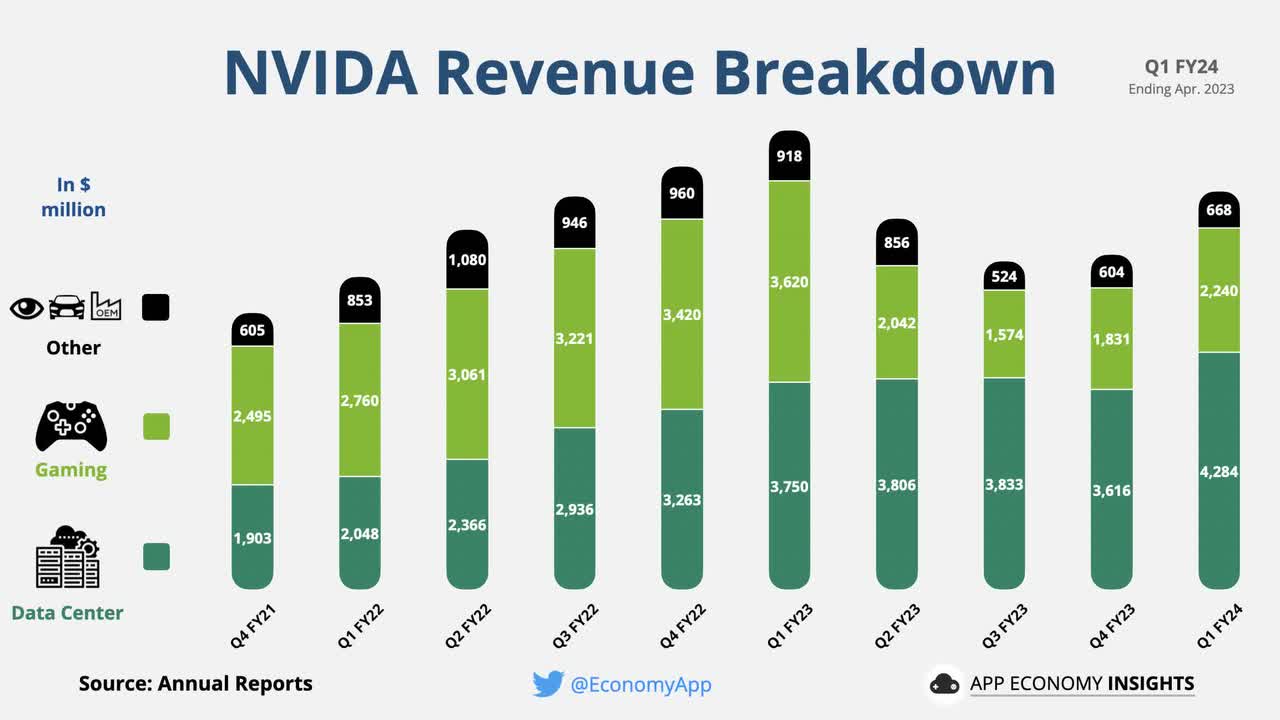

- Nvidia Corporation witnessed soaring data center revenue with a 279% YoY increase driven by high demand for the Nvidia HGX platform catering to large language models and AI applications.

- The gaming segment also saw remarkable revenue growth, which can be attributed to increased demand for GeForce RTX 40 Series GPUs.

- Nvidia faces challenges due to geopolitical tensions and export controls, with a significant portion of its data center revenue coming from sales to China and Russia.

- Nvidia’s P/E ratio reaches 5-year historical average, reflecting steady performance improvement and highlighting solid long-term growth.

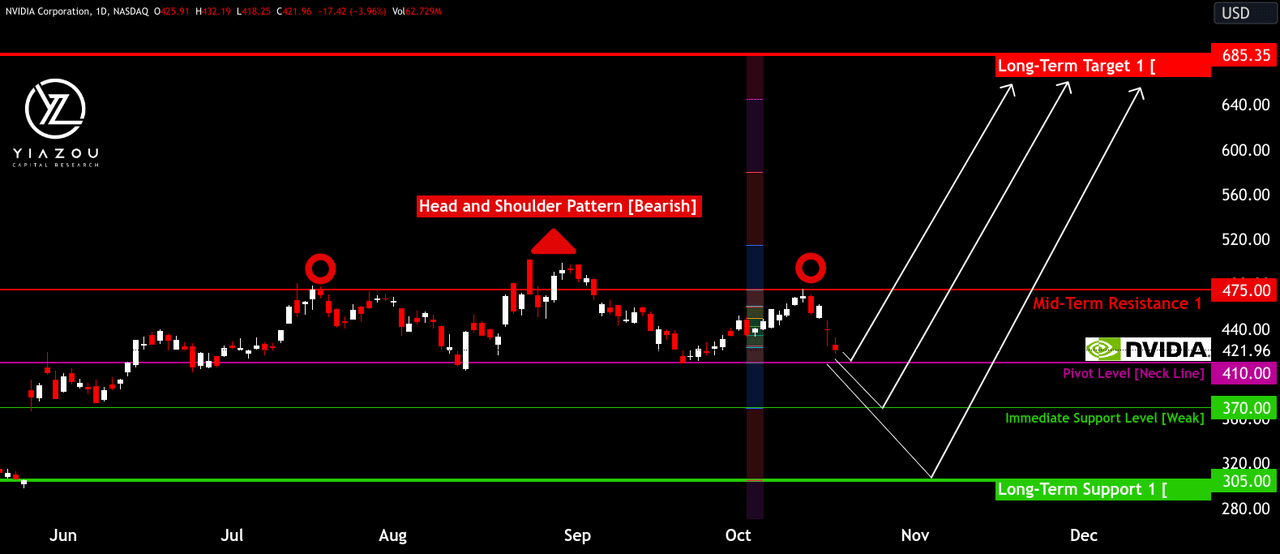

- Technically, Nvidia stock hit $410 Neckline Support, confirming the first scenario from our bullish trend projection.

Sharamand/iStock via Getty Images

Investment Thesis Update

In the ever-evolving realm of technology, NVIDIA Corporation (NASDAQ:NVDA) stands as a beacon of innovation and growth. The third quarter of fiscal 2024 has marked a significant milestone in Nvidia’s journey, showcasing a meteoric rise in its data center revenue, a pivotal shift in its product architecture, and a robust expansion in the gaming and professional visualization segments. However, Nvidia’s success story has its challenges, especially with the potential impact of geopolitical tensions and export controls threatening Nvidia’s global dominance.

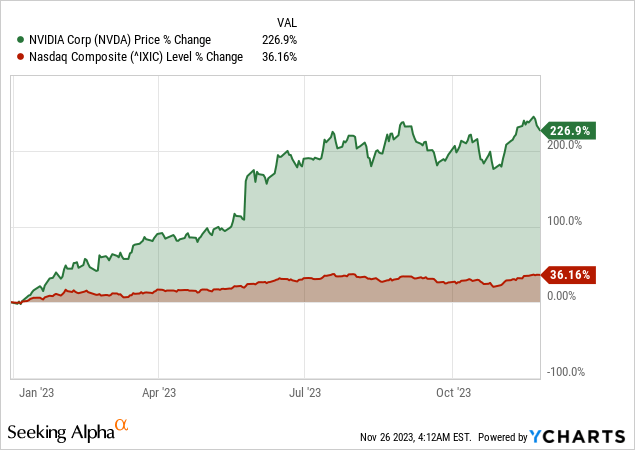

In our June 2023 analysis, we emphasized Nvidia’s strong performance and the surge in bullish momentum following its Q1 2024 earnings call, primarily fueled by the company’s advancements in AI technology. We also cautioned about a potential short-term bearish trend due to the fading AI hype and a possible lack of fundamental support.

As of today, our updated analysis reveals a notable shift in Nvidia’s market position. Based on the company’s P/E ratio alignment with its 5-year historical average, it marks a significant development. Contrary to the expected bearish trend, this alignment indicates sustained performance improvement rather than a decline in stock price. Therefore, the strong indicator of the company’s robust fundamental health and market confidence compels us to upgrade our rating from “Hold” to “Buy.”

Nvidia’s Meteoric Rise: Unveiling Q3 2024 Triumphs and Transition

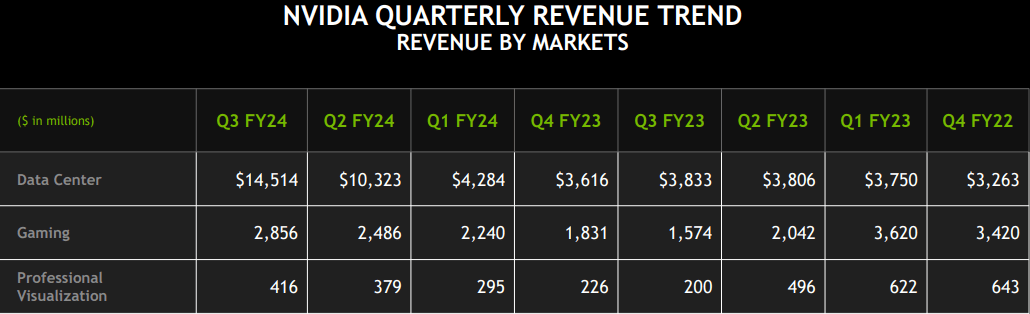

Nvidia experienced an exceptional surge in data center revenue in Q3 fiscal 2024, with an impressive 279% year-over-year increase and a substantial 41% increase sequentially. The high global demand for the Nvidia HGX platform was the key driver behind this growth.

This platform catered to the increasing need for training large language models, recommendation engines, and generative AI applications. Similarly, the Data Center compute showed staggering growth, escalating by 324% year-over-year and 38% sequentially. This growth was primarily fueled by the robust ramp-up of the Hopper GPU architecture-based HGX platform. The strong adoption came from cloud service providers (CSPs), GPU-specialized CSPs, consumer Internet companies, and enterprises.

Nvidia Investor

Notably, while sales of Ampere GPU architecture-based data center products remained substantial, they experienced a sequential decline. This decline was an indicator of nearing the end of the architecture’s lifecycle and the company’s transition toward new architectures and product lines. Despite this, Nvidia recognized initial revenue from ramping the L40S GPU and the GH200 Grace Hopper Superchip, catering to a broad customer base. Approximately half of the data center revenue came from CSPs, while consumer internet companies and enterprises contributed the remaining half.

The gaming segment experienced remarkable revenue growth in Q3, with an 81% increase from the previous year and a 15% sequential increase. The upsurge in revenue was attributed to heightened demand for GeForce RTX 40 Series GPUs, particularly during the back-to-school and early holiday seasons. This increased demand followed the normalization of channel inventory levels, resulting in higher sales to partners.

Game-changing innovations and Professional Visualization Breakthroughs Propel Growth

Looking forward, Nvidia continues to innovate in gaming technology, introducing DLSS 3.5 Ray Reconstruction and TensorRT-LLM for Windows and expanding its game offerings. The addition of 56 DLSS games and over 15 Reflex games contributed to surpassing 1,700 games on GeForce NOW, enhancing the gaming experience and widening Nvidia’s gaming ecosystem.

Finally, the Professional Visualization segment also witnessed substantial revenue growth, with a 108% year-over-year increase and a 10% sequential increase. The surge in revenue was attributed to increased sales to partners following the normalization of channel inventory levels. The sequential increase was primarily driven by more robust enterprise workstation demand and the introduction of notebook workstations based on the Ada Lovelace GPU architecture.

Therefore, to sustain this growth, Nvidia announced a new line of desktop workstations featuring the NVIDIA RTX 6000 Ada Generation GPUs and NVIDIA ConnectX smart interface cards, catering to professional users’ needs for high-performance computing and visualization capabilities.

Geopolitical Storm: How Export Controls Test Nvidia’s Global Dominance

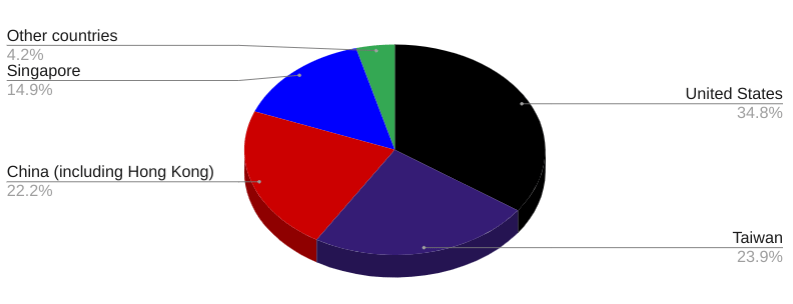

Looking at Nvidia’s revenue distribution and dependence on affected regions, approximately 20–25% of Data Center revenue over the past few quarters has been derived from sales to China and Russia.

The immediate impact on the company’s revenue in the third quarter of fiscal year 2024 was minimal due to additional demand from customers outside the named country group. However, it’s expected that sales to affected destinations will decline significantly in the Q4 fiscal year 2024 due to the imposed licensing requirements by the United States government (USG).

Looking at the SEC filings by Nvidia for Q3 2024, the company is confident about the losses from China, Russia, and some countries in the Middle East over the long term (emphasis added)”

Our competitive position has been harmed, and our competitive position and future results may be further harmed over the long term if there are further changes in the USG’s export controls. Given the increasing strategic importance of AI and rising geopolitical tensions, the USG has changed and may again change the export control rules at any time.

Another risk to Nvidia’s performance growth is the concentration in Asia-Pacific for Manufacturing. Nvidia’s supply chain is currently concentrated in the Asia-Pacific, including China, Hong Kong, Korea, and Taiwan. Any new or existing export controls limiting alternative manufacturing locations in this region could negatively impact the company’s business operations.

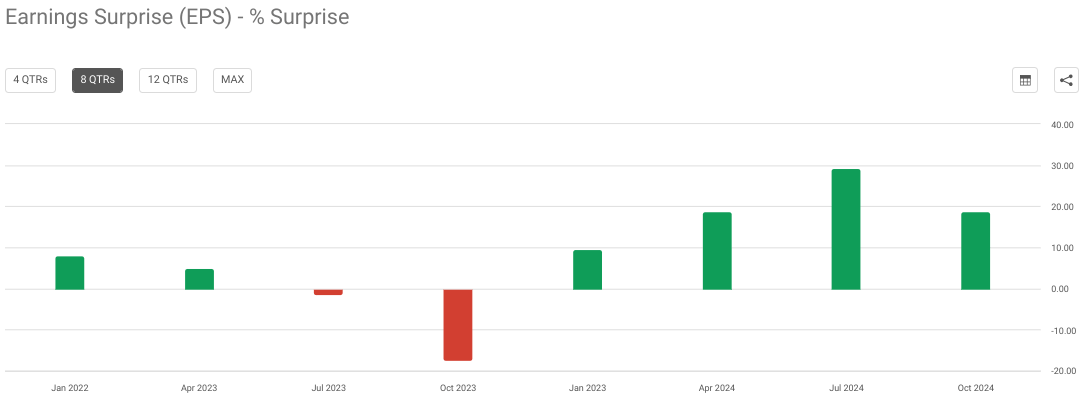

Interestingly, in the same context, the company’s momentum to surpass the Wall Street estimates has dropped this quarter already. On the positive side, the company anticipates that the decline in sales from affected regions will be counterbalanced by strong growth in other regions. To offset the damage, Nvidia is actively working to expand its data center product portfolio to offer new regulation-compliant solutions. Hence, this proactive step reflects the company’s adaptability and effort to address regulatory challenges.

seekingalpha.com

Emerging Risks in Geographical Distribution and Customer Concentration

Over Q3 of fiscal 2024, revenue from sales outside the United States accounted for 65% (64% in Q3 2023), suggesting that a significant portion of their revenue comes from international markets. There was a drop in the contribution from international markets over the nine months of 2024 to 62% from 71% compared to the first nine months of fiscal year 2023, respectively.

Fundamentally, the reduction in contribution from the international market may lag the growth of Nvidia, as this poses a permanent loss in future revenues due to losing the edge of first-mover advantage in AI tech supply. Logically, other competitors may quickly capture the share, as there is an urgency for AI development in major markets.

Geographical Distribution (Q3 Revenue) (Authors’ compilation)

In the first nine months of fiscal 2023, there were no customers with 10% or more of total revenue. However, in Q3 2024, the top customer was a major contributor, representing 12% of total revenue. Therefore, this shift indicates a growing concentration in customer contribution within a relatively short period.

Furthermore, Nvidia’s sales to the top two end customers primarily supported two end customers (as they do not purchase directly from the company). These end customers were estimated to have represented significant portions, approximately 15% ($2.7 billion) and 13% ($2.4 billion) of Q3’s total revenue, respectively. Such concentration on a few major clients poses risks and opportunities for Nvidia’s growth, as changes in these customers’ demand could significantly impact the company’s revenue.

Finally, the compute and networking segment’s concentration raises stability and vulnerability concerns, as changes in demand or relationships with these key customers can impact it. As per the company, the estimated compute and networking end-customer demand will remain concentrated.

Aligning with Historical Averages Signals Long-Term Upside

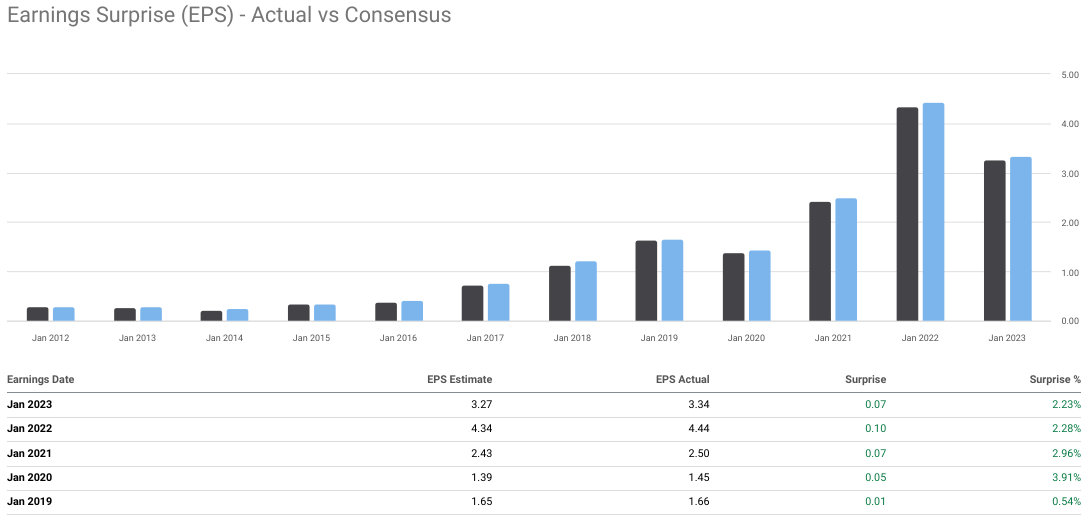

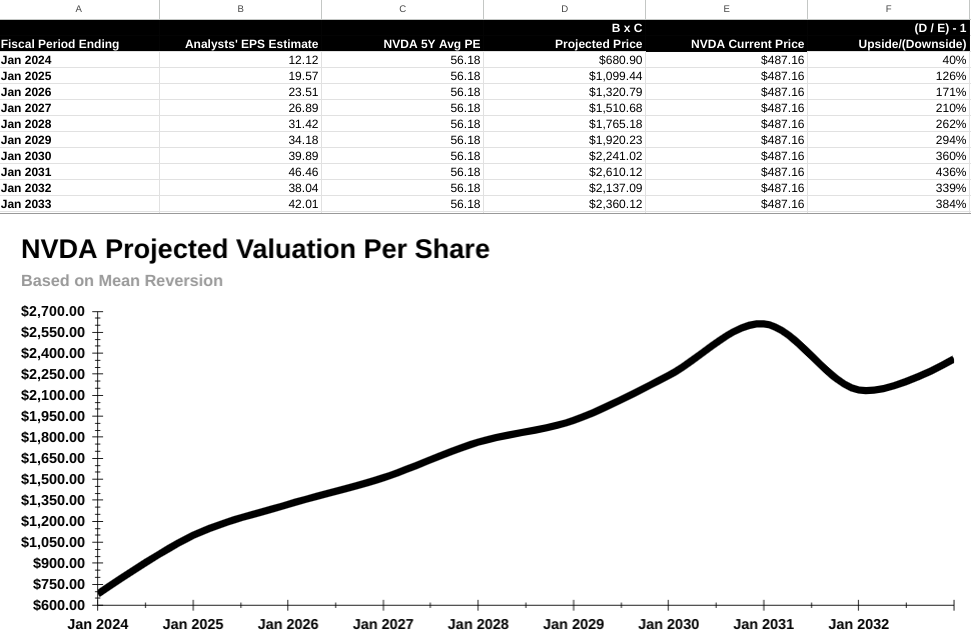

Looking at Nvidia’s P/E ratio provides a vital signal for the first time in years that Nvidia is on par with its 5-year historical P/E average. This touchdown with the long-term historical average is not due to a price drop but a performance improvement. From a conservative valuation perspective, if we assume that Nvidia may not see any further hikes in the P/E ratio moving forward and stay at its fair value level over the long term, this conservative stance may yield substantial returns to investors.

Therefore, based on the historical pattern that Nvidia constantly surpasses the analysts’ EPS estimates over the long term and the mean reversion theory, the analysts’ forward EPS estimates are used to project its fair value.

seekingalpha.com

Considering the analysts’ EPS estimates and projections, the fair value of Nvidia stock through the long-term historical average of the P/E ratio provides a 40% upside by the end of fiscal 2024. Over the mid-term, the projections represent a 171% upside by the end of fiscal 2026 and a 436% upside by the end of fiscal 2031.

Practically, it is not impossible to maintain triple-digit segment revenue growth over the long term. What is highly likely is that considering Nvidia’s innovation pace and competitive edge, the stock may see further upside. Therefore, bulls should wait to establish a long-term position at lower levels once the price absorbs the revenue loss due to export restrictions before the Q4 Fiscal 2024 results in February.

Analysts’ compilation

Nvidia’s Technical Trajectory: Previous Analysis Still Holds Amidst Market Dynamics

In our recent coverage of Nvidia last month, we listed three potential scenarios based on technical analysis, and recent market developments have validated the first scenario. Nvidia’s stock has found solid support at the neckline, near $410, aligning perfectly with our projections and resuming the bullish trend.

Despite the technical uncertainty, Nvidia’s fundamentals remain robust, underpinned by AI, gaming, and data center innovation, and favorable long-term EPS estimates. However, investors should be cautious due to the potential short-term volatility indicated by the technical analysis. Establishing a long-term position post-stabilization at these support levels could be a prudent strategy, allowing investors to leverage Nvidia’s growth potential while mitigating immediate risks.

Author (tradingview.com)

Takeaway

Nvidia Corporation stock’s alignment with its historical P/E ratio signals a potential long-term upside for investors. This suggests that now might be a strategic time for long-term positioning, especially in anticipation of market adjustments post-export restrictions.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Author of Yiazou Capital Research

Unlock your investment potential through deep business analysis.

I am the founder of Yiazou Capital Research, a stock-market research platform designed to elevate your due diligence process through in-depth analysis of businesses.

I have previously worked for Deloitte and KPMG in external auditing, internal auditing, and consulting.

I am a Chartered Certified Accountant and an ACCA Global member, and I hold BSc and MSc degrees from leading UK business schools.

In addition to my research platform, I am also the founder of a private business.