Summary:

- Tech and the impressive growth within the sector play an important role in my well-diversified portfolio.

- Amazon is the world’s most dominant cloud player and is set to become the largest e-commerce retailer on the planet.

- The company enjoys a near-perfect credit rating from S&P.

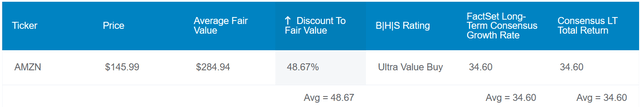

- Shares of AMZN appear to be trading at a 49% discount to fair value, which could be an appealing margin of safety.

- The world-beating business could 8x the S&P through 2025 and conservatively 6x the index over the next 10 years.

A businessman is showered with U.S. banknotes. Deagreez/iStock via Getty Images

My portfolio is as focused on blue-chip tech stocks as ever. Tech comprises five of my top 10 individual stock holdings and 12% of my total individual stock portfolio by portfolio value weighting. It wasn’t always this way, either.

Besides my largest individual holding of Broadcom (AVGO) and its 3.5% weighting (opened in 2019), my other four top tech holdings were acquired beginning in 2021 and 2022. Since opening a position in Amazon.com Inc. (NASDAQ:AMZN) in April 2022, I have regularly added a half share to a full share each month. That’s how I have built up my position in the stock to a 2.7% weighting. Additionally, I began routinely purchasing Alphabet (GOOGL) in July 2022, bringing that position up to my third largest, with a 2.4% weighting.

As I have spent the last three months strengthening my emergency fund, I have paused adding to these positions. But when I resume capital deployment to stock purchases (likely in February), I will especially continue dollar cost averaging into Amazon. Let’s discuss its fundamentals and valuation for me to articulate why I rate the stock a strong buy currently.

For a variety of reasons, Amazon earns a 13/13 quality rating from Dividend Kings.

For one, the company’s robust financial positioning doesn’t hurt. Amazon’s 46% debt-to-capital ratio is just a notch above the 40% that credit rating agencies believe to be safe for its industry. Considering that the company also is an established leader within cloud and e-commerce, it shouldn’t be surprising that S&P rates its debt AA on a stable outlook. According to Dividend Kings, that implies the 30-year risk of bankruptcy is just 0.51%. In other words, Amazon won’t be going to zero in 195 out of 196 scenarios through 2053.

The appeal to Amazon doesn’t just end at its outstanding fundamentals. Shares of the tech juggernaut look to currently be priced at a dirt-cheap valuation: Per historical valuation metrics from Dividend Kings, Amazon’s fair value per share is $285. Compared to the present $143 share price (as of December 4, 2023), shares are trading 49% below fair value.

If and only if Amazon reverts to fair value and grows at just half of the analyst consensus, here are the total returns that it could produce for shareholders in the next 10 years:

- 17.3% FactSet Research annual growth + 7.1% annual valuation multiple expansion = 24.4% annual total return potential (not including eventual dividends) or a cumulative 788% total return versus the S&P 500 index’s (SP500) 9% annual total return potential or a cumulative 137% total return

The Clear Leader Of Cloud Computing

Before diving into Amazon’s operational potential, it would be helpful to understand how the company best known for its virtual digital personal assistant Alexa, eponymous Amazon e-commerce platform, and Prime paid subscription service, is organized. The tech juggernaut consists of the following three segments:

- North America: As the name would suggest, this segment mostly earns revenue from retail sales of products to consumers and subscriptions within the North American market (all segment info here and to follow from page 66 of 81 of Amazon’s 10-K filing). Through the first three quarters of 2023, the segment accounted for 61.1% of $404.8 billion in total company revenue.

- International: As geography would imply, the International segment consists of retail sales to consumers and subscriptions sold through online stores based everywhere besides the U.S., Mexico, and Canada. The segment comprised 22.5% of total company revenue through September 30, 2023.

- Amazon Web Services or AWS: The company’s fastest-growing segment consists of revenue derived from the sale of computing, storage, and databases to world governments, colleges and universities, businesses, and non-profits. This segment made up the remaining 16.4% of Amazon’s total revenue.

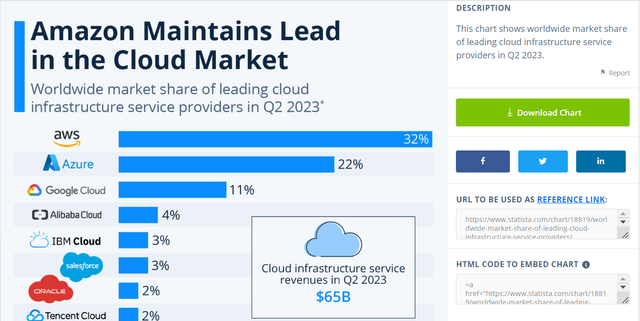

Amazon’s retail presence may drive the bulk of its headline revenue, but AWS is continuing to drive overall growth. As of the second quarter, Amazon’s 32% market share was about as much as Microsoft’s (MSFT) Azure and Alphabet’s Google Cloud combined. When customers are selecting a cloud service provider, trust and reliability are everything. Suffice it to say, that Amazon’s suite of offerings to customers and its reliability is arguably unparalleled. That is how the company is largely maintaining its market share in the low- to mid-30% range, despite heavy competition from Azure and Google Cloud.

Assuming that Amazon can simply grow in line with the overall cloud market and maintain its share, healthy growth is probable. That is because even though analysts expect $570.8 billion in total revenue in 2023, the potential from the cloud alone is multitudes bigger.

The need for more efficient ways of arranging organizations is expected to drive the demand for cloud computing much higher in the years ahead. This is why the market research firm Grand View Research thinks that the global cloud computing market will compound by 14.1% annually between 2023 and 2030, reaching $1.6 trillion in annual revenue by the latter time.

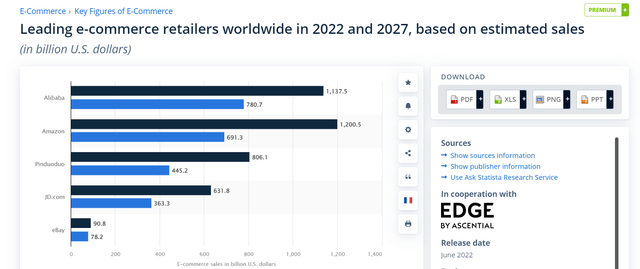

This alone could power attractive growth for Amazon. But as the share of e-commerce to total global retail sales rises, the company’s e-commerce business should grow at a strong rate as well. Because Amazon operates in numerous less mature global markets compared to China-based Alibaba (BABA), its growth outlook is superior. That is why analysts believe that the former will overtake the latter in terms of global e-commerce sales by 2027.

For these reasons, FactSet Research is upbeat enough to think that Amazon could deliver a 34.6% annual growth rate long term. Even if the company achieves half of this long-term growth rate, it’s indisputable that Amazon isn’t done growing yet.

A Lean, Mean, Free Cash Flow Machine In The Making

In the spirit of maintaining its status as Earth’s most customer-centric company, Amazon has continued to invest unbelievable sums in its business.

In its trailing 12 months leading up to September 30, the company invested $54.7 billion in capital expenditures. This was down versus the $66 billion from the trailing 12 months ended September 30, 2022. For context, if Amazon were its own country, its trailing 12 months’ capex would exceed the total GDP of Sudan by $3 billion.

Along with a sizable uptick in operating cash flows to $71.7 billion in the last 12 months, Amazon’s free cash flow swung from -$26.3 billion to $16.9 billion. As growth opportunities gradually diminish over time, expect the company to again become one of the biggest generators of free cash flow in the world like it was in 2020.

Risks To Consider

Amazon is one of the best businesses in the world in my opinion, but it isn’t perfect.

As I alluded to earlier, one of the primary risks facing Amazon is the degree of competition within the cloud computing space with Microsoft and Alphabet. If competition intensifies and the two further compete against Amazon, the operating margin of AWS could be adversely impacted.

As a predominantly consumer-oriented business, the company also is exposed to the growing risk of a looming recession. That could weigh on Amazon’s e-commerce sales and slow AWS growth considerably, which would temporarily weigh on its financial results.

Finally, the company’s massive amounts of data make it a prime target (pun intended) for repeated attempts to breach its cybersecurity infrastructure. If a major breach were to occur and compromise a great deal of sensitive information, Amazon could face lawsuits and suffer a blow to its reputation.

Summary: Amazon Is A Must-Own Growth Stock For Me

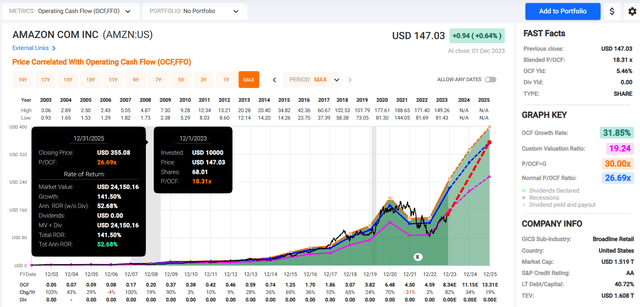

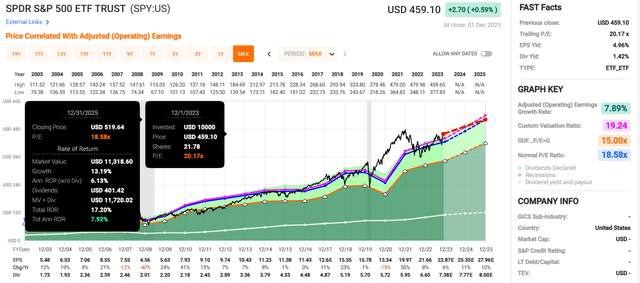

FAST Graphs, FactSet FAST Graphs, FactSet

Regardless of whether you are a consumer or you run an IT department, Amazon has growth tailwinds that can be observed in everyday life. Coupled with a discounted valuation, these operating fundamentals make it an interesting growth stock.

According to FAST Graphs, Amazon’s shares have historically commanded a P/OCF ratio of 26.7. Sure, the company won’t be able to grow as it historically has forever. So, it doesn’t quite deserve that same valuation into perpetuity. But today, Amazon’s shares trade at a P/OCF ratio of just 18.3. This is how Amazon could theoretically deliver 141% total returns through 2025 if it meets growth forecasts and returns to its historical P/OCF ratio. In comparison, that is 8X the 17% total returns that the SPDR S&P 500 ETF Trust (SPY) is expected to generate through 2025.

This margin of safety and level of total return potential is too appealing for me to ignore, which explains my strong buy rating.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN, AVGO, GOOGL, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.