Summary:

- AT&T Inc. strikes a deal with Telefonaktiebolaget LM Ericsson (publ) to accelerate Open Radio Access Networks, causing AT&T shares to rise and Nokia shares to drop.

- AT&T plans to build a telecommunications network using ORAN, covering 70% of its wireless traffic in the U.S.

- Ericsson stands to benefit from the deal, but its financial performance has been under pressure with declining profits and cash flows.

- Long term, AT&T should benefit from reduced costs, higher profits, and a better competitive position relative to peers.

bjdlzx

In many business transactions, there are both winners and losers. One such example can be seen by looking at the recent news that broke regarding telecommunications giant AT&T Inc. (NYSE:T). On December 4th, the management team at the firm announced that it had struck up a deal to collaborate with Telefonaktiebolaget LM Ericsson (publ) (NASDAQ:ERIC, OTCPK:ERIXF) in order to “accelerate” what is currently called ORAN (Open Radio Access Network) within the U.S. This is a massive development that will involve AT&T spending approximately $14 billion over the next five years. Naturally, shares of the giant shot up 3.4%, while shares of Ericsson moved up an impressive 4%. But in response to this news, Nokia Oyj (NOK), which had been thought of as a valid prospect for AT&T to work with on this kind of initiative, saw its shares drop by 5.1%.

Clearly, the market understands that this is a net negative for Nokia since it will be missing out on tremendous amounts of revenue over the next few years. But while it is slated to be the loser of the three, both AT&T and Ericsson stand to benefit. The fact that much of the $14 billion, if not all of it, that AT&T will spend over the next five years should flow to Ericsson makes clear exactly how that company is winning in this arrangement. But as for AT&T, the upside is a much longer-term play and involves bolstering the attractiveness of its network relative to similar players.

Understanding ORAN

The purpose of this article is not to provide a deep dive into ORAN on its own. To be honest, a massive body of content could be produced just by defining what this is and explaining how it operates. But it would be helpful for the context of this article to understand the very basics of it. In short, RAN architecture involves an antenna at a radio base station that picks up signals from a user’s device such as a cell phone. As technology has expanded, other types of devices have come to rely on RAN architecture. Examples include certain types of vehicles like autonomous vehicles, drones, and IoT (Internet of Things) devices.

Once the signal is received by the radio base station, it is then sent to what is known as the “core network” utilizing baseband units. The core network serves to connect the device in question to outside networks such as the Internet, while baseband units enable wireless communication by securing the wireless signal, detecting errors, and more, so as to make effective communication possible.

Historically speaking, RAN systems were built with unified hardware and software. While this sounds efficient, it comes with certain downsides such as higher costs and a more rigid way of operating that reduces the flexibility of the system in question. This is where ORAN comes into play. To be clear, there are other variations of RAN such as CRAN (Cloud RAN). The purpose of ORAN is to reduce costs, improve flexibility, and reduce complexity by relying on hardware components that are built using industry-wide specifications that make it possible to rely on hardware and software that has been disaggregated. This means that different components of the hardware can come from different sources and, by incorporating it with the cloud, it becomes easy to streamline upgrades and updates, implement automation, and more.

A boon for AT&T

If we think about the near-term picture for AT&T, this development will mean absolutely nothing for the company. But in the long run, it will help to keep costs down and boost profitability. At present, none of the major telecommunications companies in the U.S. utilize ORAN for their networks. But over the next few years, AT&T is going to be working with Ericsson to build a telecommunications network that only uses this that will cover 70% of its wireless traffic across the nation. If all goes according to plan, the first fully integrated ORAN sites that the company is working on will be operating in coordination with Ericsson and Fujitsu (OTCPK:FJTSF, OTCPK:FJTSY) sometime next year. But it won’t be until late 2026 that the company hits its 70% target.

AT&T

While I mentioned that Ericsson will be a winner here, it’s important to note that, in order to create this environment throughout the company’s wireless network, it will be coordinating also with other suppliers such as Corning (GLW), Dell Technologies (DELL), Fujitsu, and Intel (INTC). The cost and operational advantages that the telecommunications conglomerate hopes to achieve by moving in this direction will help the company, according to management, “connect more Americans with 5G and fiber.” Regarding fiber, this is a big move because management has already been investing heavily in the rollout of its new network. Its current objective remains to pass at least 30 million consumer and business fiber locations by the end of 2025 and, in a recent speech, the company’s CEO, John Stankey, stated that the company sees an opportunity to potentially pass an incremental 10 million to 15 million consumer and business fiber locations using its existing footprint.

AT&T

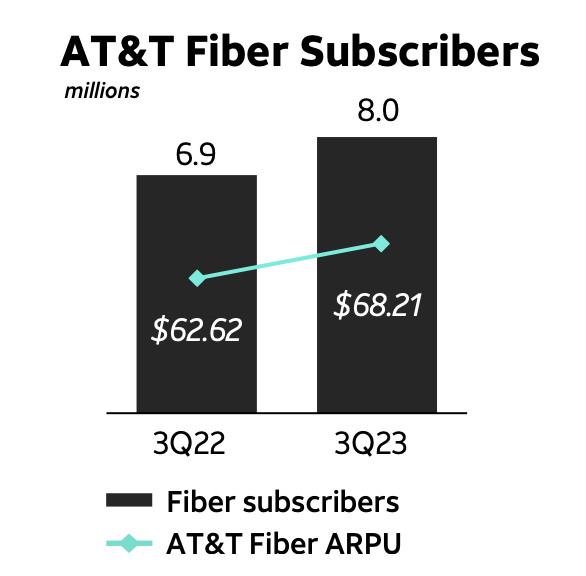

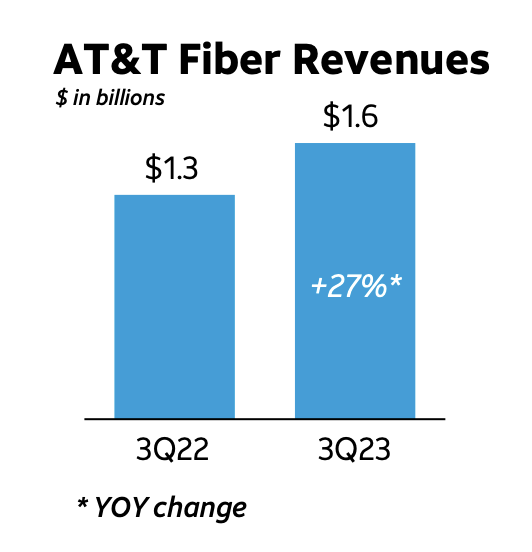

Fiber has been a big growth initiative for the conglomerate. In the third quarter of the 2023 fiscal year, the company, for the first time ever, passed the 8 million subscriber mark on its fiber network. That’s up from the 6.9 million that it had one year earlier. In addition to growing like a weed, the monthly average revenue per user, or ARPU, associated with fiber is expanding nicely. In the third quarter of 2022, it came in at $62.62. At the same time this year, it had grown to $68.21. That helped to bring quarterly fiber revenue up from roughly $1.3 billion last year to $1.6 billion this year.

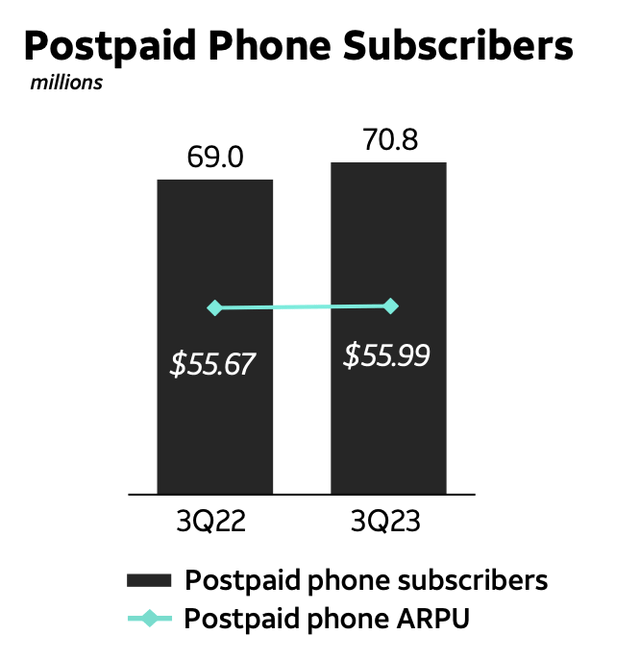

Speaking about 5G more broadly, AT&T stands to win in a rather big way. As of the end of the most recent quarter, the firm boasted that its mid-band 5G spectrum covers more than 200 million people nationwide. The sheer size of the company’s network has allowed it to grow to 70.8 million postpaid phone subscribers utilizing 5G as of the end of the most recent quarter. That’s up from the 69 million seen one year earlier. Although this does not seem like much growth, it’s important to note that the postpaid phone market is not exactly a growth area. It is incredibly mature and competition amongst the largest firms is fierce. So any sort of expansion should be seen in a positive light.

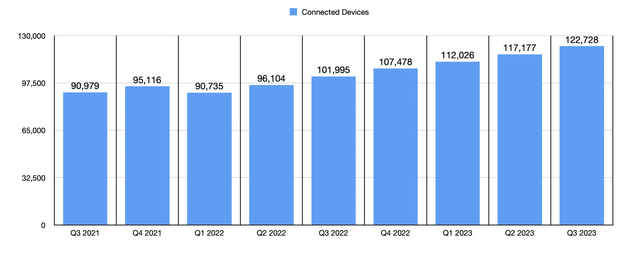

But as I mentioned earlier, 5G goes beyond just cell phones. Drones, other types of vehicles, and especially IoT devices have all caused demand for 5G access to explode. One really attractive play that the company has regarding IoT is the Connected Devices part of the firm. This involves non-phone devices, many of which are routers for vehicles that are used for connecting said vehicles to the Internet, that the company makes available for its customers. As of the end of the most recent quarter, AT&T had 122.7 million connected devices on its network. That’s up 20.3% compared to just under 102 million that the company had the same time last year. And growth continues to be strong. In just the third quarter alone relative to the second quarter, the company added 5.5 million Connected Devices to its network.

Again, none of what was recently announced should have a major impact on the company in the near term. This doesn’t change the fact that the company is still targeting free cash flow this year of $16.5 billion. It doesn’t change the fact that management still sees the firm’s net leverage ratio hitting or even falling below its target of 2.5 sometime in the first half of the 2025 fiscal year. And of course, this does mean that continued major investments in growth will be required. Next year, the conglomerate is still planning to spend between $21 billion and $22 billion on capital investments. But for those focused on the long run, this will improve the company’s competitive position and will almost certainly lead to additional revenue growth and higher profit margins.

Ericsson stands to win as well

As a special note, any financial figures covered in this section of the article reference U.S. dollars. Ericsson files its financial statements utilizing Swedish krona, so I have, using the most recent exchange rate, converted these amounts into dollars.

Operationally speaking, Ericsson is a rather sizable company that specializes in mobile network technology. It has three primary operating segments. The largest of these is the Networks segment, which specifically focuses on providing customers with RAN solutions, with its offering including a portfolio of cloud-native RAN functionality, passive and active antenna solutions, a service portfolio that covers network deployment and support, and more. Next, we have the Cloud Software and Services segment, which provides solutions for core networks, business and operational support systems, network design, managed services, and more. And finally, there is the Enterprise segment, which as its name suggests, provides various services to large enterprises.

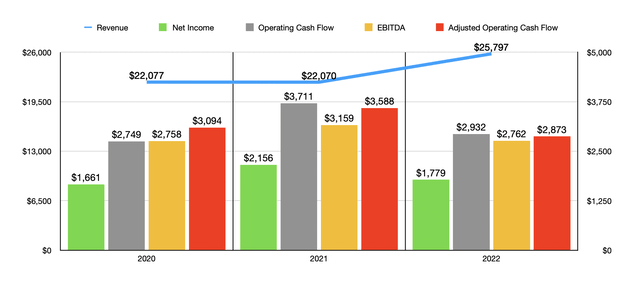

Although we have no idea the full financial impact that this relationship will have on Ericsson, it’s only likely to help the company. And frankly, help is something that Ericsson seems to need. Recent financial performance achieved by the company has been less than ideal. Revenue did spike to $25.80 billion in 2022, which is up from the $22.07 billion generated one year earlier. But profits and cash flows have come under pressure. Net income, for instance, dropped from $2.16 billion to $1.78 billion. Operating cash flow declined from $3.71 billion to $2.93 billion. Even if we adjust for changes in working capital, it dropped year over year. The same thing happened with EBITDA, which declined from $3.16 billion to $2.76 billion.

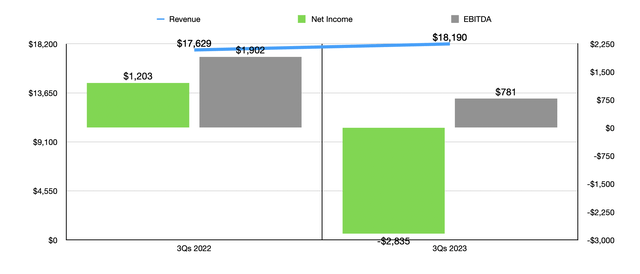

As a company that trades on the U.S. exchanges but as a foreign filer, Ericsson does not report all of its financial data on a quarterly basis. But what data we do have for the first nine months of this year suggests that it remains under pressure. Revenue fortunately jumped from $17.63 billion to $18.19 billion. But because of a massive impairment charge, the firm went from a net profit of $1.20 billion to a net loss of $2.84 billion. Even EBITDA took a hit, declining from $1.90 billion to $781 million. Outside of the aforementioned impairment, the company has been negatively impacted by margin compression. Its gross profit margin, for instance, managed to drop from 43.4% in 2022 to 41.7% thanks in large part to higher component costs that were driven by inflationary pressures and by large-scale projects that brought with them lower margins.

While I have no doubt that this transaction will help Ericsson from a revenue perspective, it will be interesting to see if it has come at a high cost from a margin perspective as well. Outside of this, the company’s purchase of Vonage, as well as a $161.5 million hit associated with foreign currency fluctuations, also hurt its bottom line last year. Gross margin pressures have also remained problematic this year, with the third quarter of the year reporting a reading of 39.2%. Although better than the 38.3% seen in the second quarter, it pales in comparison to the 41.4% experienced in the third quarter of last year. Management attributed this to lower sales and margins associated with its Networks segment.

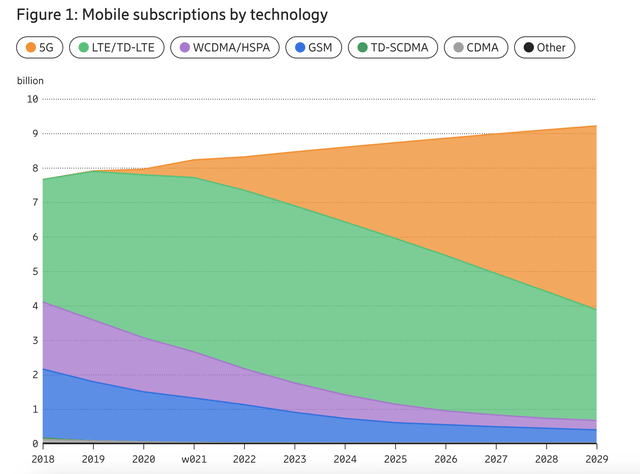

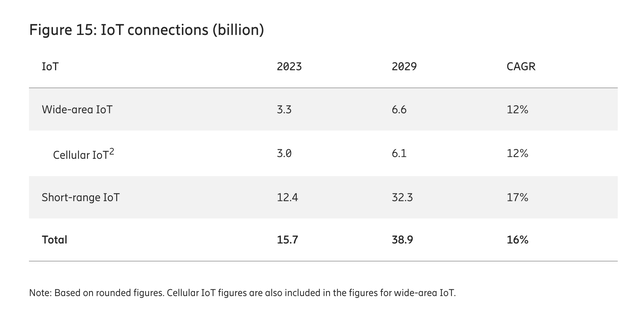

There is another angle to this as well. Clearly, investments in telecommunications infrastructure will continue to grow in order to support wider 5G device adoption. And there are a couple of different measures that show that such adoption is nowhere near where it may someday peak. If anything, the current data shows an acceleration of 5G device adoption. According to Ericsson, for instance, mobile subscriptions sold on 5G grew by 163 million globally in the third quarter of the current fiscal year. That brings the total number of subscriptions up to 1.4 billion. That same source indicated that service providers continue to deploy 5G, with 280 having launched commercial networks utilizing it so far. And by 2028, 5G subscriptions are expected to become the dominant subscription type, eclipsing 4G. This will result in global subscriptions for 5G exceeding 5.3 billion in 2029. Over this same window of time, IoT connections are forecasted to grow from 15.7 billion to 38.9 billion for an annualized growth rate of 16%. With that kind of growth, massive investments in telecommunications infrastructure should bode well for Ericsson and firms like it.

Takeaway

Based on all the data provided, I must say that I am quite happy for shareholders of both AT&T and Ericsson. As of this writing, AT&T remains the largest holding in my portfolio, accounting for 18.3% of my assets. So, to see it move up nicely in response to this transaction was encouraging. In the long run, I believe that this initiative will make the conglomerate far healthier and more profitable than it otherwise would be. But it will take time for this to play out.

As for Ericsson, it’s clear that additional revenue will come its way because of this transaction. It will be interesting to see what happens with the company’s margins. It certainly needs help from that perspective, but even if revenue can grow nicely, the additional profits associated with that are not bad to see.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights is an exclusive community of investors who have a taste for oil and natural gas firms. Our main interest is on cash flow and the value and growth prospects that generate the strongest potential for investors. You get access to a 50+ stock model account, in-depth cash flow analyses of E&P firms, and a Live Chat where members can share their knowledge and experiences with one another. Sign up now and your first two weeks are free!