Summary:

- Nvidia’s beat-and-raise fiscal third quarter results failed to deliver the decisive push for NVDA to surge above the $500 zone.

- Wall Street analysts have upgraded their rating on Nvidia to Strong Buy, with a higher price target of $653. Analysts have gone gaga over the company’s prospects.

- However, the market appears skeptical of Nvidia’s ability to meet analysts’ high earnings projections. As a result, some investors question whether the “market is wrong.”

- I argue why over-optimism, no matter how excellent the company’s prospects are, could lead to a dangerous setup, particularly when the market is telling you otherwise.

- Don’t be blinded by what analysts and management are telling you. Consider why the market has refused to let NVDA rip higher despite its third quarter beat-and-raise.

Justin Sullivan

NVIDIA Corporation (NASDAQ:NVDA) investors likely expected that its beat-and-raise fiscal third quarter or FQ3 earnings release could have bolstered buying sentiment for NVDA to finally break decisively above the $500 zone. However, astute sellers were waiting for these late momentum chasers as NVDA’s upward momentum failed again at the critical $500 zone.

Moreover, it was Nvidia’s “third straight double-digit percentage beat of sales consensus this year and raised guidance.” As a result, it demonstrated Nvidia’s tremendous execution prowess, notwithstanding tight demand/supply dynamics for its AI chips. Notably, Nvidia guided for $20B in sales in FQ4, way above analysts’ estimates of $17.9B. Nvidia Bulls would likely argue that more is yet to come with an AI accelerator TAM that could reach $150B by 2027, as highlighted by AMD. Nvidia’s data center AI chips are expected to continue driving its growth through FY28, with data center revenue potentially reaching $100B.

As a result, I’m not surprised that Wall Street analysts have gone gaga over the company’s prospects, with the consensus Buy rating upgraded to Strong Buy since August 2023. NVDA’s average price target or PT has also been increased to $653, as analysts believe its forward adjusted P/E of 24.8x might not have captured its full valuation.

Bank of America Corporation (BAC) semiconductor analyst Vivek Arya stressed that “Nvidia is in the early stages of converting the global compute infrastructure to accelerated and AI-centric computing.” As a result, he believes that the company is still early in the generative AI wave, “leading to substantial earnings growth.” In addition, Arya articulated that NVDA’s CY24 P/E of 24x “appears low” when considering its significant growth potential.

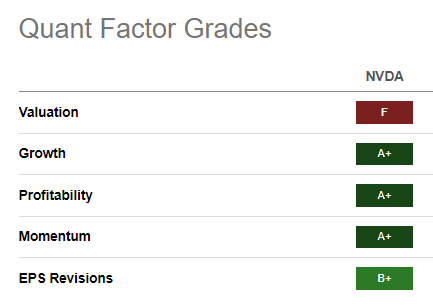

NVDA Quant Grades (Seeking Alpha)

Based on NVDA’s average forward P/E of 33.5x, it seems the market has not accorded sufficient credit to CEO Jensen Huang and his team. Notwithstanding the analysts’ optimism, the market appears skeptical of Nvidia’s ability to meet the Street’s growing earnings projections.

Despite that, it’s hard to argue that NVDA boasts best-in-class “A+” grades in three of the five Quant factor ratings, corroborating the company’s dominance in the AI chip space.

The critical question facing investors is this: If the market believes in actualizing Nvidia’s earnings estimates over the next three to four years, there’s likely a substantial price upside from the current levels. If so, we shouldn’t have observed NVDA buyers struggling to push above the $500 zone over the last few months.

However, if the market thinks Wall Street analysts could be overly optimistic (possibly, given its Strong Buy rating), Nvidia could disappoint if analysts’ high expectations couldn’t be met. While I understand that Huang and his team aren’t strangers to setting high expectations and outperforming them, paying attention to the underlying message from the market is essential. As a result, I’m often bewildered by articles suggesting that the “market is wrong.”

I’ve learned from esteemed Seeking Alpha analyst Avi Gilburt that “the market is always right; analysis is what can be wrong.” Therefore, I believe it’s essential for investors to consider whether the market is signaling a distribution or accumulation signal for NVDA at the current levels. Does the market concur with analysts’ estimates, or should investors with heavy exposure in NVDA consider cutting some exposure and rotating out?

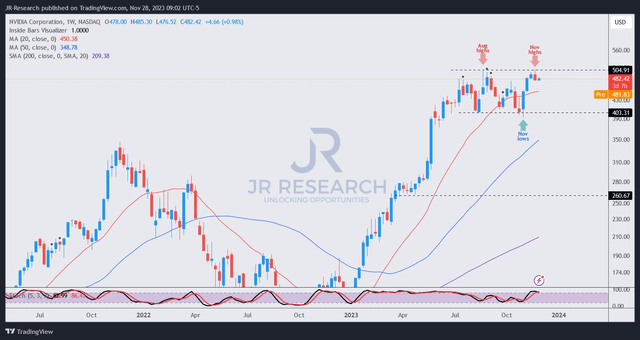

NVDA price chart (weekly) (TradingView)

As seen above, NVDA buyers have struggled for upward momentum since early July 2023. Despite its third consecutive beat-and-raise quarter in November 2023, the selling pressure at the $500 zone is evident for all price action investors to see.

Dip-buyers’ attempts to help NVDA bottom out at the $400 level have been constructive, driving momentum buyers to return. However, the double-top bull trap (false upside breakout x2) at the $500 level in November 2023 deeply concerns me.

Investors must question why, despite knowing that NVDA last traded at a forward adjusted P/E of less than 25x, market participants have not been willing to let NVDA rip higher.

For what it’s worth, I believe sellers entering at that level suggests a lack of conviction in letting NVDA surge higher from here without a steep pullback to force out weak hands first.

As a result, I believe it’s time to cut some exposure (I didn’t say all) if you are sitting on significant gains and move back to the sidelines, waiting for another opportunity to load up.

Rating: Downgraded to Sell.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!