Summary:

- Walt Disney Corporation may have found a turnaround strategy under new management. The new CEO has improved profitability metrics in just a few quarters.

- Streaming segment metrics are just getting better as both subscribers and ARPU are growing.

- With higher margins and streaming profitability expected in 2025, Disney shares could see significant growth in the next two years.

Charley Gallay

The bounce back is here already

The long-suffering Walt Disney Corporation (NYSE:DIS) might have actually found a way to its turnaround that investors have been waiting for years. New management sees improvements all around the company and things may just get better from here.

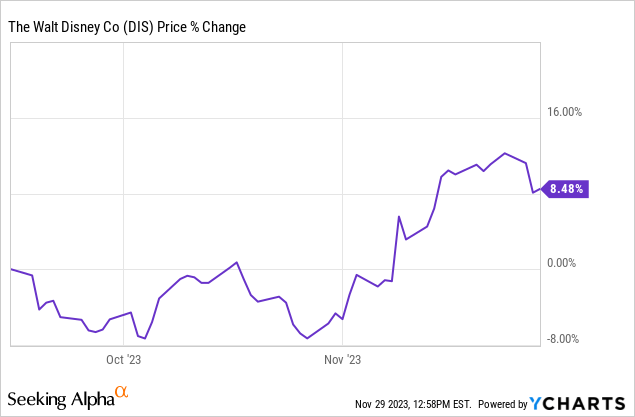

Since the publication of the article two months ago, the shares are up 9% as the FY2023 results confirmed my thesis about the continued reduction in losses across the business and strong positioning in streaming that allows raising prices without losing subscribers.

The organic growth continues at a strong pace across the business. Revenue increased 7% YoY to $21.2 billion and operating margins remained at consistently high levels while cost-cutting massively reduced losses in Q4. At the same time, cash flows have stabilized and are approaching pre-pandemic times. The new old CEO in just a few quarters has done an excellent job in improving profitability metrics. Given Disney’s position in the media entertainment market, higher margins, and streaming profitability in 2025, I believe that shares would be way higher from here in two years.

Taking a closer look at streaming & content

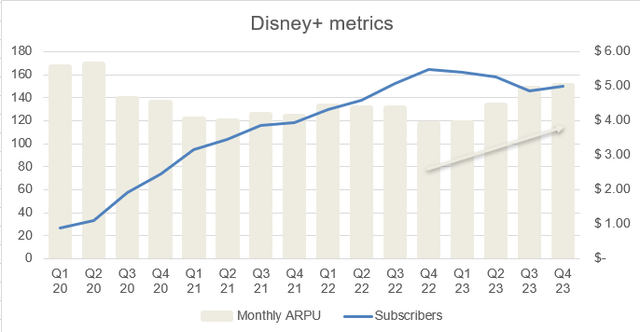

Disney Plus core indicators keep getting better as the company managed to add 7 million users to reach 112 million paid subscribers. Moreover, these subscribers are willing to spend more on the product as the total monthly ARPU (including Hotstar) grew to $5.02. That is the first quarter in a long time that has both a growing user base and revenue by a single viewer.

Source: Author, Disney

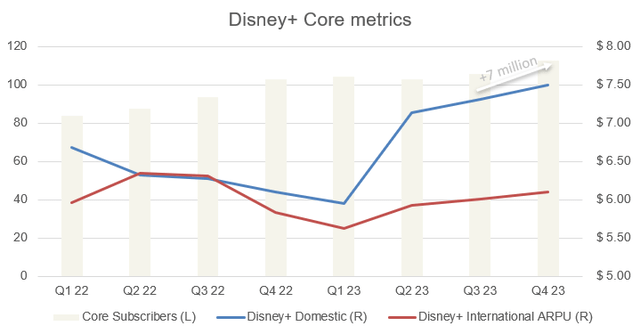

If we exclude Hotstar though, we see an even better picture: all metrics are starting to accelerate. In fact, if it weren’t for outflow in India, overall results would be much better since both core domestic and international subscribers are growing despite the price hikes.

Source: Author, Disney

This momentum is also driven by the introduction of ad-supported plans, which have higher margins. Robert Iger said that “more than 50% of Q4 new US subscribers chose an ad-supported Disney+ product”, which is a positive dynamic.

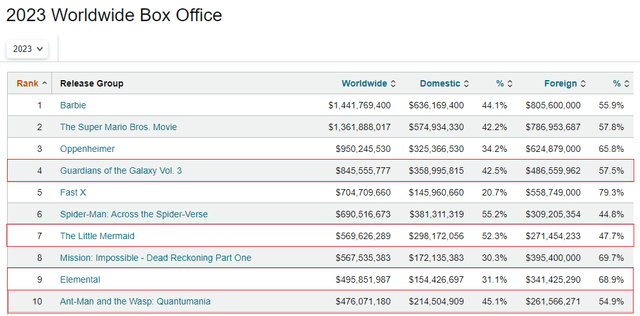

It is worth noting that an increased demand for the company’s products is the result of many big names making it to the streaming. 4 out of 10 highest-grossing movies this year belong to Disney. “Guardians of the Galaxy 3” and Pixar’s “Elemental” are 2023 hits making $2 billion combined at the box office.

Source: Box Office Mojo

However, problems to be faced, are the reputation of brands and, well, the corporation’s too has been sliding down for years now (although overall branding force still remains out of reach for competitors). This can be seen in the user ratings of the latest films. A recent “The Marvels” failure is an indicator of how tired fans are of such conveyor belt production. Iger hinted that they will reduce the number of films made to focus on quality:

And I’ve always felt that quantity can be actually a negative when it comes to quality. And I think that’s exactly what happened. We lost some focus. And so, working with the talented team at the studio, we’re looking to and working to consolidate, meaning, make less, focus more on quality.

And I do believe that is a key to success. Disney has an amazing story-telling portfolio that they are not using to a full capacity.

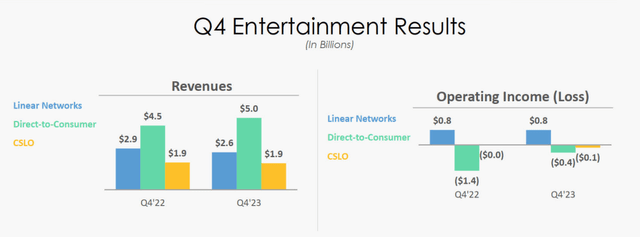

It is important to understand here that Direct-to-Consumer is the only segment that is carrying Entertainment results. And while Linear Networks are losing money due to the unfavorable environment, if the management could fix the content problem, CSLO, which now isn’t fully working as the subsegment is operating at a loss, could become another growth factor. It is already consistently delivering hits for streaming, which is a great example of the synergy of areas within Disney.

Source: Disney

Going forward, I estimate growing total ARPU at an organic pace of ~2-3% QoQ through Q4 2024 given recent revaluations of plans with subscribers standing at 150 million assuming a peak of problems in India and some but not many subscribers will fight the rising prices. We can reflect these numbers to a whole DTC segment, which leaves us with ~9-10% YoY revenue growth. I recommend closely watching Domestic ARPU numbers since users in the US are way more exposed to competition in streaming services.

Parks are stronger than ever

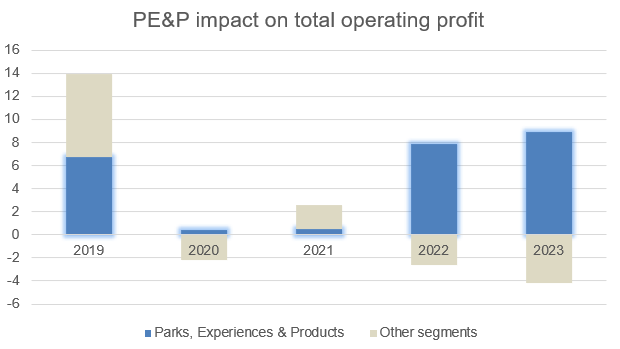

The Experiences (Parks, Experiences & Products) segment is indeed a #1 Disney’s fundamental strength as it fully absorbs the losses generated in other segments. The operating profit was up 13.2% YoY in FY2023 amid higher attendance rates. At the same time, the operating margin still expanded and grew 3 percentage points to 22%.

Source: Disney 10K

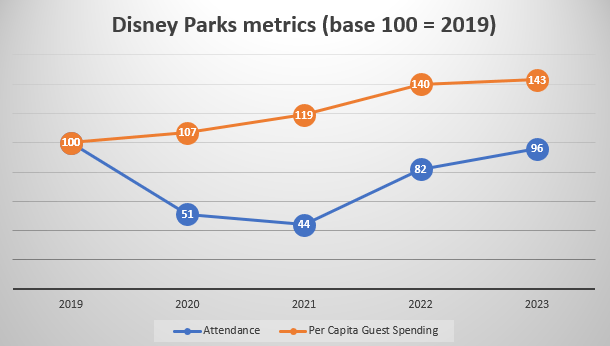

The parks still remain very popular across the world as the occupancy was 17% higher in 2023. The metric is still below pre-COVID levels mainly because there are higher ticket pegging as the company tries to make crowds smaller to increase consumer experience which would result in higher per capita spending.

Source: Disney 10K

This is the result of strong branding and high investments, which totaled $5 billion last fiscal year, which is a significant portion of capital expenditures. That trend is expected to continue in 2024, with an overall CapEx of $6 billion as Disney has multiple projects planned at Disney locations, including the launch of three new cruise ships in 2025-26.

In fact, Experiences is not a segment where current management wants to cut costs and it is a good approach as parks are a cornerstone in this entertainment empire. There are no competitors in the whole world that provide a similar consumer experience as Disney does. The ability for visitors to interact with beloved characters known around the world creates an incredible connection with fans that lasts from childhood to adulthood and management understands that.

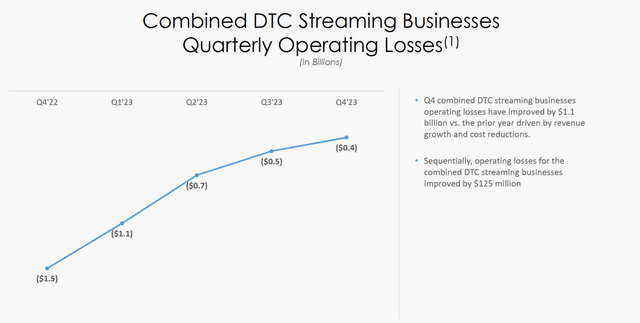

Iger’s magic in numbers

The main achievement of the new management is a large-scale reduction of DTC losses. A $1.1 billion improvement is massive as a bleeding segment is no longer taking operating profit from the company. The remaining $400 million loss is expected to move to zero in Q4 2024.

…This has helped us to improve operating results of our combined streaming businesses by approximately $1.4 billion from fiscal 2022 to fiscal 2023. And we remain confident that we will achieve profitability in Q4 of fiscal 2024.

Source: Disney

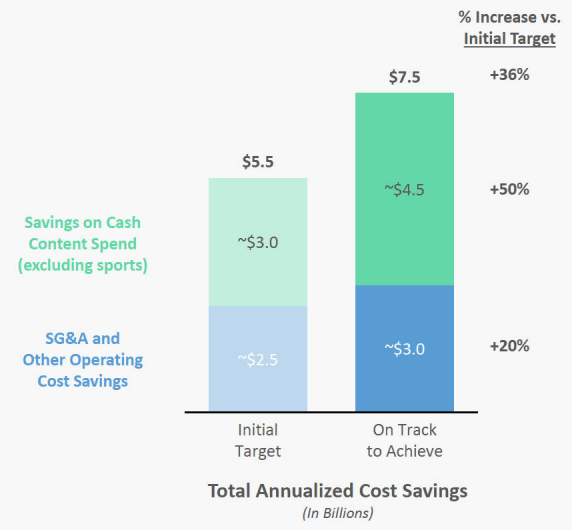

The overall annual cost savings goal was raised by 36% to $7.5 billion due to lower SG&A (thanks to lay-offs) and cost-cutting in content.

Source: Disney

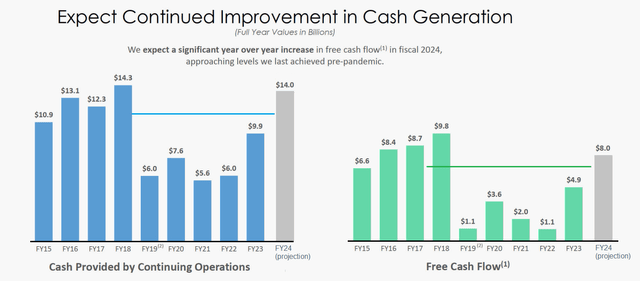

Cash flows are improving and approaching pre-pandemic levels and their 2018 highs. In 2024 the company expects a “significant year-over-year increase in free cash flow” to roughly $8 billion, which would mean that cash from operations will reach $14 billion, which is just $0.3 billion under 2018 levels. If true, in just two years the company will manage to more than double its OCF, which is a huge result.

Source: Author, Disney

Moreover, thanks to increased cash flows, it looks like the company is back to paying dividends, which is the first time since 2020.

Disney is undervalued

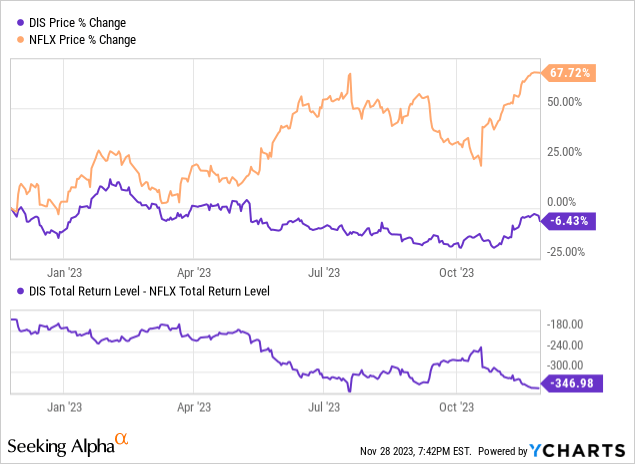

All in all, we can safely say that this year Disney has become way more shareholder-friendly thanks to a massive and clear cost reduction program. However, the market is still not feeling it. The stock is way behind the broader market and its main competitor Netflix (NFLX). The spread between these two is huge and only continues to increase. Comparing the companies with smaller competitors like Paramount (PARA) and Comcast (CMCSA) makes little sense as they have much smaller exposure in a streaming market and don’t have the same economies of scale.

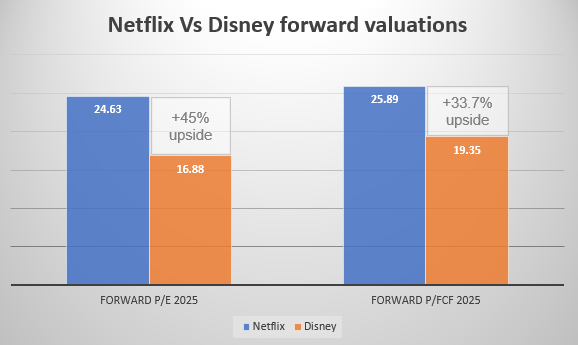

I believe this spread will narrow as Disney’s profitability increases. In the same way, the spread in valuation should shrink; Netflix is estimated at 24.6 forward earnings, which is 45% more than Disney, while forward P/FCF approach suggests 33.7% upside. Thus, I estimate at least a 33% undervaluation in Disney.

Source: Seeking Alpha, Author

#1 Risk for Disney

Things can get worrisome in Disney if the content problems will prevail. It is estimated the company lost $2 billion in the last 15 months as many major projects failed to get the excitement they used to have. These include “Indiana Jones and the Dial of Destiny”, “Strange World”, “Lightyear”, “The Marvels” and “Wish”. The losses in the box office themselves are not critical, since they are offset by the positive effects of streaming and licensing. However, if this trend continues, then it will be possible to declare a crisis of ideas in the company, which will be destructive for the entire synergy that has been built since such storytelling will gradually bore the fans, which will negatively affect the brand. Numerous competitors will be only too happy to intercept the company’s audience.

Conclusions

The company has achieved great results with the new management, which put streaming on the right track, wisely invested in parks, and reduced operating losses. Moving forward, this whole system will begin to work to its full potential, and the operational metrics may definitely surprise investors. The current valuation looks inexpensive given the prospects and stability of future cash flows and earnings. I believe anything below $90 is a fantastic chance to buy a great company at a bargain.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in DIS over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.