Summary:

- Disney’s decision to reinstate the dividend is questionable given the company’s recent struggles.

- The $1.10 billion dividend could have been better allocated to invest in Disney+ to make it profitable, invest in quality content, improve the theme parks, or reduce debt.

- The dividend may not have a significant impact on shareholders and does not address the underlying problems facing the company.

Keystone

Context

Until the early 2000s, Disney (NYSE:DIS) was one of the most dominant companies in the world: its brand was very strong thanks to successful productions and proper administration of the parks. Everyone was crazy about Disney, including me to be honest.

At the time, it was hard to imagine that this company would struggle, after all, its business model was as simple as it was brilliant: create successful productions, put them in the theme parks and sell merchandise at a high price. Who wouldn’t purchase Mickey Mouse ears once arriving at Walt Disney World?

Apparently, however, even the best companies in history can run into trouble and that is what is happening to Disney. In my opinion, the main problem has been the management of the last 7-8 years (starting with the acquisition of 21st Century Fox). Anyway, how this company has gradually weakened I have already talked about in a previous article, today I want to focus on the latest questionable decision: issuing the dividend again.

A few days ago the company announced that it will reinstate the dividend, paying $0.30 to shareholders every half year. In other words, we are talking about a dividend yield of about 0.60%. It is likely that the decision to reinstate the dividend was made so that various institutional investors could invest in Disney, but frankly I wonder if it was worth it. Shareholders do not seem happy with this choice and at this point wouldn’t a buyback have been better since the price per share is so low compared to the past?

In my opinion, this is yet another flawed choice made by the company and in this article I will show you at least four better uses for allocating the $1.10 billion or so that will paid out via the dividend.

First use: investing in Disney+

As we all know, the DTC segment has been one of the most talked about issues in recent years since it is bringing huge operating losses to the company. That segment includes Hulu, ESPN+ and the much-loved Disney+.

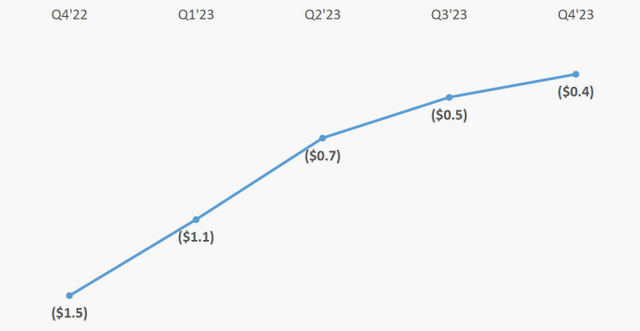

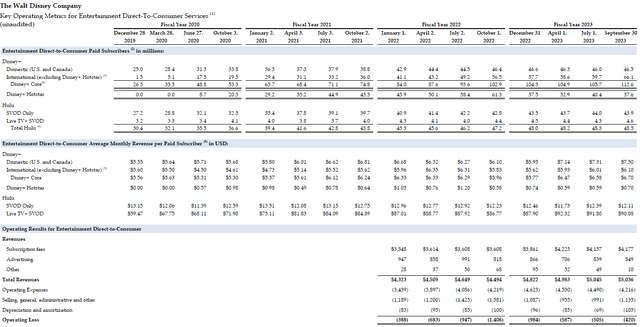

Disney’s Fiscal Full Year and Q4 2023 Earnings Results

Since Q4 2022, the DTC segment’s operating losses amount to as much as $4.20 billion, much of which depends on Disney+. The latter, according to management’s expectations, should become profitable by Q4 FY2024. Indeed, the improvement is evident from quarter to quarter, but my doubts remain about the feasibility of the target.

Disney’s Fiscal Full Year and Q4 2023 Earnings Results

Revenues reached $5.03 billion in Q4 FY2023, up 12% from the previous year but stalled from the previous two quarters. At the same time, operating expenses decreased steadily over the past two quarters and reached $4.21 billion. Basically, since Q2 FY2023 the main driver for the improvement in operating income is no longer revenues, but the reduction in operating expenses. While this reduction is positive as it saves the company several million, it also means investing less in a segment that remains highly unprofitable. Having less operating expenses also means spending less on entertainment content and thus having less material within the Disney+ platform or reducing their quality. For a platform that still has to grow before it reaches profitability, this could prove to be a glaring mistake in my opinion.

Although unprofitable, in terms of subscribers Disney+ is already a mature platform and has reached 112.60 million users (Disney+ Core). Its growth has slowed significantly in recent quarters compared to a few years ago, and I see the reduction in operating expenses as a reason to think that reaching new users will be difficult in the future. Should my hunch be correct, the goal of making Disney+ profitable by Q4 FY2024 may not be feasible. After all, we are talking about a business with high fixed costs and increasing users is the basis for making it profitable. Disney+ Core’s average monthly revenue per paid subscribers came in at $6.70, only $0.74 more than Q4 FY2022: too little in my opinion to overlook subscriber growth. By the way, Disney+’s ongoing price increase could be another reason for slowing new subscriber growth.

My impression is that management underestimated how difficult it would be to make Disney+ profitable, and the resounding success within a few months of the platform’s release fueled the misconceptions.

The goal of making Disney+ profitable by FY2024 is not recent, but dates back to late 2020. Actually, the plan was feasible, but as long as total subscribers (Disney+ Core and Disney+ Hotstar) increased as in the first quarters. By FY2024 between 230-260 million Disney+ subscribers were expected; today we are at 150.20 million. Frankly, I would be surprised if subscribers continue to increase, let alone get 110 million subscribers in one year.

Over the months the company’s guidance has been gradually lowered, but that doesn’t take away from the fact that the early estimates made were totally different from what is the situation today. With 260 million subscribers there is no doubt that Disney+ can be profitable; with 150 million and declining operating expenses I would not be so sure. So, since it may take longer than expected to make the platform profitable, I would expect operating losses to be greater than expected.

In light of these considerations, I personally do not think there is a case for issuing a dividend. Disney+ is critical to Disney since it has invested several billion over the past few years, and that $1.10 billion it will give to shareholders could have been used to improve the platform. It could have been spent on advertising, creating/acquiring new content, or anything else that would have had a positive impact on revenues and new subscribers. I think shareholders would be more pleased to know that Disney+ has become profitable than to receive a 0.60% dividend yield. Maybe investing this $1.10 billion wouldn’t have solved the problem, but the dividend certainly won’t solve it.

Second use: investing in quality content

Over the past few years, Disney’s new content has come under heavy criticism and has often not received the following they had hoped for. I do not want to dwell too much on this point, partly because you already know why this is happening. In any case, the worrying aspect is that new Disney productions are having often disappointing results and are not even breaking even. For a brand like Disney, investing hundreds of millions of dollars in a production and not getting the desired result is a major image loss. From this point of view, 2023 has been a complicated year:

- Wish was released a few weeks ago and had one of the worst Disney openings ever for an animated film. Its production costs were among the highest in history for an animated film: a whopping $200 million not counting marketing expenses. To be considered a success, at a minimum it must make $400 million at the box office, but so far it stands at only $82 million. Wish has the potential to be a financial disaster.

- The Marvels cost $274.80 million not counting marketing expenses. The worldwide box office was only $198 million, so another disaster financially. Even the Marvel saga, which was popular until recently, is gradually deteriorating.

- The Haunted Mansion cost $90 million and had a worldwide box office of $156 million. Considering marketing expenses as well, more or less this production has broken even. Regardless, we are far from considering it a success.

- The Little Mermaid had a worldwide box office of $568 million, thus a good result. However, production costs were $250 million and marketing expenses as much as $140 million: the net is about $178 million. It was not a failure compared to previous ones, but much more was expected from this production. For example, the live action The Lion King and Aladdin totaled $1.60 billion and $1.05 billion, respectively. Also, it is worrying how The Little Mermaid has a huge amount of 1-star ratings on IMDb: fans are disappointed with the latest productions.

- Indiana Jones and the Dial of Destiny totaled $381 million at the box office worldwide but cost $300 million not counting marketing expenses. In other words, it is yet another mediocre result.

Elemental was probably the main success having totaled $486 million against $200 million in costs, but still we are talking about a rather low net by Disney standards. In short, it is clear that there are major problems in the production since fans no longer have the same pleasure of going to see a Disney film in the theater. It certainly affects the fact that all movies are available for free on the Disney+ platform a few months after release: this leads subscribers not to go to the theaters. In any case, I wonder how long this strategy can go on since box office revenues are depressing and Disney+ is still unprofitable despite everything.

Returning to the dividend discussion, since there are obvious difficulties in the company’s core business as it loses money in its new productions, the choice to issue $1.10 billion externally each year seems quite ambiguous. With that money one can finance at least three successful productions to bring the brand back; one can invest in making productions that can bring fans back to the theaters. Apparently, this all comes after the dividend issue.

Third use: investing in parks

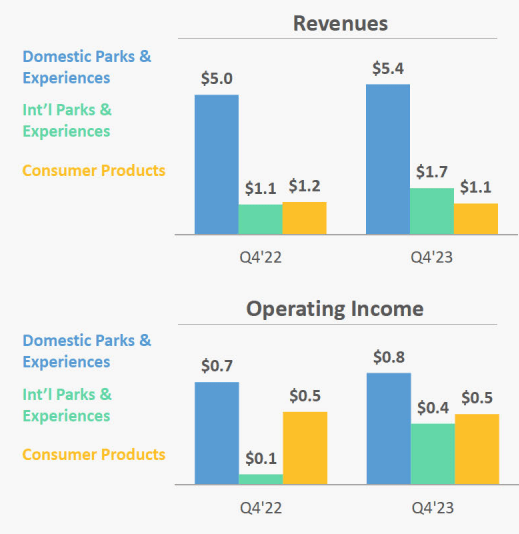

Disney parks are undoubtedly the strength of this company and the market segment where it really has a competitive advantage unlike streaming.

Although streaming is responsible for most of the revenue, in the end it is the parks that generate most of the operating income, so they have significantly higher profit margins.

Disney’s Fiscal Full Year and Q4 2023 Earnings Results

Compared to last year, there has been both an increase in revenue and an increase in operating income, which is definitely a positive factor. Clearly, this is the best line of business, and I personally don’t understand why they would give away $1.10 billion to shareholders when that money can be used to improve the experience in the Disney parks even more.

A few months ago the company stated that it will invest $60 billion in the parks over the next 10 years, which seems to be a smart idea since it would enhance its best line of business even more, but where will this money come from?

Free cash flow in 2023 was $4.89 billion and net debt is a whopping $36.49 billion. As we will see later, some of that debt will have to be refinanced at much higher interest rates probably and this would lead to higher interest expenses. So, it will not be an easy task to invest $60 billion in parks over the next 10 years: that $1.10 billion a year would have been helpful to at least reduce the increase in debt.

Finally, regarding the parks, a potential problem should be highlighted: they are becoming too expensive. This phenomenon mainly affects Walt Disney World rather than the international parks. Disney does not release attendance numbers, so it is rather difficult to quantify the extent of this phenomenon. In any case, insidethemagic has released an interesting article:

Over the last few months, the Walt Disney World Resort has actually seen some of its lowest attendance numbers in years, especially around the 4th of July weekend.

Disney World saw its lowest attendance numbers in a decade during this period, shocking guests. This trend is continuing, with the months of August and September being relatively low for Disney World as well.

Probably, Walt Disney World’s exorbitant prices are driving visitors to the competition. In addition, recent failures in terms of new productions may have affected attendance at the world’s most famous theme park. After all, when the brand deteriorates, interest in everything about the company in question declines. In light of these considerations, the introduction of the dividend seems even more senseless.

Fourth use: reduce debt

As already anticipated, following the acquisition of 21st Century Fox, Disney has become a highly indebted company and net debt stands at $36.49 billion. From 2016 to the present, debt sustainability has changed greatly:

- In 2016 EBIT / Interest Expense was 40.92x, today 4.73x.

- In 2016 Total Debt / EBITDA was 1.19x, today 3.17x.

With this I do not want to create alarmism, certainly Disney will not go bankrupt in the coming years. In any case, the fact that the interest burden is growing more and more is not good news.

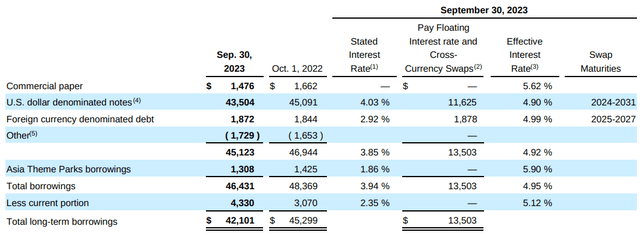

Disney’s Fiscal Full Year and Q4 2023 Earnings Results

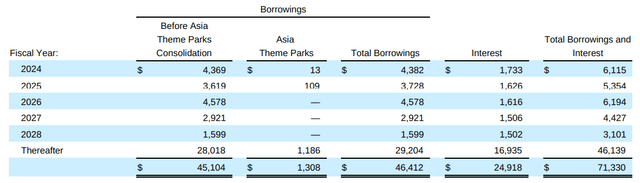

Total borrowings amount to $46.43 billion and have an effective interest rate of 4.95%. Since the current Fed Funds Rate is 5.25-5.50%, we can expect the debt to be refinanced at a much higher rate.

Disney’s Fiscal Full Year and Q4 2023 Earnings Results

Fortunately for Disney, most of the debt is very long term, so we are far from a critical situation. Anyway, loans worth $4.38 billion will mature in 2024 and need to be refinanced. Potentially, refinancing $3.72 billion in 2025 could also be painful for the company.

The financial situation is still stable, but if new productions and Disney+ continue to generate losses, over the course of a few years things could change. That $1.10 billion could have helped the company refinance in a complicated year like 2024, but again it chose to remunerate shareholders.

Conclusion

Disney’s choice to issue a dividend is in my opinion rather questionable since there are at least four better allocations of capital:

- Invest in Disney+ in order to make it profitable.

- Invest in successful new productions in order to reverse the recent disappointing trend.

- Invest in theme parks while avoiding further debt.

- Improve the financial position.

Assuming that shareholder compensation is the most efficient way to allocate this $1.10 billion, I don’t understand why not do buybacks since the price per share is quite depressed. By the way, I doubt that it will change anything for shareholders to get a dividend yield of 0.60%. Overall, I cannot understand why this choice was made. It may have been made to convince the market that Disney is back to what it used to be; to give a signal of strength.

The choice of my strong sell lies in the fact that I do not understand the choices of management in recent years, so the dividend is the straw that broke the camel’s back. The Disney brand is deteriorating and in my opinion the dividend issue is the last thing they should have thought about.

Finally, I would like to make it clear that what is said in this article represents only my opinion based on the external data that we investors have at our disposal. Since we do not know the internal dynamics of the company, it is very easy to judge management’s performance based on its results. There may be crucial factors that I do not know that led to the issuance of the dividend. So, although to me it seems senseless as a choice, it is not necessarily so.

As someone who has loved the brand for decades, I hope Disney can recover as soon as possible, but as of today I believe the light at the end of the tunnel is far away.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.