Summary:

- Chevron’s stock hit new 52-week lows after the Hess deal; this increased the dividend yield to 4.17%.

- CVX stock price drop is likely a correction of the prior overvaluation; the dividend appears quite safe.

- The dividend discount model implies the Company is now fairly valued.

- For me, Chevron would be a definitive buy at $120 which corresponds to a 5% dividend yield.

Brandon Bell/Getty Images News

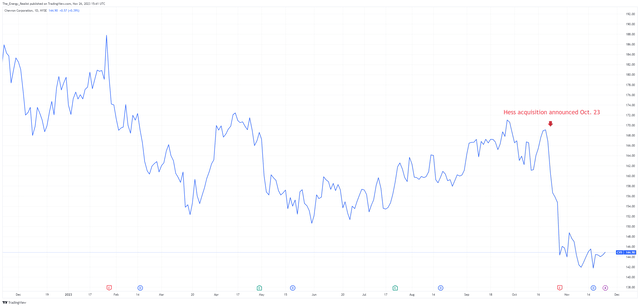

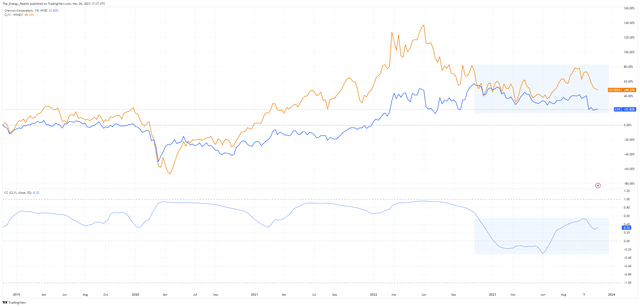

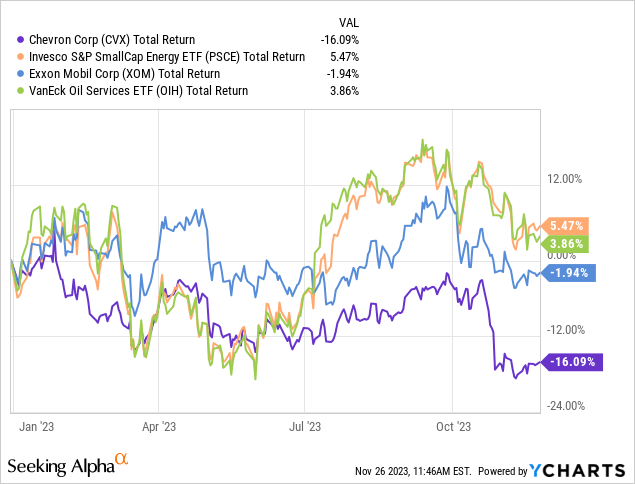

Chevron’s stock (NYSE:CVX) already wasn’t doing well this year but made new 52-week lows after the widely publicized Hess (HES) deal:

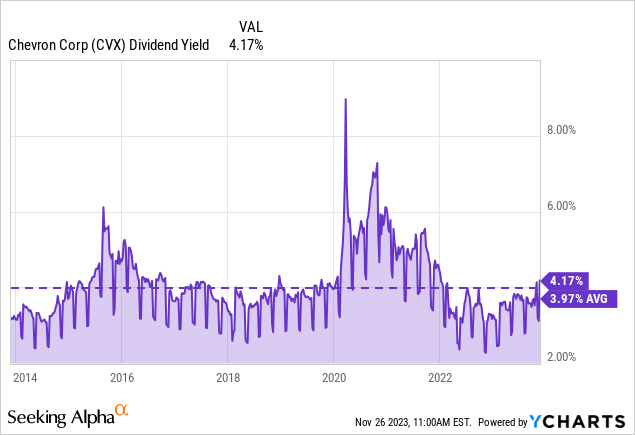

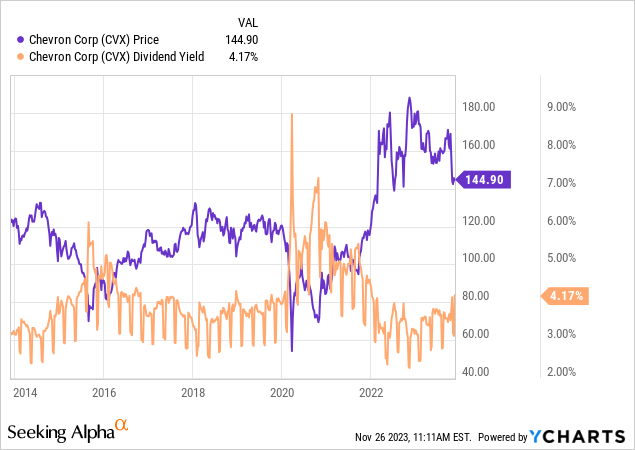

The chart doesn’t look good and it’s hard to say if the stock is done falling. The good news is that the correction has increased the dividend yield to 4.17%:

The 4.17% yield is above the 10-year average but clearly not the same bargain as during the pandemic or even the oil price lows from 2016.

Furthermore, the 3.97% average yield mostly coincided with the Fed’s zero interest rate policy. Yet, after 18 months of Fed tightening, the cost of capital has increased. A 4% yield is one thing when treasury bonds yield 1% and a completely different matter when the long-term risk-free rate is 4.50%.

A simple dividend discount model implies a share price of $145 for Chevron, which suggests the stock is fairly valued. However, going into year-end with important news pending from OPEC+ and tax-loss selling, I would probably look for a greater safety margin.

In recent history, the two major bottoms were marked by the dividend yield going above 5%:

A 5% dividend yield would be consistent with a $120 share price. If we get to $120 at all, CVX would be an obvious “buy” for me; however, at $145 I see the stock as a “hold.”

Why did Chevron’s stock go down this year?

Simply put because it went up too much the year before. There are negative opinions on the Hess acquisition, but I don’t think the deal is unfavorable to Chevron’s shareholders. The market also wasn’t very positive on Exxon’s (XOM) acquisition of Pioneer (PXD). The fear perhaps is that such large deals usually mark the “top of the cycle.”

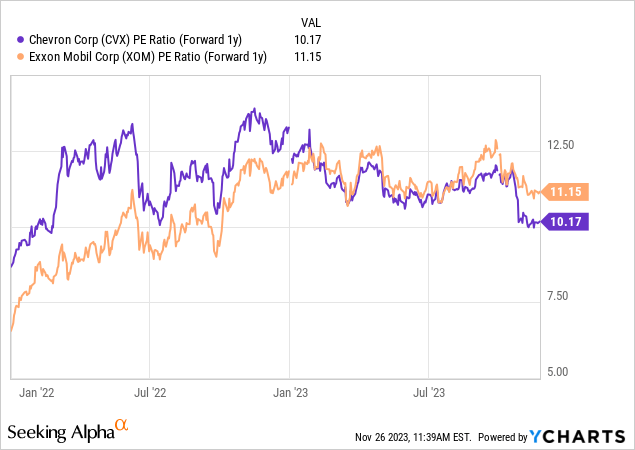

Part of the answer may simply be the good old mean reversion. Chevron’s multiples led Exxon for most of 2022 with no apparent reason so it isn’t totally unexpected that the valuation premium had to be given back at some point:

Chevron and Exxon have also both had a worse year relative to smaller cap energy equities (PSCE) and oilfield services stocks (OIH):

This is something I warned about a year ago in my energy outlook for 2023. After a major downturn as what we saw in 2020, it makes sense that the largest and most liquid names lead the recovery. However, over time the others will eventually catch up.

Is Chevron a safe investment right now?

No energy equity is “safe” in any sense of the word, but Chevron has been making strides towards transforming itself from an amalgamation of assets into a “going concern.” What do I mean by that?

Upstream oil and gas companies are typically seen as a claim on their reserves, whether producing or still undeveloped. When those reserves get depleted, the company’s runway ends too. The valuation is basically a sum-of-the-parts approach.

In contrast, a going concern perspective extends beyond the immediate tangible value of the business. It implies that there is some managerial playbook that can continue to generate value and positive return on capital in the indefinite future.

Consider Apple (AAPL) for example that is probably the most valuable franchise right now; the valuation isn’t just supported by the cash flow generated from the current products but also the expectation that the company would come up with novel products and ideas in the future.

In Chevron’s situation, there are several variables that are gradually moving the company from the sum of its assets into a bit of a going concern.

Large downstream segment

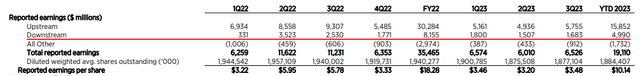

Chevron’s downstream segment has been contributing a quarter of the company’s earnings as of late:

Downstream adds a lot of diversification and is a value-added business that can earn positive refining margins in a low-oil price environment too.

Chevron also has a chemicals business, Chevron Phillips Chemical, which is a 50-50 joint venture with Phillips 66 (PSX). Downstream and chemicals will also suffer in a recession, but these sectors are more tied to the general health of the economy. On the other hand, an OPEC+ supply event could crush upstream but may actually make downstream and chemicals more profitable.

Pivot to natural gas over the last decade

Chevron saw much of its capital expenditures over the last decade go into the Gorgon and Wheatstone projects in Australia. These are massive developments with LNG (liquefied natural gas) export infrastructure that answer the increased global call for this fuel. Chevron also focuses on natural gas in the East Mediterranean; its production from the Tamar platform was recently in the news due to the conflict in the Middle East.

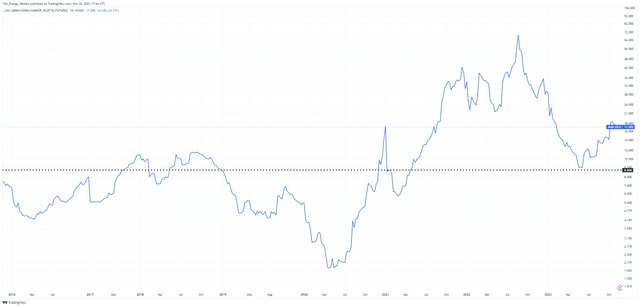

Natural gas prices globally have remained elevated compared to before the war in Ukraine:

Compared to oil, LNG is less risky because it is usually sold on long-term contracts with minimum takeoff commitments. Much of the LNG consumed is also for power generation which tends to be stable even in recessions.

New energy technologies

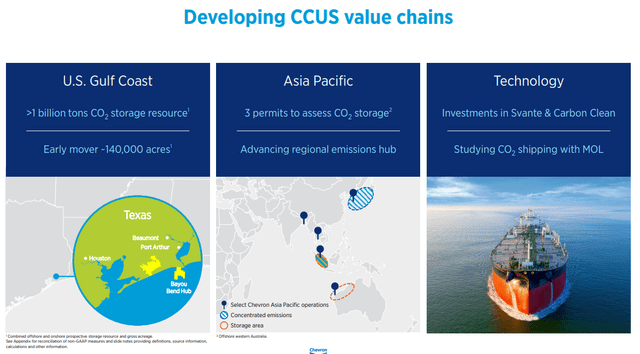

Chevron is also developing various renewables businesses including hydrogen and carbon capture, utilization, and storage (or CCUS):

It remains to be seen to what extent any of this will be valued and added from an environmental perspective, but from a financial perspective, these activities are heavily subsidized so Chevron should be able to turn them into predictable cash flow streams.

“All of the above” capital allocation strategy

Perhaps an unappreciated aspect of the Hess deal is that Chevron is signaling it will play anywhere it can generate a satisfactory return on capital regardless of whether that is U.S. shale (the PDC acquisition) or deep water Guyana (Hess). In this framework, the overall quality of the management approach may become more important than the company’s specific upstream asset configuration at any given point in time.

Interestingly, and maybe just a coincidence, but over the last year Chevron’s stock price has decoupled a bit from oil prices (CL1:COM) and the rolling correlation is at its lowest level for the last five years:

Absent more pandemic-like events, I think Chevron’s future may be one of less volatility; this comes with less upside but also a steady return on capital that can support a stable dividend.

Dividend and valuation

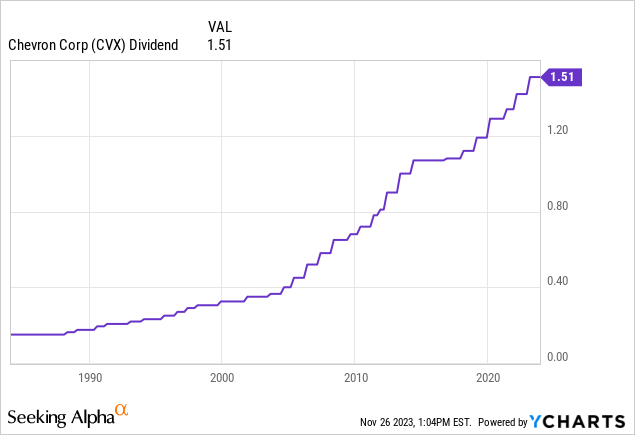

Chevron has been growing its dividend for 36 years:

The annual dividend right now sits at $6.04 which translates into a 4.17% yield.

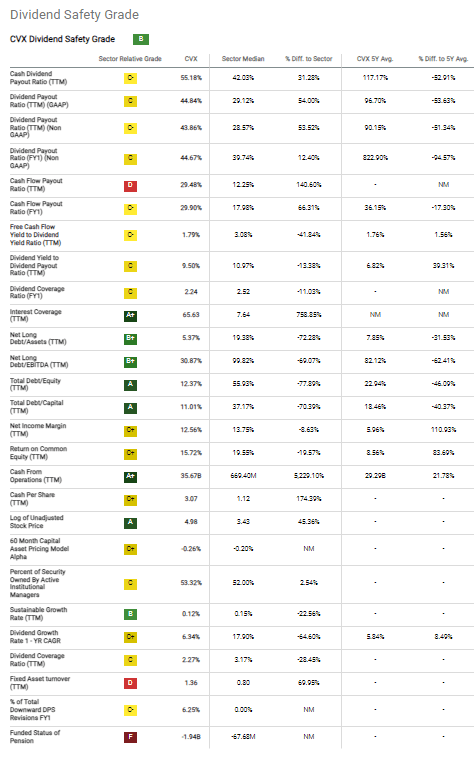

Despite the falling stock price (which may sometimes signal dividend concerns), Chevron’s dividend is safe both from a payout ratio and cash flow coverage perspective:

Seeking Alpha

In Q3, for example, Chevron generated $5 billion in free cash flow, paid $2.85 billion in dividends and was left with $2.15 of post-dividend free cash flow, which can be used for debt reduction or buybacks.

A safe dividend doesn’t mean a safe valuation though. We do have to acknowledge that in the current macro environment, Chevron’s cost of capital isn’t low. I considered the following assumptions:

5-year monthly beta = 1.16

Risk-free rate = 4.50% (consistent with the 10-year treasury note)

Market risk premium = 5.00%

Based on these inputs, Chevron’s cost of equity is about 10.3%.

Combined with a 6.2% dividend growth, based on the compound average from the last five years, the dividend discount model implies a share price of $145.82; just a dollar above Friday’s close of $144.90.

Therefore, from a dividend perspective, Chevron appears fairly valued.

However, for me, the price that provides a sufficient margin of safety is $120, consistent with a 5% dividend yield.

We aren’t guaranteed to see $120 of course. If your holding horizon is long enough, you will likely make money even buying at $145. Oil and gas isn’t going anywhere and Chevron, as noted, is even diversifying into other areas.

Bottom line

Chevron’s stock price has done poorly this year. Part of it may be the market’s dissatisfaction with the Hess deal, but part of it is likely just mean reversion. Chevron got ahead of its peer sector for no apparent reason so it was probably just a matter of time until its valuation saw some correction.

Based on Chevron’s transformation into a dividend stock, the company now appears fairly valued from a dividend perspective and is a “hold.” An extension of the correction down to $120 would make the company a clear “buy” in my view.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of XOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

My articles, blog posts, and comments on this platform do not constitute investment recommendations, but rather express my personal opinions and are for informational purposes only. I am not a registered investment advisor and none of my writings should be considered as investment advice. While I do my best to ensure I present correct factual information, I cannot guarantee that my articles or posts are error-free. You should perform your own due diligence before acting upon any information contained therein.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.