Summary:

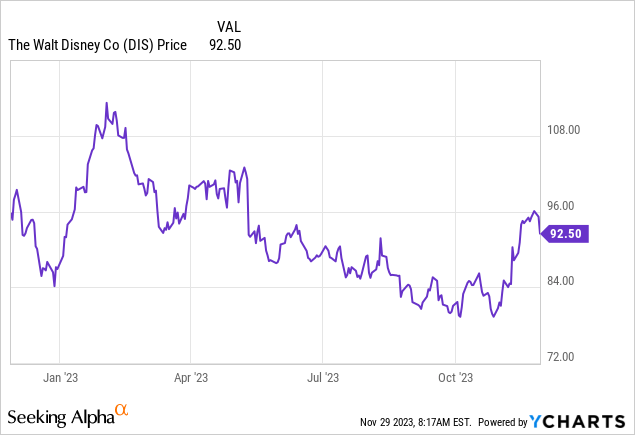

- The Walt Disney Company’s recent stock price increase is due to strong earnings, increased Disney+ subscriptions, and cost-saving targets.

- However, the company still faces challenges with its debt, linear TV, and ESPN.

- Selling off ESPN and ABC TV could raise funds to reduce debt and improve the company’s financial position.

Bastiaan Slabbers

Premise: Let’s begin by agreeing that the recently nice run up of The Walt Disney Company (NYSE:DIS), ~$15 a share is understandable given the recent Q4 earnings release showing a hefty y/y earnings beat. Credit a sharp increase in Disney+ subscriptions, good parks numbers, and increases in free cash flow, or FCF. The company has now raised its cost saving targets to $7.2b up from 5.5b. More good news, but bear in mind strong FCF did not find its way into a some meaningful pay down of the persisting, massive debt. Clearly, CEO Bob Iger has other fish to sell Mr. Market that appear to them to be fresher than a frontal attack on debt.

But overall subscriber growth for Disney+ at 7% (mostly international), is largely what has driven the spike in DIS shares to date. Any examination of the annual results by realists will conclude that yes, there has been progress in cutting production costs of movies. Validation that price increases for Disney+ thus far seem to be working. The parks business continues to show improvement. ESPN revenue was essentially flat with its international unit showing a (21%) decline. What may lie ahead could be another story whether or not a recession shows up next year and poops the party for Disney’s many divisions.

Meanwhile, in our view, the persistent, tough foundational issues facing DIS have not, as yet been confronted and fixed. We agree It’s neither an easy nor overnight task in a company of that size. For that reason, we are inclined to believe that the recent upside move, while nice, may just be a sugar high eagerly swallowed by DIS fans who will never toss their pom poms back in the closet no matter what.

Nothing in the improved results tells us that the tougher core challenges DIS faces have been addressed forcefully yet. Serious threats to the established business model continue.

Above: The recent upside momentum will need more to sustain itself.

Disney avoids confronting key business model issues that will not go away—i.e., a mountain of debt, woke overkill, the futures of linear TV and ESPN

Right now while DIS management laps up the kudos of many investors for its streaming gains, it still doesn’t appear to be reacting to some of the macro issues it faces. They owe investors better answers on linear TV, ESPN, and the underperformance of its recent spate of movies.

Google

Above: Does ABC figure to be a meaningful part of the DIS future?

Has DIS management finally surrendered to the reality that their lackluster grosses in recent movies were partly victims of its virtue messaging in addition to aged out IP?

The truth is that complaints about DIS virtue messaging are not about politics at all. It’s not personal, it’s strictly business, said Mr. Michael Corleone. This should be the only DIS goal: Make great entertainment for ALL—make it economically, widely appealing and keep all eyes trained on profit when green lighting projects.

A recent article in D.C.-based The Hill by Johnathan Turley citing this year as the 300th anniversary of the birth of the estimable Mr. Adam Smith, noted that apparently Disney is finally listening to some of Smith’s mantra. Turley’s article included quotes from Iger’s remarks in the SEC filing, best characterized as confessions through gritted teeth.

Yes, Iger admitted, DIS may well have intruded too deeply into virtue signaling to the detriment of its core mission, which is to make the most money entertaining everyone and leave the social issues to others. Turley sees this as a welcome change in DIS embracing the core free enterprise capitalism goals that Adam Smith asserted was good for all. Alas, the invisible hand of free capital finally finds its way to the mouse house.

Quality not quantity is the order of the day — or should be

Operating from a different paradigm that less is more sans virtue signals not only that it will husband assets better but also gives product a fighting chance to bring in far better revenues. Iger says he wants quality over quantity. Now it’s time to prove it.

Reordering creative priorities in film and TV production would be a strong step forward toward grasping the new reality. Make fewer pictures of higher appeal for less money is a challenge DiS creative people must embrace if we are to believe Iger’s SEC statements..

Said one DIS alumni friend:

“They had the success they thought produced an insatiable demand for anything Disney and went hell bent to buy and create a massive amount of product, some good, some not. It hasn’t worked in this crazy new world post COVID.”

Iger solutions to date may be nice Band-Aids but hardly the cure needed to get out of the way of debt, the linear TV disaster forming, the ESPN stasis, and filmed entertainment pivoting beyond repurposing of dated IP that has its limits going forward.

The question as we see it is this: Do linear TV and ESPN belong in the DIS of the future? And is monetizing those businesses that could play a key role in contributing to be more in tune with the media/entertainment business to be rather than the one that was pre-COVID, pre-AI?

Our menu: The game is afoot: cut the debt

Iger is the guy who spent $100b on IP, overpaying in the process when the DIS treasury brimmed over with cash. The implied thrust of Nelson Peltz’ move to get two board seats must include, in our view, more than that. Former CEO Robert Chapek didn’t work out, so it seems clear that a reconstituted board could serve investors well by setting a new course ahead. And whoever should direct that pivot is a successor to Iger, who ought to be the subject of a search now as a number two to Iger.

Deep dives into each vertical within the DIS portfolio are all over the place. They have ignited both positive and negative forward sentiment by many analysts and investors. Our aim here is to focus on the debt issue. It is the most dangerous of all headwinds facing the company, because hefty interest costs bog down deeded money to fix the company.

The burden of DIS debt has remained too high too long

The interest coverage ratio though robust at 7.4X is a long way from the 44.9 it was in 2015. DIS now sits on $14.18b in cash, yielding a current ratio of 1.05, okay but not great. There’s no question of challenged solvency, of course. The real sword issue is cost of money. DIS overall cost of debt is a comfortable for the moment 4.3%.

That may face serious challenges ahead if the U.S. FED ignores the cheering squads of some gurus who see rates possibly coming down by early next year. The fires of inflation may have flickered a bit, but overall they are still burning up consumer dollars ferociously, as most consumer sentiment surveys show. Serious investors are not served if indeed a recession does fall upon us, triggering a move up in rates that will put all corporate entities with huge debt at risk.

Here is what the annual cash drain to meet debt obligations has cost DIS shareholders:

In the period between 2019 and 2023, DIS has paid out nearly $6b in cash to meet debt payments on its $44.8b in debt.

The company has made a start in reducing debt from its apogee way above $50b, but has now shoved it to the back burner as a core forward issue.

As we have noted, what future purpose is served by DIS holding onto its linear networks, ESPN and other smaller verticals that don’t appear to bring much to the party in the real world of media/entertainment today?

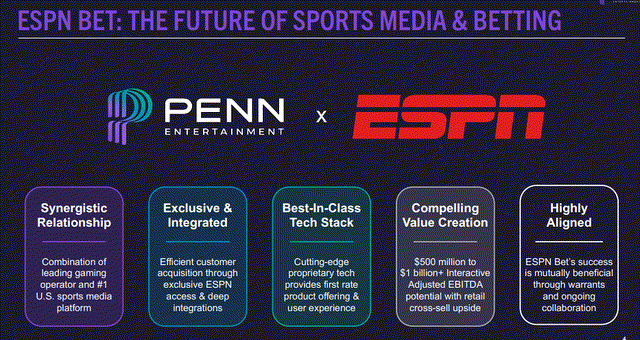

Above: Its gone live late to the party, but nice early downloads in great part are a result of huge $200 free bet giveaways. Time will tell.

ESPN’s foray into sports gambling five years too late has now been launched in 17 states by its partner PENN Entertainment (PENN). In the first few days, it triggered 459,000 downloads to the BetESPN site. That seems like a decent start, but bear in mind, the introductory deal had $200 in free money on offer. It remains to be seen how many of the newbies will remain. We looked at the Fanatics launch as well. That deep-pocketed newbie site was launched with a 14% share of the download market. Within days however, when the free money deals had been laid down, the newbie signups tanked to a 3% share.

Our point here: DIS has a $150m/10yr annual revenue pledge from its PENN partner to provide the major marketing engine to build a respectable share in sports betting for the brand. Under its prior partner Barstool, Penn had brought ~1m bettors into their market handle share, which has never grown beyond low single digits. Yet Barstool presumably 66m “stoolies” as a potential crop to harvest for PENN gaming.

We turn to ESPN, which begins in 71m homes (down from 100m ten years ago) and 22m subscribers to ESPN+. Management has wisely tamped down expectations as to the market share of handle ramp they expect BetESPN to achieve. Yet to be tapped is the ESPN segment in fantasy sports leagues which do hold real possibilities as they did for both DraftKings (DKNG) and FanDuel (OTCPK:PDYPY). But those explosive growth arcs occurred beginning in 2018. With BetESPN just out of the starting gate, we see potential, but a much tougher road ahead to meaningful market share any time soon.

Sports betting will not unto itself justify DIS continuing ownership of the vertical. Activists have repeatedly urged DIS to sell off the site, estimating its value at ~$22B to any number of logical buyers. With the ESPN sports betting unit now part of the picture, it could make a deal even more attractive. Even if BetESPN achieves something like a 5% share of total win, it is a value contributor in a sale negotiation. Right now, we are looking at an estimated $40b in sports betting revenue by 2030. Were BetESPN to reach a 5% share, that would make it a $2b business, a positive for a potential buyer.

ABC TV could fetch $10b, according to several sources we checked among bulge bank analysts.

Our point here: Selling off ESPN and ABC-TV could raise ~$32b in gross proceeds to DIS. If, say, half of it could go to debt reduction, or $16b over a given short period, it would reduce DIS debt to $28b and cut its interest cost by $640m. Scenarios with even bigger debt wipeouts could conceivably cut DIS debt even lower and approach savings of $1bm easily. Clearly, this is not a solvency issue but a management miscalculation as to the pile of cash that could be awaiting them through unit sales better directed to uses other than paying lenders.

Two final goals achieved: At a far more viable level of debt, DIS faces no potential crisis ahead if rates rise. And the exit of two businesses which were acquired in a different era, almost a different planet if you will. It makes imminent good sense for DIS to dramatically reduce debt, liberate cash to either fatten dividends, institute stock repurchases, or invest in core businesses. Overall a leaner, smarter DIS with a great asset base, low debt and a real shot at returning the value of its shares to the loftier heights once occupied.

Our sense now: If you own DIS, keep your eyes peeled on the next sequential quarters in terms of any moves to sell verticals. If you don’t, there could be a dip coming back well below $80 if we see recession looming.

Overall, DIS may look like a profit taking sell now, or a hold at least until we get a better grasp on what Peltz is thinking.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

The House Edge is widely recognized as the only marketplace service on the casino/gaming/online sports betting sectors, researched, written and available to SA readers by Howard Jay Klein, a 30 year c-suite veteran of the gaming industry. His inside out information and on the ground know how benefits from this unique perspective and his network of friends, former associates and colleagues in the industry contribute to a viewpoint has consistently produced superior returns. The House Edge consistently outperforms many standard analyst guidance with top returns.

According to TipRanks, Klein rates among the top 100 gaming analysts out of a global total of 10,000.