Summary:

- This article provides an updated and upgraded view of The Walt Disney Company.

- I last wrote on Disney stock about 3 months ago, amid the Hollywood writer’s strike.

- Now, with the strike over and a new 3-year agreement in place, many of the uncertainties I saw at that time have been removed.

- As a result, I see more reasons to be optimistic about Disney.

- I see limited impacts of the new agreement on Disney stock, and its current P/E implies the market is overestimating these impacts.

smckenzie

Outcome From the Hollywood Writer Strike

I last wrote on The Walt Disney Company (NYSE:DIS) about three months ago. At that time, its stock prices just hit a 9-year low amid the Hollywood writer strike (see the chart below). My article argued for a bullish thesis because the market sentiment had swung too far in the fear extreme in my mind. I view its beaten-down stock prices now as an overaction to temporary issues, including the Hollywood writer strike.

Now, the strike is over, and a new 3-year agreement has been reached between the Writers Guild of America (“WGA”) and the Alliance of Motion Picture and Television Producers (“AMPTP”). At the same time, the stock prices have rallied quite a bit since then (about 13.5%). I believe these new developments provide enough motivation to reevaluate the stock. In the remainder of this article, I will analyze the impact of the new agreement on DIS and its updated valuation at its current price. You will see that my conclusion is that the impact will be limited, and its valuation is still attractive. As such, I see more reasons to be bullish on the stock.

For readers unfamiliar with the writer’s strike, I will start with a brief recap of the major outcomes. The Hollywood writer strike lasted for 148 days, during which many film and television productions were shut down or delayed. As detailed in my earlier articles, DIS has suffered its fair share of setbacks. The major outcome of the strike was a new three-year contract between the WGA and AMPTP. The contract is considered a win for the WGA, as the main points from the contracts are:

- Writers will now earn more money when their work is streamed on services like Netflix, Hulu, and Disney+.

- Writers will have access to better health insurance and retirement plans.

- Writers will have a say in how AI is used to generate creative content.

Next, I will explain why I see limited impacts on DIS from this new agreement.

DIS – Strong Brand Name and Well-Diversified Revenues

First, let me be crystal clear that I am not trying to argue that Disney WON’T feel any impact. I am sure the new agreement, especially the increased residuals for streaming services, will put some pressure on Disney’s content costs. What I am trying to argue is that these impacts will be limited, and the current market valuation overestimates the impacts, in my view.

The first reason for my above argument lies in the durability of Disney’s iconic brand names. The following quotes from Warren Buffett summarize this better than anything else that I’ve seen.

It’s kind of nice to be able to recycle Snow White every seven or eight years. You hit a different crowd. It’s like having an oil field where you pump out all the oil and sell it. And then it all seeps back in over seven or eight years.

The nice thing about the mouse is that he doesn’t have an agent. He is not in there renegotiating every week or every month… If you own the mouse, you own the mouse.

If I thought the children of the world were going to want to be entertained 10 or 20 years from now, and I was betting on who is going to have a special place in the minds of those kids and their parents, I would probably bet on Disney.

Even though Buffett made these comments about 3 decades ago (around 1996), they are still valid today in my view. DIS still can recycle (and still is recycling) its iconic characters and stories every few years. And a wave of new audiences is still eager to see them. I expect such durability makes it much less sensitive to the new agreements mentioned above compared to other competitors.

Second, unlike other streaming pure players, DIS has well-diversified revenue streams. Besides its streaming business (the so-called direct-to-consumer segment including Disney+ mostly), DIS also generates strong cash flow from its Media Networks, theme parks, and also via content sales and licensing. I see very little impact of the new agreement on many of its revenue streams. For example, its Parks and Experiences segment includes Disney’s theme parks, cruise lines, hotels, and consumer product licensing business, all practically immune to the new agreement.

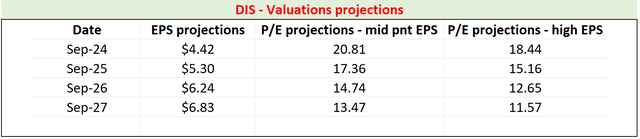

As a matter of fact, based on consensus estimates of its earnings and revenues, my analysis shows improved, instead of pressured, net profit ahead as seen in the table below. In this table, I used the consensus estimate of its EPS in the next 4 years (second column) and revenues (third column) to infer the implied net margin (the 4th column). As seen, the margin is projected to expand from 8.75% in 2024 to about 11.65% in 2027.

Author based on Seeking Alpha data

Valuation

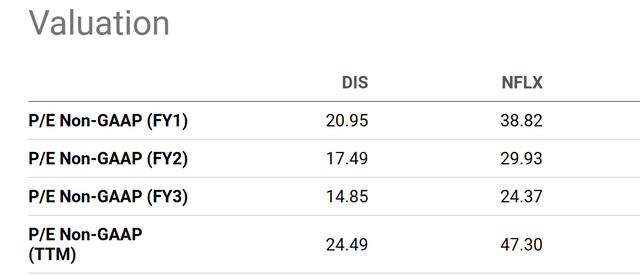

Despite its durable moat and the projected margin expansion, the stock is trading at a discounted valuation multiple. In terms of the P/E, DIS is trading at about 21x FY1 EPS as seen from the chart below. It is only about half of the multiples from its streaming peers like Netflix’s (NFLX) (~39x FY1 P/E) and discounted from the overall market’s P/E (about 25x as of this writing).

When its growth is considered, the P/E is even more compressed than on the surface. The consensus EPS estimate translates into an annual growth rate of 11% in the next 4 years (from $4.42 per share in FY 2024 to $6.83 per share in FY 2027). With the durability of its moat, I think it is reasonable to apply the so-called Benjamin Graham P/E as an estimate of its fair valuation. With the 11% growth rate, the Graham P/E for DIS would be about 30.5x (8.5 plus twice the expected annual growth rate without the percentage sign), substantially above its current market P/E.

Risks and Final Thoughts

Before closing, it is important to point out some of the headwinds that DIS is facing. Despite its well-diversified income streams, the COVID-19 pandemic has revealed that extreme events could impact several of its revenue streams all at once: ranging from movies to theme parks. Such black swan events are rare but could happen again. Also, compared to many of its close peers, DIS has a relatively high exposure to international markets with physical properties like theme parks and hotels. As such, it is more sensitive to factors such as political instability and trade tensions in my mind. A notable example involves its China market. Its operation there has been impacted by the China COVID policy and also ongoing trade tension with the United States.

To conclude, I see the positives far outweigh the negatives with The Walt Disney Company shares. To recap, I see very limited impact from the new agreement on its future profitability. Actually, I see expanding profitability based on consensus estimates. In the meantime, I see the essence of its business model intact. I see DIS continue to enjoy many of its iconic IPs indefinitely and the strong resonance among its complementing segments. In terms of valuation, despite the sizable rally since my last writing, I view The Walt Disney Company’s current multiples as very reasonable or even at large discounts when growth potential is factored in.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.