Summary:

- Thermo Fisher has normalized its growth spurred by the pandemic-induced boom.

- It has made progress in paying down its high level debt and pulling up its cash-at-hand.

- M&A is an integrated part of its growth strategy, we take a look at its past and current cases and form an expectation for deals next year.

- Looking ahead at near-term cash flow indicates its current stock price is embedded with a rich premium.

jetcityimage

Investment Thesis

Preview

We initially covered Thermo Fisher Scientific (NYSE:TMO) in our article “Thermo Fisher Scientific: From Pandemic Boom To More Sustainable Growth Path” in March this year. Our thesis was built on the company’s current trajectory of normalizing from its boom brought about by the pandemic. We identified its high debt and low cash-on-hand as factors to reckon with, given our expectation of gradually drifting lower earnings ahead. Since then, the company’s stock has declined by as much as 20% but later bounced back. It is now about only 8% lower than in March.

Updates

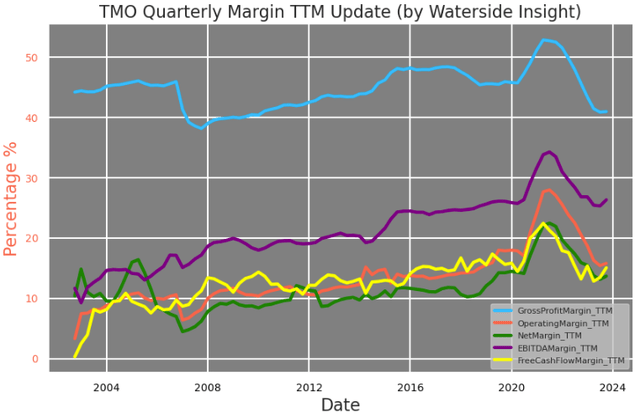

Although Thermo Fisher’s revenue is still at its all-time high levels, its margins have indicated it is mostly back to pre-pandemic levels. This confirmed where we pointed out before that it is on a path to more sustainable growth normalizing from the pandemic boom.

Thermo Fisher: Quarterly Margins Update (Calculated and Charted by Waterside Insight with data from company)

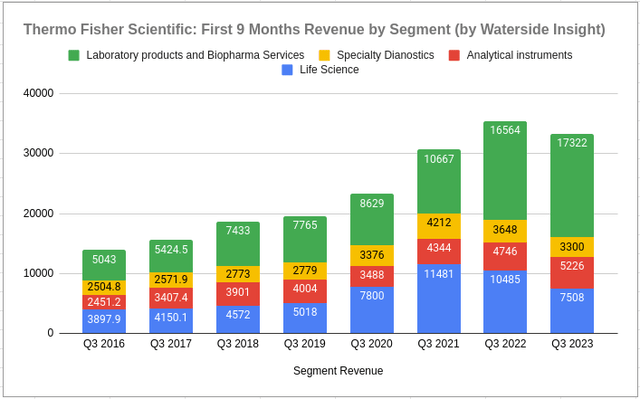

We previously expected the company to tackle its high debt level and develop new growth patterns in the post-pandemic world. In the updated charts below, we can see the biggest revenue slowdown is in the Life Science Solution (LSS) segment. The gain for the Lab & Biopharma (LPBS), and Analytical Instruments (AI) segments are showing staying power. They both have continued to expand since 2020.

Thermo Fisher: First 9 Months Revenue by Segment (Calculated and Charted by Waterside Insight with data from company)

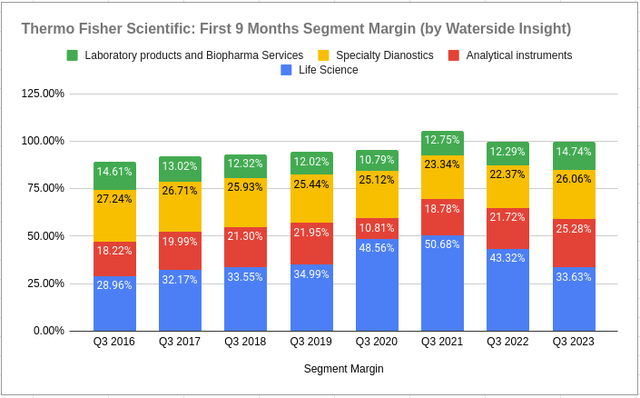

From each segment margin’s perspective, most of them held up on a YoY basis except for Life Science Solutions (LSS) again. But its margin was falling back to where it was in 2019. All other three segments’ margins were having steady growth compared to pre-pandemic.

Thermo Fisher: First 9 Months Segment Margin (Calculated and Charted by Waterside Insight with data from company)

The LSS segment is critical to Thermo Fisher, and the company has been taking actions aimed at strengthening its competitive advantage. The company is expanding a strategic partnership with Flagship Pioneering to form new platform companies for life science, and it didn’t stop there. It is in the process of making a $3.1 billion acquisition of Olink, a leading provider of next-generation proteomics solutions. Olink is set to become part of the Life Science Solutions segment. According to the acquisition announcement, Olink is expected to deliver $200 million in revenue in ’24 and grow in mid-teen annually. It is also expected to deliver $125 million of income by year five. So if we assume it grows 15% per year, by year five, its revenue will be $350 million, then the expected net income margin is 35.73% for Olink. It is about the same as the LLS segment’s current margin, but the potential of proteomics has far greater implications for Thermo Fisher. In the latest field of biopharma research, combining the proteomics approach with genomics and bioinformatics provides a greater in-depth understanding of the information of the biological systems along with their disease alteration. This is highly complementary to TF’s existing mass spectrometry platforms and applications.

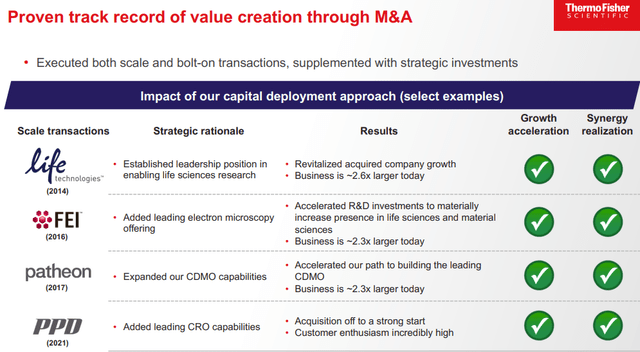

Thermo Fisher has a proven track record of successful M&As. The acquisitions it made during the five years before the pandemic have grown more than 2x. Since then, in 2021 it acquired PPD for the Laboratory Products and Services Segment, which strengthened the drug development process, and later changed the name of this segment to Laboratory Products and Biopharma. The LPBS segment grew by 45% in revenue in the next year after this acquisition. Also by the end of 2022, it acquired the Binding Site Group focusing on early diagnosis and monitoring via regular testing in patient care to enhance the Specialty Diagnostics segment, expecting to add $0.07 EPS this year. Since then, the SD segment’s revenue has stayed flat in the first 9 months but its margin increased by 16.5%. Acquisitions have always been an integrated part of Thermo Fisher’s growth strategy, but Investors should also pay attention to its goodwill, which is sitting at about $45 billion or 47% of its assets, up from 42% before the pandemic. From this perspective, until it accumulates a larger pile of cash with faster asset growth, its deal-making next year could be smaller.

Thermo Fisher: Record of M&A (Company Presentation)

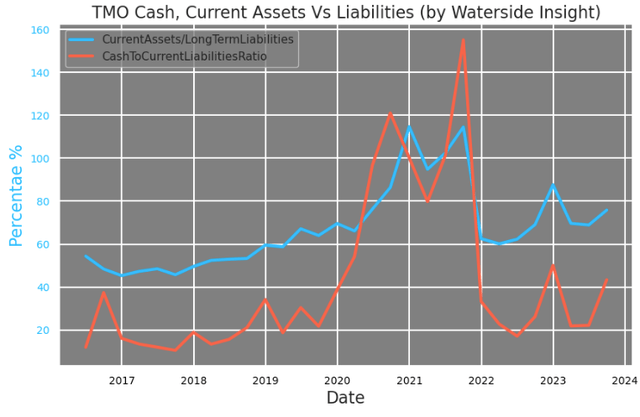

On the debt front, which is another aspect that we previously wanted to see improvement on, Thermo Fisher has also made some progress. It repaid $2 billion or 5% of debt in the first 9 months of this year, up from $375 million for the same period last year, Its total debt still grew by 2.3% this year after this repayment. It paid about $1.9 billion of commercial paper this year but is currently in the process of issuing another $2.5 billion of notes. Its cash and cash equivalents cover about 40% of its current liabilities, which was up from the 20% low earlier in the year. The Olink acquisition requires about $143 million in cash, and we expect this ratio will go back down to 20-30% again. Its current assets are covering about 80% of its long-term liabilities, a bit higher than pre-pandemic. Its leverage over its liquidity is within the norm, but there is limited room to go higher. We think at least for the next three years, it will need to continue reducing its debt by a similar size as this year.

Thermo Fisher: Current Assets vs Liabilities (Calculated and Charted by Waterside Insight with data from company)

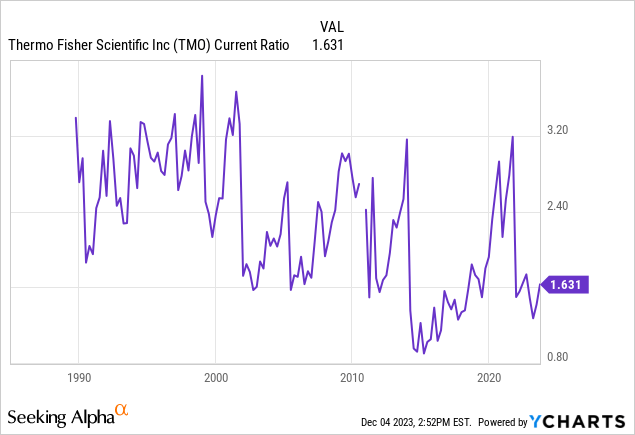

The company’s current ratio has improved by a tad to above 1.5x, and its average in the past twenty years is about 2x. Thermo Fisher has also just authorized $4 billion of share repurchase in November, replacing its remaining $1 billion existing authorization. It has made $3 billion in common stock repurchases and a $387 million dividend payout in the first 9 months so far. But we think the repurchase for next year could be smaller.

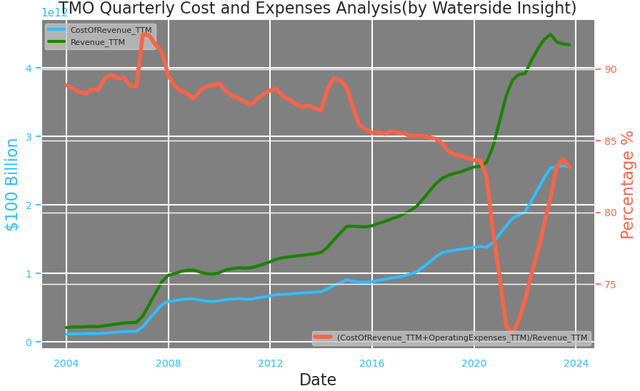

For execution in cost reduction and efficiency improvement, Thermo Fisher executes a PPI system, short for Practical Process Improvement (PPI) business system. In this system, the company deploys global sourcing initiatives, headcount reduction, facilities consolidation, and low-cost region manufacturing strategies to keep costs and expenses under control. Such a system helped it to navigate the phase with supply chain constraints effectively in the past two years. Now its costs and expenses are back up to the level of 2020. With more acquisitions done in the past three years, including the ongoing one of Olink, there is room for the PPI system to be put to work with more consolidation and perhaps headcount reduction as well in order to maintain the margins.

Thermo Fisher: Costs and Expenses (Calculated and Charted by Waterside Insight with data from company)

Overall, we see Thermo Fisher making progress in the areas that we were concerned about and our expectation of its normalization has mostly materialized in the past six months. The company has made one large acquisition per year of targets that can best complement its current portfolio in search of long-term growth drivers. But the pace or the size could moderate next year if it makes any acquisitions. To take a pause and consolidate its current holdings probably wouldn’t be a bad idea.

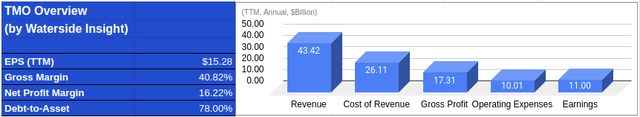

Financial Overview & Valuation

Thermo Fisher: Financial Overview (Calculated and Charted by Waterside Insight with data from company)

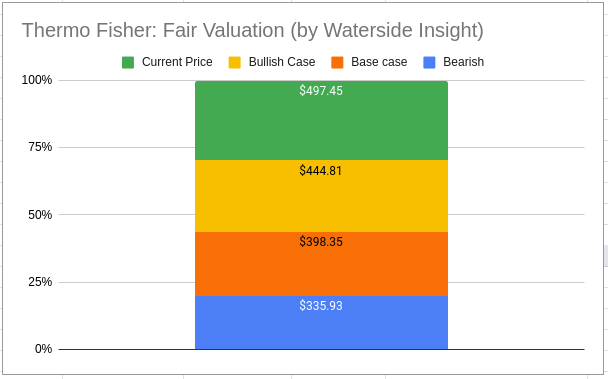

Thermo Fisher has greatly reduced its CapEx since early this year, from over $500 million to now about $300 million quarterly. This has brought the CapEx back down to where it was in 2020. We originally expected its free cash flow would decline by about 15% this year, but due to this reduction, it’s now on track to only lessen by 5% YoY. Its CapEx is hard to be reduced further from here. So for us, a free cash flow slowdown is still to be expected in 2024 if net income doesn’t improve. And its rising debt level has prompted us to increase the WACC to 8.4% from 6.77% previously, given the higher interest rate environment. The updated fair value assessment has been revised down with current prices topping our bullish case.

Thermo Fisher: Fair Valuation (Calculated and Charted by Waterside Insight with data from company)

Conclusion

Amidst a normalization from the pandemic-induced boom, Thermo Fisher has continued to make progress on several fronts to keep long-term growth intact, reducing debt and strengthening its cash reserve. But these efforts are not going to be one-off, and they will need to be kept up in the next few quarters, while more consolidation could be on the card. The rising price since the end of October has taken the stock above our revised fair valuation. Although we are optimistic about its long-term growth, we will recommend a sell based on the rich premium embedded.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.