Summary:

- Higher interest rates have negatively impacted the real estate industry, but rate cuts expected in 2024 could lead to an increase in valuation.

- VICI Properties owns premier gaming, hospitality, and entertainment real estate locations, with a 100% rent collection and a 7.3% AFFO yield.

- VICI is experiencing growth in its cash flows, with the possibility of rising valuations due to potential rate cuts.

Nature, food, landscape, travel

Higher interest rates have had an extremely detrimental impact on the real estate industry, particularly on the commercial side of things, as the cost of capital is pressuring margins and increasing cap rates. Currently, we potentially are at an inflection point where the Fed has finished its rate-hiking cycle, with rate cuts expected in 2024. I’m not an interest rate prognosticator, but instead am a value investor/investment manager and I like buying quality assets at discounts to intrinsic value, where the discount is driven by short-term concerns. My firm has been acquiring the common stock and bonds of various real estate firms including Crown Castle (CCI), W. P. Carey (WPC), Kennedy-Wilson, (KW), and our topic for today’s article is VICI Properties (NYSE:VICI). VICI offers some of the highest quality real estate assets that have experienced 100% rent collection since formation. The stock trades at a compelling AFFO yield of 7.3% and offers a 5.6% dividend yield, which I expect to grow at a solid rate in the future. Long-term investors could see solid double-digit returns per annum over the next 3-5 years as VICI grows its cash flows and dividends, while potential rate cuts could lead to an increase in the valuation.

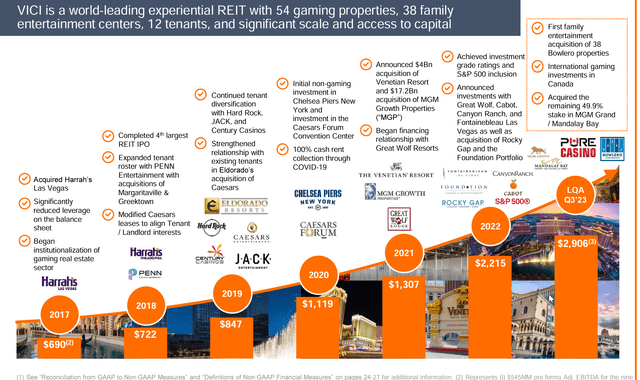

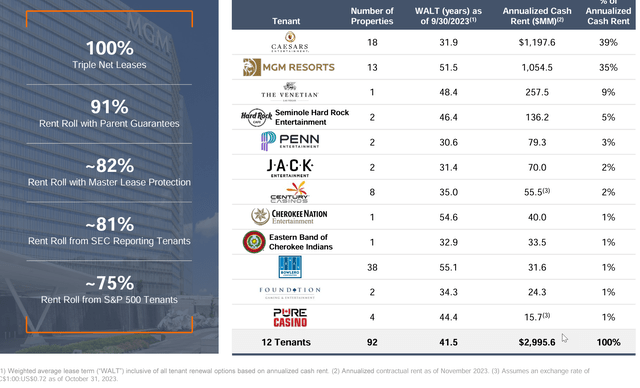

VICI Properties is a triple-net REIT that owns many of the premier gaming, hospitality, and entertainment real estate locations, including the iconic Caesars Palace Las Vegas, MGM Grand, and the Venetian Resort. The company owns 92 experiential assets, consisting of 54 gaming properties and 38 non-gaming properties across the United States and Canada. The portfolio contains approximately 125 million square feet and features approximately 60,300 hotel rooms, roughly 500 restaurants, bars, nightclubs, and sportsbooks. The properties are occupied by several of the most prominent operators under triple-net lease agreements. The company has expanded into non-gaming experiential partnerships with Bowlero, Great Wolf Resorts, Cabot, Canyon Ranch, and Chelsea Piers. 81% of the rent roll is derived from SEC reporting operators, which provides transparency on tenant performance and health. This is important because VICI is a more concentrated REIT than many of the other popular ones. 50% of the rent has CPI-linked escalation in 2023 and 96% has it over the long term. The challenging regulatory environment in the gaming industry creates huge barriers to entry and limits tenants’ ability to move locations, which contributes to VICI’s 100% occupancy rate. VICI’s average rent per asset is $32,560,000 with a remaining lease term of 42 years, with bother figures being considerably larger than the average triple-net lease. VICI’s scale leads to tremendous efficiency with G&A as a percentage of revenue in Q3 2023 coming in at only 2%.

VICI has raised its annualized cash dividend per share at a 7.6% CAGR, with the current dividend being $1.66 per share. One thing I like about VICI is that the assets have multiple revenue streams, such as restaurants, entertainment venues, golf courses, convention space, etc. The company dominates the Las Vegas strip with 10 premier trophy assets, consisting of 660 acres of underlying land, 41,400 hotel rooms, and 5.9MM square feet of conference, convention, and trade show space. VICI owns 26 acres of undeveloped land strategically adjacent to the LINQ and behind Planet Hollywood. Las Vegas continues to grow and is becoming more and more of a sports hub, with the Raiders, Golden Knights, and now Formula 1 and Athletics. Las Vegas is going to be the destination for the first NBA in-season tournament Final Four, as well as the host of the Super Bowl in 2024, and the NCAA Final Four in 2028. The Sphere has also added just another incredible venue and landmark.

After VICI acquires properties, it will help existing tenants invest in growth opportunities and capital improvements. The company has also started to provide debt capital to new and existing partners that produce attractive rates or returns and open a path toward potential future real estate ownership. VICI has entered into several rights of first refusal and put/call agreements that provide the opportunity for embedded growth, boosting visibility to future cash flows. VICI is also investing in the gaming space through sale-leasebacks, which can be a more affordable source of capital for operators. The company is now venturing further into the experiential sector with the companies that have roll-out business models, where there should be a multitude of properties to invest in. On October 19th, VICI completed the acquisition of the real estate assets of 38 bowling entertainment centers from Bowlero Corp. (BOWL) in a sale-leaseback transaction for an aggregate purchase price of $432.9MM. VICI has a right of first offer for a term of eight years for future sale-leasebacks as Bowlero continues to consolidate and convert the market, which opens the door for future VICI acquisitions. The initial annual rent on the $432.9MM acquisition is $31.6MM, for a solid cap rate of 7.29%, on a 25-year initial lease term with >2% or CPI annual escalators.

VICI’s investment grade BBB- S&P credit rating allows the company to access capital at reasonable rates in this challenging environment for commercial real estate. The reality is that companies like Bowlero wouldn’t sell at a 7% cap rate a year ago, but as capital has become more constrained, opportunities are becoming more plentiful. Other notable investments in the experiential space were loans to Chelsea Piers in New York, and various loans to Great Wolf Lodges and CanyonRanch. VICI’s long-term net leverage target is 5-5.5x, but as of the end of Q3 stood at a net leverage ratio of 5.7x. 99% of VICI’s debt is fixed rate, with 83% of it being unsecured, with 6.1 weighted average years to maturity. $1.05B and $2.05B of debt is maturing in 2024 and 2025, respectively. VICI’s bonds are trading at a little over 5%, so it is good to see the company capturing higher initial cap rates, offering a nice investment spread. VICI also has some put/call agreements that would provide initial cap rates in the high 7-8% range. The company has raised approximately $1.3B of equity capital opportunistically, which has allowed the company to make accretive investments.

The biggest risk to VICI is if inflation perks back up causing rates to stay high for longer, while the economy also suffers a deep recession, pressuring revenues in the gaming and experiential sector. VICI’s biggest tenants are Ceasar’s and MGM, so financial distress with either of those two could be problematic, but it is unlikely the assets would remain empty even in a restructuring. VICI’s expansion beyond gaming opens different risks, so a major miscalculation could of course reduce the quality of the assets, but I’m confident from what I’ve seen from VICI’s management.

VICI offers a dividend yield that is nearly 1% higher than the 10-year Treasury and is well-covered by AFFO. AFFO has solid embedded growth channels within the portfolio and VICI is becoming an attractive option for other high-quality operators outside of the gaming space. In Q3, VICI increased its AFFO per share earnings by 10.7% YoY to $.54 and has announced about $1.1B of new capital commitments in Q3 and so far in Q4. VICI’s guidance for 2023 is now AFFO of $2.17-$2.18B, or between $2.14 and $2.15 per share. At a recent price of $29.62, VICI trades at a roughly 7.3% AFFO yield with a dividend of 5.6%. If AFFO can grow by a realistic 5% a year, VICI would offer double-digit returns, and if the valuation were to increase to around 16.5x AFFO, returns would be in the mid-high teens over the next several years.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VICI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.