Summary:

- GameStop’s pre-earnings period sees a 20% increase in stock price, with further potential volatility in the coming days.

- Options volumes for GME stock are high, with many traders betting on the stock reaching $20 or higher.

- GameStop faces fundamental headwinds, including poor margins and declining sales, making it a structurally unprofitable company.

Michael M. Santiago

Meme stock legend GameStop (NYSE:GME) is set to report earnings next week, and traders kicked off the pre-earnings period in style yesterday with a 20% run higher. GameStop is no stranger to volatility, and the next few trading days could be absolutely wild. But as we look forward to the earnings report next Wednesday, there are a few things I’m watching.

The last time I covered GameStop I placed a hold on it, with a few qualifiers. I’m in a similar but slightly less bullish spot here, as the chart is looking neutral to me, the valuation is improving, but the company continues to face immense fundamental headwinds. Let’s dig in.

Options craze in full swing

GameStop, of course, was the genesis of the meme stock craze of 2021 that was characterized by high levels of short interest, and insane volumes of options trades. Those days are gone, but some of the characteristics are still present, even if the magnitudes are much lower.

Seeking Alpha

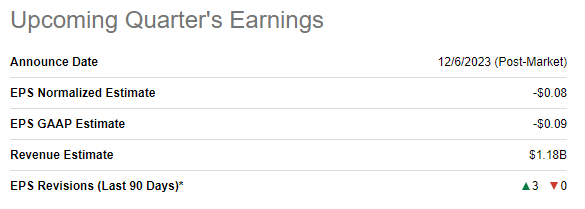

Remember that the October quarter is generally very weak seasonally, ahead of the much stronger January quarter. The company consistently posts losses in the October quarter, and that’s what’s expected again. For what it’s worth, the last three EPS revisions have been higher, so optimism is building for GameStop. It’s been some time since the company was consistently profitable, so the closer to breakeven it can get, the more favorably it will be viewed by traders.

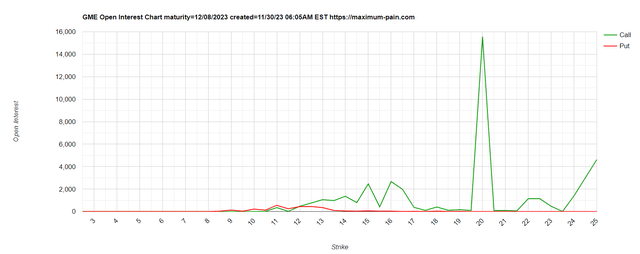

Now, options volumes for the 12/8/2023 expiration – which is two days after the earnings report – are huge. The chart below shows open interest for both puts and calls, and as we can see, there are basically no puts, but a bunch of calls.

There are about 2.5k open calls at the 15 strike, just under 3k at 16, but 15k at 20, as well as just under 5k at 25. Keep in mind the stock closed yesterday – after a 20% run – at $16.25. That means the few thousand calls that were bought at the 16 strike and under are now in the money. However, there are still more than 20k calls that were bought at higher strikes that are way out of the money, and they expire next Friday. In other words, these will expire worthless unless GameStop puts in another 25%+ move off of earnings.

These kinds of options volumes so far out of the money are reminiscent of 2021, as it appears retail traders are taking moon shots and just hoping for the best. I obviously don’t think GameStop will close over $20 next week, but some options traders clearly do, and are betting on it.

Short interest is about 23%, so it’s high. It’s nothing like what it was before the stock went on its legendary run in 2021, but under normal circumstances, 23% short interest is a lot. Let’s take a look at yesterday’s rally with the technical picture to get a sense of what we can reasonably expect based upon this.

Is this time different?

GameStop hit $27 earlier this year, but since then spent months doing nothing but falling. The stock eventually bottomed just under $12, putting in a nice double bottom from which it has rallied.

We can see the positive divergence that was put in over the October/November timeframe, where momentum improved while price fell. That often portends a trend change, and in this case, it did once again.

The rally yesterday made a lot of progress from a technical perspective, with the stock now well ahead of the major moving averages. However, I cannot help but think this rally looks similar to the March short squeeze rally that saw the stock explode higher, only to put in a sizable decline in the days to follow.

Volume was huge yesterday at about 60 million shares, similar to the March rally. A 20% move on 60M shares reeks of a short squeeze move, and it’s important to note that anyone that shorted anytime in October or November is now underwater. For the short squeeze to truly take off, it would need to clear roughly $20, in my view, which would put all the August/September shorts underwater as well. As it turns out, that’s exactly what options traders are betting on next week, but I think the battle for that is an uphill one for the bulls. I’ll also note that, by definition, short squeezes don’t last. They’re very quick, violent rallies that fade almost immediately. For that reason, even if GameStop does clear $20 next week, I cannot recommend anyone put their capital at risk as I doubt it would be able to hold that level for long.

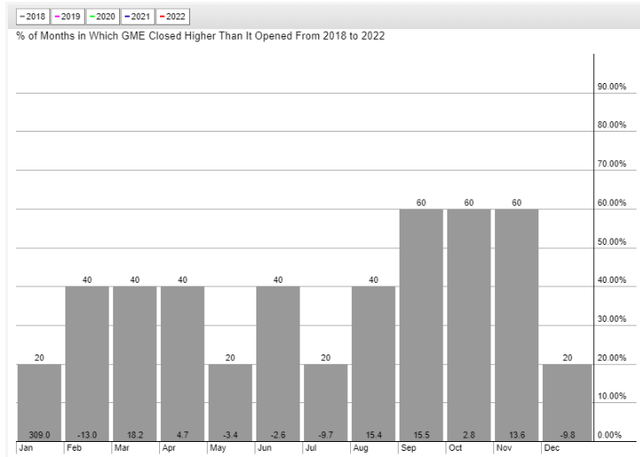

One headwind we have for GameStop is seasonality, as December is a terrible month for the stock.

The stock has averaged a 9.8% decline in December over the past five years, having put in a positive month just once in that time frame. January is historically not a good month either, but we can see a comical value of 309% average gains on this chart. That’s obviously due to January 2021’s short squeeze, but if we exclude that clear outlier, January is generally negative for GameStop as well. Seasonality is not a guarantee, but there’s a strong pattern here of the stock struggling in these two months.

Improving fundamentals, but GameStop has much to do

I’ve said for some time that I struggle with the bull case for GameStop because it’s a business that had its core revenue stream become obsolete several years ago. GameStop used to have its bread and butter in reselling used games, but with the rise of the ability for gamers to stream rather than purchase physical games, that pretty much went away. Management has done an admirable job of attempting to reinvent the company, but I simply don’t see a long-term bull case here.

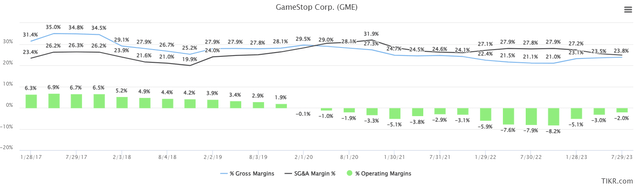

One of the biggest reasons is that GameStop is structurally impaired when it comes to margins. By this I mean, it has proven incapable of generating sufficient revenue over time to be consistently profitable.

As we can see above, with trailing-twelve-month margins, it has been since 2019 that operating profit has been positive on a 12-month rolling basis. Granted, the past four quarters have been close, but the fact is GameStop hasn’t figured out how to be profitable again. I don’t see any catalysts for that to change anytime soon.

SG&A costs (in black above) remain elevated relative to gross margins (in blue), which means GameStop is structurally unprofitable. There has been progress in recent quarters on this, but the fact is that 24% gross margins are extremely difficult to make profitable for a retailer. In fact, 24% gross margins are absolutely horrendous for a retailer, and unless that changes, my stance on GameStop’s long-term fundamental outlook won’t change. The best it can do right now is incremental changes by cutting costs; that’s not something I want to be involved in.

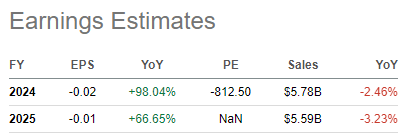

Estimates for this year are for a loss of two cents, and for a loss of a penny next year. Sales, however, are expected to decline 2.5% this year and a further 3.2% next year.

Seeking Alpha

This is the problem I have with GameStop; it has no revenue growth and extremely poor gross margins. That is a recipe for a structurally unprofitable company, and that’s exactly what I see today.

Is GME stock at least cheap?

Given the chronic lack of profits, we are forced to value the stock on a price-to-sales basis. To be fair, the long downtrend in the stock has seen the valuation improve on that measure.

After yesterday’s rally, the stock is at 87% of total revenue. That’s lower than the 103% average for the past year, but well off the floor of 64%. Given margins are improving of late, it seems like the stock is probably about fairly valued here. I’m neutral on the valuation for that reason and notably, I would have been bullish on it yesterday prior to the 20% advance we saw.

If we wrap all this up, I’m moving to sell on GameStop ahead of earnings next week. I see a stock that has short squeeze potential, but for it to continue to run, bulls will have to put in another day like yesterday. That’s possible, but unlikely. In addition, while valuation is okay, it’s much worse than it was yesterday. Structural margin issues persist and I don’t see a catalyst for that changing.

I’m placing a sell on GameStop because the risk of owning it, to me, outweighs the potential reward of a short squeeze. Could it run to $20 or $25 next week? Yep, anything is possible. But to my eye, the risk to the downside outweighs the slim chance it will continue to rally, and for that reason, I cannot recommend anyone risk their capital on what I view as no more than a coin flip for earnings next week.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you liked this idea, sign up for a no-obligation free trial of my Seeking Alpha Marketplace service, Timely Trader! I sift through various asset classes to find the best places for your capital, helping you maximize your returns. Timely Trader seeks to find winners before they become winners, and keep you out of losers. In addition, you get access to our community via chat, direct access to me, real-time price alerts, a model portfolio, and more.