Summary:

- Affirm’s stock has experienced significant volatility but has shown strong growth potential with its partnership with Amazon and Shopify.

- A significant portion of Affirm’s profit comes from merchant service fees rather than interest income, showcasing greater cost efficiency compared to competitors.

- Affirm mitigates risks through strategic partnerships and is expanding its ecosystem by introducing products like a branded debit card.

Sviatlana Zyhmantovich

Affirm’s Stock Rollercoaster

Affirm’s (NASDAQ:AFRM) stock went on quite the rollercoaster ride lately. It hit an all-time peak back in November 2021, only to tumble to a gut-wrenching 83% soon after.

But zoom out and you’ll notice the stock has now rebounded 131% over the past year. So things aren’t totally bleak for this buy now, pay later lending startup.

In fact, we think Affirm is a company investors should keep firmly on their radar looking ahead to 2024. Because when interest rates remain at a high level, Affirm stands to benefit as we will explain in the latter section.

Investment Thesis

We believe investors should buy Affirm shares aggressively before an expected 2023 economic rebound. Here’s why this out-of-favor fintech disruptor looks poised to soar.

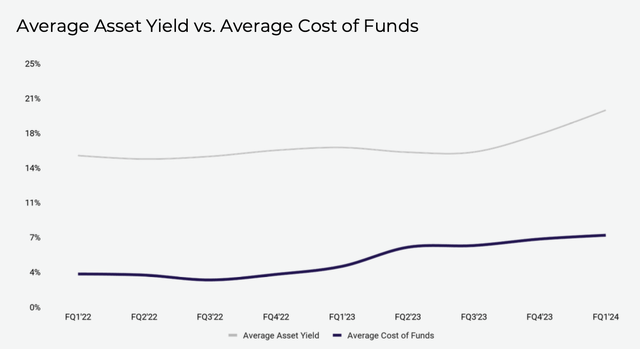

First, higher interest rates in 2023 should turbocharge Affirm’s profit margins on their “Buy Now, Pay Later” loans. Using installment credit as a lead generation tool for its merchant platform, Affirm can ratchet up APRs far more easily than rate-sensitive banks. So while other lenders choke in a rising rate environment, Affirm should rapidly expand net interest income.

Second, through key partnerships with e-commerce titans Shopify (NASDAQ:SHOP), and especially Amazon (NASDAQ:AMZN), Affirm enjoys exclusive access to mint millions of new customers. Converting even a small portion of Amazon’s buyer base to Affirm users would transform its growth trajectory. No financial competitor can match that kind of unique customer acquisition avenue.

Finally, by focusing narrowly on perfecting BNPL lending and the associated merchant solutions, Affirm has crafted an ecosystem with advantages no jack-of-all-fintech trades like PayPal or Block can rival. Specialization breeds the most durable competitive edges.

Business Model and Criticisms

Affirm operates a platform that serves both merchants and consumers. On the consumer side, it provides “Buy Now, Pay Later” installment loans to help shoppers finance purchases. Affirm earns fees and interest income on those loans.

For merchants, Affirm helps convert more sales by letting their customers split payments into biweekly or monthly installments. Merchants fork over fees to Affirm in exchange for driving greater checkout conversion.

In fact, Affirm delivers higher conversion rates (+8%) and boosts repeat purchase rates by 20% on average.

Now Affirm’s business model has drawn plenty of skeptics. Short interest sits at a sky-high 20%, in fact. Critics point out that Affirm still isn’t profitable, and its active user base remains smaller than major rivals.

It certainly faces fierce competition too. PayPal, Block, Apple Pay, and Google Pay all boast way more customers and have broader product suites beyond just BNPL lending.

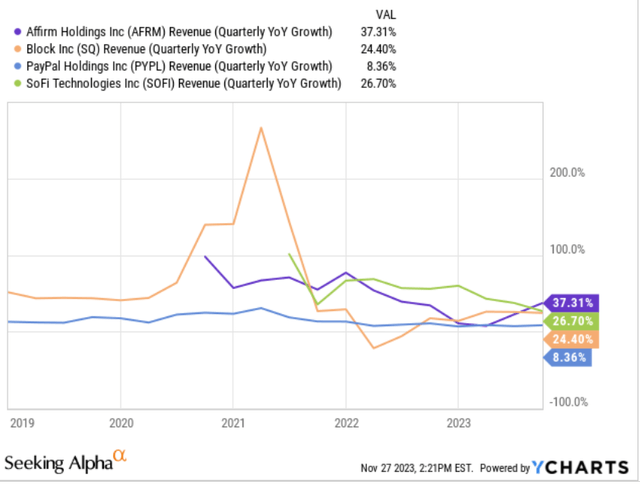

Yet even as the clear underdog, Affirm has maintained far faster revenue growth than its peers. And momentum accelerated last quarter versus prior periods.

YCharts

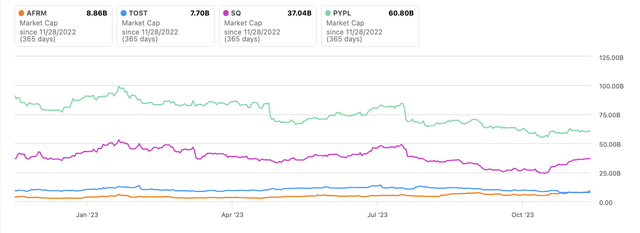

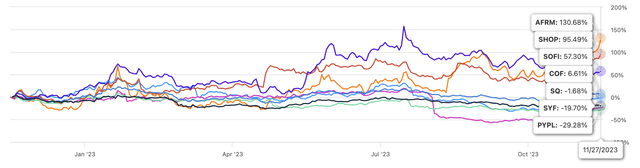

Affirm’s share price performance also dusted the competition over the past year. Its stock rebounded 131% versus a 29% drop for PayPal (NASDAQ:PYPL) and a 2% dip for Block (NASDAQ:SQ).

So despite lacking any apparent scale advantages, David keeps taking down Goliaths lately when it comes to Affirm. Pretty impressive given the competitive challenges it navigates.

Seeking Alpha

BNPL Landscape Overview

Here’s a background on the BNPL competitive landscape:

Klarna is the leader in the BNPL space. The Swedish firm pioneered “Pay Later” installment loans way back in 2005. Affirm didn’t arrive until 2012. Other major players like Block, PayPal, and Apple (NYSE:AAPL) jumped into BNPL more recently through acquisitions or new product launches.

Now those competitors do dwarf Affirm in customer size. But most focus heavily on markets outside the US, where credit card rewards are less generous. Affirm conversely directs almost all energy on its home American turf. And it offers a narrower BNPL-only suite than financial service conglomerates like PayPal and Block.

Unique Profit Drivers for Affirm

So some investors argue that little Affirm is outmatched in the BNPL wars against way bigger foreign sharks and fintech whales. But we couldn’t disagree more – and actually think 2023 could be a breakout year for the industry. That’s because BNPL profit drivers differ hugely from traditional lenders.

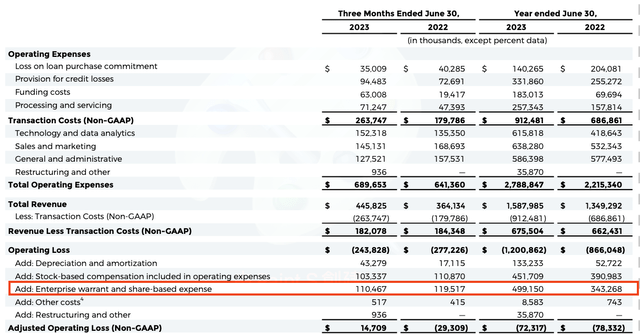

Banks make money on the spread between deposit funding costs and loan rates. BNPL players like Affirm though use installment credit more as a customer acquisition tool for their merchant platform. Most of their profits come from merchant service fees, not interest income.

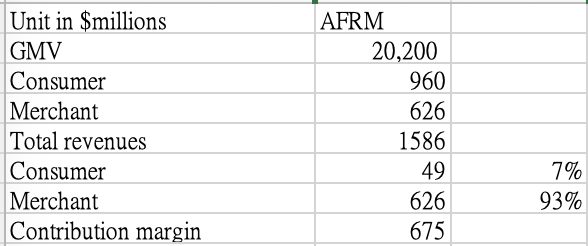

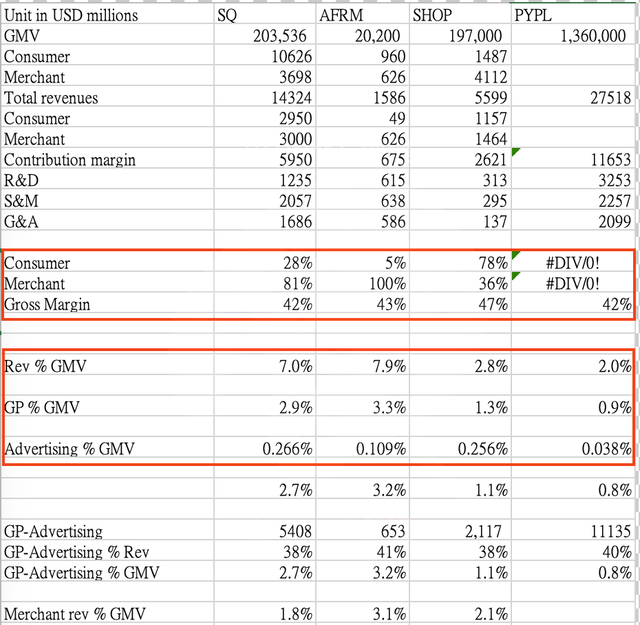

In fact, just 7% of Affirm’s gross profit flows from their consumer loan book. The merchant side drives the profits.

Analyzing contribution margins also reveals Affirm is far more cost-efficient than players like Block and PayPal right now. It converts more gross profit from each dollar of revenue or GMV thanks to its BNPL focus.

So investors betting against the little pureplay BNPL specialist in a pool of gigantic financial conglomerates may have it totally backwards. We believe Affirm’s leanness provides major advantages that make it one of the most attractive assets in fintech looking ahead to an economic recovery.

Transaction Value and Profit Margins

The key takeaway is that Affirm captures more value per transaction than rivals like Block or PayPal.

That’s because Affirm provides more unique value to merchants with its specialized BNPL offering. Block and PayPal compete fiercely on payment processing – basically just fighting to offer the lowest fees. Their 1-3% charges barely cover costs.

But Affirm uses installment lending to help merchants convert sales, not win on price. This better meets the needs of premium brands who hate constant discounting.

So Affirm grabs a much bigger slice of each transaction it facilitates – and at a higher margin too. That’s why it earns substantially more profit per dollar of revenue or GMV than payment processors.

Affirm also beats out Shopify when it comes to monetizing merchants. Shopify caters more to fickle consumers who demand ultra-low fees. Merchants will pay up more.

Risk and Opportunity: Partnerships

Now a huge reason Affirm keeps advertising costs so low is thanks to partnerships with giants like Amazon and Shopify. Affirm leans on its massive customer base rather than paying to attract users itself.

But that strategic benefit isn’t free – and does concentrate risk. If Amazon or Shopify ever cut ties with Affirm or signed up rival BNPL platforms, Affirm’s future growth prospects would dim big time.

For now, though, those partnerships allow Affirm to operate much more efficiently than if it had to purchase all its own user traffic. So the Amazon and Shopify relationships remain vital competitive strengths subsidizing Affirm’s profit engine.

To become the exclusive BNPL provider on Amazon and Shopify’s platforms, Affirm had to sweeten the partnership deals by offering each company warrants – basically, the right to purchase Affirm stock at set prices in the future.

As Affirm revealed in its annual filings:

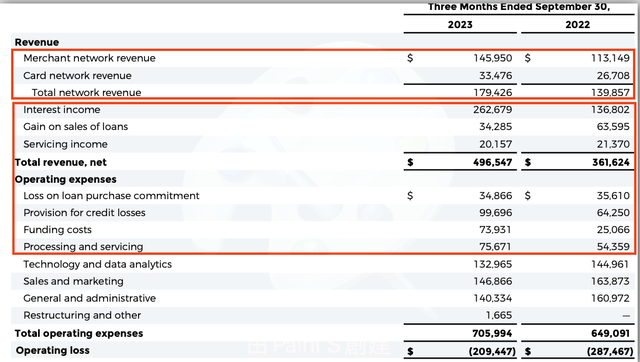

During 2022, we granted Amazon warrants connected to our commercial agreement… We recorded a $133 million asset on our balance sheet for the vested portion of those warrants.

In 2021 we issued warrants tied to a similar Shopify partnership deal. Those warrants got valued at $270 million.

So despite having higher transaction-level profits than rivals, Affirm’s overall GAAP earnings still show huge losses in part due to these warrants.

But securing exclusivity from giants like Amazon likely justified the near-term profit hit. Having BNPL dominance on those leading commerce platforms helps lower risks considerably.

It means Affirm doesn’t have to worry about Amazon or Shopify ever adding competing “Pay Later” offerings from Block, PayPal, or other rivals down the road.

So while costly warrant incentives depressed income recently, they help cement durable competitive barriers around Affirm’s valuable merchant relationships.

Own Ecosystem

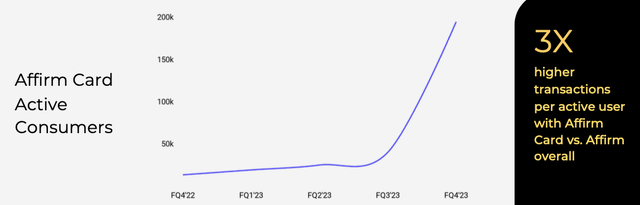

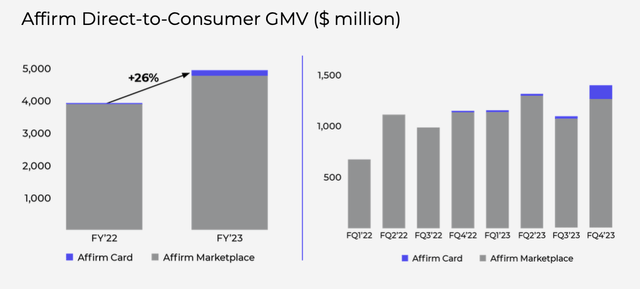

The good news is Affirm has started building its own ecosystem beyond just partnerships – like rolling out a branded debit card.

Offering a debit card should:

- Lower Affirm’s funding costs for loans

- Help directly acquire consumers to avoid reliance purely on Amazon/Shopify shoppers

- Support Affirm’s growth of its own marketplace

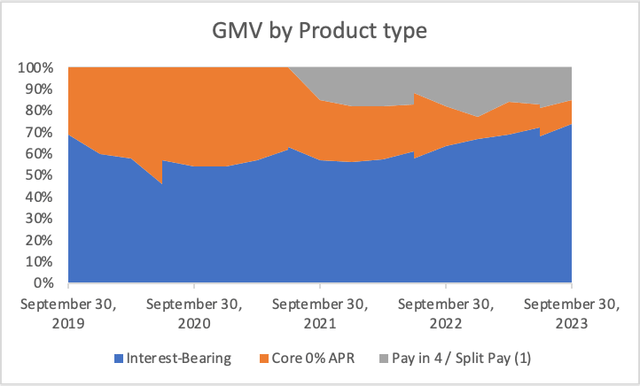

Affirm is also expanding its mix of interest-bearing loans rather than just fee-based “Pay Later” products for customers. This likely signals consumers increasingly view Affirm as a credit card alternative. That’s great progress towards cementing itself in shoppers’ minds as a leading mainstream payment option.

Thanks to more interest income and stable funding costs, Affirm has grown its net interest margin lately too. So it depends less on merchant revenue streams.

Risk Management

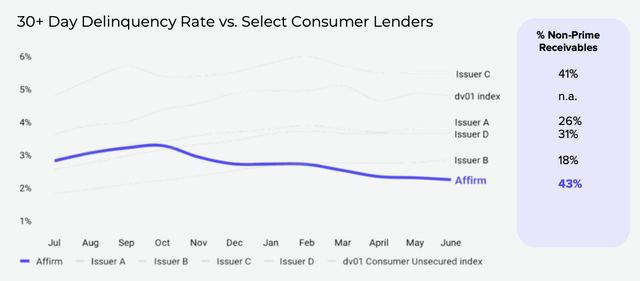

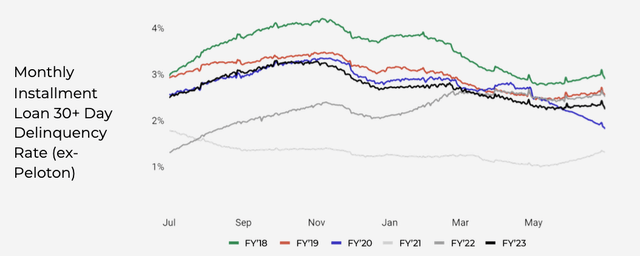

Finally, the credit quality of Affirm’s loans still compares very conservatively next to high-risk lenders like Capital One (NYSE:COF) or Discover (NYSE:DFS). So investor demand should remain strong.

That lets Affirm leverage its capital markets access to keep growing much faster than banks since BNPL loans acquire customers for Affirm’s ecosystem beyond just generating interest spreads.

So initiatives like its own branded debit card and expanding credit products signal Affirm is prudently but aggressively moving to control more of its destiny. The market should reward that expanding autonomy.

Valuation

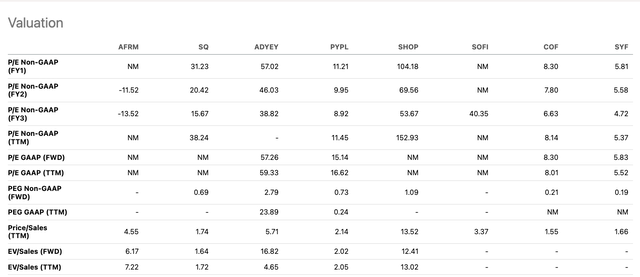

Now Affirm’s valuation multiples look lofty compared to other fintech giants. But tremendous upside still exists in our view.

That’s because, through partners like Amazon and Shopify, Affirm can leverage massive existing user bases to expand its own customer pool much more efficiently than Block or PayPal can.

Amazon and Shopify also target different merchant needs than Affirm. They help identify potential new buyers. Affirm enables sales without discounting to existing consumers. So BNPL on those platforms has virtually no internal competition.

Given its specialized BNPL focus plus those ideal partnerships, Affirm should realistically wind up larger long-term than payment conglomerates like Block or PayPal. Its high take rates and vast addressable market warrant greater scale.

So criticisms of Affirm’s relative valuation seem shortsighted. If anything, we’d argue fast-growing pureplay BNPL innovator Affirm deserves a substantial premium over its peers like PayPal and Block.

Before they partnered up, Affirm joining forces with e-commerce juggernauts like Amazon and Shopify would have seemed unthinkable. Now Affirm has a visible path to surpass those fintech behemoths one day by focusing intently on excelling at BNPL through best-in-class merchant partnerships.

Conclusion

Affirm looks severely underestimated to us compared to other BNPL and payments peers.

Critics rightly argue Affirm competes with credit card rewards generosity unique to the US, and its small user base limits visibility.

But they overlook how Affirm’s partnerships with e-commerce titans Shopify and especially Amazon now give it more growth runway than any rival. Affirm even secured exclusivity through warrant incentives – a useful risk mitigant.

And by launching its own debit card, Affirm is prudently addressing concerns over reliance on those partners longer-term.

Compare Affirm’s risk management to subprime lenders like Capital One too, and it stands out hugely despite similar growth. Conservative underwriting while still expanding rapidly is a rare combination.

So amid the negativity about small scale and fierce competition, the market completely misses how Affirm has secured a pole position to dominate BNPL through its partnerships and focused execution.

We rate Affirm stock a Buy with a huge upside in both the short and medium term before any risk of the Amazon/Shopify deal change materializes. Savvy investors should position aggressively for the upside while doubters persist.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AFRM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.