Summary:

- The Petronas discovery in Suriname has the potential to double the basin development projects available for Exxon Mobil Corporation.

- Suriname is supportive of the oil and gas industry and has no active border disputes.

- Exxon Mobil and its partners can develop multiple FPSO projects simultaneously as needed.

- A second partnership discovery makes it very possible that basin production growth will become significant to Exxon Mobil.

- The market is seeing the value of discoveries in Suriname and Guyana because there is cash flow from operating FPSO’s in Guyana.

Jeremy Poland

Exxon Mobil Corporation (NYSE:XOM) has been developing the Guyana discoveries for some time. That is likely to continue as Guyana has some very strong allies that want Guyana just as it is now. In the meantime, Petronas appears to have found enough oil partnered with Exxon Mobil to put Suriname way up the priority list for the foreseeable future. Together, these two countries represent a lot of growth potential, even for a giant like Exxon Mobil. It will take a couple of years for the cash to begin flowing. But once it does, it is likely to be very significant to the partners.

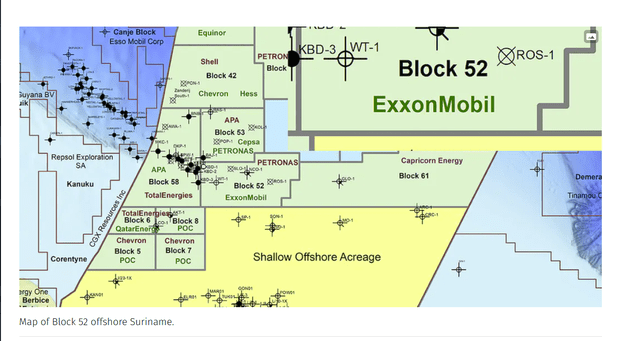

Suriname

A quick summary in English of Suriname can be found here. This country was a Dutch colony and is now an independent country. Suriname is supportive of the oil and gas industry because it will be bringing in foreign currency that the government can use in its budget. Unlike Guyana, there is little to no active border disputes. Therefore, this country, the oil and gas development will be far more unfettered than might be the case next door in Guyana.

The Announcement

In early November, Petronas, the operator of the partnership, announced a major discovery in block 52 of Suriname, of which Exxon Mobil is a 50% participant.

Exxon Mobil In Partnership with Petronas Discovers Oil In Suriname (Oil & Gas Journal November 3, 2023)

For those unfamiliar with Petronas, Petronas is a government-owned Malaysian company with several public subsidiaries. Petronas is very large and responsible for a fair amount of government income. Both companies in this partnership, Petronas and Exxon Mobil bring a lot of experience and resources “to the table.”

What this discovery means for shareholders of Exxon Mobil is that the discoveries very likely will extend the Guyana oil fields into Suriname for one giant project (split between the two countries appropriately).

Of course, more wells need to be drilled, but like Guyana, there are a lot of wells finding oil and not too many dry holes to the current trend. At this time, there appears to be a lot of upside potential (with multiple FPSO’s producing) that needs to be further de-risked in the future. As with any projection, there are the usual offshore upstream risks to getting to that final production goal.

A lot of investors stated that the current pace of development in Guyana was not all that significant to a company like Exxon Mobil. But as more lease areas discover oil, then there will be multiple development projects that will in total be significant to Exxon Mobil. This discovery is probably the most visible step in that development to shareholders because the discovery is clearly on another lease that appears to have significant upside potential.

With any discovery, dry holes can be encountered “tomorrow” with no more successes in sight. While that result appears to be a minimal risk right now, it is worth keeping in mind because at some point this basin will have outer limits.

What The Market Is Hoping For

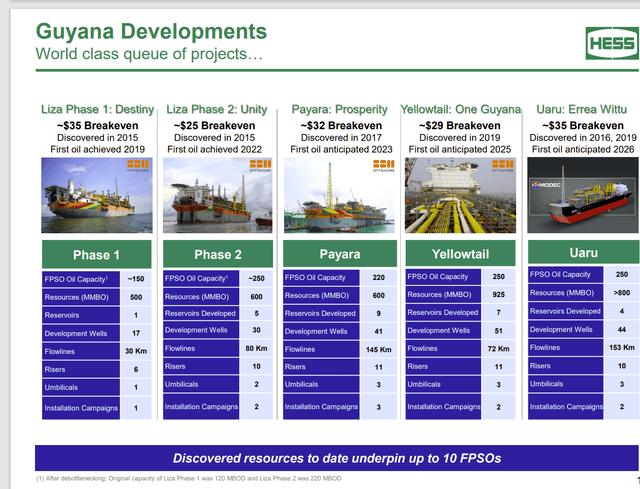

The market is hoping for a giant extension that can produce results similar to what is going on in Guyana:

Hess Corporation Description Of Approved Projects And Projects Under Review (Hess Corporation Corporate Presentation September 2023)

Exxon Mobil is the operator in Guyana. Because the Guyana project is a few years ahead of the discovery in Suriname, there is now some industry nearby that will help facilitate the development of the oil industry in Suriname. Exxon Mobil had to begin “from scratch.” But now a discovery that might not have been commercial is more likely to be commercial with existing production nearby.

If the Guyana business does not help the situation, then the discovery on the Total block shown above is also available. With the number of discoveries mounting in Suriname, the hope is that the industry will be every bit as large as what the Guyana business appears to be.

The rumors are having a field day with this as a result. However, it needs to be stated again that the “party can be over tomorrow.” That is always the risk with any discovery. It does look far more likely though that the Suriname business will be a significant addition to the business in Guyana, with the possible upside potential to be equal in size.

The other thing is that Wall Street sees a lot of potential profits in Suriname. But the profit parameters have yet to be really discussed by any operator in Suriname. In fact, that discussion is likely a couple of years away. There are a lot of profitable scenarios from the discoveries in Suriname so far that are commercially viable, but may not match what is happening in Guyana. So Wall Street could be potentially disappointed with the relative profitability of Suriname wells, even though major projects are viable. We just do not know yet.

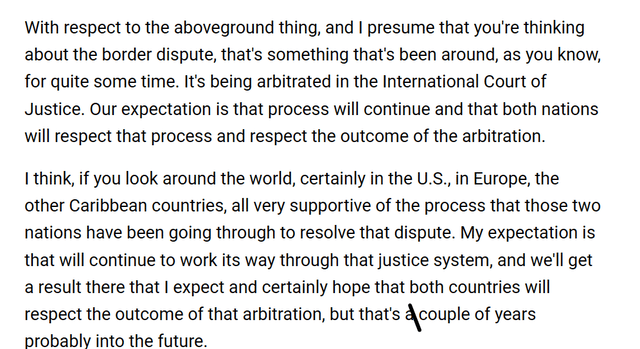

Guyana Border Dispute

The Guyana border dispute is highly unlikely to affect the offshore business in Guyana, let alone the offshore business in Suriname. Guyana has too many boosters like Brazil that would likely put an end to any unfavorable outcomes quickly. The United States currently has a presence in Guyana as well.

Here is a statement from Darren Woods, CEO and Chairman, Exxon Mobil on the situation:

Exxon Mobil CEO Darren Woods Answering A Question About the Guyana Dispute During the 2023 Plan Update Presentation (Exxon Mobil Plan Update Presentation December 2023)

It would be a very small chance that Venezuela would gain control of the industry in Guyana. Should that small chance happen, it may set back the development of the Suriname industry. But it would not prevent the development of the industry.

Anytime there is the existence of oil and gas infrastructure nearby, there is usually some development aid available to the next set of discoveries. So Suriname should be able to initiate production a bit faster than was the case in Guyana, where the Exxon Mobil partnership was the first.

The Overall Importance

To a certain extent, this discovery diversifies the country risk for what is becoming a very large project even for Exxon Mobil. Even large companies do not want to be too dependent on any one area.

The discovery has the potential in the eyes of many to double the existing business. Exxon Mobil and its partners are more than capable of handling the startup of two or more FPSO’s at one time. The good news is that Exxon Mobil and its partners can easily handle a big project like this with large upfront costs.

As the slide from the Hess presentation above shows, there are a lot of costs that go into a producing FPSO. There are still more costs to be done first, though, to make sure the first FPSO is even needed. While that appears to be likely to many, it is far from assured until the operator completes all the necessary due diligence.

Nonetheless, discoveries like this keep the market excitement going now that there is cash flow from one project. For a very long time, the market paid no attention to the events in this area because no one project had any positive cash flow. Obviously, that has now changed to where the market can see at least some potential.

The more of this basin that gets developed, the more likely you will have a market reaction to later basin extension discoveries. So far, this basin has world-class low breakeven points. That great profitability could diminish as you get closer to the basin boundaries. But for right now, this basin is in the “building excitement” stage, even for a company as large as Exxon Mobil.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of XOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor, and this article is not meant to be a recommendation of the purchase or sale of stock. Investors are advised to review all company documents and press releases to see if the company fits their own investment qualifications.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Long Player believes oil and gas is a boom-bust, cyclical industry. It takes patience, and it certainly helps to have experience. He has been focusing on this industry for years. He is a retired CPA, and holds an MBA and MA. He leads the investing group Oil & Gas Value Research. He looks for under-followed oil companies and out-of-favor midstream companies that offer compelling opportunities. The group includes an active chat room in which Oil & Gas investors discuss recent information and share ideas. Learn more.