Summary:

- 3M has a string of decent quarterly earnings beats and stock price reactions.

- With a historically high free cash flow yield and lofty dividend, I see earnings trends stabilizing as settlement charges come about.

- I spot key price levels on the chart to monitor as the January earnings date approaches.

jetcityimage

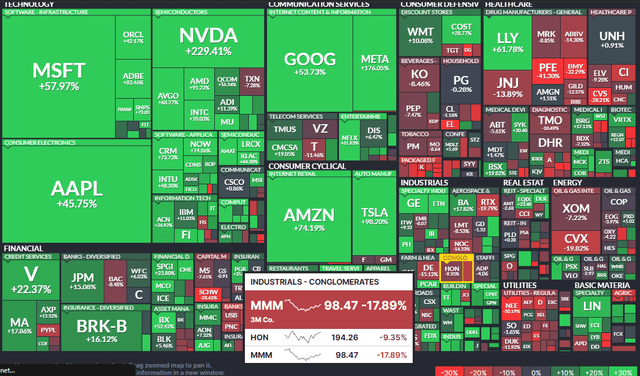

Macro and micro factors have been at play, driving some sharp outperformance and severe underperformance among the diversified Industrials sector of the S&P 500. One of the poorest stocks in that slice of the SPX is 3M Company (NYSE:MMM). The firm continues to face uncertainty with investigations and lawsuits, casting a significant shadow, critics assert, over its underlying earnings and cash flow.

Amid all the unknowns, I reiterate my buy rating on the stock and assert that the negativity and risks are largely priced in as shares attempt to stabilize.

YTD S&P 500 Stock Performance Heat Map: 3M An Industrials Loser

According to Bank of America Global Research, 3M Company was founded in 1902 as a mining concern and today it provides diversified technology services in the United States and internationally. Today, the firm is a diversified, global manufacturer. Its businesses are technology-driven and organized under four segments: Consumer, Safety and Industrial, Transportation and Electronics, and Health Care. Its popular brands include Scotch, Post-It, 3M, and Thinsulate. It holds over 500 US patents.

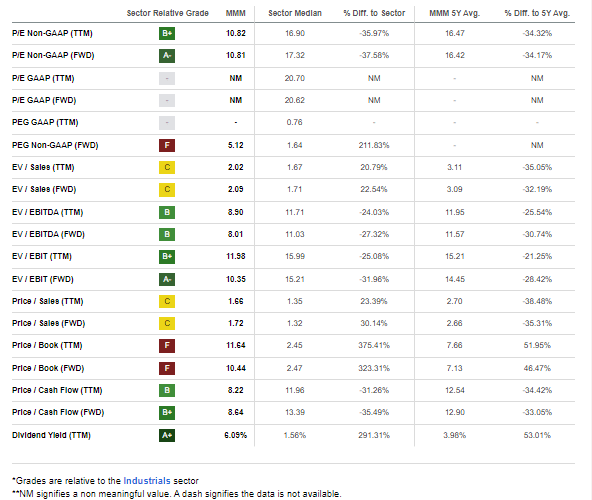

The Minnesota-based $54 billion market cap Industrial Conglomerate industry company within the Industrials sector trades at a low 10.8 forward non-GAAP price-to-earnings ratio and pays a high 6.1% forward dividend yield. Ahead of earnings in January, shares trade with a low 19% implied volatility percentage, and short interest on the stock is low at 1.9% as of November 29, 2023.

Back in October, 3M reported a strong quarterly profit beat. Q3 non-GAAP EPS of $2.68 topped analysts’ expectations by $0.33 while $8.3 billion of revenue, down almost 4% YoY, also beat estimates. The company took a $68 million pre-tax charge related to its restructuring, or about $0.10 per share. Also, 3M took a $4.2 billion pre-tax charge related to its Combat Arms Settlement, but there was good news in its guidance.

With decent operational results, particularly in Safety & Industrials and Transportation & Electronics, the management team raised if FY 2023 adjusted EPS and adjusted free cash flow conversion outlook – it now sees adjusted EPS in the $8.95 to $9.15 range. For Q4, $2.13 to $2.33 of EPS is the guide. Along with strong margin numbers in the previous quarter, 3M’s Health Care business is on track to be spun off in the first half of next year, which could be a positive headline risk over the coming weeks.

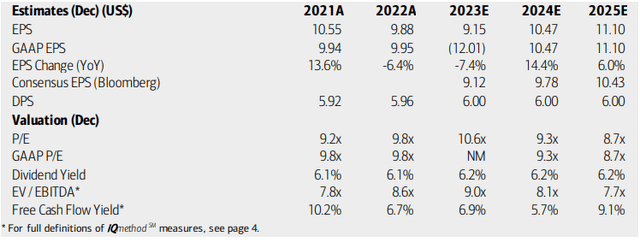

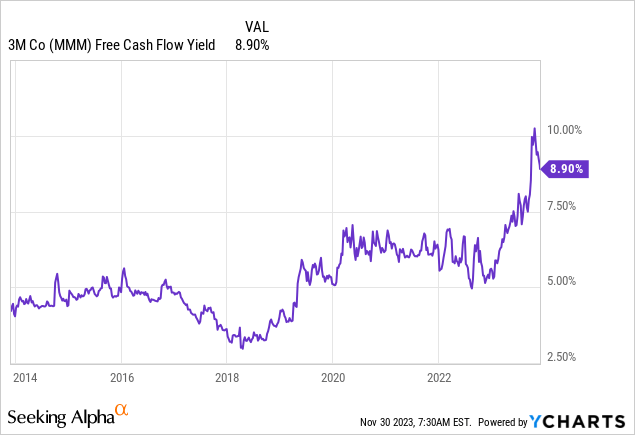

3M: Historically High FCF Yield

YCharts

On valuation, analysts at BofA see earnings falling more than 7% this year before per-share profits climb back above $10 in 2024. While EPS growth may decelerate in 2025, the current consensus estimate for ‘25 EPS, per Seeking Alpha, is $10.56 with sales growth holding in the low single digits over the out years. Dividends, while uncertain, are expected to hold at the $6.00 annualized rate, and I believe that will hold firm given a solid free cash flow yield in the mid-single digits, and potential rising toward 9% by 2025. With a forward non-GAAP P/E near 10, there is a significant amount of pessimism priced in.

3M: Earnings, Valuation, Dividend Yield, Free Cash Flow Forecasts

If we assume normalized operating earnings per share of $10 over the coming 12 months and apply a 12x earnings multiple, heavily discounted compared to its 5-year average north of 16, then the stock should be near $120. That would imply about 21% of upside from today’s price, not to mention the high dividend yield along the way. If the price/cash flow rating was not as strong, then the valuation and fundamental earnings strength case would be much softer.

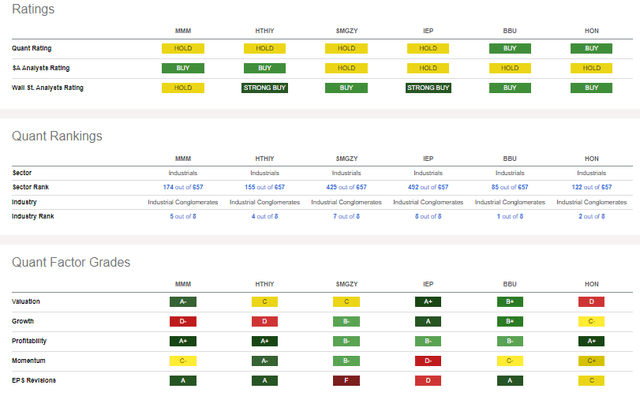

3M: Attractive Valuation Metrics, Strong Cash Flow & Yield

Seeking Alpha

Compared to its peers, 3M features a strong valuation while its recent growth trend is poor, but that is partly due to the GAAP earnings charges taken in 2023. On an operating earnings basis, the firm has strong profitability trends and EPS revisions are actually quite positive following three straight bottom-line beats (and shares traded higher post earnings in each of those three instances). Finally, share-price momentum has been relatively poor, but I will detail key price levels that bear watching ahead of the company’s earnings report coming up in late January.

Competitor Analysis

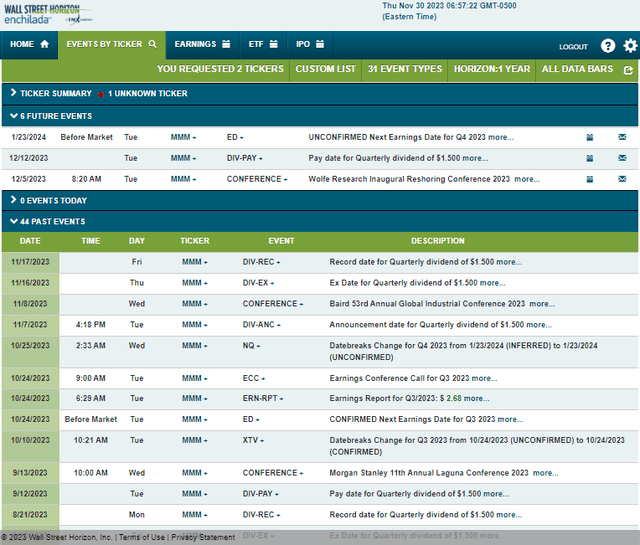

Looking ahead, corporate event data provided by Wall Street Horizon show an unconfirmed Q4 2023 earnings date of Tuesday, January 23 before market open. Before that, the company’s management team is expected to speak at the Wolfe Research Inaugural Reshoring Conference 2023 from December 4 to 5 in New York. Mike Roman, Chairman and CEO, is slated to present.

Corporate Event Risk Calendar

The Technical Take

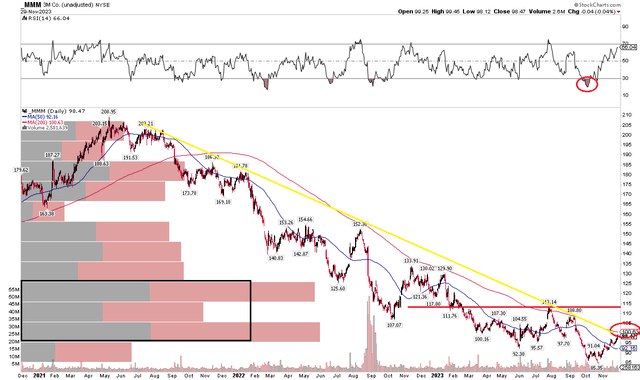

Earlier this year, I noted that the mid-$90s was not holding as important support as I would have liked to see. I pointed out that a capitulation-type of move could be in store, offering prospective buyers an opportunity to step in. Did we see that? Not so much when scanning the volume trends but notice in the chart below that the RSI momentum oscillator notched its lowest mark in more than a year in early October – the stock then went on to make marginal new lows later in the month while the RSI gauge did not confirm a new low. That bullish RSI divergence following a momentum washout was a positive turn of events for the bulls.

With a clear low in place just above $85, there is a downside bogey to monitor. On the upside, the falling 200-day moving average is once again in play – that has been a point of selling dating all the way back to late 2021. So, rising MMM above that line is step 1. Next, I continue to see resistance in the mid-$110s. Finally, a long-term downtrend resistance line comes into play around the current price, so we are near a crucial point on the chart in my view.

Overall, the technicals remain troubled, and while we have a spot to watch on the downside, the onus is on the bulls to bring MMM above key resistance levels.

MMM: Persistent Downtrend, $115 Remains Key Resistance

The Bottom Line

I reiterate my buy rating on 3M. I see shares as significantly undervalued, though not a screaming buy, while the technicals offer some important price points to consider.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.