Summary:

- Chevron’s operations in Venezuela may face challenges due to the country’s border dispute with Guyana.

- The acquisition of Hess’s Guyana operations by Chevron could be at risk if the situation escalates into an invasion.

- The loss of the Guyana assets would significantly impact the valuation of Hess and may lead to Chevron reconsidering the acquisition.

Jeremy Poland

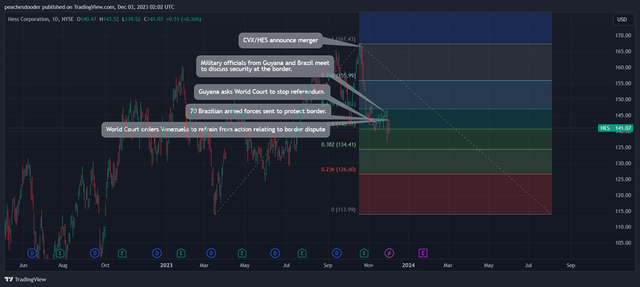

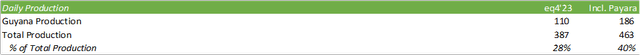

There’s been a lot of talk concerning the independence of Guyana as Venezuela presses forward with a referendum relating to the border. Overall, this shouldn’t be a challenge for Chevron (NYSE:CVX) given their authorization to operate in Venezuela. What I’m most concerned about is if this escalates into an invasion, what will offshore drilling and production look like after the fact, especially with the Hess (NYSE:HES) acquisition right around the corner? Guyana production accounts for 28% of Hess’s total production as of q2’23. With the addition of Payara, daily volumes in Guyana will account for closer to 40%. This assumes Hess’s 30% stake in the 620mboe/d in the Stabroek Block. Certainly, if the skirmish were to escalate and Venezuela potentially takes Guyana by force, I believe this could lead to further sanctions and potentially a complete write-off of Guyana assets. This can also create challenges for Chevron’s Venezuelan production. My biggest concern is Chevron walking away from the acquisition or adjusting the acquisition price down if this were to occur. Until more information is released, I believe it would be prudent to provide HES a HOLD recommendation and maintain my SELL recommendation on CVX maintaining my price target of $136/share for CVX.

As a disclaimer, predicting geopolitical action is not in my field of expertise. The purpose of this report is to discuss the potential effects of the border dispute in the instance of escalation.

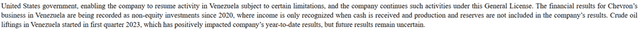

The joint venture between Chevron and Venezuelan State oil company PDVSA produces 135mboe/d and exports 124mboe/d to the US. In total, using q3’23 production figures, this only accounts for 4% of Chevron’s total production. Bear in mind, Venezuelan assets are not accounted for in production and reserves figures, as disclosed in their 10-Q.

Relating to their reported financial statements, effects should not be visible if Chevron’s General License 41 were to be revoked and operations in Venezuela were to cease.

My eye is on Hess and their Guyana operations. Guyana accounts for 28% of Hess’s q3’23 production; and, with the added Payara project, will account for closer to 40% of total production.

Guyana accounts for 23% of Hess’s total proved reserves and 37% of their total oil and condensate reserves, in accordance with their last reported 10-k. The remaining assets are spread across North Dakota, the US Gulf Coast, and Malaysia & JDA. Though the Bakken assets are high-quality, short-cycle assets, I don’t believe these were the assets Chevron was targeting in the acquisition.

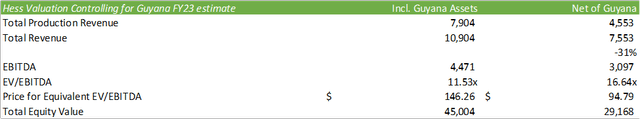

Holding constant q3’23 production volumes, losing the Guyana asset will reduce EBITDA by ~30%, assuming constant margins.

Again, this is purely a hypothetical exercise to understand the implications of the worst-case scenario of an invasion on Guyana and sanctions placed on the region. I believe the loss of the Guyana assets will place significant stress on the valuation of Hess and may lead to Chevron reconsidering the acquisition target. There’s no telling what will happen in Guyana until it happens; and further, there’s no telling how the US Government will retaliate if an invasion were to occur. I don’t believe it would be appropriate to ring the alarm bells just yet. If you are a holder of Hess shares, my recommendation is to hedge your position by purchasing put options in the instance of this geopolitical risk going sideways. Otherwise, I maintain my SELL recommendation of CVX with a price target of $136/share and no price target for Hess as the stock will continue to track CVX and there are too many unknowns if otherwise.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.