Summary:

- AbbVie has agreed to acquire ImmunoGen in a $10.1 billion all-cash deal, aiming to revitalize its struggling oncology operations.

- ImmunoGen’s recent success with its drug ELAHERE, which received accelerated approval for the treatment of ovarian cancer, makes the acquisition potentially lucrative.

- The purchase of ImmunoGen is a risky move for AbbVie, but if ELAHERE proves to be successful, it could justify the high price paid.

vzphotos

It’s not every day that we see a major transaction in the biotechnology space. But on November 30th, news broke that a behemoth in this space, AbbVie (NYSE:ABBV), agreed to acquire a rather small company by the name of ImmunoGen (NASDAQ:IMGN) in an all cash deal valued at $10.1 billion. Shares of ImmunoGen spiked in response to this news, closing up 82.8%. Clearly, for its investors, this was a fantastic development that created significant amounts of shareholder value instantly. But for investors of AbbVie, the outcome is far less certain. For the past few years, AbbVie’s oncology operations have struggled in light of declining revenue. And prior to this transaction, management was expecting weakness in this category to continue. This is a massive bet aimed at revitalizing that unit. And while the market responded favorably to the news, pushing shares of AbbVie up 2.8% during the day, only time will tell if this transaction will make sense.

A risky transaction

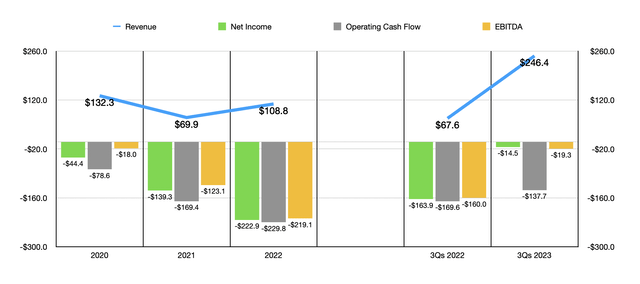

According to a press release issued by AbbVie, the company agreed to acquire all of ImmunoGen in a deal valued at $10.1 billion, or $31.26 per share. If one were to look at the financial results achieved by ImmunoGen in recent years, this kind of price would sound absurd. From 2020 through 2022, revenue generated by ImmunoGen has been all over the place, bouncing around between a low point of $69.9 million and a high point of $132.3 million. Over that same three-year window, the profitability picture of the business had worsened. The company went from generating a net loss of $44.4 million in 2020 to generating a loss of $222.9 million last year. As the chart below illustrates, operating cash flow and EBITDA followed a very similar trajectory.

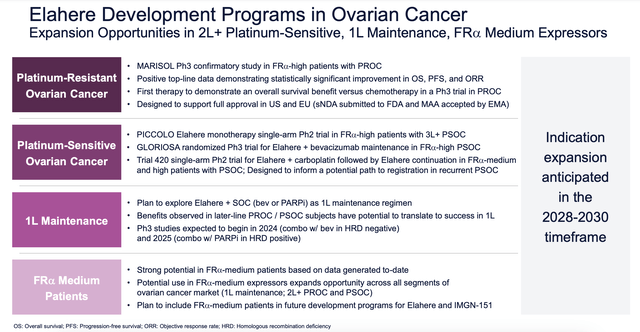

What you might notice, however, is that a change started to occur this year. Revenue skyrocketed from $67.6 million in the first nine months of 2022 to $246.4 million the same time this year. Profits and cash flows also improved drastically year over year. And all of this is the result of one major development that the company locked down. On November 14th of 2022, the FDA granted ‘accelerated approval’ for a drug that ImmunoGen had been developing called ELAHERE. For those who don’t know, ELAHERE is used for the treatment of adult patients who have what is called folate receptor alpha-positive, platinum-resistant epithelial ovarian, fallopian tube, or primary peritoneal cancer.

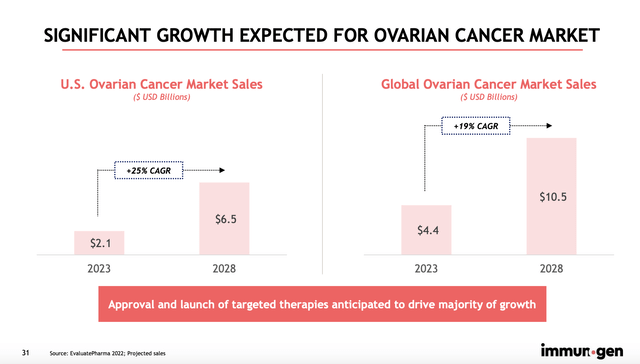

For the oncology market, this was a massive development. This is because ELAHERE is actually the first targeted medicine to show any meaningful increase in survivability for those suffering from platinum resistant ovarian cancer, more commonly referred to in the industry as PROC. In terms of market opportunity, this could be rather lucrative for any company that has such a solution. This year, for instance, the ovarian cancer market in the US was estimated to be worth around $2.1 billion. It’s expected to grow at a 25% rate per annum until eventually hitting $6.5 billion by 2028. Globally, this market opportunity is expected to expand from $4.4 billion this year to $10.5 billion by 2028.

Sales associated with ELAHERE have quickly ramped up. In the first nine months of this year, revenue associated with the drug totaled $212.1 million. A whopping $105.2 million of those sales came from the third quarter alone. This shows rapid deployment here in the US market. But this is not the only area of opportunity for the drug. Just recently, the European Medicines Agency validated the company’s application for selling ELAHERE in Europe to the same types of patients it has been approved for here at home. Around the same time, the company also submitted an application to the FDA to support the conversion of its accelerated approval to a full approval. On top of all of this, the company is also focusing on the Chinese market. Its partner in that country, Huadong, was approved when it comes to the launch of ELAHERE throughout Greater China.

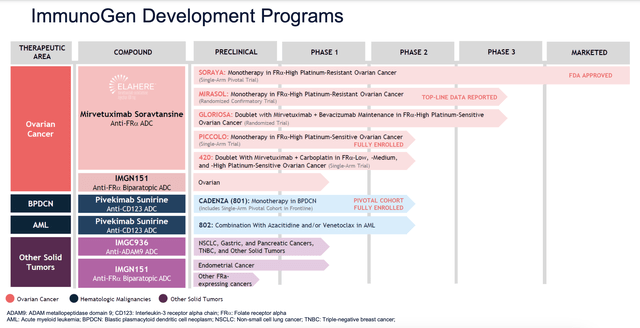

It’s incredibly important to keep in mind that ImmunoGen is not a single product company. The firm actually has a rather extensive pipeline at this point in time. In its third quarter earnings release, for instance, it reported that it continues to move forward with Pivekimab Sunirine, which is an ADC that is made of a high affinity antibody that could be useful in treating blastic plasmacytoid dendritic cell neoplasm (a rare form of blood cancer) and acute myeloid leukemia. The company also has some other drugs going through the approval pipeline that could help treat things like endometrial cancer, pancreatic tumors, and other solid tumors. All the while, it is also working at different indications for ELAHERE.

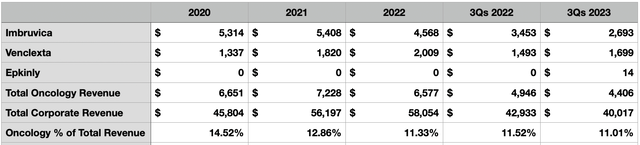

Truth be told, if ELAHERE can be a home run, then the purchase of ImmunoGen might be worth it even if the other drugs in ImmunoGen’s pipeline turn out to be duds. And the fact of the matter is that, if AbbVie wants to truly be a big player in the cancer market, it needs to do something and soon. I say this because the company’s oncology products have not been faring particularly well as of late. Oncology products went from accounting for 14.5% of the company’s revenue back in 2020 to 11% in 2022. In the first nine months of this year, they accounted for 11% of sales. That’s down from the 11.5% seen in the same time last year.

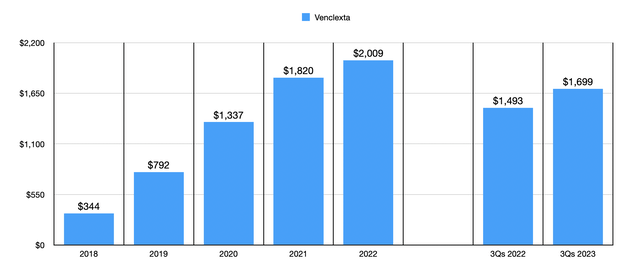

The most significant of the drugs in the company’s portfolio of oncology products is Imbruvica, which is an oral, once daily therapy that has been approved for the treatment of adult patients with blood cancers and certain forms of non-Hodgkin lymphoma. However, this is a drug there has been seeing its revenue drop as of late. In the first nine months of this year, it generated revenue of only $2.69 billion. That’s down 22% from the $3.45 billion generated the same time last year. But this isn’t to say that every oncology product that AbbVie owns is in decline. Venclexta, a drug that is used to treat hematological malignancies, with a focus on adults with chronic lymphocytic leukemia and small lymphocytic lymphoma, has seen its revenue skyrocket in recent years. Back in 2018, it generated only $344 million in revenue. By 2022, sales had hit $2.01 billion. In the first nine months of this year, sales had grown to just under $1.70 billion compared to the $1.49 billion reported the same time of 2022.

Even with this growth, however, AbbVie recognizes that it’s in a pickle. According to management in an investor presentation that came out prior to this acquisition being announced, oncology related revenue should drop to about $5.7 billion this year compared to the $6.58 billion generated in 2022. Even with the growth associated with Venclexta, sales should more or less flatline in 2024 and 2025 before ultimately resuming growth in 2026. This growth will likely be driven by the approval of Venclexta for other indications, with the company already having four such variants undergoing Phase 3 trials at this time. But in a market where investors want to see additional growth, I can understand the reason behind a rather large acquisition.

This is not to say that the company’s purchase of ImmunoGen is a definite home run. In my opinion, the price paid is a rather lofty one. But then again, management is literally betting on the future of not only ELAHERE, but also on the other drugs in the company’s pipeline. The good news, however, is that the purchase might not be as lofty as it initially appears. First and foremost, while the deal does cost $10.1 billion, ImmunoGen actually has cash that exceeds debt by a total of $533.4 million. That helps to bring some of the costs down. But there are other ways that the company should bring in cash as well. Back in October 2020, for instance, the firm entered into a collaboration and license agreement with Huadong that grants Huadong an exclusive, royalty bearing, and sub-licensable right to develop and commercialize ELAHERE in certain markets like China, Hong Kong, Macau, and Taiwan.

Already, as part of that arrangement, AbbVie received an upfront payment of $40 million. However, there is the potential for $265 million in various other payments. ImmunoGen also is entitled to receive royalties associated with the sale of ELAHERE. There is no telling how high these royalties might go. But as of this writing, the firm has received another $15 million worth of payments. Management has also made other similar arrangements in the past. Its deal with Takeda grants Takeda similar rights for the commercialization of ELAHERE in Japan. Management recorded $23.2 million worth of payments received up front, with the potential to receive up to another $135 million in payments and certain royalties above that in the future. The firm’s deal with Vertex grants that company rights to ImmunoGen’s ADC technology for the purpose of researching and evaluating certain applications of ADCs in exchange for $15 million up front, up to $337 million in contingency payments per target identified, and more. The list goes on, with other partners including Eli Lilly (LLY), Roche, and Novartis (NVS).

Takeaway

Nobody knows what the future holds for AbbVie or for the drugs that the company is essentially acquiring. Early results are promising, and I would argue that there’s a fair chance that shareholders of AbbVie will be happy over the next few years as a result of this maneuver. Meanwhile, investors in ImmunoGen should be exceedingly happy because of the massive premium that they are receiving in exchange for their units. In fact, further upside seems to exist, with the spread between where shares are traded at today and the buyout price totaling 6.5%. All said and done, this leads me to rate both companies a soft ‘buy’ for now.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights is an exclusive community of investors who have a taste for oil and natural gas firms. Our main interest is on cash flow and the value and growth prospects that generate the strongest potential for investors. You get access to a 50+ stock model account, in-depth cash flow analyses of E&P firms, and a Live Chat where members can share their knowledge and experiences with one another. Sign up now and your first two weeks are free!