Summary:

- Pfizer held an R&D day this week where it discussed its broad pipeline.

- There are 19 near-term or expected product launches that are expected to contribute approximately $20 billion in revenues in 2030.

- The company expects significant longer-term contributions in hematology, sickle cell disease, and obesity.

- Business development is expected to contribute $25 billion to 2030 revenues.

- The COVID-19 business will be a drag on revenues in the next two years, but Pfizer can be a decent compounder in the next 7-8 years.

I going to make a greatest artwork as I can, by my head, my hand and by my mind./iStock via Getty Images

Pfizer (NYSE:PFE) held an R&D day this week, outlining the near-term product launch opportunities and the long-term growth potential of these products and candidates. The company was a major beneficiary of the COVID-19 pandemic and ended up with a revenue windfall that will be very hard to replace, and it has tried to do so by active business development and has been one of the best friends of small and mid-cap biotech companies – as a valuable partner and as an outright acquirer.

The growth concerns seem to be priced in at current levels, and while I am not interested in taking a position in Pfizer because it does not fit my targeted company profile (typically a small or mid-cap company with higher growth potential), I think it can do well in the following years driven by its expanded pipeline and through additional business development.

Existing pipeline and business development key to value creation in the rest of the decade

One thing seems clear when looking at Pfizer’s existing product portfolio – the best years of the COVID-19 business are behind it and this side of the business is unlikely to ever reach the revenue levels of the last two years.

This means the rest of the product portfolio and pipeline need to pick up the pace considering the expected losses in COVID-19 revenues and the estimated loss of $17 billion in annual revenues by the end of the decade due to the loss of exclusivity for some of the existing marketed products.

The presentation slide below shows the potential negative impact of the loss of exclusivity and the expected contribution of the existing pipeline. Specifically, the year-to-date product launches and the launches in the next 18 months are expected to contribute approximately $20 billion in risk-adjusted revenues by 2030, and at least another $25 billion are expected from additional deals the company will make in the following years. There is also an unspecified contribution from the internal pipeline.

The business development part is typically the part that is missing in analyst projections, and given the windfall in profits from the COVID-19 business and the profitable base business, Pfizer will have a lot of cash to invest in the coming years.

At the R&D day this week, the company discussed at length the existing and recently acquired pipeline candidates that it expects will drive significant growth in the following years. There were two parts – the first was focused on near-term launches, and the second was on meaningful longer-term pipeline opportunities. I will list the potential contributions of the near-term launches and discuss where I think the estimate is unrealistic, and in the second section of the article, I will go over the longer-term opportunities that were covered at the R&D day and that seem significant.

Pfizer’s near-term launches

Pfizer highlighted 19 different launches in the next 18 months and that includes ongoing launches.

Several key assets were highlighted:

- The migraine franchise came from the $11.6 billion acquisition of Biohaven. Pfizer expects $6 billion in annual peak sales through the expansion of the CGRP class in migraine, product portfolio expansion, and international expansion. Improved gross to nets should also help as Pfizer intends to make corrections to the market access strategy that Biohaven used to capture initial market share. This sounds like an ambitious goal, but with all the levers Pfizer can pull, it looks achievable.

- Elranatamab, a BCMA bispecific antibody in development for multiple myeloma. The peak sales guidance for elranatamab is $4 billion, and the plan is to move from later lines of therapy to frontline multiple myeloma. Multiple myeloma is increasingly crowded and elranatamab will be just one of many BCMA bispecifics to hit the market in the following years. The field is also evolving rapidly – I particularly like the data Carvykti generated that I covered in my recent article on Legend Biotech (LEGN) and believe Legend’s partner Johnson & Johnson (JNJ) is in a particularly strong position in the multiple myeloma market with the market-dominant Darzalex, Carvykti, but also its own BCMA bispecific Tecvayli and talquetamab with a novel target (it redirects T cells to mediate killing of GPRC5D-expressing myeloma cells) and promising data in later lines of multiple myeloma. But going back to elranatamab, the data it generated do not look differentiated to me and I believe it will have a much harder time competing against the likes of J&J and potentially others.

- Respiratory Syncytial Virus (‘RSV’) PreF Vaccine Candidate. RSV is a virus that can cause serious and sometimes life-threatening respiratory illness. Pfizer developed a vaccine with two targeted populations – pregnant women and older adults. The annual peak sales guidance is more than $2 billion and it sounds achievable but will require market-building efforts. RSV is underdiagnosed and awareness has increased lately but it is still not adequate.

- Etrasimod in ulcerative colitis. This asset came from the $6.7 billion acquisition of Arena Pharmaceuticals and Pfizer expects to generate between $1 billion and $2 billion in peak annual sales. This is a decent-sized market and the company believes there is an unmet need for oral therapies like etrasimod and that the lack of a black box warning in the label should help the launch. I was interested in Arena at one point as I liked etrasimod’s potential but never initiated a position and I do believe this estimate range is achievable.

- Ritlecitinib in alopecia areata. Pfizer expects approximately $1 billion in global peak sales.

- Talzenna in prostate cancer. Talzenna was the first PARP inhibitor combined with Xtandi to demonstrate clinical benefit in metastatic castration-resistant prostate cancer with or without HRR gene mutations. We are yet to see the data at a medical conference in the following months, but we do know that the combination achieved a statistically significant and clinically meaningful improvement in radiographic progress-free survival (‘rPFS’) compared to placebo and Xtandi (a 30% reduction in the risk of progression) with a trend toward improving overall survival. There are additional ongoing studies and Pfizer expects Talzenna to generate more than $1 billion in global annual peak sales.

I have no specific views on the potential of ritlecitinib and Talzenna, but both peak annual sales goals look achievable, and, alternatively, not getting to $1 billion in annual sales for each product will not be a serious issue for a company of Pfizer’s size.

The listed products along with the other 13 are expected to contribute to the company’s goal of delivering a compounded annual revenue growth rate of 6% from 2020 to 2025. This guidance excludes the COVID-19 franchise. Some of the peak global annual sales expectations do not look realistic to me with elranatamab being the primary asset where I believe it is unlikely to reach $4 billion in peak sales, while others look ambitious but achievable.

Longer-term pipeline opportunities

Pfizer also highlighted five areas as longer-term opportunities on its R&D day.

The company expects to enhance and expand its mRNA vaccine leadership and believes it can be a $10 billion to $15 billion a year business in the long run. This is not exactly a growth opportunity – it is the company’s effort to keep this business at a solid and sustainable run rate in the future considering the expected declines in COVID-19 vaccine and Paxlovid sales. COVID-19 vaccines, flu vaccines, and the combination vaccine for COVID-19 and flu are expected to be the primary source of revenue in the long run, and the shingles vaccine is targeting a $6 billion global market by 2030.

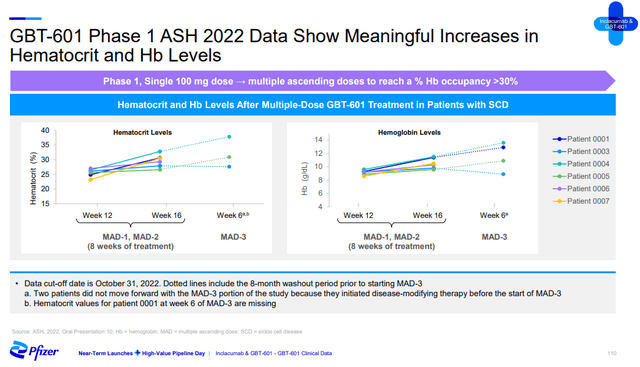

The sickle cell disease (‘SCD’) franchise the company got through the acquisition of Global Blood Therapeutics is expected to contribute $3 billion in global peak sales. This is not too far off my $2.3 billion to $2.5 billion estimate range I outlined in my last article on Global Blood Therapeutics, but it could get there if GBT601 achieves the desired clinical profile. Similar to my expectations, GBT601 is expected to contribute the vast majority of the $3 billion in peak sales with some contribution from inclacumab.

There is still not enough GBT601 data, but we saw a bit more at ASH this month. Three of the six SCD patients that restarted GBT601 in the phase 1 trial had even greater improvements in hemoglobin levels compared to the previous dosing periods, and the fourth patient was not compliant and failed to see a rise in hemoglobin. Two patients decided not to participate in the third dosing portion of the trial because they initiated disease-modifying therapy.

TTI-622 was gained through last year’s $2.2 billion acquisition of Trillium Therapeutics and Pfizer believes this could be the “PD-1 of hematologic malignancies” and that it can generate $3 billion in annual peak sales. Pfizer is also excited about the opportunity to do combination trials of TTI-622 and elranatamab in multiple myeloma. TTI-622 has generated some interesting early-stage clinical data, but this is still an emerging field and I will need to see more data before I get bullish on this asset’s potential.

PF-06823859 is an anti-interferon-beta candidate in development for the treatment of dermatomyositis and polymyositis. Dermatomyositis is a debilitating and life-threatening disease that affects the skin and muscles and polymyositis is a rheumatology indication characterized by inflammation of the proximal muscles and may include arthritis, interstitial lung disease, and/or heart involvement. Pfizer has generated some promising phase 2 results and intends to do a basket phase 3 trial in these indications. The company estimates the global addressable market will be in the $6 billion to $12 billion range and that PF-06823859 can generate between $1 billion and $3 billion in global peak sales.

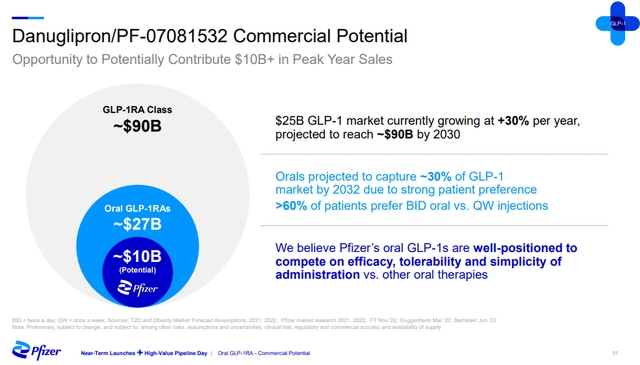

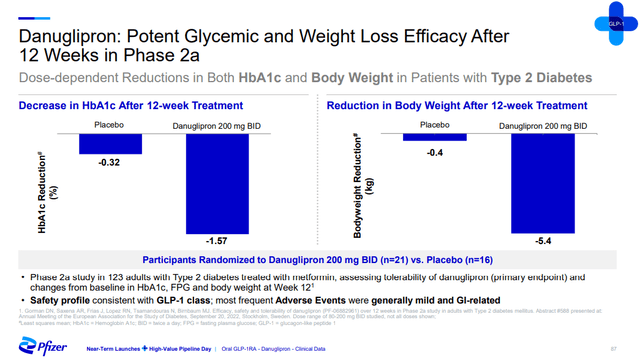

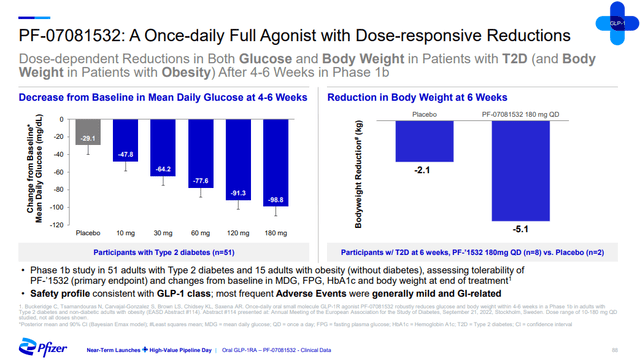

And the last area is obesity and type 2 diabetes. This is an emerging area where competitors Novo Nordisk (NVO) and Eli Lilly (LLY) have generated amazing data, specifically in obesity where patients taking Wegovy and Mounjaro have experienced 15% to 20% total body weight reductions.

Both Wegovy and Mounjaro are injectables and Pfizer believes it can develop oral versions of GLP-1 receptor antagonists. In type 2 diabetes, a GLP-1 receptor antagonist has an effect on glycemic control, weight loss and reduces cardiovascular risk, and in obesity, it leads to significant weight loss.

The company has two shots on goal here with danuglipron and PF-07081532. The two compounds are thought to have favorable characteristics and distinct half-lives – danuglipron’s is shorter and PF-07081532’s is longer. Pfizer says that these two candidates are the only two oral small molecule full GLP-1 receptor antagonists among assets in development.

The two candidates have generated positive proof of concept data in type 2 diabetes patients, but only over six and 12 weeks, a period that is too short to make strong conclusions about their potential, but it appears their impact could be more modest than the injectables like Wegovy and Mounjaro.

Pfizer investor presentation Pfizer investor presentation

This is the likely reason Pfizer believes the peak sales potential of the two candidates is greater than $10 billion in a market that is expected to exceed $90 billion by 2030. The company has come to this number by estimating the oral market will reach $30 billion, or about a third of the total market, and that its candidates will capture a 30% share of the oral market. Generally good results for type 2 diabetes and obese patients (even if less favorable than the results of injectables) and patient preference for oral drugs are the ingredients for the growth of the oral GLP-1 market and Pfizer’s two GLP-1 candidates.

This class and the type 2 diabetes and obesity markets are important areas for Pfizer to address and I believe the two candidates are just the beginning of the company’s efforts and that it will be active on both the internal development and M&A side to participate in this rapidly growing market.

Business development

Acquisitions and product or product candidate in-licensing will play a major role in value creation in the following years. And more so in the near- and medium-term than in the past due to the cash windfall from the COVID-19 business. Pfizer has been increasingly putting money to work and has made three mid-size acquisitions in the last few quarters – Biohaven for $11.6 billion, Arena Pharmaceuticals for $6.7 billion, and Global Blood Therapeutics for $5.4 billion, and it spent $26 billion year-to-date on M&A.

Looking at the deal sizes and Pfizer’s peak sales expectations for the assets it got through these acquisitions, we can get an idea of how much each dollar invested could translate to revenues in the future. Biohaven and Global Blood therapeutics were acquired for slightly less than two times the expected peak annual sales and the Arena deal is a bit more complicated since etrasimod is expected to generate between $1 billion and $2 billion in annual peak sales but it also has potential in other indications, so, it appears likely that the multiple is around two here as well, or even below two.

There are also earlier-stage deals like Trillium last year where the multiple is lower ($3 billion in expected peak sales versus $2.2 billion spent), but these deals also carry higher risks and TTI-622 getting to $3 billion in annual sales is far less certain than the migraine portfolio generating $6 billion in annual sales to justify the $11.6 billion Pfizer spent on Biohaven.

Of course, it is far from certain that each of these deals will lead to the expected peak sales, but we get an idea of how Pfizer allocates its dollars to M&A.

Going back to the presentation slide I posted earlier, the company expects business development to contribute approximately $25 billion in risk-adjusted revenues by 2030, and given the expected cash flows and the above-mentioned multiples, it may need to deploy approximately $50 billion for M&A over the next eight years to get to that number assuming a 2x peak sales multiple for marketed or late-stage clinical assets, or less than that if it focuses on earlier-stage assets, but this approach also brings a much higher risk of missing the expected revenue levels.

However, it seems likely that Pfizer will be able to put more than $50 billion to work in the next 7-8 years as it spent $26 billion on M&A this year alone.

Conclusion

Pfizer has been a major beneficiary of the COVID-19 pandemic and it is now working hard to put the cash to work to generate returns for shareholders in the following years. The company’s pipeline and business development activity certainly have the potential to lead to decent revenue growth for the ex-COVID-19 business and while I believe some of the peak sales estimates are not realistic, there are other moving parts (primarily M&A) that can make up for the company falling short in some areas.

I believe that the declines of the COVID-19 business are largely priced in at current levels – the stock is trading less than 13x its 2024 EPS and I am taking 2024 as the year where the decline of the COVID-19 business will be largely accounted for. From there, it is likely that this multiple can be maintained or expanded based on at least mid- to high single-digit earnings growth through 2030 and that Pfizer’s share price can grow by an average of 7% to 10% in the next 7-8 years.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article reflects the author’s opinion and should not be regarded as a buy or sell recommendation or investment advice in any way.

I publish my best ideas and top coverage on the Growth Stock Forum. If you’re interested in finding great growth stocks, with a focus on biotech, consider signing up. We focus on attractive risk/reward situations and track each of our portfolio and watchlist stocks closely. To receive e-mail notifications for my public articles and blogs, please click the follow button. And to go deeper, sign up for a free trial to Growth Stock Forum.