Summary:

- Comcast is rated buy, agreeing with the consensus from Seeking Alpha analysts and Wall Street.

- Positive drivers of bullish sentiment are dividend growth and yield, earnings growth over multiple quarters, subscriber growth, and share price decline back to near 200-day average.

- Negatives include moderate recession and debt risk in the current high interest rate environment.

jetcityimage

Company Snapshot

In today’s research note, I cover Comcast (NASDAQ:CMCSA), in the cable and satellite sector. Some relevant facts about this Philadelphia-based company include the fact that it trades on the Nasdaq, calls itself a global media and tech company, delivers broadband /mobile/entertainment across multiple platforms, and is also known for acquiring NBCUniversal in 2011.

Total Rating Score

Comcast – score matrix (author analysis)

Based on the score total in the score matrix I created above, I am rating this stock a buy.

In comparing my rating with the consensus today in Seeking Alpha for this stock, I am agreeing with SA analysts and Wall Street this time, but slightly less bullish than the quant system:

Comcast – consensus (Seeking Alpha)

Rating Methodology

Starting in December 2023, I adopted a simplified and straightforward 8-point approach focusing on just a few core areas such as whether the company is growing both revenue and earnings, whether it presents a strong dividend income opportunity, whether an undervaluation opportunity exists, a share price presenting a value-buying potential, and identifying a key risk of the company as well as its potential impact to an investor.

Top-Line Revenue YoY Growth

I am looking for any positive revenue growth on a YoY basis, and here is what I found:

After the recent Q3 FY2023 reported results that were released on Oct. 26th and the income statement on Seeking Alpha, I can see that they achieved $30.1B in quarterly revenue vs $29.84B in the same quarter a year prior, which is less than 1% YoY revenue growth.

As someone who remembers the cable TV craze of the 1980s and early 90s, when having “cable” was like a status symbol, even if it was just 30 channels or so, today going into 2024 we should ask – Where is the growth potential of a company like Comcast?

In my opinion, it will continue to come from segments like streaming, which the company highlighted as one of its drivers of growth in its Q3 presentation:

Comcast – drivers of growth (Comcast q3 presentation)

I picked out streaming from the bunch because not only do I use various streaming services but also see the business value to both customer and company: recurring subscription-based revenue for the provider and on-demand multi-platform content for the end user, a win-win combo. Long gone are the days when you were surfing through cable channels on the 1989 RCA TV and were fed whatever programming is decided you should watch.

As a potential investor, the recurring revenue stream is certainly a great business model I think. However, also thinking like an investor I like that their business model is diversified beyond just being a cable TV provider, as I believe revenue diversification can also lower risk. Their market penetration has extended into multi-platform content production, theme parks, and wireless too.

Net Income YoY Growth

I am looking for any positive net income growth on a YoY basis when possible, and here is what I found, referring to data from the income statement again:

At first glance, you will see $4.04B in net income for the quarter, vs a net loss of ($4.59) a year prior, which appears to be a YoY improvement. However, the net loss a year ago appears to be caused by a one-time charge affecting the FY2022 Q3 income statement, causing a one-time net loss reported in that quarter.

According to their FY2022 Q3 earnings release, the company highlighted that item:

In the third quarter of 2022 we recorded noncash impairment charges related to goodwill and intangible assets in our Sky segment totaling $8.6 billion. The impairments primarily reflected an increased discount rate and reduced estimated future cash flows..”

Therefore, I think it better to compare FY23 Q3 earnings with the quarters ending June and Dec 2022. In both cases, the most recent quarter achieved an earnings growth compared to those quarters. For example Q3 saw a 19% earnings growth vs the quarter ending June 2022. I think that is significant.

Further, the company appears to have had sustained earnings growth since Dec 2022, for the most part:

Comcast – sustained earnings growth (Seeking Alpha)

Worth noting are the following notable mentions from the Q3 earnings release:

Theme Parks Adjusted EBITDA Increased 20% to $983 Million, Its Highest Adjusted EBITDA on Record.

Adjusted EPS increased 12.5% to $1.08.

EBITDA for Residential Connectivity & Platforms increased due to higher revenue and lower operating expenses.

Further, I would also mention significant earnings growth in the content and experiences business segment:

Comcast – content & experiences segment (Comcast q3 presentation)

These impressive bottom-line figures add confidence to my bullish sentiment on this stock. However, will this earnings success sustain itself into Q4 results and beyond into 2024?

I would argue that sustainable earnings growth will continue and be powered by subscriber growth. For instance, in Comcast’s Peacock paid streaming service, “Peacock paid subscribers increased nearly 80% y/y to 28M, including 4M net adds in 3Q,” according to their Q3 presentation.

Also, in their connectivity business segment, they “added 294K wireless lines; 10% penetration of domestic residential broadband customers – long runway for growth.”

Consider that having WiFi in the house or apartment nowadays is what I would call a utility like paying the electric, water, or phone bill. It is also critical infrastructure, particularly with the number of people working from a home office in the last several years since the 2020 pandemic. So, there’s more potential for continued and sustainable growth, particularly in geographic areas experiencing population growth.

Dividend 10-Year Growth

I am looking for dividend 10-year growth trends, and here is what I found:

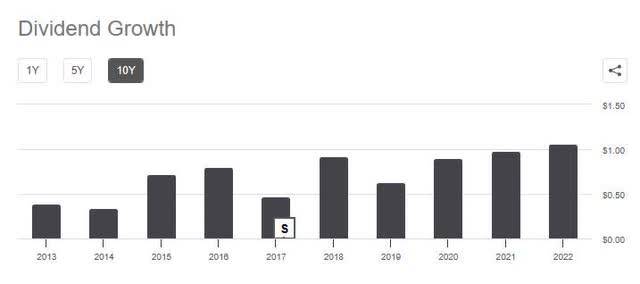

Comcast – dividend growth (Seeking Alpha)

When considering the 10-year dividend growth chart above, although there were a few dips such as 2017 and 2019, overall in the long-term sense the stock went from an annual dividend of just $0.39 in 2013 to $1.06 in 2022, a 170% growth in 10 years.

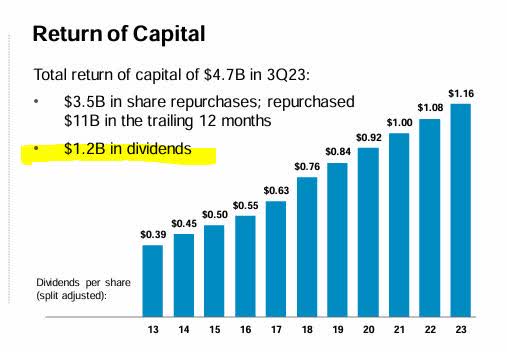

In addition, I would mention that supporting my positive dividend sentiment is the following data which shows a commitment to return capital back to shareholders each year, and paying out $1.2B in dividends in the last quarter.

Comcast – return of capital (Comcast Q3 presentation)

Dividend Yield Above Average

I am looking for a dividend yield above its sector average, and here is what I found:

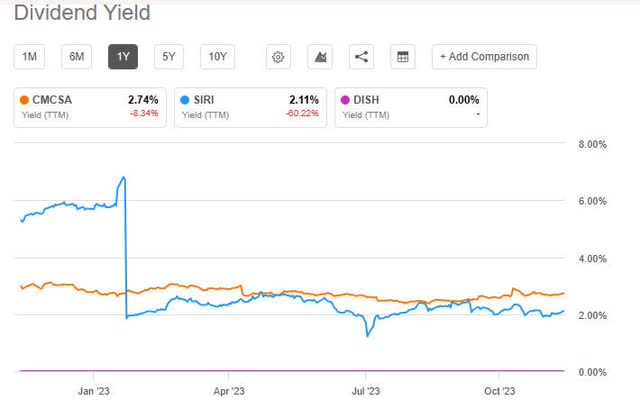

Comcast – dividend yield (Seeking Alpha)

In comparing Comcast’s dividend yield against two selected companies in the same sector, I picked SiriusXM (SIRI) and DISH Network (DISH). Of these three, Comcast with a yield of 2.74% beats Sirius whose yield is slightly lower at 2.11%, whereas DISH does not pay a dividend at all and I am looking for a dividend-paying stock.

I would consider adding this stock to an existing basket of diversified dividend-paying stocks, at the current yield, which could drop somewhat if the share price goes up again.

Also let me address some comments lately in a few articles that suggest someone can earn a near 5% yield on a CD or bond, as opposed to only 2.7% with a stock like this that I am touting for its dividend yield. The fact is, perhaps you could, however, the three have different tax categories (interest earned on a CD vs qualified dividends on a stock) and a CD does not give you any shares of ownership in the bank but is a deposit product. Just some food for thought, and not a recommendation of one being better or worse.

P/E Valuation vs Average

I am looking for an undervaluation opportunity when it comes to price-to-earnings, and here is what I found from valuation data on Seeking Alpha:

The forward P/E ratio of 11.65 is nearly 32% below the sector average.

What I believe is driving this undervaluation, when tying to the financials I discussed and also the current price chart, is a recent dip in the share price combined with sustained earnings growth since Dec 2022, so I think the undervaluation is justified for that reason… a dip in price combined with earnings growth. In fact, the data shows Comcast’s P/E is 32% below its own 5-year average, so valuation is on an improvement trend.

P/B Valuation vs Average

I am looking for an undervaluation opportunity when it comes to price-to-book value, and here is what I found:

The forward P/B ratio of 2.09 is around 21% higher than the sector average.

Tying back to the financials, we can see from the balance sheet that total equity /book value actually increased on a YoY basis and now surpasses $83B, so the company has quite a bit of positive book value and this is a key data point to mention. At the same time, which I will discuss in the next section, the share price has fallen, but still remains slightly above the 200-day moving average and has been there for a while.

Important to note is that according to Seeking Alpha data the fwd P/B has come down about 6% from its 5-year average, indicating valuation improvement. So, I think what has been driving the premium vs book value is the generally bullish share price for most of the year, rather than a drop in book value. With equity improving and share price hovering around the moving average, I would say the P/B valuation is justified where it is at.

Share Price vs 200-day Average

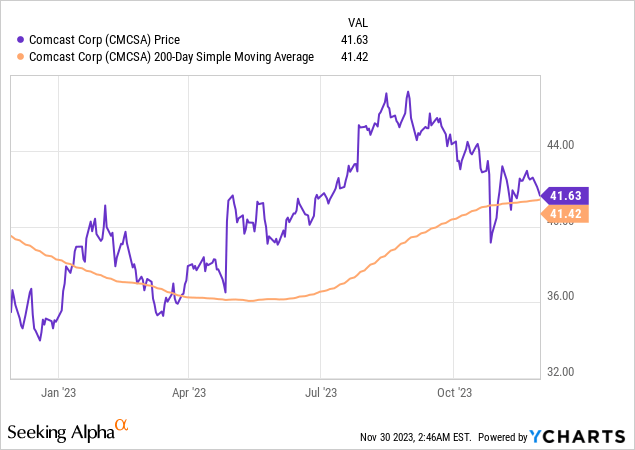

My portfolio strategy prefers dip-buying opportunities when the share price falls below the 200-day simple moving average, so here is what I found:

In looking at the yChart above, comparing the current share price (as of this article writing) vs the 200-day simple moving average, what I see is a share price hovering very close to the average and practically in line with it, and significantly down from its high price this summer.

Because it is around the 200-day average, well off its summer highs, and the company is showing both revenue and earnings growth lately, I will call this a value-buying opportunity right now. I like it at around $41.60 and ride it up until it gets into the low 50 range (a $10/share profit while also earning dividend income along the way).

However, I would exactly call it a strong buy unless it were to dip 5% to 10% below the 200 day average, at which point I could get an even better dividend yield.

Key Risk

As an investor and analyst, I find it relevant to analyze risk as well. This being a company selling its product to consumers as well as many small businesses, the risk of recession can impact spending decisions by both, with a pullback on non-essentials.

However, the jury is still out on recession certainty. This is what a November 28th study by global consultancy Bain & Co. had to say on this:

The question of whether the US will fall into a recession remains open as the tension between growth and inflation continues to challenge the Federal Reserve. The US 10-year minus 2-year Treasury yield spread has been inverted since July 2022, which is typically indicative of a recession within 12 months, though that spread has been tightening.

The other risk I should mention is debt risk, considering the high interest-rate environment. Although interest expense for this company has ticked up, the good news is that the balance sheet shows long-term debt declining to $94.35B from $95.57B a year prior, about a 1.3% YoY debt decline.

So, taking the two risks into consideration, I would call this company a “moderate” risk.

Wrap-Up

To summarize, my bullish sentiment on this stock is driven by positives such as earnings growth over several quarters as well as subscriber growth, dividend growth, and above-average yield of 2.7%, as well as a share price down from its summer highs.

Some negative drivers were weak YoY revenue growth and moderate risk score impacted by debt and recession risk.

I see its market leadership position driven by the ability to win with streaming-services customers that become regular long-term subscribers, as well as growth in home wireless subscribers driven by the need for fast home WiFi treated as another critical utility.

In addition, it benefits from business diversification beyond just cable/WiFi and TV, as its movie Oppenheimer delivered over $900M in worldwide box office.

Going forward I think this will truly be a multi-platform, multi-media company influencing content consumed as well as broadcasting of that content too.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2024 Long/Short Pick investment competition, which runs through December 31. With cash prizes, this competition — open to all contributors — is one you don’t want to miss. If you are interested in becoming a contributor and taking part in the competition, click here to find out more and submit your article today!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.