Summary:

- The iRobot Corporation deal to be acquired by Amazon.com, Inc. deal has faced numerous obstacles, including a second request from the FTC and an in-depth investigation by the European Commission.

- Reuters initially reported that the deal would be cleared unconditionally, but later sent a statement of objection to the acquisition.

- The objections raised by the European Commission focus on Amazon potentially hindering vacuum-cleaning competition and gaining benefits from additional data gathered from iRobot’s users.

cyano66/iStock via Getty Images

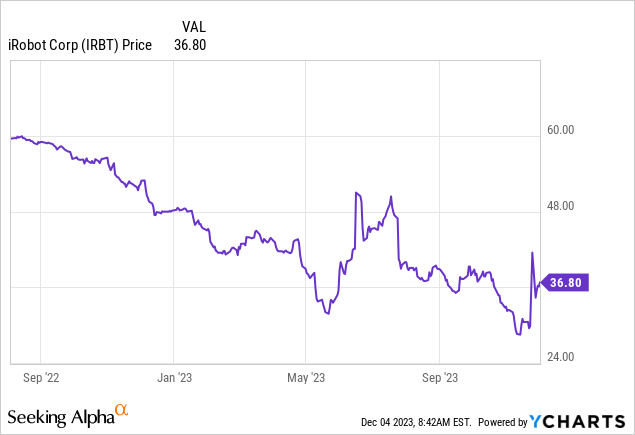

The iRobot Corporation (NASDAQ:IRBT) deal with Amazon.com, Inc. (NASDAQ:AMZN) has been a rollercoaster ride. The company received a second request from the FTC on September 19, 2022. The U.K. CMA cleared the deal in June 2023. The European Commission opened an in-depth investigation in July 2023. The deal was recut from $61 to $51.75. The latest drama began when Reuters reported the deal would be cleared unconditionally by the European Commission. Then, a day later, the story came out that the European Commission had sent a statement of objection to the acquisition.

There is a 40.62% upside to the deal closing at $51.75 from the current price. Fellow contributors Chris DeMuth and Andrew Walker briefly discussed the deal on the highly recommended YAVB podcast. One thing they discussed is the weird turn of events where on one day, Reuters is reporting the deal is cleared in the EU (with no less than three sources), and the day after, we have a statement of objection. Their conversation inspired me to write this article because I agree with them on how unusual it was and have some thoughts on what happened.

I got the sense from Reuters reporting on the change of heart that the situation on Wednesday was such that the EC lawyers were recommending clearing the deal.

The Commission’s legal service did not think a statement of objections regarding the deal was warranted, in contrast with antitrust officials handling the case, the people said. Without such a charge sheet, the deal would have been cleared unconditionally.

…The lawyers subsequently changed their mind and backed antitrust officials’ decision to send the charge sheet setting out their concerns, the sources said on condition of anonymity, declining to provide confidential details.

It seems like the lawyers didn’t see a case and expected to drop it. But then the boss told them to send a statement of objections anyway. Reuters included the following as a sort of explanation of how it is possible the Boss can just tell the lawyers to send out whatever he/she likes:

Antitrust officials can override objections from the legal service by either tweaking or narrowing their concerns to get their backing or by appealing to the top officials.

The objection narrowed in on sales of vacuum cleaners in specific European countries (Spain, France, etc.) and moved away from the deal, strengthening Amazon’s marketplace.

The EC formulated the threat of Amazon hindering other vacuum sellers like this (emphasis is by the EC):

Amazon may have the incentive to foreclose iRobot’s rivals because it may be economically profitable to do so. The merged entity would likely gain more from additional sales of iRobot RVCs than it would lose from fewer sales of iRobot’s rivals and other related products on Amazon. Such gains include benefits from additional data gathered from iRobot’s users.

It seems like a weak argument that Amazon would make more from additional sales of iRobot RVCs than from other producers. In an absolute sense, that’s likely true. There’s a reason platform businesses are treated differently by the EC and the marketplace(they get phenomenal multiples). Sales by third-party producers require zero inventory, and there are only limited marginal costs associated with these sales. In practice, I’d think there’s a good argument to be made for Amazon to favor sales of competitors if it wanted to maximize shareholder value (increase its stock price).

What is worse is that this favoring of a platform’s products is (by my non-lawyer understanding) illegal under the Digital Markets Act, which went into effect in early 2023. It is sort of like saying: we think you’re going to break the law, so you can’t do this deal.

The EC tried to give the claim a little bit more gravity by including:

Such gains include benefits from additional data gathered from iRobot’s users.

To me, this comes across as if they were looking for ways to beef up their justification.

What also stood out to me from the EC release was the following:

The Commission closely cooperated with other competition authorities during both the initial investigation and the in-depth investigation and will continue such cooperation during the remainder of the in-depth investigation.

It isn’t unheard of for the EC. This is also true with the Adobe (ADBE) and Figma merger. I don’t recall the Activision and Microsoft (MSFT) deal disclosures. I’m unsure what this means in practice. Perhaps one of the regulators is point (or bad cop) on one deal or the regulators share the research burden.

In the earlier podcast, Chris and Andrew discussed the current U.S. antitrust regime, which could be viewed as quite aggressive regarding antitrust enforcement. In my opinion, the difference in the probability of deals getting over the finish line is only marginally different under different regimes. This is likely partly due to investment bankers and companies adjusting to what will fly under a particular regime. Second, the budgets aren’t always that different. Regulators can’t always go after everything they want.

For a particular deal, though, it could make a big difference. I also subscribe to the assessment proffered by Chris that there seems to be a regulatory willingness to bully/intimidate/frustrate companies out of deals. At every stage. Before they leave the boardroom, as well as during the merger process. Antitrust regulators seem very energetic and perhaps more cooperative lately. It is something to watch, although I expect it is generally beneficial for merger arbs as it widens spreads.

Reuters also reported the case echoed the Alphabet (GOOG, GOOGL) case where they acquired Fitbit. I wrote about that deal here. The market was skeptical that it would clear the EC, but ultimately it did. In that case, Alphabet had to agree to restrictions on using customers’ health-related data. This is now also covered under the DMA. The Fitbit deal was done before this regulation was in effect. From the Reuters article:

Some of the issues in the Amazon deal are covered in new tech rules known as the Digital Markets Act which sets out a list of dos and don’ts for Big Tech, but antitrust officials do not want those obligations as an excuse to take a more lenient line on the deal, one of the people said.

It seems sensible not to give Gatekeepers a free pass because more strict laws cover them. The law is supposed to have the opposite effect, after all. However, proactively barring deals on stuff that you have specifically created laws for, I don’t think the general court is going to love that.

I got the sense from the latest developments that the lawyers at the EC wanted to clear this unconditionally. For some reason(maybe tactical to help negotiations with the regulator playing the bad cop part here), the boss interfered, and they begrudgingly objected to parts of the deal. They’ve cornered themselves in a fragile position. I’m not sure they will extract much from Amazon this way. The deal is taking a very long time. This could be because Amazon isn’t very eager to compromise on many issues to get the deal done.

The retail giant has paid top dollar for iRobot (even after the recut) and may not want to lose on all sides. If the EC or the FTC clears a deal, it is historically quite rare the other ultimately does block it. That’s why the stock price increased so much on the news of Europe clearing. The objection is terrible news, but I don’t think it is as bad as it would be without the above context.

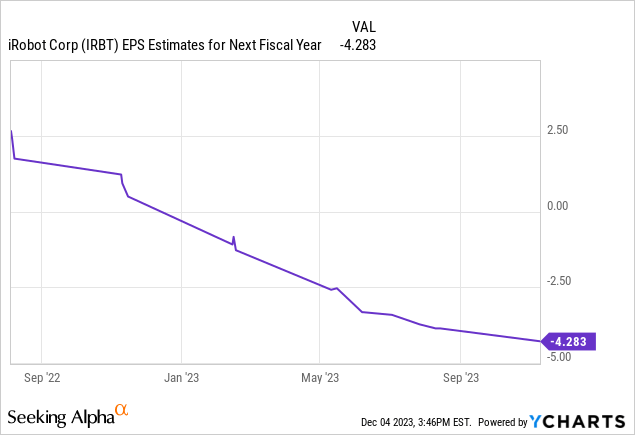

If this deal is shut down or breaks, it could be bad. Analysts have been constantly revising estimates downwards since the deal:

The company also hit one EPS target, then surprised 3/4 on the downside, including a massive surprise. Companies tend to outperform EPS estimates, so that’s pretty bad.

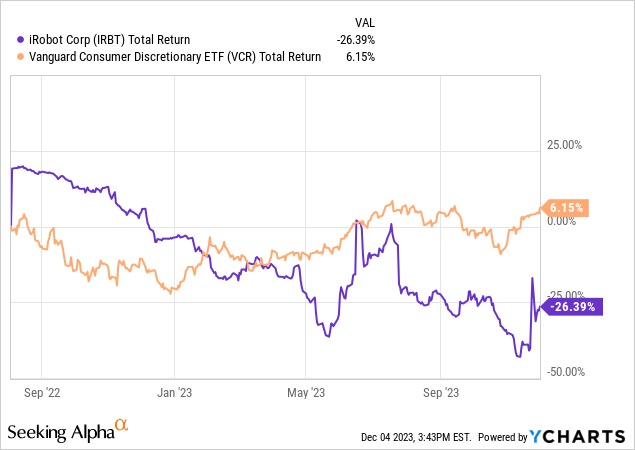

But the stock is trading like the merger is highly questionable, so some of that has been priced in. Consumer discretionary as represented by Vanguard Consumer Discretionary Index Fund ETF Shares (VCR) just had a fast rally:

From the options market, I understand that the downside will likely fall somewhere in the $20 – $28 range. That’s a downside risk of between 24% and 46%. Meanwhile, there is a 40% upside here. Suppose Amazon gets to a deal with the FTC; that probably also solves the EC (given that the objection is very weak). Mergers don’t fail very often. They fail even less often for regulatory reasons. Naturally, the failure rate is much higher after objections and/or 2nd requests vs. the average.

The merger process has already been going on for over a year. iRobot Corporation is a $1 billion vacuum cleaner company. I think it is unlikely to close in December or January. I think the market underestimates the odds this will close somewhere after that. It’s not my favorite M&A event out there, but I think iRobot Corporation stock is good enough to have exposure to.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of IRBT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign up here for a 14-day free trial of my weekly premium trade & investment ideas. Discover the best things I can find in this market. Unique and hard-to-find ideas, selected based on the presence of edge, outstanding risk/reward and being uncorrelated or being less correlated to the S&P 500.