Summary:

- American Tower stock is upgraded from strong sell to buy due to significant improvement in its technical picture and relative strength compared to peers.

- The stock is overbought but is supported by key support levels and positive seasonality in December.

- Falling Treasury yields and improving fundamentals, including revenue growth and margins, support a higher share price.

xijian

Back in July, I wrote a piece about telecom tower behemoth American Tower (NYSE:AMT) where I slapped a strong sell on the stock. That garnered quite the reaction from those loyal to the stock, but to be fair, I had plenty to be concerned about. Now, the stock is actually higher today than it was at the time, but there’s a bit of context that’s helpful in this case.

Shares lost 21% from when I said to sell and the ultimate bottom was made in October. I’m happy with that call, but today, I see a totally different stock. As such, I’m upgrading American Tower from sell to buy.

Immense improvement in the chart

Back in July, I said the stock was about to break down because its chart looked pretty awful. As we know, the stock did break down, but has absolutely blasted higher since the bottom in October. A huge amount of progress has been made technically, and to be honest, it looks pretty bullish now. What a difference four months can make.

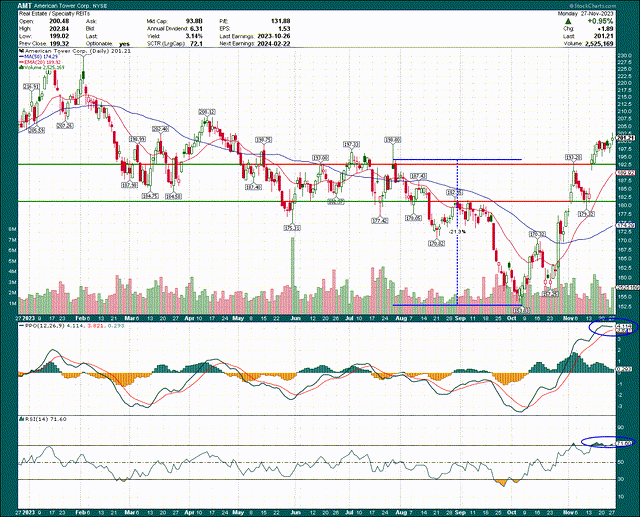

I’ve drawn in two lines on the daily price chart above, one at $193, and one at $181. That corresponds not only to a very long consolidation that took place earlier this year, but also gap support from earnings-related moves in recent weeks.

In addition to that, we have the rising 20-day exponential and 50-day simple moving averages, which should provide additional support if called upon. The point is that American Tower’s technical picture has improved enormously, to the point where the bias is clearly up.

I’ll caution that the stock is extremely overbought, after a ~$50 rally in basically a straight line. The PPO at 4+ is not sustainable, and needs to come down. Now, it can come down via a consolidation, or it can come down through selling. I’d be surprised if we see a lot of selling, but that’s why we use support levels to limit risk. Those support levels in order are gap support at $193, the rising 20-day EMA at $190, and gap support at $181.

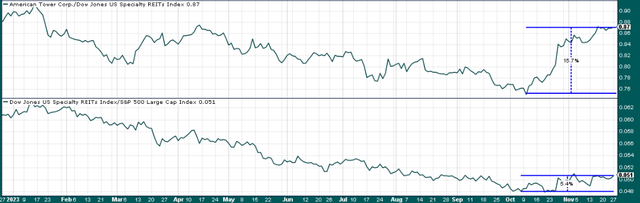

Part of the progress that’s been made is on a relative strength basis, and we can see below just how much progress has been made.

Since the October bottom, specialty REITs have outperformed the S&P 500 by about 5%. That’s good, but American Tower has beaten its peers by 16% in that same time, for total outperformance of about 21%. Doesn’t get much better than that, and what that means is that money is rotating into REITs, and of that money rotating into REITs, a lot of it is going to American Tower.

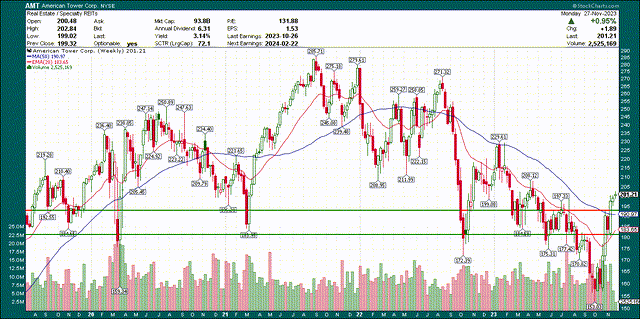

One more quick thing that I think supports the bulls is the weekly chart.

I’ve marked those same support levels – $193 and $181 – and you can see they correspond nicely to the major moving averages on the weekly chart. All of this support coinciding makes me more confident any pullback will be contained, and that the rally will resume afterwards.

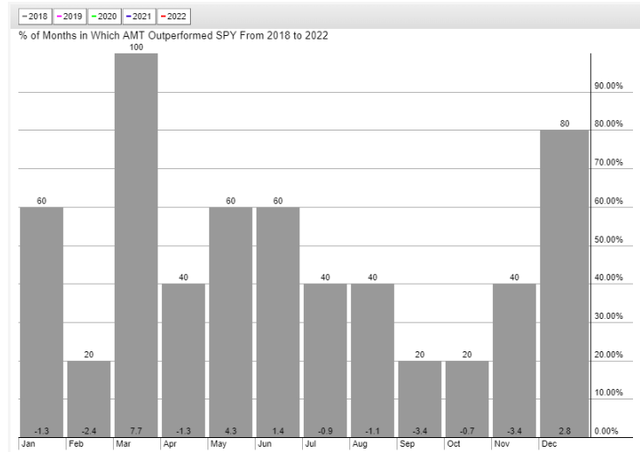

From a seasonality perspective, bulls are supported as well. Below we have the past five years of AMT’s performance against the S&P 500, and we can see December is quite friendly to American Tower.

December averages 2.8% outperformance, so if we do get a pullback, again, it is likely to be shallow and short.

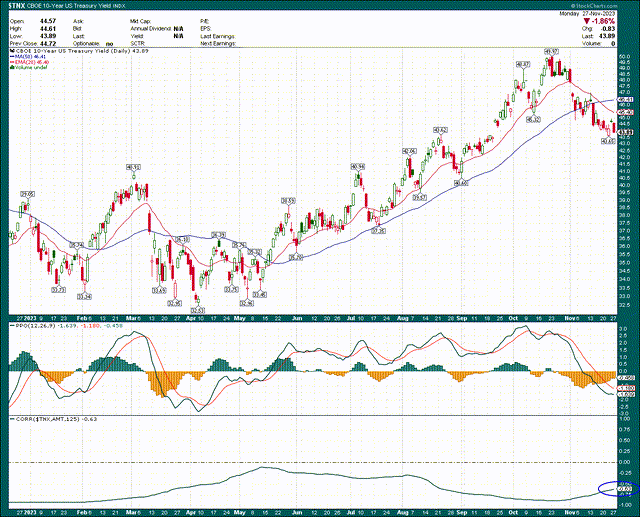

Plunging Treasuries are your friend

We know stocks like American Tower are held primarily for their income generation. That means they’re sensitive to prevailing interest rates, and there’s some interesting correlation to Treasuries. Let’s take a look.

I’ve chosen the 10-year Treasury here, and we can see first that yields have been destroyed since mid-October. They’re in a downtrend now – as defined by price being below the major moving averages – and that’s been great for rate-sensitive stocks. In the bottom panel, I’ve charted AMT’s correlation to the 10-year Treasury for 125 days, which is six months of trading activity. That correlation is pretty much always negative, but has been very negative for a few months, standing today at -0.63. That just means they move in opposite directions most of the time. Now, if Treasury yields are falling, and it’s inversely correlated to AMT’s share price, well, you know the rest.

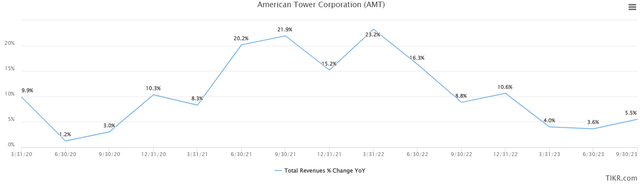

Improving fundamentals also support bulls

Last time, I mentioned that AMT’s growth prospects didn’t look so hot. And while this is certainly no growth stock, I’d argue we’re seeing exactly what we need to support the big move we’re seeing in the stock.

Revenue growth is ticking higher, with the most recent quarter at +5.5% after bottoming under 4% in the prior two quarters. Is there work left to do? Absolutely. But if you wait for the numbers on this chart to print higher, it will be too late to buy the stock. American Tower’s revenue growth has always been pretty lumpy, but it looks to me like we’re moving in the right direction. Keep in mind also that as these weak quarters are lapped into next year, comparisons get easier, and YoY growth rates will be commensurately higher than they otherwise would be.

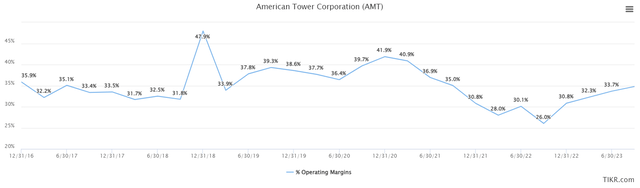

Margins are on the march as well, and again, we’re seeing easier comparisons that could drive further growth. I won’t belabor the point but it certainly appears the fundamentals are supportive of a further move.

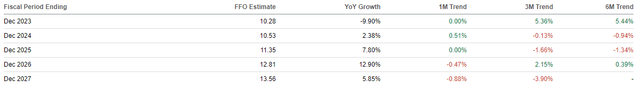

Indeed, estimates for FFO-per-share continue to rise, with 2023 estimates about 5% higher than they were three and six months ago. We’ll see if this continues into the out years, but current forecasts are for solid FFO expansion in the coming years. Recent progress on revenue and margins is supportive of this.

Wrapping up

As we look to tie up the loose ends here, the technical picture has improved immensely, and I think the fundamental progress that was made in the last quarter on the revenue and margin fronts is supportive of a higher share price. With Treasury yields falling, we have a perfect storm for American Tower bulls.

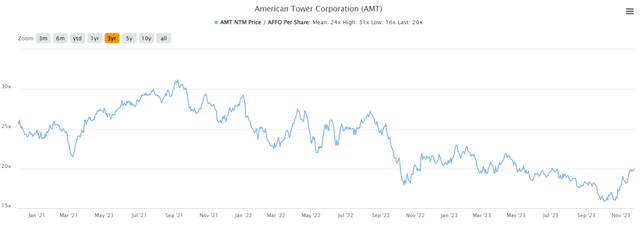

But one more thing I think supports a higher share price is the downright cheap valuation we have today. This stock is never cheap in the traditional sense, so there’s no point sitting around waiting for a forward PE of 8 or something like that. Shares are 20X forward FFO at the moment, and that is cheap for AMT.

It’s 4X lower than the three-year average, and 11X lower than the peak, so anyway you look at this, AMT is cheap. It’s a high quality name with a big moat; you have to pay up to own something like that.

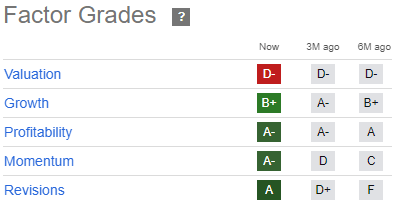

Seeking Alpha

Seeking Alpha’s Quant Rating on AMT is 3.32, good for a Hold. You can see the only black eye for AMT is the valuation, but I actually think the valuation is better than D- given AMT’s unusual valuation history. At any rate, the Quant Rating just a month ago was 2.27, or Sell. It’s rapidly improving, and that’s exactly the kind of stock I want to own.

I was down on AMT four months ago, but the situation has changed comprehensively. As such, I’m changing my mind, and I’m upgrading AMT from strong sell to buy. I think we may see a consolidation or pullback in the short-term, but this stock is setting up for a very strong end to 2023, and start to 2024.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in AMT over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you liked this idea, sign up for a no-obligation free trial of my Seeking Alpha Marketplace service, Timely Trader! I sift through various asset classes to find the best places for your capital, helping you maximize your returns. Timely Trader seeks to find winners before they become winners, and keep you out of losers. In addition, you get access to our community via chat, direct access to me, real-time price alerts, a model portfolio, and more.