Summary:

- 3M’s stock has faced significant pressure since 2020 following the Earplug Lawsuit, erasing all gains made in the past decade.

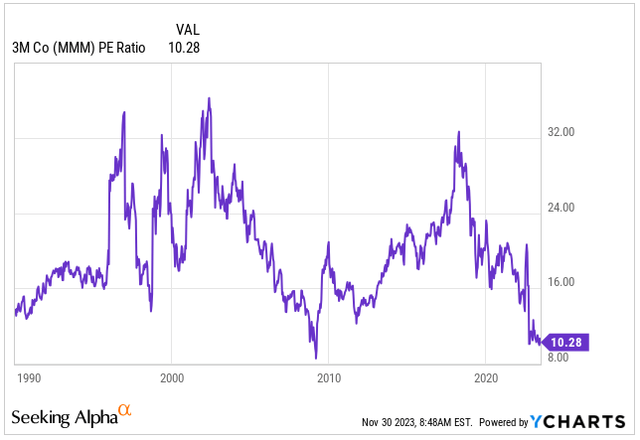

- The litigation drove the stock to trade at levels not seen since the Financial Crisis, offering an attractive valuation at 10.28x its earnings.

- The $6 billion settlement of the Earplug lawsuit should signify a new chapter for the company, potentially paving the way for recovery in 2024.

- 3M remains a secure income vehicle for retirees with a 6.1% yield.

- The stock is currently trading at approximately an 18% discount to its fair value, with a 2024 price target of $118.

jetcityimage

3M (NYSE:MMM) is a company that needs little introduction. With an expansive portfolio boasting over 60,000 products, 3M stands as a global conglomerate. Whether you’re in America, Europe, or anywhere else, chances are you’ve interacted with their ubiquitous products like the widely used Post-It Sticky Notes, reliable Scotch Tape, or the convenient Command Hooks tailored for wall-friendly item hanging.

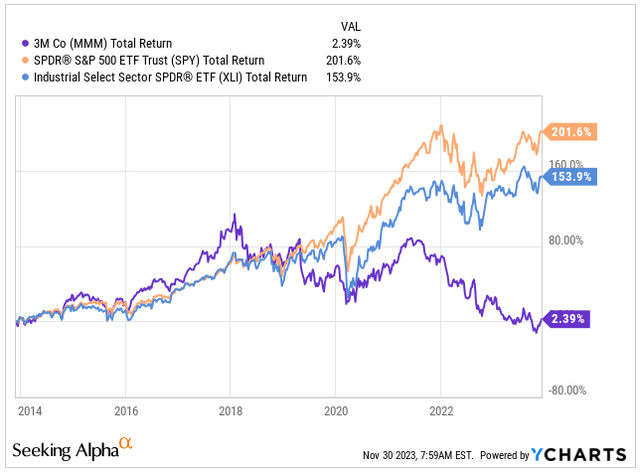

Despite its vast scale, 3M has faced a challenging period in recent years due to legal disputes involving US military earplugs. In settling these lawsuits, 3M agreed to a $6 billion payout, essentially erasing the stock’s gains from the past decade. This resulted in significant underperformance compared to the market (SPY) and other industrial stocks (XLI), translating to negative total returns for investors when adjusting for inflation.

Total Return (Seeking Alpha)

The ongoing litigation might continue to cast a shadow over 3M because the agreement isn’t yet definitive, and 22 US states are striving to impede it, asserting that it doesn’t sufficiently hold the company responsible.

Despite this uncertainty, the stock is trading at prices not seen since 2012. Considering its forward PE valuation of 10.82x based on its FY24 earnings and a robust 6.1% dividend yield, I believe these factors already account for the negative publicity. I don’t anticipate a significant impact on its healthy dividend yield even if the legal battle drags on for another year.

The combination of today’s low valuation, decreasing net debt and high dividend, makes this company a secure income vehicle for retirees, but also an interesting play for value investors with a potential reversal in sight.

Let me show you why I like 3M today.

Inferior Economic Cycle, Yet Diversified Business

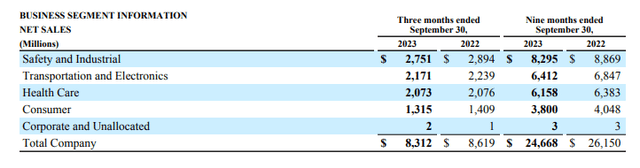

In Q3 FY23, 3M, known for its diverse business segments—Health Care (expected to be spun off next year), Safety & Industrial, Transportation & Electronics, and Consumer — achieved $8.3 billion in net sales. This figure demonstrates a 3.5% decrease in net sales compared to the same quarter of the previous year.

Business Segment Performance (MMM IR)

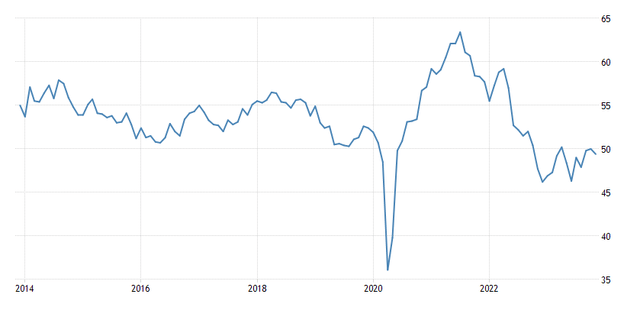

The marginal decline in sales was noticeable across most business segments, reflective of the broader economic slowdown. Factors contributing to this include the Federal Reserve’s 11 consecutive interest rate hikes and a reduction in industrial activity, as evidenced by the PMI standing at 49.4 points, indicating a continued contraction in the manufacturing segment.

PMI (Trading Economics)

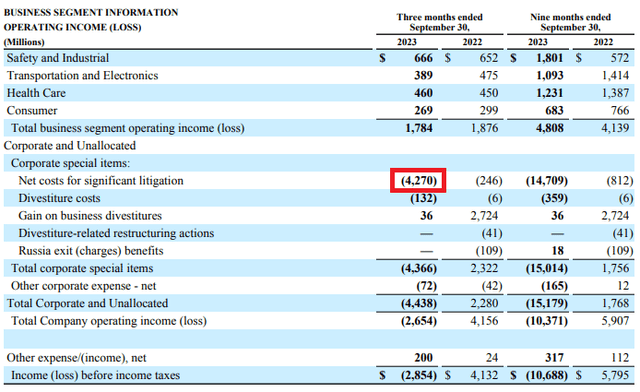

3M achieved $1.9 billion in adjusted free cash flow (FCF). Nonetheless, the company incurred a pre-tax impairment charge of $4.2 billion in Q3, a matter detailed further in the discussion about litigation.

Due to the litigation costs, the EPS came in at a negative value of $3.74. It’s important to note that this expense is a one-off, non-recurring charge.

Business Segment Information (MMM IR)

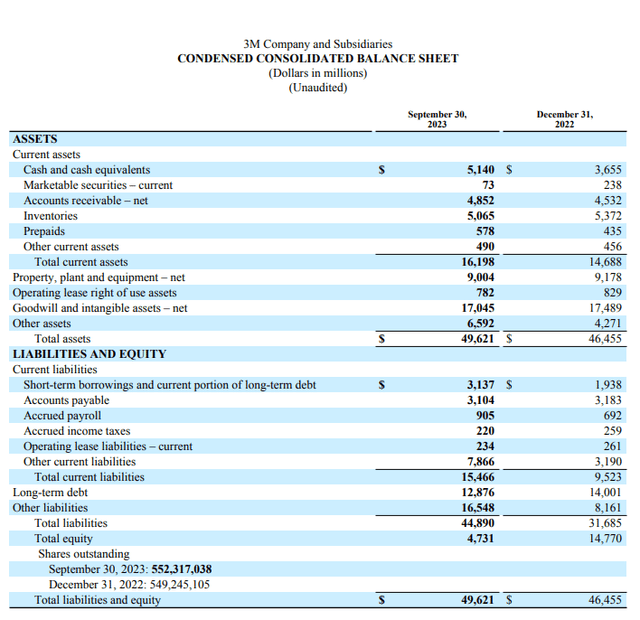

Despite the decline in net sales owing to an inferior economic cycle and negative earnings triggered by litigation compensation and legal expenses, 3M has achieved notable strides in its financial health. One significant achievement includes an 8% reduction in long-term debt, decreasing from $14 billion in December 2022 to $12.88 billion by September 2023.

Simultaneously, the company has bolstered its financial position with an impressive 40% increase in cash, now standing at $5.14 billion compared to the previous year-end figures.

However, there’s been a rise in short-term borrowings, potentially necessitating the use of some cash reserves to meet these short-term obligations. Nonetheless, overall, 3M remains in a robust financial position.

Balance Sheet (MMM IR)

Earplug Lawsuit Settled, Or Is It?

Thousands of military service members and veterans filed lawsuits against 3M, alleging that the company’s combat earplugs were faulty and caused hearing damage due to exposure to loud noises during combat or training exercises.

At the core of the case were the Combat Arms earplugs used by the US military from 2003 to 2015, notably in conflict zones like Afghanistan and Iraq. Plaintiffs claimed that the company concealed design flaws, manipulated test results, and failed to provide proper usage instructions, resulting in hearing damage.

While I refrain from speculating and hold the highest respect for all military veterans worldwide, it’s important to acknowledge that working in what I consider high-risk areas carries inherent health risks. Hearing loss appears to be the most prevalent condition among military veterans, and not just in the US.

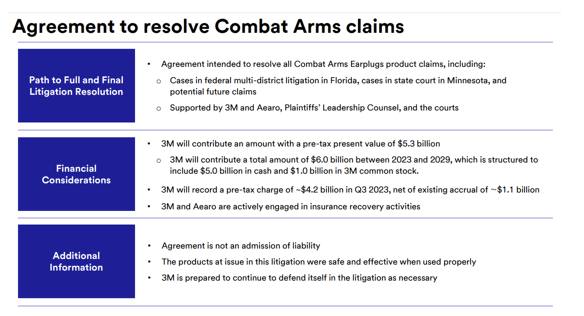

Amidst a legal battle with what I call opportunistic behaviors and fraudulent elements, 3M reached an agreement in August to pay $6.01 billion to settle these lawsuits.

Lawsuit Resolution (MMM IR)

This legal dispute became one of the largest mass tort cases in US history, marked by fluctuating outcomes and substantial scale. Negotiations stagnated until 3M’s unsuccessful attempt to move the lawsuits to bankruptcy court.

It is estimated that around 240,000 individuals may qualify for the settlement surpassing $6 billion. According to 3M, the settlement will be dispersed between 2023 and 2029, comprising $1 billion in 3M stock (equating to approximately a 2% dilution for current shareholders) and $5 billion in cash compensation. The cash compensation is roughly reflective of the company’s annual free cash flow.

Nevertheless, the finality of this agreement remains uncertain, as 22 US states and territories seek to challenge it, arguing that it inadequately holds 3M accountable.

While I believe that if the case settles in its current state, the one-year worth of free cash won’t significantly harm the company’s long-term outlook, some analysts speculate that the expenses including damages and legal fees for the earplug settlement could escalate to $10 to $15 billion. If such a scenario were to unfold, 3M might face challenges, potentially requiring the company to incur debt, dilute shareholder value, or even consider dividend reductions. However, I maintain skepticism regarding this perceived ‘worst-case scenario’ outcome.

Dividend King

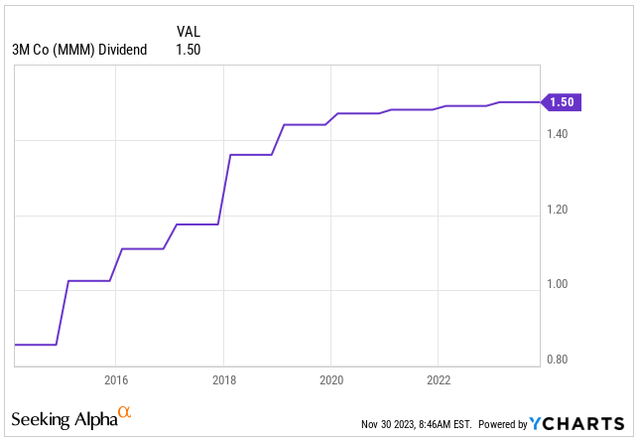

In the face of a near 20% year-to-date decline in stock price due to legal uncertainties, 3M, known for its unbroken 64-year streak of growing dividends, emerges as not just a dividend king but also an appealing prospect for income investors, yielding an attractive 6.1% or $1.50 per share.

To put it in a perspective, the 4-year average dividend yield is only 4.21%.

Understandably, the pace of dividend growth has slowed since the onset of these risks. This measured approach aims to avert an unsustainable dividend payout ratio. Since 2020, 3M’s annual dividend increases have been a meager $0.01, a concerning trend.

Nonetheless, I anticipate that with a clearer legal landscape in the near term, the company should be capable of achieving a moderate 2-4% annual dividend growth. While that is nothing to write home about, the high starting yield should compensate for the lack of growth.

Dividend (Seeking Alpha)

When it comes to safeguarding the dividend, things get a bit tricky. Historically, 3M maintained a dividend payout ratio around 63%, which, in my view, was quite solid considering the high yield.

Normally, 3M generated an average of $5.1 billion in FCF, allowing the company to pay out dividends of $0.8 billion per quarter or $3.2 billion annually, constituting that 63% dividend payout ratio.

However, due to substantial litigation costs amounting to approximately $14.7 billion in the fiscal year—tied not just to the earplug issue but also to settling claims with US public water systems over chemical-related water pollution — the company’s FCF will be negative for the year. Consequently, 3M will need to finance this year’s $3.2 billion dividend payout through either cash reserves or by taking on debt.

If the worst-case scenario unfolds, and 3M is compelled to pay $15 billion instead of the anticipated $5 billion in damages, the company might have to slash dividend payments, as it will no longer be able to afford to pay approximately $3.2 billion annually. Another option could involve taking $10 billion in debt or raising capital, which would dilute shareholders, a move I consider unlikely.

I personally believe that a dividend cut would be the last resort because it would significantly affect the perceived value of one of the few dividend kings. There are several alternative avenues, as mentioned, to finance these non-recurring legal expenses if the worst would come true.

Dirt Cheap

Undoubtedly, amidst all these challenges and uncertainties, 3M’s stock has become dirt cheap.

While I usually adhere to the advice from Sun Tzu’s ‘The Art of War’—to pick battles worth fighting — 3M’s legal battles appear to be nearing resolution, presenting a good opportunity to invest in the stock at 10.28x its FY23 earnings.

The stock hasn’t been this attractively priced since the Great Financial Crisis in 2009.

PE Ratio (Seeking Alpha)

Even when comparing the current valuation to the trailing 5-year averages, the Forward PE Ratio at 10.8x FY24 earnings stands at a 34% discount, while the Forward EV/EBITDA of 8.01x is 31% lower than historical averages.

In my view, 3M doesn’t deserve to be trading at such a steep discount, approximately 32.5% below its 5-year averages.

Despite projecting a modest 4-5% annualized EPS growth over the next five years, I estimate the stock should realistically be valued around 13x its expected FY23 earnings, at $118.

Conclusion

3M, a globally diversified industrial conglomerate offering an extensive array of over 60,000 products, has witnessed a decline in revenue attributed to an economic slowdown stemming from the Federal Reserve’s 11 consecutive interest rate hikes.

Simultaneously, the company grapples with the aftermath of the earplug lawsuit settlement, where 3M resolved the matter by paying $6 billion in combined stock and cash compensation. Despite the settlement, the stock remains under pressure as certain US states intend to challenge the resolution, claiming insufficient compensation for the affected individuals.

I anticipate that this proposed settlement will likely mark the conclusion of the legal dispute, allowing 3M to refocus on its core business. With the economy projected to recover in 2024, this might ignite a stock rally. My fair value price estimate stands at $118, presenting an 18% potential gain compared to today’s price of $100.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MMM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.