Summary:

- Adobe’s stock has performed well since 2011 and has recently shown strong momentum, potentially reaching all-time highs.

- Adobe’s profitability has been consistent, but its growth numbers have declined, indicating potential issues further down the income statement.

- Adobe’s valuation is a concern, as its sales, assets, and cash-flow trail historic averages, which may hinder sustained share-price appreciation.

Sundry Photography

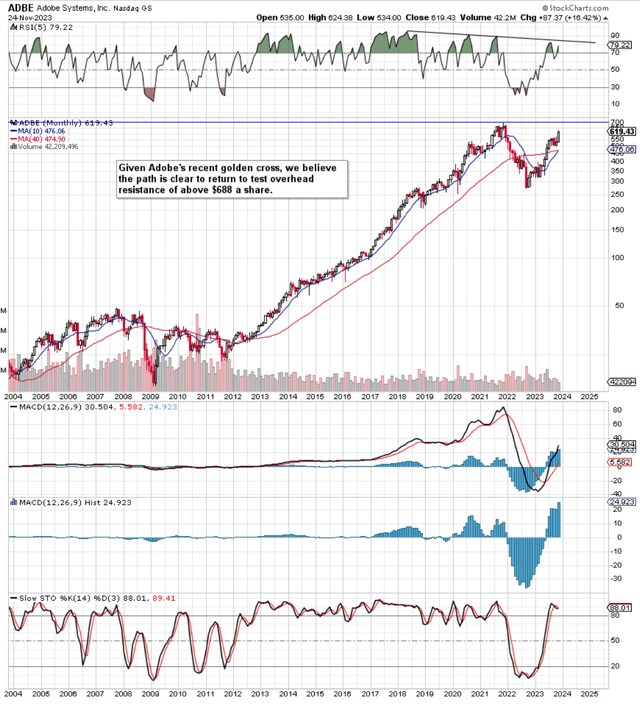

If we pull up a long-term chart of Adobe Inc. (NASDAQ:ADBE), we see that long-term investors in particular have been rewarded very handsomely since 2011. Furthermore, the stock gave investors a prime opportunity in September of last year to double down on their investment as shares have managed to return well over 100% over the past fourteen months. Moreover, the fact that Adobe’s 10-month moving average just recently managed to cross above its corresponding 40-month average is a strong sign that shares should at least test their all-time highs (Close to $700 a share in late 2021) in this present move. A long-term moving average golden cross invariably provides sustained momentum so investors should continue to see gains in ADBE at least over the near term. The real question technically is whether shares will have the required momentum to break out above that resistance level at that juncture. We do have a slight bearish divergence in Adobe’s long-term RSI momentum indicator so it will be interesting to see if a fresh breakout will occur on this present trending move or in another cycle.

Adobe Long-Term Chart (StockCharts.com)

Profitability

Technicals aside, the trajectory of Adobe’s share price will be governed by how investors view the relationship between the company’s profitability versus its valuation. With respect to Adobe’s profitability, the company has been able to actually grow its key gross margin metric (87.89% over the past four quarters) which has kept the income statement ticking over with consistent bottom-line growth. On this, after announcing another earnings beat in Q3 of this year, consensus expects 16.2% bottom-line growth in this present fiscal year followed by 12.7% in fiscal 2024. However, when we go to historic growth numbers, we see year-over-year EBIT growth of 5.22% compared to a 5-year average growth number of 21.19%. The above trend exemplifies that above-average gross margins can often mask what is happening further down the income statement. Suffice it to say, a good way to measure Adobe’s profitability in this regard is to go through associated trends in the key ‘return on capital employed’ metric.

The key here is that a fluctuating ‘ROCE’ can impact Adobe’s valuation in a significant way. Although Adobe is renowned for generating high returns on the capital it employs, the key is in being able to consistently improve this metric as rising ROCE leads to more free cash flow for the company’s shareholders. We calculate ROCE by dividing Adobe’s EBIT by ‘Capital Employed’ which is the company’s total assets minus current liabilities. To observe near-term trends, we will go back eight quarters, calculate ‘ROCE’ for each quarter, and then annualize the results to see the underlying trends.

| Quarter | Q3-2023 | Q2-2023 | Q1-2023 | Q4-2022 | Q3-2022 | Q2-2022 | Q1-2022 | Q4-2021 |

| Adjusted ROCE Annualized | 32.7% | 32.77% | 32.99% | 31.62% | 30.75% | 32.29% | 33.65% | 29.56% |

As we see from the table above, Adobe’s return on capital employed (when quarterly results are annualized) has remained elevated and pretty constant over the past 10 quarters. When we factor in the ramifications of inflation however and Adobe’s rising cost of capital, the company’s return on capital employed has definitely been declining in real terms which is a worrying trend.

Valuation

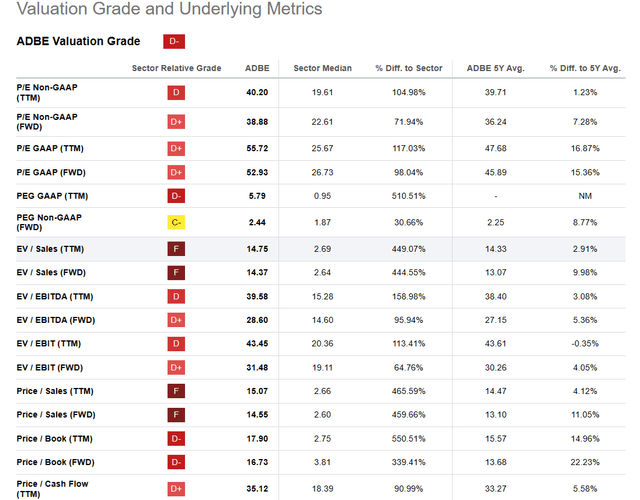

Although one could make the argument that Adobe’s non-GAAP earnings multiples are in line with historic averages, the company’s sales, assets as well as cash-flow trail historic averages by some distance which again is a worrying trend concerning sustained share-price appreciation. The ‘capital allocation’ exercise above ties in with what we are seeing in Adobe’s above-average cash-flow multiples in that the company is not making as much cash (allocation) off the earnings it is reporting. Remember, assets & sales (in this order) are what essentially cause earnings growth to take place so buying them as cheaply as possible makes sense from a long-term standpoint. However, both the forward book & sales multiples (17.90 & 14.55 respectively) come in ahead of what we have been accustomed to in Adobe which again is worrying in an environment where returns on capital in recent years have seen negative growth in real terms.

Adobe Valuation Multiples & Underlying Metrics (Seeking Alpha)

Conclusion

To sum up, after delving into Adobe’s profitability & valuation trends, Adobe does not stand out as a long-term investment at this time. If forward-looking earnings revisions continue to remain strong, we see a return to the stock’s all-time highs (as the technicals are suggesting) in due course. Let’s see what the fourth quarter entails next month. We look forward to continued coverage.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.