Summary:

- Salesforce, Inc.’s delivery of another profitable growth quarter, alongside a raised forward guidance, has been a boon to the stock in recent weeks.

- We believe the company is positioned for another earnings surprise come Q4, as growth continues to stabilize, while new AI CRM deployments continue to scale and complement ongoing cost-savings.

- However, the lack of multiple expansion ensuing from the outperforming earnings release underscores continued concerns stemming from broader macroeconomic headwinds, which could harbinger a compelling risk-reward buy opportunity.

Stephen Lam

Salesforce, Inc. (NYSE:CRM) stock has maintained gains from its latest post-earnings surge following delivery of an impressive cost-cutting campaign without compromising significantly on its business growth prospects. The consistent fundamental improvements observed in recent quarters imply that Salesforce is establishing a value proposition to its AI strategy. While we had previously feared that AI democratization would dilute Salesforce’s market share in customer relationship management (“CRM”) software, the company has instead continued to reinforce its grip in the industry by ramping deployment of newly introduced value-add features. These include the Einstein Trust Layer and an integrated Data Cloud to better facilitate customers’ existing CRM needs in the AI era. The effectiveness of Salesforce’s emerging AI strategy is corroborated by stabilizing growth in the low double-digit percentage range during recent quarters following a period of steep deceleration last year due to the cyclical downturn in enterprise IT spending.

The company’s increasing utilization of self-service sales channels where application, as observed through its recent partnership with Amazon Web Services Marketplace (AMZN), also marks a key approach for reducing marketing and sales costs – the largest portion of its operating expenses. This permits the reallocation of resources to funding growth investments, particularly Salesforce’s AI CRM strategy, which management views as the priority to stay economically and technologically competitive.

Looking ahead, we would expect further cost improvements at Salesforce heading into fiscal 2025, as new developments introduced in the current year – including Einstein GPT, Einstein Trust Layer, and other features/bundles associated with the ramp of Data Cloud offerings – continues to scale. And this will likely become the key compensating factor to Salesforce’s new normal of maturing growth in its core Sales and Service Cloud offerings.

Value Proposition in AI CRM

The deceleration in Salesforce’s core Sales and Service Cloud sales have stabilized in recent quarters, which corroborates increasing uptake in recently introduced AI CRM features, including Einstein. The incremental advancements made to the Data Cloud in recent quarters is likely bolstering adjacent demand as well by addressing customers’ increasing need for an integrated data strategy supportive of their respective AI strategies.

As discussed in our previous coverage, Salesforce’s newly introduced slate of Einstein GPT solutions integrated across its key analytics, productivity, and PaaS offerings have been key to its AI CRM strategy. While Einstein GPT-enabled applications offered by Salesforce primarily relies on third-party technology (i.e., OpenAI’s GPT model), the company has sought to boast its unique value proposition through the Einstein GPT Trust Layer. The Trust Layer effectively addresses enterprise data security needs in the process of adopting emerging generative AI technologies, while also catering to industry’s ongoing cost and performance optimization demands.

Specifically, the company’s proprietary Einstein Trust Layer allows customers to build their respective generative AI-enabled CRM solutions on Salesforce’s platforms without the need to move or store their data within the model, thus enabling a “secure and trusted” experience critical to the enterprise environment. With the Einstein Trust Layer having only recently entered general availability (“GA”) in October, we expect ensuing demand to have an improved impact in sustaining the company’s overall sales growth heading into fiscal 2025.

And to better improve user experience and cost effectiveness in customers’ transition to AI CRM software, Salesforce has introduced a slate of advancements to its Data Cloud and Einstein offerings, including the latest “Einstein 1 Platform.” The Einstein 1 Platform essentially takes Data Cloud integration to AI-enabled CRM solutions offered through Sales and Service Cloud to the next mile by allowing integration of customers’ data into models for building generative AI applications via a simplified low-code process. This feature is realized through the unification of disparate data sources within the Data Cloud for customers, enabling a “common language” that allows different applications built on Salesforce Platforms to communicate and interact with one another, and create value for customers.

The introduction of Einstein 1 Platform and its integration with Data Cloud effectively enhances workplace productivity, while also improving costs and reducing time to deployment for customers. The value proposition directly addresses the ongoing call for cloud spend optimization in the industry, while also catering to customers’ increasingly urgent need for the scalable adoption of AI solutions to maintain economic and technical competence, thus reinforcing demand for Salesforce’s CRM solutions.

In addition to the Einstein 1 Platform, the recently introduced Einstein Copilot AI assistant and Einstein Copilot Studio AI app builder offerings currently in pilot phase are also experiencing strong uptake amongst customers, which is corroborative of growing momentum in Salesforce’s AI CRM strategy. In the latest earnings call, management has reported a 17% adoption rate for Einstein Copilot amongst the Fortune 100 during the current pilot go-to-market phase, which underscores significant headroom for incremental adoption. Both features are also reliant on integration with Data Cloud, underscoring the critical role of the platform’s advancements in supporting CRM experiences in the AI-first environment.

More importantly, the Data Cloud is now offered at no additional charge for all Enterprise Edition+ customers, which helps to improve the exposure of Salesforce’s growing slate of AI CRM offerings to customers, and reinforces its prospects in capturing related opportunities. This is consistent with progress made in Salesforce’s improved product bundling strategy in recent quarters following the announcement of price increases during the summer, which management expects to impact new and upcoming contract renewals that will have a gradual impact on growth over the next three years.

In addition to Data Cloud’s availability through Enterprise Edition+ (“EE+”), Salesforce has also included its Einstein GPT-enabled CRM apps through its priciest Unlimited Enterprise+ (“UE+”) premium tier. With the rolling GA of recently introduced Einstein GPT apps, management has specified improved adoption rates on the UE+ tier during the fiscal third quarter. This effectively reinforces prospects of growth in multi-cloud deals and longer-term pricing gains at Salesforce, as up-tiered UE+ customers have already been observed to increase their spend on the platform by more than 70%. Taken together, Salesforce’s AI CRM strategy continues to deliver consistent positive progress supportive of sustaining normalized growth in the double-digit percentage range over the longer term, even as cost-cutting efforts continue.

Cutting Where it Matters Most

Meanwhile, Salesforce has also continued to deliver on its commitment to reducing costs and enabling a sustained pace of profitable growth. Management’s raised guidance for full year operating margins – even after an 800 bps y/y improvement – and cash flows, while maintaining a stabilizing pace of growth in recent quarters, effectively assuages investors’ concerns that ongoing cost-cutting efforts will “come at the expense of revenue growth.” The nimble balance between cost reductions and sustained growth is further observed through Salesforce’s revamped go-to-market strategy. In addition to significant headcount reductions across the board this year, Salesforce is further drilling into reducing marketing and sales expenses – its largest operating cost center – through the reliance on channel sales partners.

This includes the company’s recently announced availability of its CRM applications, as well as data analytics and productivity solutions like Tableau and MuleSoft on AWS Marketplace. Salesforce’s newly announced go-to-market strategy through AWS Marketplace will be key to further reducing its marketing and sales costs, as it encourages a greater volume of self-serve deployments of its offerings across customers. It will also help to address customers’ cost and time to deployment optimization needs by allowing seamless integration of AWS data into Salesforce products purchased through Marketplace.

Meanwhile, the partnership is expected to reinforce Salesforce’s exposure to AI CRM opportunities by leveraging AWS’ massive reach into the enterprise segment. Specifically, AWS is currently the leading primary cloud service provider, commanding about a third of the market share. Approximately 30% of large enterprises generating annual revenue of more than $5 billion, and about 60% of cloud needs across medium-sized enterprises with annual revenue between $1 billion and $5 billion uses AWS as their primary cloud service provider, which complements Salesforce’s aspirations to further its reach into AI CRM opportunities.

The combination of reduced sales and marketing outlays and expanded market reach enabled by the partnership with AWS Marketplace underscores an effective strategy for Salesforce to further improve profit margins without compromising on revenue growth. It also paves way for additional channel sales partnerships with other major hyperscalers, including Microsoft Azure (MSFT) and Google Cloud Platform (GOOG, GOOGL), in the future, which would reinforce Salesforce’s market share gains in AI CRM opportunities ahead.

Fundamental and Valuation Considerations

The combination of a unique value proposition in enterprise CRM software through Salesforce’s proprietary Einstein AI offerings, alongside seamless integration of Data Cloud continues to reinforce the company’s moat in the industry. Meanwhile, increasing reliance on a self-serve go-to-market strategy via hyperscaler partnerships where applicable also mitigates Salesforce’s exposure to both macroeconomic and optimization headwinds by addressing customers’ efficiency needs, while also optimizing its marketing and sales efforts. The combination will be key to sustaining Salesforce’s current pace of likely normalized, albeit slower, growth going forward, and complement the growing impact of recent price hikes on services provided over the next three-year horizon as expected by management.

Meanwhile, the stabilizing growth set-up will likely compel a continued market focus on Salesforce’s margin expansion and cash flow prospects. We believe there is incremental room for further reduction in Salesforce’s marketing and sales costs, particularly as management expects greater reliance on channel sales. The newly introduced AI CRM offerings are also expected to scale and improve overall operating leverage.

However, we remain cautious of execution risks over the longer term – specifically, Salesforce’s aggressive cost-cutting efforts need to be a balanced endeavor to prevent erosion of its future growth prospects. Despite secular tailwinds to its AI CRM strategy, and Salesforce’s increasing role as the standardized enterprise CRM solution provider, the company has yet to demonstrate an ability in driving value accretive gains supportive of growth reacceleration, nor structural advantages in preserving its market share leadership against disruption from competitors – including Microsoft’s recent deployment of generative AI-enabled Sales Copilot software aimed at taking share from the CRM market.

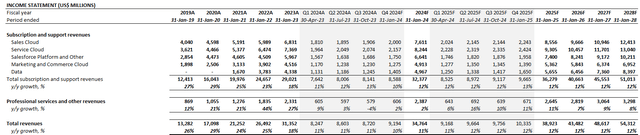

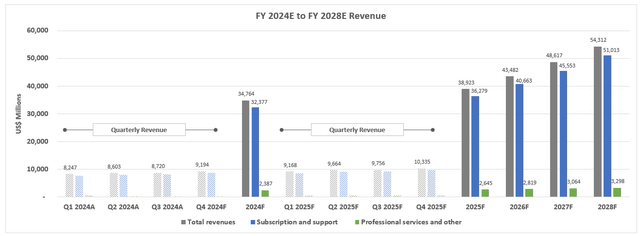

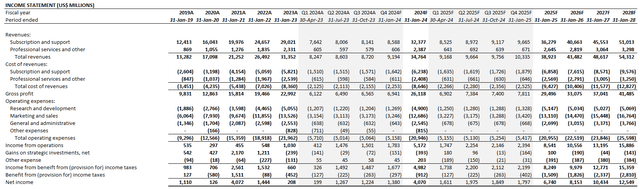

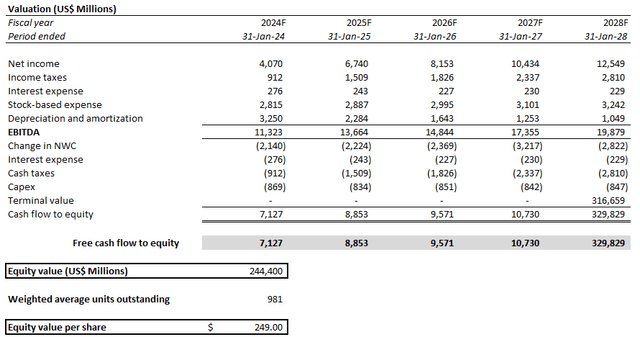

Taken together, our forecast expects Salesforce’s growth prospects to stabilize at a 12% five-year CAGR, with limited room for significant growth reacceleration in subscription and support revenues. Specifically, anticipated momentum in Data Cloud uptake is expected to complement demand for AI CRM solutions offered across the Sales and Service Clouds, and offset maturing growth in legacy solutions within Salesforce’s “highest grossing” segments.

Meanwhile, our forecast estimates further expansion of GAAP operating margin over the next five years. In the upcoming quarter alone, even based on Salesforce’s lower range revenue guidance, the company is well-positioned for another EPS beat of as much as $0.20 like it did in Q3. This is expected to be primarily driven by the continued scale of rolling GA on recently introduced AI CRM solutions, as well as incremental cost reductions stemming from greater reliance on self-service purchases and other sales optimizing efforts. The undertakes are expected to at least maintain the cost structure and profit margins observed in Q3 and potentially take Salesforce’s EPS beyond $1.40 in the current quarter, compared to management’s guide at the $1.20-level.

Salesforce_-_Forecasted_Financial_Information.pdf

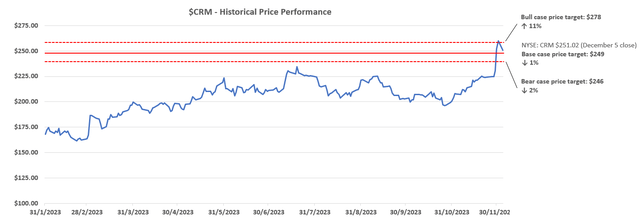

As a result of our latest adjustments to Salesforce’s fundamental forecast based on its recent performance and forward prospects as discussed in the foregoing analysis, we are upping our price target for the stock to $249.

The price target is derived using the discounted cash flow (“DCF”) approach, which considers cash flow projections taken in conjunction with the foregoing fundamental analysis on Salesforce. The upward revised price target is primarily the result of Salesforce’s continued cash flow growth outperformance realized through its sustained pace of profitable growth observed in recent quarters, which offsets conservatism over the forward normalized risk-free rate environment.

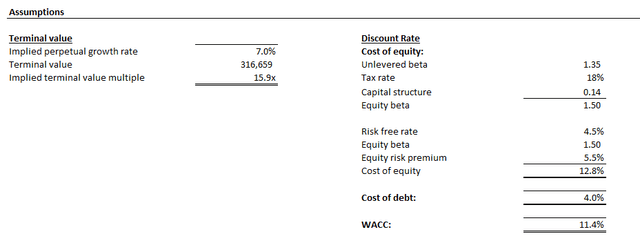

Specifically, our analysis applies an estimated perpetual growth rate of 7% on projected fiscal 2028 EBITDA. The perpetual growth assumption applied is equivalent to 2% on projected fiscal 2033 EBITDA when Salesforce’s growth profile is expected to normalize in line with the pace of estimated economic expansion across its core operating regions.

Our analysis also assumes an 11% WACC in line with Salesforce’s risk profile and capital structure relative to the anticipated normalized risk-free rate of 4.5% considering the “higher for longer” monetary policy stance. Despite our optimism for another round of earnings beat in Q4, we remain cautious of the uncertain interest rate backdrop in the near-term, which continues to serve as a key roadblock to unlocking pent-up value in the Salesforce stock.

Final Thoughts

Salesforce’s continued realization of cost-savings without compromising on its recent growth trajectory remains a bright spot. The achievement continues to bolster returning market confidence in Salesforce’s ability to sustain a normalized pace of growth at current levels, supported by improving demand for its proprietary AI CRM offerings. The results have also demonstrated Salesforce’s ability to effectively mitigate against market share dilution risks given the increasing democratization of AI access across the broader software industry, which helps to preserve its moat as the standard enterprise CRM solution provider.

Despite significant growth deceleration from its heyday, Salesforce’s continued margin expansion and cash flow growth efforts will remain a key focus area for investors and upside driver for the stock. However, from a valuation perspective, we believe the stock’s fundamental-driven upsides continue to be impacted from broader market risks in the near-term. We believe this could potentially harbinger a compelling buy opportunity in the next 12 months to optimize participation in Salesforce’s longer-term upside potential realizable through its improving cash flows.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Thank you for reading my analysis. If you are interested in interacting with me directly in chat, more research content and tools designed for growth investing, and joining a community of like-minded investors, please take a moment to review my Marketplace service Livy Investment Research. Our service’s key offerings include:

- A subscription to our weekly tech and market news recap

- Full access to our portfolio of research coverage and complementary editing-enabled financial models

- A compilation of growth-focused industry primers and peer comps

Feel free to check it out risk-free through the two-week free trial. I hope to see you there!