Summary:

- Consumer intent to purchase EVs in the future is high, despite current demand appearing weak.

- EVs are reaching price parity with ICE vehicles, making them more attractive to consumers.

- The Detroit Three automakers (GM, Ford, Stellantis) are falling behind in the EV transition and their stocks are no longer worth owning for the long term.

- One of the Detroit Three is positioned particularly poorly for next year due to near-term catalysts, and that automaker is therefore my top short pick for 2024.

- By contrast, Tesla, Inc. is well positioned to take advantage of the EV transition, and due to massive positive catalysts in the near term, it is my top pick for 2024.

ADragan

Introduction

In the finance media, a growing number of articles, like this one, proclaim that electric vehicles, or EVs, are seeing a decline in demand, and that consequently, carmakers are reducing their spending on EV production, and even delaying EV production targets. But a few important points about these trends are being left out of the reports: consumer intent to purchase an EV in the future is actually very high, but demand for EVs from well-known and established car manufacturers is falling and is being absorbed by, among others, Tesla, Inc. (NASDAQ:TSLA), the Detroit Three’s most noteworthy EV competitor.

In contrast to the Detroit Three’s crumbling EV ambitions, Tesla’s production of a popular all-electric vehicle line with no traditional combustion vehicles, its EV profitability, its autonomy leadership, and other tailwinds puts the company in pole position to become a globally renowned EV manufacturer and succeed where the Detroit Three are likely to flounder.

While many non-Tesla carmakers, as well as the dealerships dependent on them, will fare poorly based on these and other phenomena, in this article, I will focus on the Detroit Three automakers, General Motors (GM), Ford (F), and Stellantis (STLA). I will lay out why I think their current conditions and next moves demonstrate that they will fall behind as the world transitions to EVs, compare their position and progress to Tesla’s, and conclude that the Detroit Three’s stocks are not worth owning for the long term, especially compared to Tesla’s stock, a clear long term winner. Further, I will declare which Detroit Three automaker is my top short pick for 2024, alongside Tesla, my top 2024 long pick.

Intent to Purchase EVs is Present and Widespread

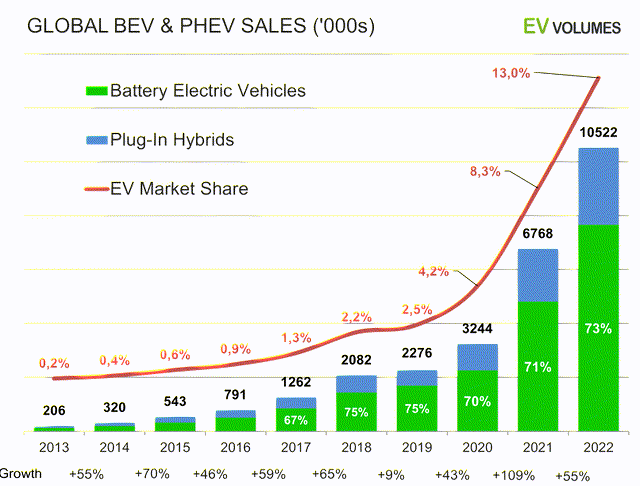

Demand for EVs is often described as low and plateauing. While it is certainly low, it is not plateauing – EV demand has been increasing for a decade, growing exponentially, with battery electric vehicles, or BEVs, as the main attraction. Hybrids, on the other hand, have made up a consistent minority of EV sales.

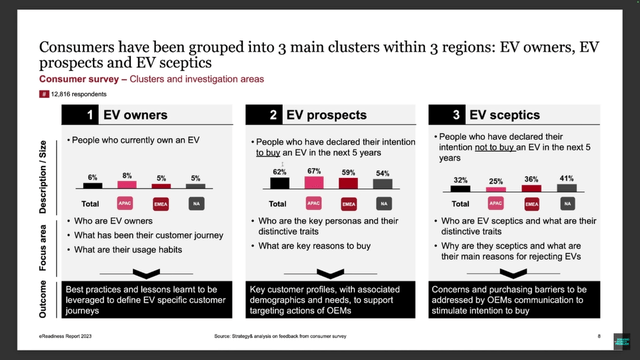

Furthermore, a majority of car buyers in multiple regions of the world have indicated that in 5 years, they want to purchase an EV; only a minority oppose EV ownership within that time.

Clearly, future intent to purchase EVs is strong, even if current demand may appear weak. Yet even current demand is likely stronger than many say, considering that Tesla, which produces only BEVs, consistently delivers about as many vehicles as it produced per their last several earnings reports, e.g. the Q3 2023 earnings report, the Q2 2023 report, and so on.

Based on these numbers, it would appear that even current demand for EVs is mostly weak only for automakers that are not Tesla.

EVs are Reaching Price Parity with ICE Vehicles

EV sticker prices are set to approach prices of ICE cars (i.e. internal combustion engine vehicles) in the very near future, due in part to Tesla’s price cuts throughout 2023, but also because of falling EV material costs. What’s more, the total ownership costs of EVs are already, on average, thousands of dollars lower than the ownership costs of an ICE car. This is due to lower repair costs and lower fuel costs over the lifetime of owning an EV vs an ICE car. In any case, these long-term savings likely explain some of the consumers’ intent to purchase an EV in the next 5 years, and why consumer demand for EVs is likely to rise over time and remain high permanently.

The Detroit Three Reduce BEV Commitments in a World Going All-Electric

The Detroit Three’s once-rigorous EV transition is now in shambles. GM and Ford have announced plans to delay BEV production, with Ford and Stellantis planning instead to pivot to hybrids. Stellantis doesn’t even produce BEVs yet, though it did debut its first EV platform in mid-2023. Considering the many years it will take for these companies to ramp up all-electric vehicle production, they should be moving very quickly to shift to BEVs, ideally plowing money into BEV production using profits from their divisions centered on ICE vehicles. Ford and GM appear to already be doing this, but both automakers are now slowing their BEV pivot, and frankly, all three firms need to be very aggressive about this funding strategy and overall transition if they want to survive in the long term.

Some investors and analysts may say that this is unwise since, per Ford and GM’s EV financials, ramping up EVs is leading to steep losses, and these losses would eat into company profits from ICE cars if diverted to these cash-burning divisions. These are true statements, but they are not good reasons to slow down. The fact that ramping up EV production will be expensive is a reason to hurry up and ramp faster, not ramp slower in order to preserve profitability.

The longer these firms hold onto profits from ICE car sales without channeling that profit toward EV manufacturing investments, the less prepared these automakers will be when their ICE car sales collapse completely, eliminating those profits and removing a vital funding source for their EV transition. It would be better for these automakers to quickly consume ICE profits now, while those profits are still coming into the business. Based on consumer preferences, they won’t have those profits forever, and wasting time and money increasing hybrid capacity instead of BEV capacity will come back to bite the Detroit Three later.

A Small Note on Stellantis’ Slow Pace of EV Adoption

Notably, while Ford and GM are taking a big long-term risk in slowing their BEV transition, the danger is even greater for Stellantis, which is literally years behind its Detroit Three peers in even starting. Ford began producing its Mustang Mach-E in 2021, along with its very popular F150 Lightning in 2022; GM has been selling Bolts, Volts, and other BEV models since the 2010s; meanwhile, laggard Stellantis finally announced that it anticipated sales of its first BEVs late this year and that production on its first BEV truck will commence in 2024.

Despite recent progress, Stellantis’ apparent lack of urgency in fully electrifying its lineup is not a good sign for the automaker and has put it far behind in the EV race. Every moment Stellantis waited to sell attractive BEVs was a moment its Detroit peers outcompeted it during this EV transition period, delaying the inevitable financial pain of Stellantis’ transition while leaving less and less EV market share for Stellantis in the long run.

Internal competition aside, though, if, by around 2030, the Detroit Three are still not fully ramped and ready to produce high volumes of quality EVs for customers, then those customers will buy those quality EVs from automakers who are ramped, e.g. Tesla. The Detroit Three will subsequently all see their market share collapse, regardless of which automaker among them lags more in EV adoption.

Lagging on Autonomy Means Risking Your Autonomy

The Detroit Three’s Subpar Autonomy Approach

Speaking of lagging, the Detroit automakers are not just dragging their feet on producing the vehicle hardware needed for electric transportation – they’re struggling with the software, too, and have chosen an overall autonomy approach inferior to that of Tesla.

Creating fully autonomous driving software has various benefits, which I summarized in an article about the opportunities in autonomous flight. In short, autonomous driving software will make significant money for the companies involved with it, improve road safety, and lower transportation costs for consumers. Unfortunately for the Detroit Three, Tesla is as far ahead of them on autonomous driving software as it is on EV production.

Per my article on Tesla from July of 2023, I think there are many reasons to own TSLA stock for the very long term, one of the biggest being Tesla’s ambitious, and very lucrative, upcoming robotaxi service. To create a robotaxi service, though, you need a highly capable autonomous driving software package. I laid out in the article why Tesla’s approach to this is superior, so to recap:

As an AI and machine learning academic explained regarding Tesla’s Autonomy advantages, Tesla’s ability to collect massive amounts of real-world data primarily from cameras (mimicking how humans would see the road with the eye) makes Tesla’s [autonomous driving software] FSD more likely to become a good substitute for human eyes when driving in the real world. FSD’s training on drivers’ responses to real world stimuli will also enable it to similarly mimic driver’s reactions. This two-pronged approach will make Tesla’s autonomous software an all-purpose solution for most, if not all, driving needs and conditions, allowing it to be used on nearly any road that can be navigated by people.

Compare this to the approach being taken by the Detroit Three’s autonomy projects, dependent largely on LIDAR (short for “laser imaging, detection, and ranging”):

LIDAR-based solutions, on the other hand, work well for mapping a constant and unchanging road environment, but since things change frequently on roads in the real world, LIDAR-based self-driving software will likely be inferior as an all-purpose Autonomy solution. Tesla’s LIDAR-based competitors also have less data, in miles driven, that they can draw from when training their autonomous software, since Tesla uses a much larger car fleet with many more miles of data to train on. Tesla’s competitors will therefore take longer to train their software regardless of sensor number or sensor type, since they are far behind Tesla on the critical element of data collection. Additionally, fewer cameras and sensors means fewer points of failure that could disable Tesla’s self-driving capabilities, likely resulting in fewer instances of spontaneous failure of Tesla’s system compared to competitors’.

Put another way, the use of a non-general, LIDAR-based approach to autonomous driving likely will not be sufficiently scalable for a large, environment-agnostic, multi-terrain, multimillion-unit robotaxi network like what Tesla plans to build. This approach by Tesla’s autonomy competitors, including the Detroit Three, will thus be widely understood over time as the worst way to go in developing an autonomous robotaxi fleet, setting the Detroit Three up to be autonomy also-rans based on their architecture alone.

The Detroit Three and Tesla’s Specific Autonomy Setups

The Broad Strokes

Let’s now look at the specifics of the Detroit Three’s autonomy programs.

Ford’s most developed autonomous software consists of the driver assistance feature BlueCruise, but further progress may be on the horizon, with Ford having created a new autonomy division in early 2023 from the remains of its defunct autonomy partner Argo AI. Given how new this new division is, Ford’s advanced autonomy efforts from it are likely early stage, and probably not particularly impressive at this time.

Meanwhile, GM’s autonomy division Cruise, which is worth its own Seeking Alpha article, has suffered several recent public failures of its autonomous driving system, embarrassing the autonomy space while producing cumulative losses of around $8 billion since 2017. But losses and scandals aside, Cruise is plagued by another major issue: its software isn’t even truly autonomous, as it relies on human intervention every few miles.

Lastly, Stellantis claimed in 2021 it would release Level 3 autonomous software in 2024; it subsequently announced the acquisition of AI company aiMotive, whose “technology supercharges Stellantis[‘s] mid-term development of [Stellantis’] AutoDrive, the Company’s autonomous driving tech platform.” I have seen few substantive updates on this since, so we shall see how things unfold on that front. Suffice it to say, though, taking around 3 years to level up in autonomy progress, while understandable, is far from industry-leading (as is Stellantis’ minuscule amount of mileage data collected for training its software, discussed below).

I’ll next examine Detroit Three’s training data, compute power and competitive disadvantage.

Training Data

Continuing on with the Detroit Three, for training its software, Ford had around 50 million miles of autonomous driving data by the spring of 2023 (though this is for its driver assistance feature if you count these as autonomous miles for training); GM racked up 3 million driverless miles by summer of 2023; and Stellantis touted a truly staggering 1 million kilometers (~620 thousand miles) worth of “Level 3” mileage data by 2022.

Compute Power

Regarding the Detroit Three’s processing of all this data for autonomous software training, there have been a few statements of note. Ford has announced a compute-related venture for data processing in the form of a 2021 announcement of a partnership with Google (GOOG, GOOGL) to “apply the best of Google’s AI, data analytics, compute and cloud platforms to help transform Ford’s business and build automotive technologies that keep people safe and connected on the road.” This may include access to Google’s powerful AI supercomputer, powered by 26,000 Nvidia (NVDA) H100 GPUs.

GM announced a different AI compute structure. Per a 2022 statement, the company declared that it would deploy a system in every vehicle powered by Qualcomm (QCOM) chips to process data, opting for a decentralized setup. This compute power would consist of “more than 300 Tera Operations Per Second for camera, radar and lidar processing.” It should be noted, though, that this is for GM’s next-gen driver assistance technology, not for processing data to train higher-level autonomous driving software. Whether this next-gen driver assistance program could evolve into GM’s fully autonomous driving software is a separate question, but for now, I will deem it separate from any full autonomy efforts by GM.

Lastly, similarly to Ford, Stellantis has announced a partnership with a software-centric company, this being Amazon (AMZN), seeking to “bring[] together Amazon’s leadership and innovation in digital experiences, cloud computing, artificial intelligence (AI), and machine learning with Stellantis’ automotive engineering excellence.”

Curiously, however, Stellantis’ Amazon partnership, as well as its subsequent development of its Mobilisights data management division, doesn’t seem to be focused too much on data compute for autonomy. Based on page 18 of Stellantis’ 2021 Software Day presentation, the company seems to imply that autonomy is no more important than any one of the company’s powertrain, body, cockpit, or connectivity applications. This apparent lack of perceived importance of autonomy by Stellantis could explain the company’s scant data collection and absence of autonomy-centric computer processing allocated for autonomous software development. This is rather worrisome for Stellantis due to autonomy’s importance to EVs, which I will address in the next main subsection on the consequences of Detroit Three’s autonomy status.

Whatever their differences in autonomy development, it is noteworthy that none of the Detroit Three automakers have mentioned supercomputers for training their autonomy software. With this omission, one can safely assume that they are likely using run-of-the-mill data-crunching technology for the job since the approved use of a tech company’s supercomputing power for autonomous software training would be a talking point any company would shout from the rooftops.

Tesla’s Autonomy Setup by Comparison

Tesla registered 150 million miles of autonomous mileage data by spring 2023, three times as much as Ford had at that time; Tesla went on to amass 500 million autonomous miles by fall 2023, more than tripling its own mileage data from spring. Furthermore, with the launch of Tesla’s in-house autonomy-centric Dojo supercomputer, the company now has 340 Peta FLOPs of total compute power at its disposal – a level of compute that made Dojo one of the five most powerful supercomputers on earth as of August 2023.

Not only do none of the Detroit Three automakers have an in-house supercomputer (or possibly any supercomputer) available to process their autonomous miles and train their autonomous driving software, but these three automakers also have far less driving data to train their autonomous software compared to Tesla.

In short, Tesla has more data, more processing power, and the right setup to create a general-purpose autonomous software package, with an autonomy approach that prepares it to allow a multitude of cars to drive anywhere under nearly any road conditions. Its competitors in autonomy, including the Detroit Three and their autonomy divisions, are far behind in comparison, so they will be playing catch-up to Tesla in the autonomy space for some time.

The Consequences of the Detroit Three’s Subpar Autonomy Status

As a result of the Detroit Three’s lag in autonomy, as well as their subpar autonomy approach that is based on LIDAR, HD mapping, and other non-scalable solutions, any robotaxi service they develop will likely be released years after Tesla’s competing service, and whenever they arrive, the Detroit Three’s robotaxies likely won’t be capable of widespread, general-purpose usage. As GM’s Cruise mishaps demonstrate, the Detroit Three’s robotaxi services could indeed result in dangerous accidents, huge lawsuits, and more legal costs and bad publicity than the revenue from rides can reasonably justify.

The importance of autonomy in the EV transition cannot be overstated. Autonomy and EVs will go together like peanut butter and jelly, fish and chips, Batman and Robin, etc. That is to say, the technologies needed to develop autonomous software and the technologies needed to develop EVs are inevitably going to combine to form robotaxies. If the Detroit Three want to preserve their own autonomy in the robotaxi space, they will be required to create not just compelling EVs that consumers want, but general-purpose robotaxies that people trust.

Failure to create sufficiently competent autonomous driving software will imperil their ability to create robotaxies without needing to pay to license the software of others. Should this occur, the Detroit Three would cede a valuable income stream and control of their autonomy destiny to other players and would be boxed out of a lucrative new market in the transportation industry.

The UAW Impact and Labor Costs

One cannot mention the Detroit Three without discussing the impact of the United Auto Workers. The union, known as the UAW, conducted very effective strikes on the automakers in September and October of 2023, extracting significant concessions for workers. Concessions aside, one estimate suggests that the total impact of the strikes alone exceeded $10 billion, with the Detroit Three’s direct losses totaling over $4 billion and losses to their suppliers, dealers, customers, and support networks totaling over $5 billion. Additionally, Ford’s CFO reported that their UAW deal could result in an added $850-900 cost to car prices over the life of the UAW contract, impacting consumers down the line; since the UAW contracts were about the same, this is likely the case for all of the Detroit Three.

This increase in car price assumes the manufacturers pass the added labor costs on to consumers in the first place, and while this is a reasonable assumption, there are reasons this may not occur. For example, to remain competitive during the EV transition, especially while demand for their EVs is flagging, the Detroit Three might just eat the new labor costs and try to attract consumers with lower-than-expected prices, hopefully with dealers’ cooperation. This strategy would entail sacrificing some profitability for the automakers, and possibly the dealers too, but it might be worth it to help prop up demand during a possible upcoming recessionary macro environment.

Either way, with the new UAW contract lasting until April 2028, added labor costs of ~$875 per vehicle, Detroit Three US sales in 2022 of 1,864,464 + 2,273,942 + 1,861,000 vehicles (per Ford, GM, and Stellantis’ earnings reports), and the assumption that sales volumes for the Detroit Three remain stable from 2022 to 2028, this results in the Detroit Three’s customers, or the Detroit Three and their dealers, paying an estimated $5.2 billion extra per year over the next 4-5 years, for a total of $21-26 billion extra in labor costs by the UAW deal’s expiration.

Due to these added costs imposed over the next few years by the UAW on either the Detroit Three or their customers, transitioning to EVs will be even more difficult for the automakers. They will either need to eat the labor costs and eat into profits faster while ramping EV production, an already expensive process, or pass the costs onto customers and risk lowering demand for their vehicles during a possibly inflationary period – a very unenviable position for the Detroit Three.

On the other hand, Tesla is facing a completely different set of much more beneficial circumstances. Tesla already has industry-leading EV profitability and may be the only carmaker selling EVs for a profit as of Q3’23. On top of this, Tesla is pursuing greater automation of its manufacturing operations by eventually deploying its humanoid robot to factory floors, which would further lower its labor costs if successful. In addition, Tesla’s lack of a unionized workforce means it will not face any forced labor cost increases for the foreseeable future, and Tesla’s lack of an ICE car business to transition away from means it has no expenses necessitated by a pivot to EV production.

With no union issues that would cause a sharp rise in Tesla’s labor costs and an upcoming product that could actually reduce labor costs, Tesla’s financial journey during the EV transition will be a cakewalk, unlike the Detroit Three’s.

The Financials

Speaking of financial journeys, I will now sum up all these firms’ financial information over the past decade.

Ford’s revenues have hovered in the $130-150 billion range in the past decade, dipping significantly in 2020 but rebounding afterward. Ford’s gross profit has generally remained between $12 billion and $18 billion, with a downward trend visible from 2015 to 2020 and a rebound thereafter. Ford’s net income has fluctuated wildly over the years but has generally ranged from $1 billion to $10 billion. Notably, net income dipped negative or near negative in 2019, 2020, and 2022.

For GM, revenues have generally stayed around $130-155 billion over the past decade, with standout years 2019-2021 seeing revenue between $100-120 billion. Gross profit hovered at $15-18 billion for much of the decade; however, 2018-2020 saw a gross profit of around $14 billion per year, and 2022 and 2023 each see GM profiting by over $20 billion. GM’s net income is inconsistent like Ford’s, but hovered around $4-10 billion over the decade, with 2017 anomalously bringing in only $300 million.

For Stellantis, the financials look a bit different – that is, smaller than the prior two Detroit Three peers, but showing great improvement since the Covid-19 pandemic struck. Before 2020, revenues were in the $50-70 billion range, with $80 billion on a good year; in 2021 and after, revenues have increased, spiking to over $150 billion per year, and rising to reach over $200 billion by end of 2023. Gross profit was between $10 billion and $16 billion before Covid; after Covid, profit has risen to $30-40 billion per year. Stellantis’ net income was very negative in 2013 and 2014, but besides those years, it hovered around $1-3 billion pre-Covid; post-Covid, net income has been $15-20 billion.

Lastly, for Tesla, revenues and net income rose exponentially for most of the past 15 or so years. From 2008-2017, Tesla’s revenue rocketed from $15 million to nearly $12 billion, while over a similar period, Tesla’s net losses rose from $37 million to nearly $650 million. Ultimately, the lossmaking trend broke, and Tesla began posting net profits around 2020. As for its post-Covid performance, I summed it up well in my Tesla article:

“Today … [Tesla’s] lossmaking has completely reversed, allowing the company to gain $22 billion in cash at time of writing, with only $5 billion of debt that the company can pay off at any time. Tesla’s net income has risen since mid-2021, remaining resilient in the $2.5-3.5 billion per quarter range in the face of the economic fallout from one of the most aggressive rate hiking cycles in American history by the U.S. Federal Reserve Bank. Meanwhile, revenues for the company have continued to rise, with quarterly revenue doubling from nearly $12 billion in Q2’21 to over $23 billion in Q1’23.

Tesla’s financial position has never been better, and it stands as proof that the company has left the growing pains of its startup era behind.”

On the Detroit Three’s Debt

I previously wrote up an article on Volkswagen (OTCPK:VWAGY) (OTCPK:VLKAF) in which I rather clumsily dismissed its debt pile as an inherent negative, not realizing this was debt related to financing divisions within the company; similar to banking debts, this debt is usually covered and/or collateralized in one way or another. This debt dynamic for certain large automakers is laid out simply and in detail in these very enlightening comments.

However, I anticipate that more deleterious debt, e.g. debt incurred by automakers as a cost to support their transition to EVs, will soon plague automakers’ balance sheets over this decade, and will worsen the financial picture for these firms as the EV transition intensifies. Additionally, regarding their benign or beneficial debt from financing, my thoughts on it are also pessimistic, and are encompassed in my reply excerpt in the VW article comments:

Even if the debt is balanced by financing sources, … I think even those financing sources, like dealership revenue and leasing asset revenue, may see some unexpected declines if the EV transition is as fast as I anticipate.

In short, I think the debt picture for the Detroit Three is set to worsen significantly during the EV transition, financing divisions or not, whereas Tesla has only a small amount of debt of any kind to worry about.

Valuation

The Detroit Three

The Detroit Three’s stock shares are all trading at deep discounts to the overall consumer discretionary sector, with valuation ratios generally 20-70% lower than the sector’s ratios. Some of this discount is quite likely due to investors’ concerns regarding recent bad publicity and increased labor costs stemming from the UAW strike.

However, I suspect some of it is also explained by shrewd investors, and perhaps much of the market, correctly pricing in a less-than-stellar transition to EVs by the Detroit Three. Especially after reducing EV commitments, showing ambivalence toward making a product consumers want, I would say the discount is justified. Due to the Detroit Three’s backtracking on BEVs, issues developing autonomy, and several other matters holding these automakers back, it’s no wonder the market is unwilling to give these companies’ shares a premium. Accordingly, I consider the Detroit Three’s discounted shares a value trap.

Tesla

Regarding Tesla’s shares, since little has materially changed on the valuation front, I will quote my thoughts on its valuation from my July article:

I acknowledge that all valuation metrics for the stock look awfully inflated, … but let me cut to the chase – I think TSLA is actually incredibly undervalued[, and that] TSLA’s ostensible overvaluation compared to its so-called sector peers is misleading.

First, if ever it was appropriate to analyze Tesla and its stock as part of the consumer discretionary sector, it is not appropriate now. Tesla is a technology company, and is best analyzed and compared as such, including analysis regarding its peers, sector, and valuation.

Second, Tesla’s current maturing business lines, namely EVs and energy generation and storage, are almost certain to outperform Wall Street’s expectations as they grow and contribute significantly more to revenues and profits. Observant investors’ eagerness to pile into TSLA before these predictably large revenues and profits lower valuation metrics to more digestible levels is quite reasonable, considering the market’s tendency to look at least 1-3 years ahead regarding a company’s prospects when valuing it. The market assigning a premium valuation to Tesla in the form of a forward P/E ratio of 77 at time of writing therefore makes sense to me.

Third, even the current premium assigned to TSLA is miniscule compared to the company’s likely future performance [through the end of the decade], which I think the market isn’t pricing in yet.

While the specific ratios for both TSLA and the consumer discretionary sector have changed since the article, Tesla’s ostensible overvaluation compared to sector still remains the same, as does my opinion that TSLA is deceptively overvalued. Because of this,

I think even value investors should consider this name, contrary to conventional wisdom: TSLA is actually in deep value territory…

The Competition is Coming – The Detroit Three’s Market Share

For years, financial analysts predicted that the young EV startup would eventually be swept away by the well-established Detroit Three, because once they decide to focus on producing EVs in earnest, Tesla would be helpless against the barrage of high-quality EVs mass-produced by these legacy automakers. The common refrain to summarize this argument was that “the competition is coming.”

In case anyone has forgotten, Tesla already leads the Detroit Three in brand loyalty, safety (in the US and Europe), EV profitability, and EV production volumes. If Tesla manages to beat the Detroit Three in total production volumes, the Detroit Three will find it very difficult to compete against the pure-play EV maker, as Tesla will have no trouble reliably satisfying customer demand and earning repeat customers for its vehicles.

In case anyone has also forgotten, Tesla has set a goal of an average growth rate of 50% in production increases in BEVs per year, culminating in 20 million BEVs produced per year by 2030. Considering their last successful production ramp from a few thousand vehicles to 500 thousand vehicles per year between 2012 and 2020, another ramp from about 2 million vehicles in 2023 to 20 million in 2030 seems doable. As Teslas begin to take up space in the auto market, and as EVs become the dominant vehicle type on roads, the Detroit Three may find themselves sidelined in the auto market altogether, since they may be selling vehicles at lower volumes, for lower profit, and to a less loyal customer base compared to Tesla.

Tesla would certainly have no problem stealing the Detroit Three’s market share in response – its 20 million vehicles per year goal for global 2030 production is more than three times the Detroit Three’s annual US sales of less than 6 million vehicles in 2022. To put this into perspective, since the Detroit Three are unlikely to see sales increases considering their struggles, by 2030 Tesla could split its BEV sales 3 ways for 3 continents (US, Europe, and Asia), at 6 million EVs each, sell the remaining 2 million across the other continents, and still manage to absorb all of the Detroit Three’s US sales – not just their EV sales, but all of their sales. In doing this, Tesla would effectively replace the legacy automakers at home while establishing itself as a global automaker on par with Toyota, the current leader in automobile delivery volume. That is the magnitude of Tesla’s challenge to the Detroit Three.

As we near the middle of the 2020s decade, it is evident that legacy automakers everywhere, including the Detroit Three, are now earnestly producing EVs, yet they are struggling to ramp up their EV volumes and prop up demand for their EV offerings despite price cuts – not to mention their difficulties in keeping up profits and minimizing expenses while transitioning away from ICE sales. Meanwhile, Tesla is increasing its vehicle sales and production exponentially at substantial volumes while pulling in reliable profit and further lowering expenses, all while selling about as many vehicles as it produces quarter to quarter, indicating virtually no true demand problem that a price cut or two can’t fix.

Ironically, the competition is coming, indeed – the competition being Tesla, coming for the Detroit Three’s market share.

How Dealerships Will Deal with This

Currently, by law, the Detroit Three must sell their vehicles in the US to car dealerships, who then sell to individual consumers at a profit; however, Tesla and other EV startups are actively resisting this dealership model. Because of this, dealerships will have to compete with direct sales from manufacturers like Tesla, reducing dealerships’ sales and revenues. If, while EVs take off, the Detroit Three produces fewer vehicles in total, or fewer in-demand vehicles, then car dealerships will lose out on more sales because of the reduced sellable inventory available from the Detroit Three.

Of course, the vast majority of Americans have hated dealing with dealerships for years, so any excuse to avoid walking into their showrooms to buy a car will be welcomed. This will worsen dealers’ prospects further as people forgo dealerships to buy EVs online from manufacturers. Dealers who also sell cars online, either exclusively online like Carvana (CVNA), or to complement in-person sales like CarMax (KMX), Penske (PAG), and AutoNation (AN) do, will still feel some pain, as the inability to use in-person sales tactics on customers will reduce their ability to maximize selling prices of vehicles and earn more revenues. In any case, all dealers’ inevitable tendency to inflate car prices may become intolerable enough to drive consumers and manufacturers to demand changes to existing regulatory standards, cut some red tape, and seek each other out to engage in direct car sales, cutting dealerships out of the process entirely over time.

Even in an ideal situation in which EVs were ultimately sold at the same volumes on dealership lots as ICE cars are now, dealers would still lose significant profits. Per the Bureau of Labor Statistics, car dealers make 43% of their profits from repairs – almost three times the percentage of profit generated from new car sales (16%). Since EVs have far fewer moving parts that could fall into disrepair, EVs will need fewer repairs in general, endangering almost half the profit of car dealerships.

Considering their reduced profits from EVs, along with other added hassles involved in dealing with this new type of vehicle, it makes sense that car dealerships are reluctant to help any automakers, including the Detroit Three, to sell EVs to customers. It also makes sense that dealers have less trust in Ford due to declines in profitability from EV sales, and more trust in Toyota (TM) (OTCPK:TOYOF). Ford has been more aggressively pushing dealers to sell these less dealer-friendly electric vehicles, while Toyota is taking a decidedly less aggressive posture on the EV transition.

While dealerships have more faith in Toyota than Ford due to Toyota’s slower pace of EV adoption (and lack of union troubles), dealerships’ faith is likely misplaced. Keith Williams detailed the main thesis in his well-done article on Toyota, but in essence, while BEVs are clearly the preferred choice of EV buyers, Toyota is choosing to focus on hybrids and hydrogen vehicles instead. Since Toyota is refusing to give customers what they want, those customers will eventually turn away from Toyota, and buy from Tesla and others selling BEVs en masse instead. This development will further worsen the prospects for car dealerships since Toyota inventory will begin to pile up on their lots as well. As the Detroit Three appear to be changing tack to align more with Toyota’s hybrid strategy, dealers’ woes are set to multiply over time as customers reject the hybrid push.

In all, dealerships are facing dark times ahead as the EV transition continues. The Detroit Three and other large automakers will be forced to phase out their more profitable combustion vehicle inventory in exchange for less profitable BEV stock. At the same time, the dealership model is unravelling as EV manufacturers refuse to engage with it, forcing dealerships to compete with direct sales of vehicles to customers while handicapped by the negative public perception of car dealers and dealerships.

2024 – Bearish for Detroit Three, Bullish for Tesla

As you can see, there are many reasons why going long Tesla and short any of the Detroit Three is very promising in the long term. Regarding why this sort of automaker “pair-trade” is a solid bet within just the next year, I would like to point to some upcoming catalysts to illustrate the upside and downside for each side of the trade.

Tesla’s Bullish Catalysts – My Top 2024 Pick

Giga Berlin

While 2024 is still too early to expect a material update on the Tesla humanoid robot (a major catalyst when such an update does come), we do know that expansion on Tesla’s Berlin Gigafactory will begin around early 2024, indicating the approval of the required permits by the local government.

Of the area of the plot of land assigned to Tesla for car manufacturing, only a quarter is mostly built at this time. That quarter plot has a production capacity of 500 thousand vehicles per year. Officially, the upcoming expansion is meant to double its production capacity and boost the factory to 1 million vehicles per year. However, it is possible that production capacity from Giga Berlin could be more than twice as large as officially estimated, for the following reasons: Tesla’s decision to make Giga Berlin a site for its 25,000 euro vehicle; the second phase of expansion being at least two quarter plots in size (see the yellow region); and whispers that Tesla’s nearly completed “unboxed” manufacturing process and other innovations could double the number of cars produced on a quarter plot of the Berlin land.

If this all ends up being true, then the production capacity at Giga Berlin would rise from 500 thousand vehicles per year to not 1 million, but 2.5 million vehicles per year from the factory. Either would represent a significant increase to Tesla’s delivery numbers, but the latter possibility would be massive. With Tesla’s current production capacity being around 2.3 million vehicles per year, a 0.5 million capacity increase would result in a +20% increase in possible revenues and profits from car sales; a 2 million vehicle increase would nearly double Tesla’s production capacity, and double the company’s financial windfall. The prospect of such an increase would be a major catalyst for the stock once news hits that the Berlin expansion is complete, and considering how speedy Tesla tends to be when erecting factory space after getting administrative approvals, the expansion could feasibly be complete by the end of 2024.

Autonomous Driving Software Completion

Elon Musk, Tesla’s CEO, has recently announced that the company may have reached a major breakthrough with its autonomous driving software, and it may be complete by the end of 2023. While Musk has cried wolf before, this time may be different. The software has been fundamentally retooled: with a shift to primarily rely on cameras only, and recoding of the software to be even more AI-dependent and autonomous than it ever was before, Tesla’s software uses much less human code and much more machine learning to accomplish its goal of driving safely. This is in addition to Tesla’s new supercomputer to process data and train the software more quickly. Ultimately, signs are pointing to the possible completion of Tesla’s autonomy software by early 2024 at best, and late 2024 at worst. As a reminder, considering Tesla’s superior approach to autonomy, the software will likely debut as Level 3-4, near human-level driving capability.

If true, then as I said in July, “First comes autonomy, then comes robotaxies.” Soon after Tesla’s autonomy software is completed, the subsequent activation of a robotaxi network would mean a large payday for Tesla. I won’t get into the specifics here, but based on calculations made in my Tesla article, I concluded that aside from the Tesla robot, robotaxies will make up the biggest share of Tesla’s earnings in the long term, robotaxies made possible only by the completion of this autonomous software.

If the stock market realizes how massive the long-term opportunity is for Tesla on the back of this software (and Goldman Sachs (GS) already sees an opportunity here), then the completion of high-level autonomous software would be a massive catalyst possibly propelling TSLA stock as high as it rose when Tesla first turned profitable in 2020, a similarly monumental turning point for the company. For reference, TSLA rocketed over 600% in price from the first trading day to the last trading day of 2020 – such could be the degree of the stock impact from the completion of Tesla’s autonomy software.

The Spoils of the Price War

By trading a bit of profit to hold onto its huge EV market share, Tesla won the price war it started early this year against the Detroit Three and rivals in Europe and Asia, forcing them all to cut their prices (and their revenues) on EVs in response. As a result, Tesla will enter 2024 with a larger share of loyal customers, customers who might opt to subscribe or pay outright for its new autonomous software package, sing the company’s praises online and to friends, and increase the company’s flywheel effect in customer acquisition. The last point may require a bit of explanation.

Some might think the excitement for Tesla vehicles only exists among a few hardcore, dogmatic Tesla fans, but the size of Tesla’s customer base and the company’s brand loyalty numbers suggest it is not so simple. It seems that although many car buyers bought Teslas this year due initially to the cheap 2023 prices, they then began to appreciate the vehicles on a more fundamental level, including, among other things, Teslas’ features and performance. From there, these new Tesla owners would convince more people to try Tesla’s cars, and those new people might also buy the cars just for the low sticker price, only to then fall for the cars’ features, and then tell their friends to buy Teslas, and so on.

Perhaps before the price war, Tesla vehicles were initially bought and recommended in this virtuous cycle for their features, green appeal, and value for money. Whatever the case was before, Tesla’s price war made sure that this exponential customer acquisition rate was even greater in 2023, which will pay dividends in 2024 in the form of heightened car sales. I think this virtuous cycle will be an underrated catalyst that quickens EV adoption and simultaneously increases Tesla sales next year.

All these positive developments are very likely to move the stock much higher next year – possibly several multiples above its current share price. For these reasons, I make Tesla my top pick for 2024.

The Detroit Three’s Bearish Catalysts – My Top 2024 Short Pick

The Detroit Three’s impending 2024 pivot away from BEV development and toward hybrids (a technology that only a minority of EV buyers seem to want) will at best create the illusion of EV commitment among the legacy automakers if their hybrid sales increase. In reality, though, this shift to hybrids distracts the Detroit Three from focusing on their critical BEV ramp. That would imply a diversion of funds away from increasing BEV production capacity, which will put the Detroit Three behind BEV makers like Tesla in the long term and contribute to long-term BEV market share erosion in the long term as well as next year.

The Detroit Three’s UAW contract’s first full year will also begin in 2024, meaning an additional $5.2 billion charge to either the Detroit Three’s customers (which would blunt consumer demand for their products) or to the Detroit Three’s balance sheets; either way, a blow to the Detroit Three from this multi-billion dollar charge is imminent. Additionally, car dealerships’ resistance to selling the Detroit Three’s EVs will hamper the automakers’ EV sales and reduce their ability to compete in the EV market, which will certainly be a drag on the Detroit Three next year.

GM’s EV Transition Woes

Any of the Detroit Three would be a good choice for a top short pick for 2024, but if I’m choosing only one, my pick is GM. Stellantis is working toward building up its EV stock, while Ford and GM have both announced a slowdown in their EV production. However, while Ford is still moving in the right direction in spite of its EV slowdown by retiring ICE cars in anticipation of future EV sales, GM has just discontinued one of its top-selling popular BEVs, the Chevy Bolt, voluntarily slashing its EV sales at a critical moment when it should be fighting to gain as much EV market share as it can. This is certainly a long-term problem, but the ramifications will be felt as soon as 2024 and will act as a negative catalyst.

Remember the virtuous cycle of Tesla vehicles being purchased by consumers on a budget, then those buyers liking the features, then recommending Teslas to friends, and so on? GM is taking steps to weaken that cycle regarding its own EVs, and possibly run it in reverse. GM’s discontinuation of popular BEVs cuts down the number of people who could recommend its EVs to others, not to mention causing an immediate decline in GM’s EV sales in 2024 due to the reduced all-electric models available. With fewer customers recommending GM EVs, GM must work harder to get EV shoppers interested in its EV stock due to the reduced word of mouth from GM EV owners, which could result in tepid/disappointing EV sales from GM in 2024. At the same time, Tesla will be offering desirable BEVs that stand to absorb the BEV demand that GM relinquished by discontinuing its Bolt BEV. This means a likely reduction in GM’s EV sales market share in 2024 due to Tesla supplying GM’s would-be BEV customers, adding these customers to Tesla’s virtuous cycle of customer acquisition.

Also, GM has elected not to greenwash its operations and chase quick profits by pivoting to hybrids, which, while fairly prudent in the long term, will hurt it more next year by constraining its EV sales numbers, contributing to its EV production target misses, and forgoing the possible ESG goodwill from those increased EV numbers.

In sum, these dynamics regarding GM’s EV sales and market share in 2024 stand to drive down investor confidence in its EV transition next year, along with GM’s stock.

GM’s Autonomy Woes

GM has also seen its autonomous software division utterly implode under the weight of technical failures and a lack of candor with regulatory authorities, thus demonstrating autonomy ineptitude while fueling a scandal that wipes out much of GM’s reputation as an indirect player leading in autonomy development. Considering that Cruise’s operations have been forcibly shut down by the California DMV, the subsidiary’s material omissions to the regulator, the Cruise CEO’s departure, and more, the fallout of the Cruise crisis will hang over GM in particular, and other autonomy developers in general, for much of the next year.

These issues with GM, on both EVs and autonomy, will be on the minds of consumers and investors in 2024 and are likely to disproportionately depress their faith in GM’s ability to execute, which will likely manifest in lower sales and a lower stock price next year compared to its Detroit Three peers.

Considering all of GM’s specific issues, combined with the UAW costs and dealer concerns it shares with its Detroit peers, I think GM will be the worst positioned among the Detroit Three next year and is thus my top short pick for 2024.

A Short Disclaimer on Shorting GM

I typically focus on the long side of investments, so any short pick of mine (and shorting in general) will naturally be more speculative and risky. The possible downside of shorting a stock or company is infinite; dividends, fees, and other unique costs must be paid by shorts; short squeezes could unexpectedly batter short positions; and more. These added risks compared to long investing should make prospective short investors even more cautious. While I personally have faith in GM as my short pick, and I do think short investors could do well with it in 2024, I cannot overstate the importance of investors doing the maximum due diligence before opening a short position, on GM or any name.

Risks to Thesis

While highly unlikely in my opinion given current trends and near-term catalysts, it is possible that this sort of top pick “pair trade” does not pan out as I predict.

For the Detroit Three upside risk, hybrids could break out as the next big car trend next year, making the Detroit Three’s hybrid pivot the right move to make right now for a solid 2024 performance. For GM upside risk, 2024 could be a year in which a return to the mean for EV prices (i.e. BEV price increases) is possible, which could decrease BEV appeal to customers. This ebb in demand for EVs/BEVs would give GM time to catch up on EV production without having to resort to hybrids.

Meanwhile, for Tesla, the downside risks are as follows:

Tesla may misunderstand the markets for its products, and could therefore fail to properly market its products to generate expected sales. Maybe demand is perfectly targeted but weaker than expected, or completely nonexistent. Maybe Tesla cannot ramp up supply, leading to anemic sales despite high demand. Perhaps Tesla’s competition in most or all of these areas finally introduces better or cheaper substitutes that customers want as much as, or more than, Tesla’s products. Or, maybe, just maybe, all of Tesla’s products eventually flop for all of these reasons and more.

Conclusion

Due to macroeconomic conditions, a lack of foresight, subpar planning in both EV production and autonomous software development, and other factors, the Detroit Three are likely to decline in market share and market cap in the long term. I expect them to be overtaken by mass-market EV makers like Tesla, which has well-developed autonomous driving software on the cusp of completion, no union issues or inflated labor costs, a solid balance sheet, a firm commitment to mass BEV production, compelling EVs for sale, and several other benefits.

Since Tesla’s advantages position it to take market share and revenues from the lagging Detroit Three over the next year, the next decade, and beyond, and position TSLA stock to massively outperform the Detroit Three’s stocks, I believe that for long-term automotive investors, the shares of Ford, GM, and Stellantis, should be abandoned. Since GM is particularly poorly positioned among the Detroit Three for the next year, I’m making it my top short pick of 2024.

On the other hand, upcoming catalysts for Tesla’s business and the ramifications for its long-term prospects make TSLA stock a likely standout as the best stock of the year, and it is consequently my top pick for 2024. Accordingly, I would suggest that automotive investors abandon the Detroit Three pivot to TSLA stock, and I reiterate my strong buy rating on TSLA shares for 2024 and beyond.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2024 Long/Short competition, which runs through December 31. With cash prizes, this competition — open to all contributors — is one you don’t want to miss. If you are interested in becoming a contributor and taking part in the competition, click here to find out more and submit your article today!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.