Summary:

- AT&T was able to deliver strong results in the recent quarter, and the stock price has jumped by over 10% since the earnings.

- However, the management has a lot of discretion over spending and it can delay some essential spending in order to deliver good near-term numbers.

- The long-term story remains dire for AT&T as it is performing poorly in almost every third-party 5G network test which will inevitably have an effect on its churn rate.

- Investors getting bullish over AT&T should look at the longer-term trend and the competitive headwinds faced by the company.

Brandon Bell

AT&T (NYSE:T) has been able to surprise Wall Street in the recent quarter by reporting better-than-expected numbers in key metrics. One of the most important metrics is free cash flow in which the company reported $5.2 billion, up $1.3 billion from the year-ago quarter. The full-year guidance for free cash flow has also been increased to $16.5 billion. More free cash flow allows the company to pay down its debt faster and gives greater security for dividend payments. However, it is essential to look at long-term trends for AT&T before making a decision on the stock. In a previous article, it was mentioned that high debt levels will cause bigger swings in the stock price making it more volatile.

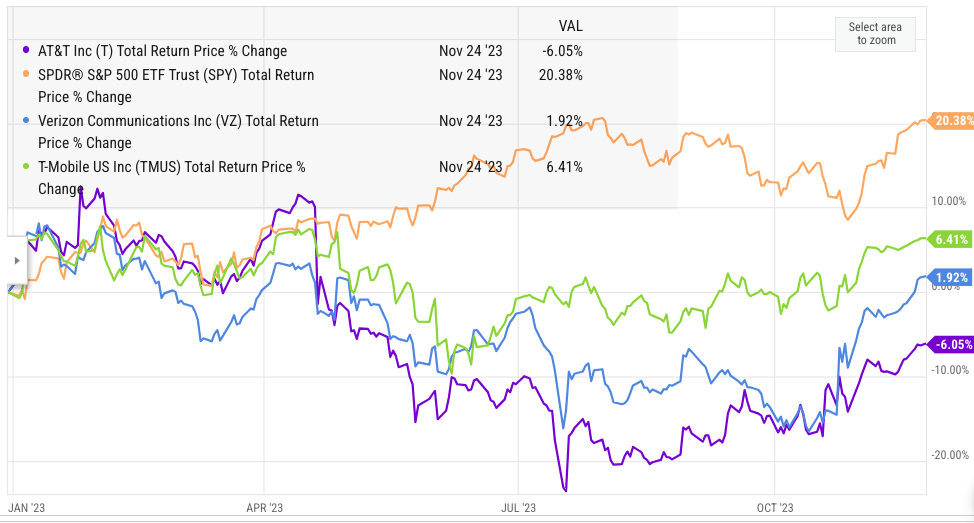

The management has a lot of flexibility in reducing spending over a quarter or two. This helps improve the cash flow numbers while pushing back essential spending to a later date. AT&T had been suffering from negative news for the entire year and it is likely that the management tried to rein in spending in the short term. AT&T stock price is up 10% since the recent quarterly earnings but the YTD returns do not look encouraging. AT&T has reported total returns of negative 6% in YTD compared to positive 20% by S&P 500. This clearly shows the impact of earlier negative news cycles including the lead controversy on AT&T stock.

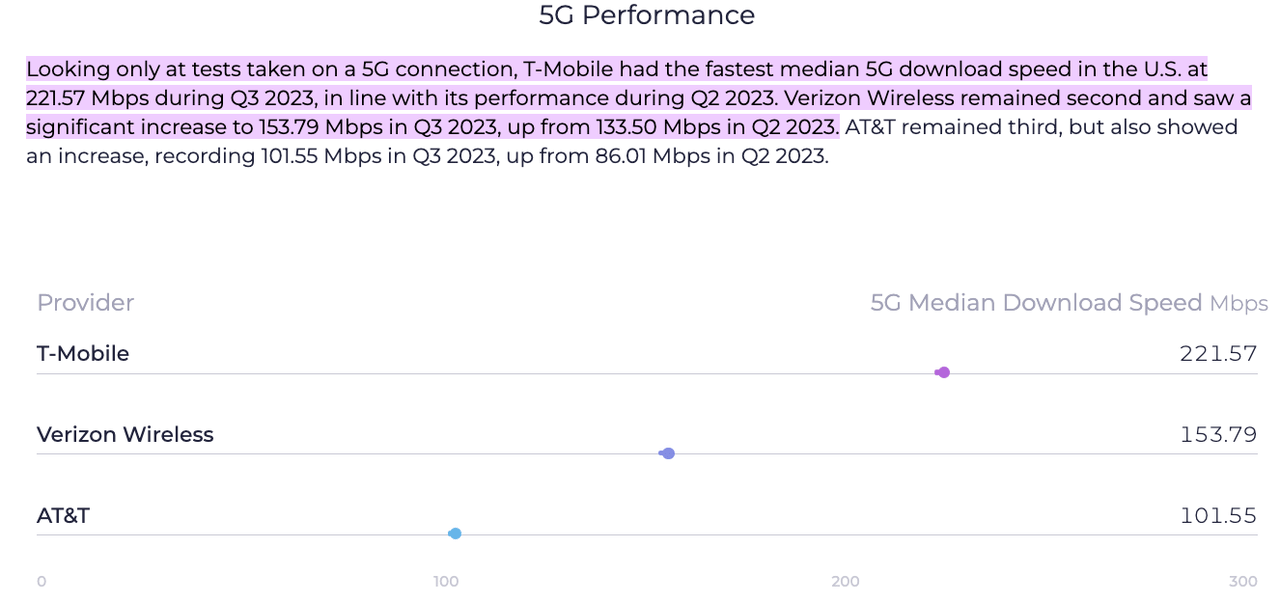

Despite massive 5G investments, AT&T is performing poorly in almost every third-party estimate about 5G connectivity. This will limit the ability of the company to charge a premium for its data plans and it is highly likely that there will be an increase in churn rate due to 5G network speeds. Investors looking for a long-term bet need to gauge the trend over the last few quarters.

Single quarter will not turn the ship

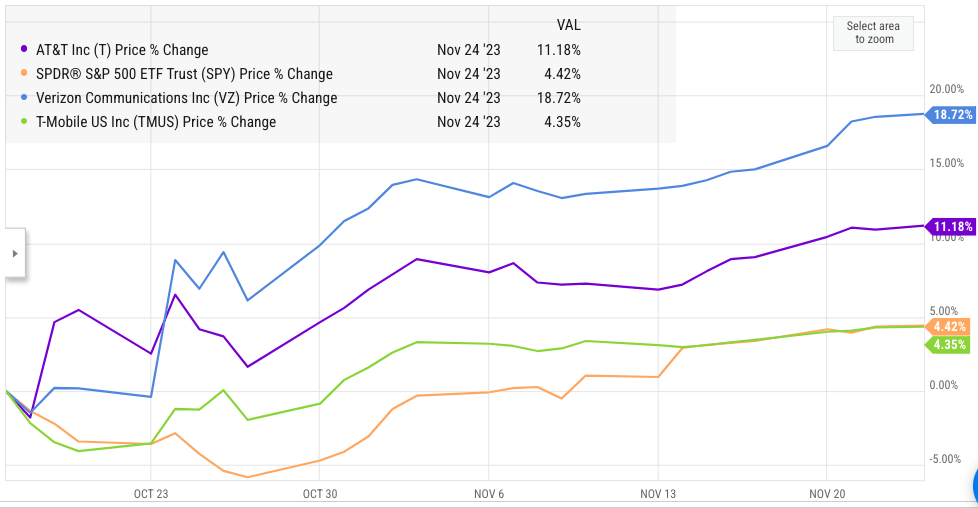

The numbers reported by AT&T in the recent quarter helped improve the sentiment towards the stock, which has seen only negative news for the previous quarters. The impact on stock price was rapid, showing over 10% jump in the weeks after the earnings.

YCharts

Figure: Jump in telecom stocks after AT&T’s earnings. Source: YCharts

The numbers from AT&T boosted the entire sector and Verizon have shown the highest jump since the earnings. One of the key reasons behind this bullishness is that Wall Street feels that future spending would be modest and the company would be able to divert more cash towards paying down the debt. However, the stock price trend changes completely when we look at the YTD numbers.

YCharts

Figure: Massive underperformance shown by AT&T in 2023. Source: YCharts

AT&T stock has shown a total return of negative 6% in YTD compared to positive 20% for the S&P 500. This massive difference in returns is due to a number of headwinds including the lead controversy.

AT&T losing competitive edge in 5G

A bigger story about AT&T is that it is regularly performing poorly in almost all third-party estimates about 5G connectivity. T-Mobile had taken the lead in investing in 5G network but it was expected that AT&T would soon catch up as it invested heavily to build its own network. Despite the massive investments, AT&T has not improved the ranking for its 5G network and there is a big gap between T-Mobile and AT&T.

Figure: AT&T is significantly behind T-Mobile in terms of median 5G download speeds. Source: Speedtest.net

A reduction in churn rate in the recent quarter is a positive for AT&T but it will need to tackle the massive gap between its 5G network and that of T-Mobile.

2024 does not look encouraging

AT&T stock has performed poorly in 2023 and there is a massive gap between S&P500 returns and that of AT&T. This has encouraged some value hunters to become more bullish on AT&T stock. However, 2024 will be a challenging year for AT&T as customer spending power remains subdued. It is inevitable that AT&T will need to spend more on improving its 5G network which will be a headwind for free cash flow in the next few quarters.

Most of AT&T debt is fixed rate which has shielded the company from recent rate hikes. However, if the interest rate remains elevated for a longer period, there will be growing concerns about the massive debt pile of the company. Wall Street would like good progress in this metric before AT&T stock can improve its long-term trajectory.

Future trajectory of AT&T stock

The recent uptick in AT&T stock has improved the sentiment toward the stock. However, there are fundamental issues that will limit any big bullish momentum in the stock. AT&T is in third place, behind T-Mobile (TMUS) and Verizon (VZ), when we look at third-party estimates about 5G network speeds. T-Mobile is looking to invest heavily in aggressive pricing, which can be a major headwind for AT&T as it will increase the churn rate over the next few quarters.

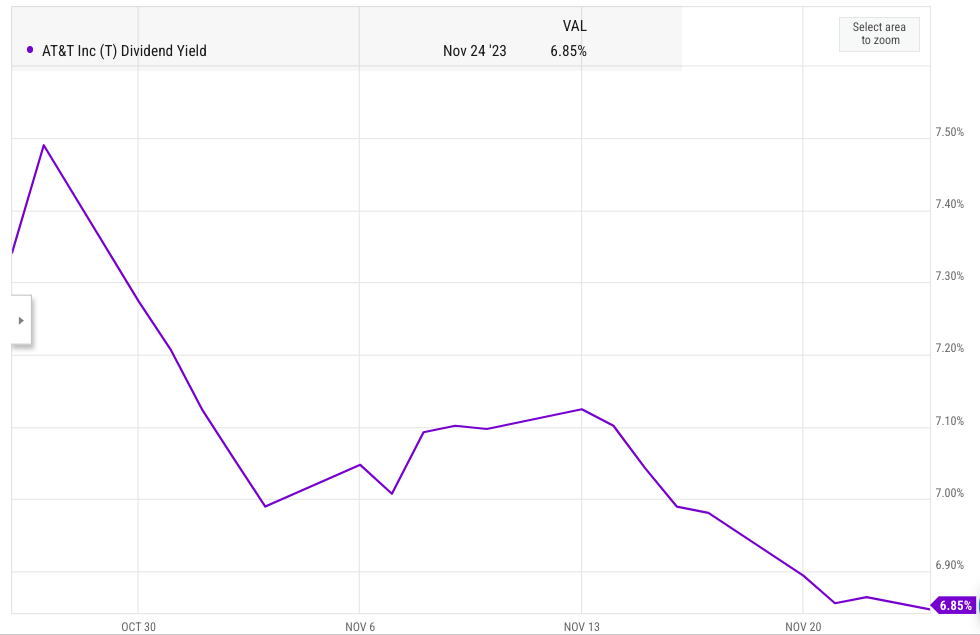

YCharts

Figure: Decline in yield after the recent uptick in stock price. Source: YCharts

The dividend yield has dropped below 7%. It is unlikely that value investors would be interested in the stock with the yield below a point. Higher treasury rate also reduces the gap with AT&T’s dividend yield.

Investors looking to jump into AT&T stock based on recent earnings should consider the long-term returns potential and the headwinds faced by the company in the next few quarters.

Investor Takeaway

AT&T’s management has increased the FCF estimate for full year to $16.5, which has improved the sentiment towards the stock. Lower churn rate and better net additions have also helped the stock. However, it should be noted that the management has a lot of leeway in terms of spending and it is likely that some of the spending has been pushed into 2024.

AT&T’s 5G network performance remains below T-Mobile and Verizon according to most of the third-party estimates. This shows the limited returns of massive investment made in the 5G network. The dividend yield has fallen below 7% and the gap with treasury rate has narrowed after the recent uptick in AT&T stock. This should reduce the interest of value investors in AT&T stock making further bullish run difficult.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.