Summary:

- Tesla, Inc.’s highly anticipated Cybertruck delivery event was a disappointment, with higher pricing and lower range than expected.

- The Cybertruck’s pricing now puts it in competition with other expensive electric pickup trucks, potentially impacting demand.

- Tesla’s EPS estimates continue to drop, and there is a risk of CEO Elon Musk needing to sell Tesla shares to fund other ventures.

Roman Tiraspolsky

On Thursday afternoon, after several years of hype and multiple delays, Tesla, Inc. (NASDAQ:TSLA) held its highly anticipated Cybertruck delivery event. The electric vehicle (“EV”) maker went with an out-of-the-box futuristic design for its newest product, not sticking with a traditional pickup form factor. While the Cybertruck has been one of the major headlines surrounding Tesla for many months now, the initial handover event was a big disappointment.

Back in 2019, Tesla unveiled the Cybertruck, which at the time was supposed to be the 7th vehicle in the company’s lineup. The next generation Roadster still isn’t here, though, and the Semi is only in pilot production, so the Cybertruck will end up being the 5th product on the vehicle side to truly hit the masses. At that time, the company provided the following slide to show the various trims and specifications for the vehicle, along with potential prices.

Original Cybertruck Specs (Tesla Presentation)

There were many skeptical at the time that Tesla could hit those ranges and price points. Those concerns have only grown over time due to inflationary pressures and questions over battery improvements. Over the past couple of years, there have been rumors suggesting that Tesla received upwards of two million refundable deposits for the Cybertruck, but the company was very tight-lipped about any concrete numbers. The $100 deposit was also much lower than Tesla’s usual deposit amounts, which could have easily allowed many speculators to place multiple reservations in an effort to try to flip an early production model for a profit.

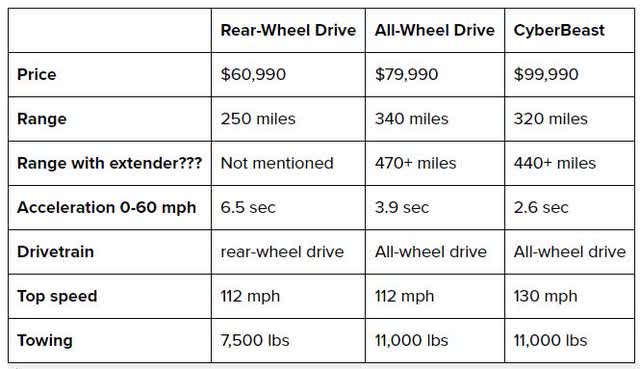

Tesla handed over a few Cybertrucks to customers on Thursday, along with a short presentation given by CEO Elon Musk. As usual, Elon focused on the very flashy items like the doors being bulletproof and the truck’s extreme acceleration. However, the event didn’t include any information on key specs or pricing, which only were revealed on Tesla’s site afterwards. The following graphic shows the new numbers the company released, and only the two more expensive variants are slated to be available in 2024.

New Cybertruck Specs (Electrek via Tesla)

For those curious, Elon Musk later tweeted about the range extender, saying that it is an “optional pack that fits in about 1/3 of the truck bed.” The extender is expected to cost $16,000, and will require a visit to a service center for installation, with production planned to begin late in 2024. Given the size of a battery pack needed to add that kind of range to the truck, it’s likely to reduce the potential payload by at least a few hundred pounds.

With the significant increase in pricing as compared to original plans, the Cybertruck demand picture gets a bit more cloudy. Starting at nearly $80,000 before any incentives, this vehicle now slots in with some of the more expensive versions of Rivian’s (RIVN) electric R1T and the Ford (F) F-150 Lightning. In Tesla terms, the Cybertruck’s price is near that of the luxury Model S and X, which has been averaging well under 20,000 units a quarter lately, and that’s in terms of worldwide sales. Rivian and Ford haven’t exactly been hitting home runs with their EV pickup sales so far.

Elon Musk has suggested ramping Cybertruck production to 250,000 units per year, but obviously that won’t happen right away. The initial production capacity listed in the Q3 shareholder letter was 125,000 units, and that might be a stretch to get to next year if the production ramp hits any major speed bumps. Thursday’s event did not feature any commentary from management on near-term rates of production. In recent months, most street analysts were looking for between 75,000 and 100,000 Cybertrucks to be sold next year.

Going into Thursday, Tesla analysts were calling for the company to show more than $21 billion of revenue growth in 2024. A good portion of that was expected to come from Cybertruck sales, but this new pricing structure may not result in the demand boom many were expecting. We’ve also seen Tesla adding some discounts and incentives to move inventory of the Model 3 and Y around the globe in recent weeks, so it’s not a given that mass market vehicle pricing has bottomed yet. Initial Cybertruck production will also hurt margins until the vehicle can get to significant delivery levels. In the past year, analysts have cut their 2024 non-GAAP EPS estimate for Tesla from $7.14 to $4.01.

I am reiterating my sell rating on shares of Tesla today for a couple of reasons. First, the Cybertruck reveal was a big disappointment, with much higher than expected pricing and range being a lot less than originally projected. Tesla EPS estimates continue to drop, with the current 2024 street average below what the company did in 2022. Tesla shares also finished Thursday about $30 above their 50-day moving average, so I think they could fall to that key technical level as investors digest the Cybertruck disappointment. There’s also a growing risk of Elon Musk needing to sell Tesla shares again to continue funding Twitter / X if it continues to lose advertisers in droves.

I would consider upgrading back to a hold should Tesla show pricing has finally bottomed across the Model 3 and Y, and EPS estimates start heading higher again. Tesla shares currently trade at roughly 60 times expected earnings, a significant premium to pay compared to traditional automakers that trade in the single digits. I also would like to see a little less controversy surrounding Musk and Twitter, because some of his comments and actions have been angering some of the biggest Tesla fans out there.

In the end, Tesla disappointed a bit with its Cybertruck delivery event on Thursday. The company’s newest product was unveiled with much higher pricing than originally thought, along with much lower than expected range. Usually quite bullish Tesla analyst Adam Jonas even issued a sour note regarding the event, and shares dipped a couple of percents in the after-hours session. With a lot of hype built into this revolutionary vehicle over the past few years, this seemed to be another “buy the rumor, sell the news” deal where Elon Musk and company didn’t deliver the goods.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.