Summary:

- Nvidia Corporation’s revenue hit $18 billion in the last quarter, with strong performance and rapid earnings growth.

- The company’s segment performance is driven by data center performance and AI demand.

- Nvidia’s outlook shows growth moderating and increasing competition from wealthy customers like Microsoft and Amazon’s AWS.

Justin Sullivan

Nvidia Corporation (NASDAQ:NVDA) is perhaps the growth story of the last half a decade. The company took graphical processing units (GPUs), traditionally used for exactly what their name implies, and proved they could be used for a variety of other massively parallelized computation problems. Then the company built a great software infrastructure around it.

OpenAI made LLM take off, and when that happened Nvidia was beautifully positioned. Demand for the company’s GPUs has soared to every single person who can handle it. Unfortunately, the market has noticed that. The company is now one of the largest companies in the world, with a market cap of more than $1 trillion.

As we’ll see throughout this article, Nvidia is a great company, but its valuation is simply too high for its profit potential in the face of rising competition.

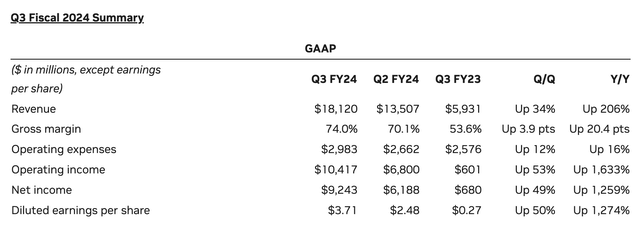

Nvidia Financial Results

There’s no denying that the company had strong performance with YoY improvement.

The company’s revenue hit $18 billion in the fiscal third quarter, an improvement even from the company’s outlook. The company’s gross margins of 74% also came above guidance, supported by higher revenue. Operating expenses came in just a bit above guidance, and at the end of the day, the company’s net income and diluted earnings were strong.

The company’s EPS from the most recent quarter, annualized, puts it at a P/E of 32. It’s worth noting this number is likely a high estimate looking forward, supported by the company’s incredibly rapid earnings growth. The company’s forward P/E is 24. Financially, there’s no denying that the company has performed incredibly well, supported by insatiable demand for its GPUs. That’s combined with potential demand drop-offs from China that led to a short-term demand spike.

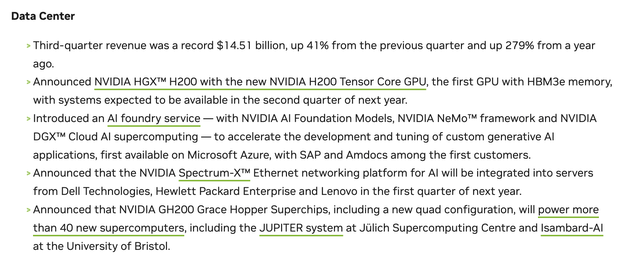

Nvidia Segment Performance

From a segment perspective, Nvidia continues to be carried by data center performance.

The company earned $14.51 billion in quarterly data center revenue, up 279% YoY. The company has continued to announce new GPUs, upgrading the memory and speed of its processors to maintain its lead. The company has announced new supercomputers that will be built on its GPUs, and it’s announced a new foundry service to build custom AI applications.

It’s working hard to cement its position in AI, and it clearly has the chips to do so. There’s no denying that, when it comes to artificial intelligence, all the large companies are desperate for all the GPUs they can purchase.

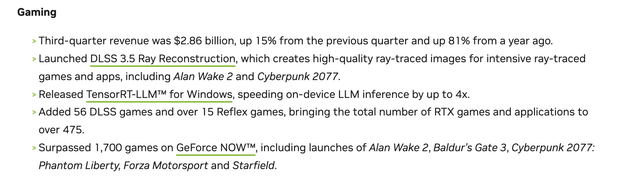

From a gaming perspective, the company saw improvement, supported by its latest GPUs. The company continues to compete with Advanced Micro Devices, Inc. (AMD) for discrete GPUs, and AMD has made a conscious decision, at the present time, not to compete at the top end of the market. That has enabled Nvidia to remain at the relative peak of the market.

However, there’s some other things worth noting. First, Nvidia gaming GPUs can be used for AI as well, similar to what was seen when the company had GPU shortages from cryptocurrency. We suspect a large chunk of the demand seen above is from individuals purchasing GPUs for artificial intelligence versus actual gaming. This especially appears to be true in China.

Second, the drastically smaller gaming business side versus the overall company is a sign that while gaming remains important to the company, it is nowhere near strong enough, by itself, to justify the company’s valuation.

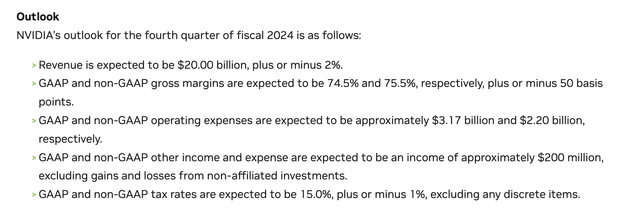

Nvidia Outlook

The company’s outlook shows that despite its recent strength, it expects growth to moderate dramatically.

The company’s revenue guidance is $20 billion, representing almost double-digit growth QoQ. The company expects margins to mostly remain in line, and operating expenditures to grow by several hundred $ million. The growth rate shows continued insatiable demand for the company’s chips, but it also indicates that the rate of growth is slowing down.

That could indicate that the company is reaching a ceiling, which combined with the downsides we’ll discuss below, makes the company a poor investment.

China

In-terms of potential risks, the company has several.

The first is China. Despite Chinese companies effectively buying as many crippled GPUs as they can, it’s clear the clock is running out. There’s massive pressure to stop Chinese companies from getting access to Nvidia GPUs. Nvidia built a workaround GPU, and that workaround GPU was subsequently banned by the government.

Not only will that cost Nvidia revenue but there’s another risk. Huawei, based on its recent GPU successes, is now looking to build its own GPU business. Continuous Chinese investment into building AI GPUs could increase the long-term competition.

Nvidia Competition

In general, we expect Nvidia’s overall competition to increase substantially.

The largest source of competition is actually from Nvidia’s incredibly wealthy customers. These are multi-trillion dollar customers currently purchasing all the Nvidia GPUs they can. Microsoft (MSFT) has recently announced its AI chip, one of the most powerful in the world. Microsoft has a 21.5% cloud market share and a >$100 billion cash position.

More so, Microsoft has an incredibly strong position with Open AI, the company that led the wave of demand for the latest chips. The company’s Maia 100 AI chip is one of the largest 5 nm chips with 105 billion transistors. For perspective, that’s roughly 25% more transistors than Nvidia’s H100 chip. That strength means strong competition for Nvidia.

Amazon’s (AMZN) Amazon Web Services, or AWS, the largest cloud computing provider in the world, has recently announced its Trainium 2 processor. The lower costs here, especially with Amazon backing another major artificial intelligence company (Anthropic), is again a threat to Nvidia. These chips might not compete today with massive demand for all chips possible, but we expect that to change in several years.

That competition could substantially hurt Nvidia’s continued growth and ability to drive shareholder returns.

Now there’s no denying that Nvidia’s hardware is top-tier. Unfortunately, the primary risk in our view is that engineering is a commodity. These projects aren’t the result of one engineer who can’t be replicated, or one brilliant idea, but many thousands of engineers hard at work. That means other hardware companies, for the appropriate number of billions of dollars, can eventually duplicate the work.

Already, prime competitor AMD is doing just that.

Nvidia’s upcoming top-tier GPU is the H200. The GPU will have 141 GB of memory with 4.8 TB/s bandwidth and 34 TFLOPs of FP64 compute. AMD just announced the MI300x GPU, also on TSMC 5 nm, with 81.7 TFLOPs, or more than double. Some compute numbers like bfloat floating-point format are ~30% lower, so it’s not all rosy numbers.

However, memory bandwidth will hit 5.3 TB/s with 192 GB of memory. On many levels, this chip is competitive with AMD. And we’re not just saying so. Meta Platforms (META), Microsoft, and Open AI have all already announced they’ll be purchasing and using the company’s new GPUs. Again the takeaway here is these companies don’t need to replace Nvidia to force it to cut its margins.

This shows how quickly competition can arise, less than a year after the announcement of Open AI.

Our View

Nvidia is a great company. They did an incredible job of building the right product at the right time, and it wasn’t all luck, they’ve spent numerous years building up the ecosystem around their GPUs.

And there’s the classic quote about how it’s better to buy a great company at a fair price than a good company at a low price. Despite all of that, though, there comes a time when a company’s valuation is simply unreasonably high. Nvidia has a market cap of more than $1.1 trillion. More so, the company’s largest customers aren’t retail customers enamored with the devices like Apple.

Those customers provide you a moat. Here, Nvidia’s largest customers are wealthy, multi-trillion dollar companies, that likely gripe about the company’s margins every time they put in an order. Several of them are building their own AI chips, including customers with major know-how and major AI businesses, which is the end game.

For example, Amazon is backing Anthropic, and Microsoft is backing Open AI. Each have massive cloud businesses to reach the end customer and their own AI chips. In the long term, we expect this will result in Nvidia’s margins and ability to drive earnings declining substantially. That makes the company a poor long-term investment.

Shorting The Stock

Nvidia is a very expensive stock and we’ve discussed above how it’s overvalued. So, why would we short it. Three reasons.

- The scale to which the company is overvalued is substantial. That’s important because you can’t make >100% on a short. So for the investment to be truly interesting with the short, you need it to drop at least 30-40%.

- Tech stocks are volatile and we think the market is overlooking the significant of the risks we discussed above. As we saw throughout this article, we expect the risks to quickly and rapidly compress both the company’s margins and revenue. That will cause the company’s profits to drop even further. That could drive strong returns.

- The market is optimistic and the stock is high flying. A unique aspect of shorting is the short-borrow fee on stocks, which current stands at 0.25% for Nvidia (annualized). It’s a modest fee and more than affordable for the time period we’re discussing.

Shorting a stock has substantial risk. You have uncapped downside. Since mid-October 2022 lows, the company’s share price has quadrupled. That means if you put in a $5000 short, you would now be sitting on almost $15k in losses. Even if you went long a stock and it went bankrupt, your losses would be limited to the capital investment not more. That is not the case for shorting where your theoretical risk is unlimited.

That shows the massive risks from shorting. We would look to exit the short at $180, where the company’s P/E has gone back to within 50% of its historic long-term range. Given we think its profits are artificially high, that would still be a lofty valuation.

For those looking to stop gap, due to the risks of shorting, we recommend bailing out at a 50% loss, or $675 per share. For us, that level would represent that the market has yet to re-evaluate the company without an indication to do so, and it’s worth re-centering the thesis and the associated risk. Unfortunately, as the saying goes, the market can remain irrational much longer than you can remain liquid.

Thesis Risk

The largest risk to our thesis is the massive demand for the company’s GPUs. The company is generating massive cash flow and it has incredibly high margins. In a world where the company’s assets are needed at any cost, the fact that they’re overpriced is unimportant. And today, the company’s GPUs are still the fastest on the market.

Conclusion

Nvidia is a great company. Those who invested half a decade ago are likely rolling around in dough celebrating. The company has had one of the most rapid rises in history to a $1 trillion valuation, joining a very select club of peers with massive earnings and cash flow, along with an incredibly relevant position in the market. Luck was involved, but a lot of it was skill.

Despite all of that, Nvidia is dramatically overvalued. The company’s largest customers are a narrow range of customers, with extremely deep pockets and their own engineering know-how. Several of them are attempting to copy Nvidia’s chips, and Nvidia’s margins make that very profitable. As a result, we expect the company’s earnings to decay over time, making it a poor investment.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2024 Long/Short competition, which runs through December 31. With cash prizes, this competition — open to all contributors — is one you don’t want to miss. If you are interested in becoming a contributor and taking part in the competition, click here to find out more and submit your article today!

Analyst’s Disclosure: I/we have a beneficial short position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.