Summary:

- In October, Exxon Mobil has announced to acquire Permian driller Pioneer Resources for $65bn in stock, sparking a wave of follow-up among competitors, most notably Chevron’s $60bn acquisition of Hess.

- The deal positions Exxon Mobil as the undisputed number 1 in the Permian Basin and on US soil and perfectly highlights management’s shift towards shorter-cycle and higher security, domestic barrels.

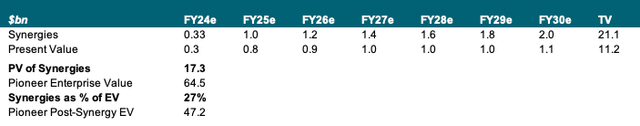

- Through leveraging Pioneer’s high-quality, continuous acreage in the Midland Basin, Exxon expects tangible synergies worth a total lifetime value of $17bn, immediately making the deal accretive to EPS and ROCE.

- Especially when compared to Chevron, the deal comes at a highly attractive price point, with Exxon paying just 4.4x Pioneer’s FY24 expected EBITDA post-synergies as opposed to 7.0x for Chevron.

grandriver

A few weeks ago, I published my note “Exxon Mobil: Superior Asset Base and Execution to fuel Returns throughout the Cycle” in which I initiated coverage of Exxon Mobil, laying out my general investment thesis of Exxon Mobil (NYSE:XOM) as a best-in-class play on structural tailwinds for the energy sector. I highly encourage readers to have a look at this first if you didn’t before as I will pick up several points I discussed in this article again. Next to a largely uneventful Q3 earnings release, the time that has passed since that article saw Exxon’ all-stock, friendly acquisition of Pioneer Resources (PXD), formally announced on October 11. With a total deal value of c.$65bn it would be the largest M&A transaction YTD and the largest for XOM since the merger of Exxon Corp and Mobil Oil in 1999.

This not only generated headlines for the two companies itself, but also started a wave of what I would describe as catch-up actions among peers. Most notably premier rival Chevron (CVX) announced its acquisition of Hess (HES) for $53bn but Occidental Petroleum (OXY) is also reported to be close to making a $10bn bid for private Permian driller CrownRock. I view this industry-wide follow up as the earliest sign of the potential such a deal can yield for the acquirer in times of declining and thus increasingly competitive prime acreage on US soil.

Deal creates the undisputed Number 1 in the Permian

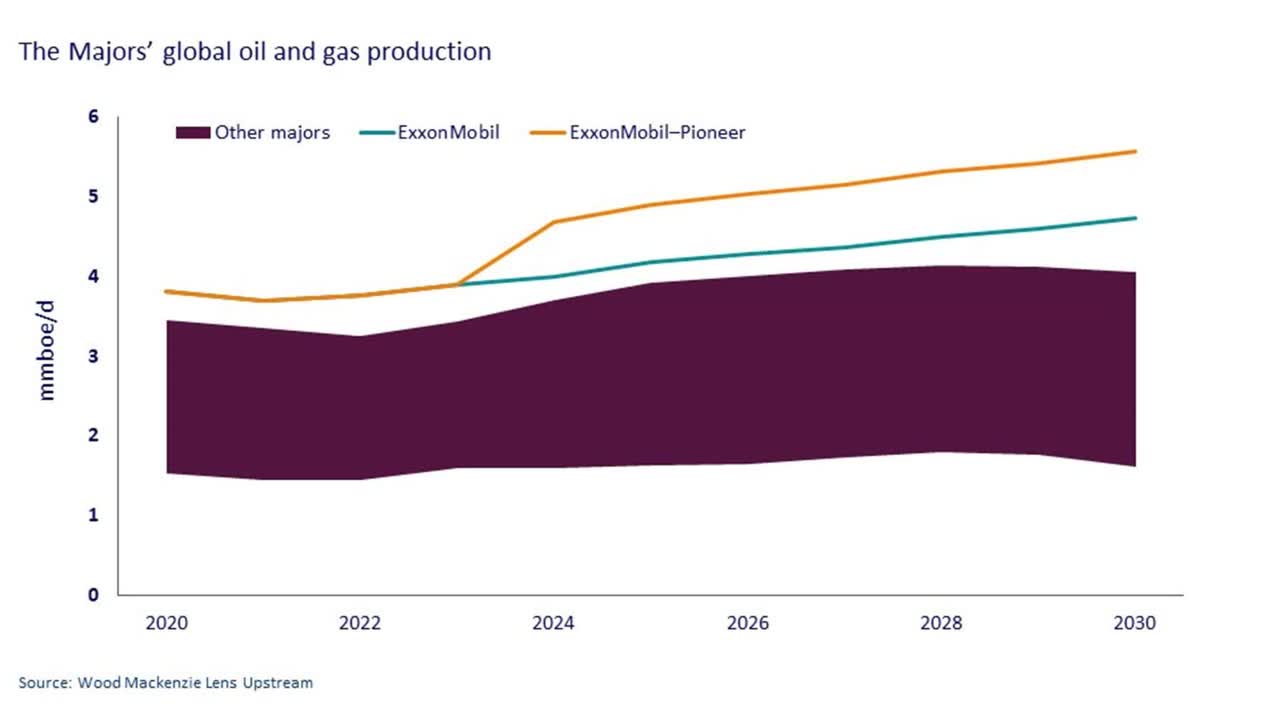

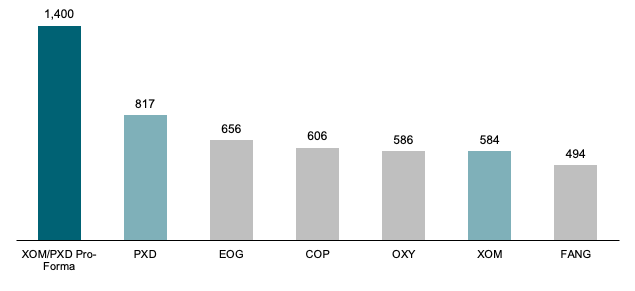

Perhaps the biggest, and certainly most striking, feature of the Pioneer acquisition is Exxon more than doubling its scale in the Permian, rising from the 5th largest producer (as of Q2 23) with around 580kboed to the undisputed number one with around 1,400kboed of pro-forma gross production. As noted by Energy research firm Wood Mackenzie, this will also make Exxon the largest producer on US soil entirely, accounting for around 10% of total domestic production.

Gross Daily Permian Production Q2 23 (Enverus via Reuters)

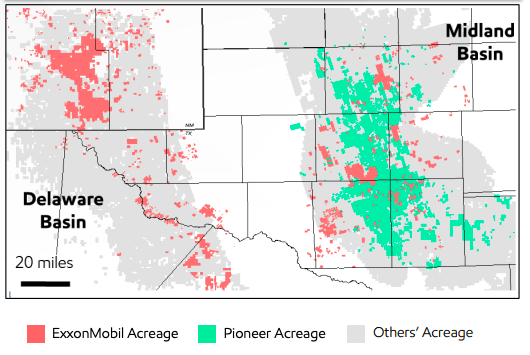

The deal significantly expands Exxon’s acreage in the Permian, adding c.860k net acres to significantly strengthen its positioning in the Midland basin where the company’s holdings had previously been highly fractured. Overall acreage more than doubles from c.570k to more than 1.4MM net acres holding current proved reserves of more than 16bn of oil-equivalent barrels (75% of which liquids).

Pro-Forma Permian Acreage (Company Filings)

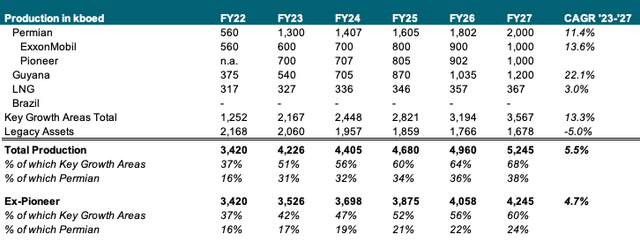

Overall Permian production is now expected by management to hit more than 2Mboed by 2027 which I expect to by then comprise up to 38% of Exxon’s total output, as opposed to c.24% on a stand-alone basis. Combined with the company’s large-scale operations in Guyana and its LNG franchise, production share from Key Growth Areas as of FY27 will subsequently increase to 68% from 60%. Factoring in c.1Mboed from Pioneer’s assets in the Permian, I estimate total output to grow at a 23-27 CAGR of 5.5% to more than 5.2MBoed in FY27, increasing from 4.7%.

Pro-Forma Production Forecast (Company Filings and Author’s Projections)

From an operational standpoint, I think this deal perfectly highlights three key themes which I believe will guide Exxon’s strategy in the coming decade.

First, it again serves as a commitment to the longevity of hydrocarbons. Exxon had already made its position regarding this clear in the past, doubling down on drilling while others were hastily cutting capacity in the midst of the pandemic. CEO Darren Woods has also repeatedly stated he would not cut production as (European) peers had vowed to do in light of shareholder and government activism.

The second conclusion investors can draw from the deal is the refocus on domestic US assets. As mentioned, I estimate the combined Exxon-Pioneer entity to produce around 38% of its total FY27 output from the Permian with other Exxon assets in shale and the Gulf of Mexico bringing total US share to around 45%, a figure the company had not seen since decades. The only geography somewhat rivaling Exxon’s US assets in production at this stage will be Guyana at around 1.2Mboed or c.23%. While over the past decades, the largest exploration efforts by the IOCs have been international with i.e. Chevron in Kazakhstan and also Exxon itself in Guyana, leaving the US and the Permian to be dominated by smaller independent E&P players, this in my opinion signals a generational shift towards a more secure, deglobalized asset base with the US as a safe ground for operations due to (almost) zero political risk involved.

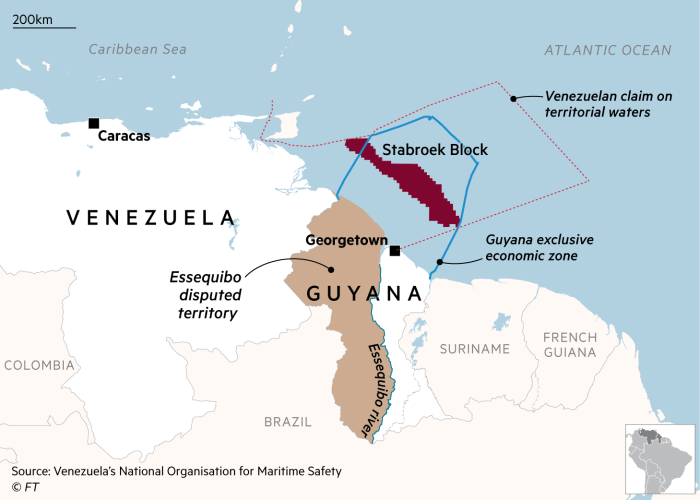

Even Guyana, which I previously regarded as a secure international operation, has recently come in international spotlight with Venezuela announcing it will hold a referendum about its 200 year old claim to the Essequibo region. Through the Essequibo region, Venezuela claims almost the entirety of the Stabroek Block, which comprises Exxon’s and other oil majors drilling and exploration activities in Guyana, as part of its territorial waters. Even if the referendum should be decided in favor of it, I do not expect Venezuela to follow through on this claim with most international researchers deeming this a mere tool for political rallying ahead of the country’s upcoming elections. However, this undoubtedly has the potential to create a significant amount of tension in the region with Brazil already reinforcing its military presence in the border regions and once more highlights the political risk associated with international operations.

I also want to draw some connection to Chevron here which through its acquisition of Hess, mainly attracted by its 30% share in the Stabroek Block behind Exxon’s 45% and ahead of CNOOC’s 25%, engaged in somewhat the polar opposite of Exxon. While at first Hess might have seemed like the ideal takeover candidate for Exxon, with the combined entity holding a 75% share in the largest Western oil discovery of the past decades, headlines such as these make me increasingly like management’s turn towards deglobalizing their production base and doubling down on the safe haven that is the US.

Financial Times

Third, the deal and specifically management’s communication around it fully embraces one of the key themes I mentioned in my previous article on Exxon, production flexibility. As oil cycles tend to get shorter and shorter with prices fluctuating at a higher level, I estimate the key differentiator between the oil majors going forward will be their ability to quickly increase and decrease output levels. Exxon itself has been a stellar example of the importance of this in the aftermath of the Covid-pandemic when they led peers in income growth through their ability to quickly ramp up production. I estimate the doubling down on these capabilities to provide a key competitive advantage for Exxon in the coming years and decades with management expecting more than 40% of Pro-Forma output to be comprised of such short-cycle barrels, as opposed to c.28% on a stand-alone basis.

I think there is an interesting comparison to draw here to the last of Exxon’s megadeals which was the 1999 merger of Exxon and Mobil itself that created today’s Exxon Mobil. Back then the deal was preceded by a prolonged period of low oil prices and mainly sought to provide one thing: scale. By combining with Mobil Oil, Exxon’ CEO at that time, Lee Raymond, sought to gain a cost advantage versus peers through headcount reduction and elimination of double competencies. Overall this combination had yielded almost $7bn in gross cost savings, a decision which tremendously benefited XOM during the commodity supercycle we saw in the early 2000s. Darren Woods’ acquisition of Pioneer seeks to do nothing like that, in fact reductions in headcount or rig count have been more or less ruled out, instead seeking to generate the projected synergies by leveraging the combined company’s superior technology and asset base to generate incremental returns while increasing Exxon’s flexibility to react to changes in oil markets.

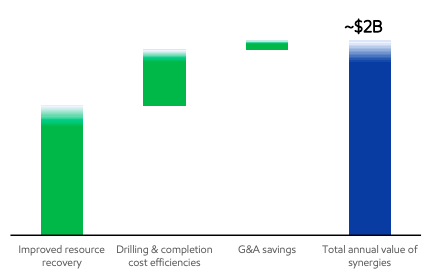

Immediately accretive to both EPS and Returns on Capital with a long Runway for Synergies

Speaking of synergies, Exxon’s management expects the transaction to yield around $1bn in cost and revenue synergies by the second fiscal year end post close in 2025, slowly ramping up to a perpetual run rate of $2bn by the end of the decade. As mentioned above, the overwhelming majority of this (c.2/3) is projected to come not from reductions in headcount and elimination of double competencies but rather from improved recovery of resources through a mix of higher amounts of neighboring acreage and the combined company’s leading production technologies. One key aspect here is the fact that the transaction, as shown above adds an incredible amount of acreage in the Midland basin where Exxon’s position had historically been fractured. Solidifying those fractured holdings into one continuous piece of acreage will enable Exxon to increasingly leverage their industry-leading lateral drilling capabilities of up to 4 miles and result in not only improved recovery of resources but also significant cost savings in both Capex and Opex as fewer wells will have to be drilled and serviced. By driving down costs of drilling and operating those wells, this will also give the combined entity the ability to leverage proven reserves in the basin which, as of previously, would not have been profitable enough thus further driving resource recovery.

Company Filings

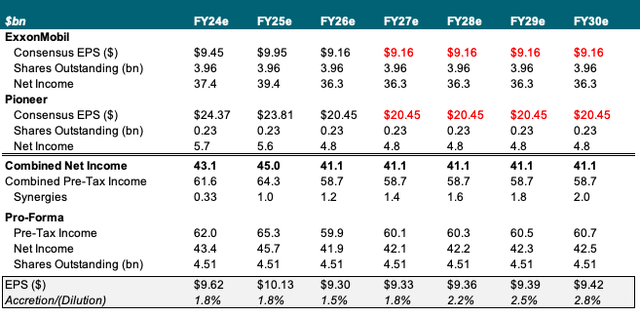

While management only provides an estimate for synergies of $1bn for the second year post-close, considering current projections for close in H1 24 I find it reasonable to assume that around a third of that can be reached by year end. Excluding merger fees and based on current consensus estimates, with Exxon having to issue around 550MM shares to finance the transaction I estimate total full year 2023 EPS impact to be around 1.8%, making the transaction immediately accretive to Exxon’s bottom line with a pro-forma EPS of $9.62 as opposed to $9.45 for the stand-alone business.

Modeling stand-alone EPS flat for the years post 2026 and with synergies linearly growing to $2bn in FY30 as currently projected by Exxon management, I estimate total EPS impact to slowly increase from 1.5% in FY26 (decline vs FY24 driven by lower EPS consensus) to around 2.8% by the end of the decade, reinforcing the long runway narrative that management has been highlighting when speaking about the expected synergies.

EPS Accretion/Dilution Analysis (Company Filings and Author’s Projections)

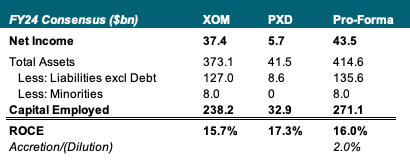

I expect similar effects to Exxon’s Return on Capital Employed (“ROCE”) as I estimate the transaction to be immediately accretive due to Pioneer’s leading capital efficiency, forecasted to generate a 17.3% ROCE in 2024 versus Exxon’s 15.7%. As mentioned in my prior note, Exxon has made stellar progress in improving their capital efficiency over recent years, leading its peer group and outperforming its pre-Covid benchmarks by a wide margin. By leveraging the combination with Pioneer’s high-quality and high-return assets I estimate this to further increase with an initial FY24 accretion of around 2%, growing Pro-Forma ROCE by 30bps to c.16%.

ROCE Accretion/Dilution Analysis (Reuters)

Of course, such projections are always to be taken with a grain of salt, however when considering Exxon’s execution excellence in recent years, especially in terms of improving operating and production efficiency, I am highly confident that management can achieve these targets.

Highly attractive Valuation especially when compared to Chevron-Hess Deal

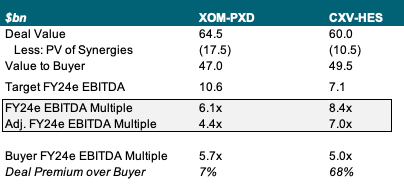

The thing I like the most about the deal however is the price point at which it comes for Exxon. While the total deal value of $64.5bn might seem enormous at a first glance, when factoring in Pioneer’s forecasted FY24 EBITDA of $10.6bn Exxon is only paying around 6.6x EBITDA which in itself is already a very reasonable valuation for an asset of Pioneer’s quality. However, this becomes even more valuable for Exxon when we consider the synergies the transaction is expected to yield.

Building on my previous expectations for initial FY24 synergies at c.1/3 of FY25 projected $1bn and linear growth throughout the decade to reach a terminal run-rate of $2bn by FY30, I estimate the total present value of synergies at more than $17bn or around a quarter of the total deal value. Deducting this amount from the total price Exxon is expected to pay for Pioneer leaves around $47bn of synergy-adjusted enterprise value. In other words, the actual price Exxon is paying for Pioneer comes down to these $47bn, pushing the deal multiple down to 4.4x. With Exxon’s own valuation at currently 5.7 times FY24 expected EBITDA this in my view further highlights the highly attractive price at which they were able to negotiate the transaction.

This becomes even more apparent when we compare it to its “copycat”, the acquisition of Hess Corp by Chevron, which was signed just about a week after Exxon and Pioneer executives announced their merger. While Hess’ total takeover valuation of c.$60bn is slightly below what Exxon pays for Pioneer, with Hess expected to only generate around $7.1bn in EBITDA in 2024 Chevron is executing their deal at a much higher multiple of 8.4x. Factoring in synergies, which in Hess’ case are expected by Chevron management at a run rate of $1bn and thus can be estimated at a present value of c.$10.5bn, this multiple comes down to 7x FY24 EBITDA which is still significantly higher than the 4.4x Exxon pays for Pioneer. Notably, while Exxon only pays a pre-synergy multiple premium of around 7% vs their own trading, Chevron has to pay around a 68% premium to their current EV/FY24 EBITDA of 5.0x further reinforcing my view that this acquisition, while enormous in absolute terms, has come at an incredible price point for Darren Woods and Exxon.

Reuters

Wrap-Up and Outlook

Overall, I believe this acquisition has the potential to play out as a masterpiece for Exxon Mobil, immortalizing Darren Woods in the same way the very merger that founded the company we know as Exxon Mobil today did for Lee Raymond. In times of rising global tensions and with flexibility becoming the name of the game for oil companies, I estimate the renewed commitment on domestic and short-cycle US production to provide Exxon with the additional capabilities it will need to navigate the coming decades in oil markets. Leveraging the combined company’s technology and leading footprint in the Permian, I expect management will be able to extract significant synergies out of the combination which by itself make up around a quarter of total deal value. Especially when benchmarking it against Chevron’s hastily announced follow-up acquisition of Hess, I believe Exxon has struck a tremendous deal here paying only around 4.4x Pioneer’s expected FY24 EBITDA on a post-synergy basis as opposed to Chevron paying 7.0x for Hess.

I reiterate my Buy rating on Exxon Mobil stock with the Pioneer deal serving as a key reinforcement in all areas of my investment thesis while coming in at a highly attractive price point, providing ample room for synergies to achieve long-term, and growing accretion to both EPS and returns on capital.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of XOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.