Summary:

- Amazon’s stock has outperformed the markets since I recommended buying it in June due to a reacceleration in its online retail business.

- The company’s AWS segment is expected to see accelerated growth in the coming quarters as enterprises loosen their budgets and demand for AI increases.

- Amazon’s margin outlook is positive, with potential for sales leverage, efficiency improvements, and growth in higher-margin AWS sales, making the stock a good buy.

Brett_Hondow

Investment Thesis

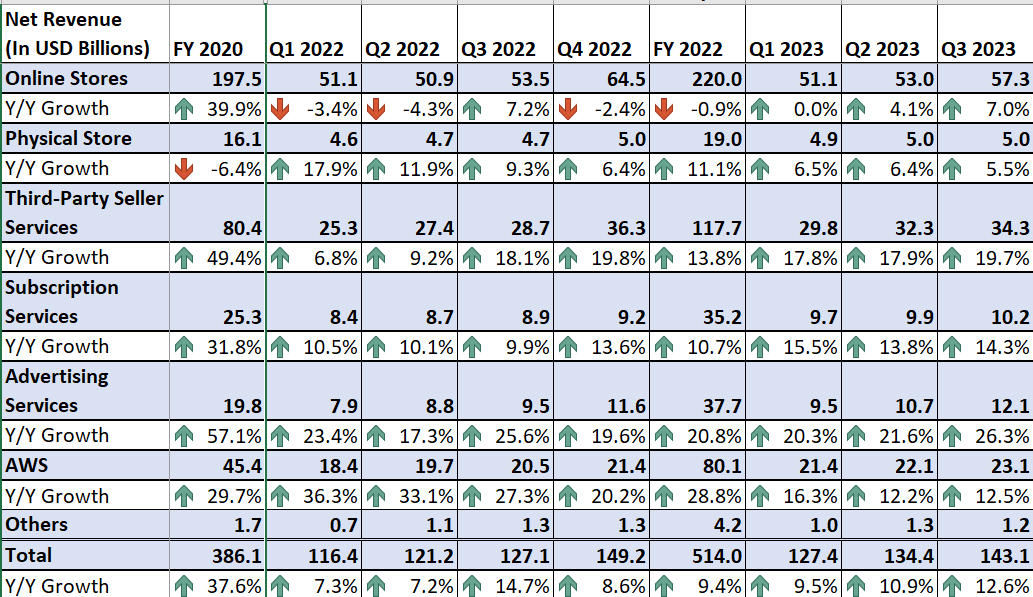

Amazon’s (NASDAQ:AMZN) stock has performed rather well since I recommended buying it in June, rising 16.78% and outperforming the S&P 500’s (SPY) 4.07% gain. My bullish case was founded on my expectations for a reacceleration in its growth rate, especially in its online retail business. I reiterated my buy rating in August and the stock has outperformed the market since then as well. My thesis worked out well and the company’s online store sales, which is the biggest portion of its retail sales, accelerated from flattish in Q1 2023 to 4% YoY in Q2 2023 and 7% YoY in Q3 2023. The third-party seller services which is the second biggest part of its retail business also did well accelerating from 17.8% YoY revenue growth in Q1 2023 to 17.9% YoY in Q2 2023 and 19.7% YoY in Q3 2023. The company recently reported record-breaking Black Friday and Cyber Monday sales events and I am expecting solid performance in Q4 2023 as well.

Furthermore, the sales growth in the company’s AWS segment should also accelerate in the coming quarters as the enterprises have started to ease their tight budgets and the increasing adoption of Artificial Intelligence and generative AI is helping demand.

The company’s margin outlook is also good and it should benefit from sales leverage, improving efficiency, cost-saving initiatives, and growth acceleration in higher-margin AWS sales which should benefit the mix. AMZN’s valuation is also reasonable with the stock trading at a discount to its historical averages. The encouraging growth prospects and lower-than-historical valuation make the stock a good buy.

Revenue Analysis and Outlook

Following the post-pandemic reopening, the company faced a noticeable slowdown in its online store business, attributed to the pent-up demand for in-store shopping as the economy reopened. This negatively impacted e-commerce sales, causing a dip in AMZN’s retail sales growth. However, as demand for in-store shopping returned to normalized levels in the last couple of quarters and consumers started getting attracted to frequent online platform promotions and lower price points amid rising inflation, the company’s online retail sales re-accelerated.

Amazon Web Services (AWS) growth has also faced some slowdown in growth in recent quarters after posting a very strong growth rate over the last few years (FY20 to FY22) as enterprise customers focused on reducing costs. However, it seems to be stabilizing over the last couple of quarters.

AMZN’s historical sales growth by business activity (Company Data, GS Analytics Research)

Looking forward, I believe the company should be able to continue delivering improved revenue growth benefiting from good demand in online retail stores and potential growth re-acceleration in the AWS business backed by increasing enterprise demand and long-term secular trends.

In the current quarter, Amazon’s e-commerce sales momentum continued with record-breaking Black Friday and Cyber Monday sales indicating a strong holiday shopping season this year. The attractive discounts on Amazon are positioning it as a budget-friendly option in the face of the current inflationary environment and helping its sales. According to management, AMZN’s customers saved nearly 70% more this year during its 11 days of deals from November 17 through Cyber Monday as compared to the same period last year.

In addition to promotional offers, Amazon continues to position itself as the fastest-delivery online retail platform with one-day and same-day delivery options for its prime members. The company was successful in achieving this through the regionalization of its national fulfillment centers, enhancing delivery speed. This enhances customer satisfaction and helps gain market share. Also, when customers derive such value from their Prime membership through promotional deals and fast delivery, they are more inclined to revisit Amazon, which should boost customer retention.

Furthermore, the company is experiencing positive results in its advertising business, where Amazon provides advertising services to sellers, vendors, publishers, authors, and others through programs such as sponsored ads, display, and video advertising. In times when consumers are mindful of their budgets, brands aim to heighten their top-of-mind awareness and bolster their advertising initiatives. However, faced with budget constraints amid inflation, brands seek cost-effective and more lucrative advertising methods. Amazon steps in here with its advertising services, leveraging machine learning to improve ad relevance for customers and optimize brands’ return on advertising investment by enhancing click-through rates. This leads to an increased return on ad spend and a reduced cost per impression. Consequently, when brands are deliberating budget allocations, they are likely to favor AMZN due to its higher volume and superior performance. This trend is expected to sustain and drive advertising sales for the company.

In addition to continued improvement in growth rates for retail business, I am expecting a re-acceleration in the company’s AWS business as well. AWS witnessed some slowdown in sales growth as sales growth normalized after the very strong lockdown period performance and the enterprise customers tightened their IT budgets in an inflationary environment. However, on the Q3 2023 earnings call, management stated that the business has started seeing some improvement in deals over the past few months. Below is the relevant excerpt from the management commentary:

Companies have moved more slowly in an uncertain economy in 2023 to complete deals. But we’re seeing the pace and volume of closed deals pick up, and we’re encouraged by the strong last couple of months of new deals signed. For perspective, we signed several new deals in September with an effective date in October that won’t show up in any GAAP reported number for Q3, but the collection of which is higher than our total reported deal volume for all of Q3.”

This indicates we can see good growth momentum in the coming quarters as these deals start converting into revenues helping AMZN’s sales growth in the coming year.

The AWS business is also supported by medium to long-term secular trends. In today’s business landscape, the growing reliance on automation and artificial intelligence is essential for navigating uncertainties and ensuring sustained profitability. Furthermore, the advanced capabilities of generative AI empower businesses to operate with increased efficiency and innovation, thereby enhancing productivity in both backend and frontend operations. As the world progressively shifts towards digitalizing processes and services, there is a rising demand for cloud technology services to support the expansion of digital infrastructures.

According to the company’s management, approximately 90% of global businesses currently operate on-premise. However, with advancing technologies, these businesses are anticipated to transition to cloud services in the long run. Consequently, AWS is strategically positioned to benefit from these emerging technological trends. The company is actively involved in developing AI and generative AI tools to capitalize on these trends and attract enterprise customers to AWS cloud services, particularly as their budget constraints ease.

Amazon has introduced new tools for Large Language Models (LLM), facilitating developers in creating more interactive and intuitive experiences on its voice assistant Alexa. Noteworthy brands such as BMW, Character.AI, iRobot, Philips Hue, Splash, and Volley are already utilizing these tools. Additionally, Amazon has made its Amazon Bedrock service generally available, providing a managed solution for building and scaling enterprise-ready generative AI applications. This service grants customers access to leading LLMs from third-party providers and Amazon’s own LLM called Titan, offering security, access control, and features consistent with the rest of their AWS applications.

I believe the company has good growth prospects ahead and there is a potential for continued sales growth acceleration in the coming quarters due to strength in both e-commerce and the AWS business.

Margin Analysis and Outlook

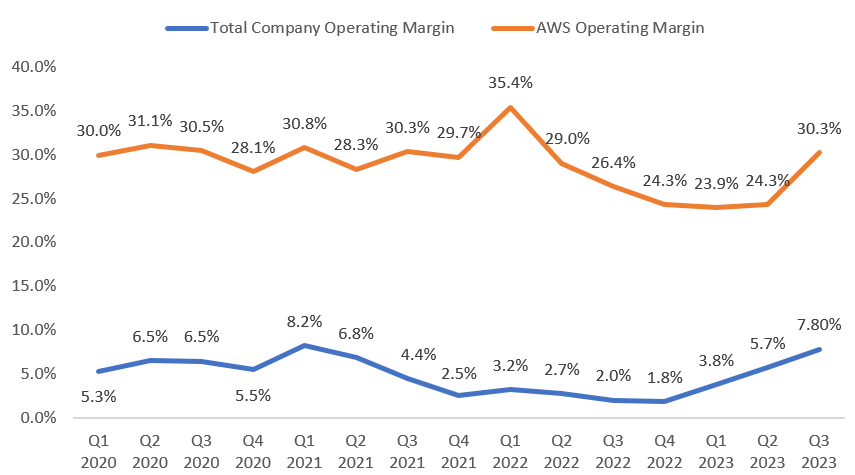

In the third quarter of 2023, the company’s margin benefited from operating leverage and cost-saving initiatives driven by the regionalization of national fulfillment centers, which has been successful in saving costs on delivery miles driven. This also helped the company offset FX headwinds and cost pressures from elevated investments. In addition, headcount reductions in Q2 23 and continued slow hiring, and rehiring for open positions also helped in margin recovery in the AWS segment, contributing to the overall margins. This resulted in a 580 bps year-over-year increase in operating margin to 7.8%, where the AWS segment operating margin increased by 390 bps year-over-year to 30.3%.

AMZN’s historical operating margin and AWS operating margin (Company Data, GS Analytics Research)

Looking forward, I believe the company should be able to continue delivering margin growth moving forward. The AWS segment has a significantly higher margin than the overall company and with good prospects of growth re-acceleration in the AWS segment as discussed in the revenue analysis, the company’s margin mix should improve. Furthermore, the margin should also benefit from operating leverage in AWS segments as well as Amazon’s retail business.

Moreover, the company’s initiatives to regionalize national fulfillment centers into eight separate regional centers, to save on delivery costs and improve operational efficiencies is just the beginning of a multi-year cost-saving initiative. The company continues to make progress in areas like optimizing inventory placement within this new regionalized network, making changes to inbound processes to improve the cost to serve and the speed of delivery, etc., which should lead to further savings.

Hence, I remain optimistic about the company’s margin growth prospects ahead.

Valuation and Conclusion

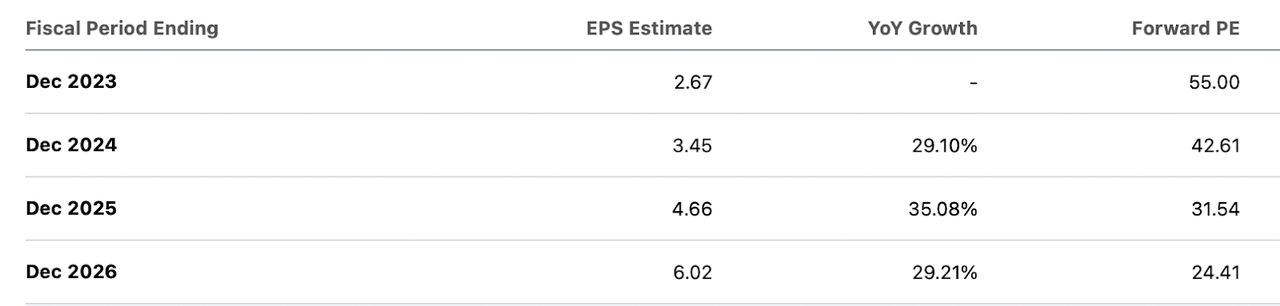

Amazon is currently trading at a forward P/E ratio of 42.61x FY24 consensus EPS estimate of $3.45 and 31.54x FY24 consensus EPS estimate of $4.66. These figures represent a discount compared to its historical 5-year average forward P/E ratio of 186x.

AMZN Consensus EPS estimate and forward P/E (Seeking Alpha)

Similarly, the company’s forward EV/EBITDA and EV/Sales valuation metrics are also trading below their historical averages. The company’s forward EV/EBITDA is 15.34x compared to its 5-year historical average of 21.21x and its forward EV/Sales of 2.84x is also below its historical average of 3.16x.

I am optimistic about the company’s growth potential over the next several years, benefiting from strong growth drivers and execution in both retail and AWS business. Additionally, there’s potential for margin growth through cost-saving initiatives and a favorable cost environment. These factors collectively make the stock an attractive investment opportunity, and given its favorable valuation and promising long-term prospects, I believe the upward trend in the stock price can continue. Hence, I maintain a buy rating on the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article is written by Saloni V.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.