Summary:

- COVID-19 vaccine Comirnaty and Paxlovid pill should contribute circa 55% to Pfizer’s 2022 revenues.

- Pfizer’s revenues from the U.S. government represented 26% of total revenues for Q2 2022, up from 13% reported in 2021.

- Pfizer’s capital structure is relatively conservative, with net debt of just $10bn.

- Moderna’s only commercial product is its COVID-19 vaccine Spikevax with 100% government revenue share.

- Pfizer’s sales should show less erosion in the coming years thanks to its diversified vaccine/treatment mix, as opposed to Moderna’s vaccine only exposure.

Jens Schlueter

Pfizer (NYSE:PFE) and Moderna (MRNA) have been at the forefront of the fight against the unprecedented (at least in our lifetime) COVID-19 pandemic. The two pharmaceutical companies were among the first to develop working vaccines against the virus, with Pfizer also launching the Paxlovid pill.

The advent of the pandemic put enormous pressure on governments worldwide who had to take urgent measures to protect their citizens and avoid economic collapse.

As a result, government spending has increased dramatically. For example, the U.S. federal government has spent nearly $4 trillion in response to the pandemic.

Focusing on healthcare, in particular, in 2020 – the year when the pandemic began – federal spending reached $287bn. A year later, a decline ensued, with federal spending dropping to $170bn.

In addition, health data company IQVIA Holdings prepared a report, according to which total global spending on COVID-19 vaccines is projected to reach $157 billion by 2025, driven by mass vaccination programs launched by public authorities.

A significant proportion of the U.S. federal government’s spending has gone to pharmaceutical companies working on COVID-19 treatments. Pfizer and Moderna are two such businesses. The two have received orders for a combined $37bn from the government in 2021 and 2022.

Hence, monitoring public spending, especially through public procurement, and the amount of revenue businesses generate from working with governments, is important, since it could also be a reliable predictor of stock performance for publicly-listed companies.

Pfizer Company Overview

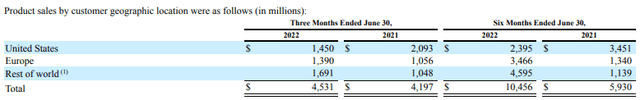

Pfizer reports results in six main segments (Figure 1), with the top four accounting for over 90% of Q2 2022 revenues, namely “Vaccines” at 37.7%, “Hospital” at 35%, “Oncology” at 11.1% and “Internal Medicine” at 8.7% of Q2 2022 revenues:

Figure 1. Pfizer Revenue Breakdown

Pfizer Q2 2022 Earnings Press Release

Pfizer Q2 2022 Operational Overview

The biggest segment by revenue, “Vaccines”, reported a 13% Y/Y rise, markedly down from the 300% Y/Y growth reported in Q1 2022. Compared to Q1 2022, “Vaccines” revenue actually fell by 30%.

The Q/Q drop in “Vaccines” revenue was more than offset by growth in the “Hospital” segment, where Pfizer’s COVID-19 oral treatment pill Paxlovid saw $8.1bn of sales in Q2 2022 against $1.4bn in Q1 2022, or a near sixfold increase.

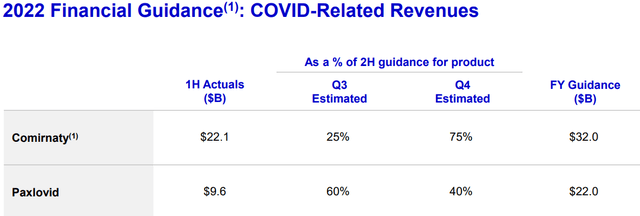

Overall, the COVID-19 vaccine Comirnaty and Paxlovid accounted for 61% of Q2 2022 revenues. Looking ahead, Pfizer expects sales of Comirnaty to continue the downward trend into H2 2022, with $32bn of sales expected for the full year against $22.1bn booked in H1:

Figure 2: Pfizer’s 2022 Financial Guidance for COVID-related Revenues

Pfizer Q2 2022 Earnings Presentation

On a brighter note, Paxlovid revenues should prove more resilient, albeit dropping from the high Q2 rate, finishing the year at $22bn.

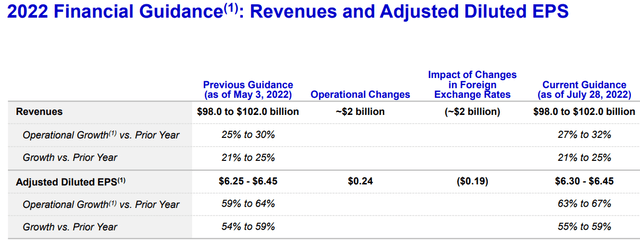

Turning to the full year guidance, Pfizer slightly boosted the bottom range of its adjusted EPS from $6.25-6.45 to $6.30-6.45 as improved operational performance was largely offset by currency headwinds.

Figure 3: Pfizer’s 2022 Financial Guidance: Revenues and Adjusted Diluted EPS

Pfizer Q2 2022 Earnings Presentation

Looking into 2023, Pfizer will face tough Y/Y comps as the May 3rd to July 28th move in the dollar index (DXY) from about 103.45 to 106.2 caused a $2bn FX hit. At the time of writing the DXY stood at 113, implying at least a $5bn hit to 2023 revenues, which will likely be magnified by the full-year effect of the DXY move from 96.2 to 113 in 2022:

Figure 4. U.S. Dollar Currency Index (DXY) 1 Year Chart

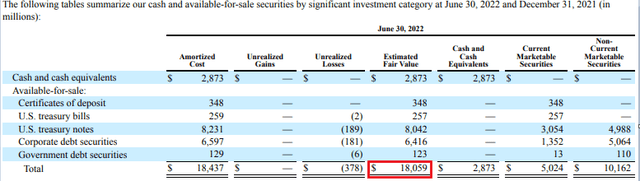

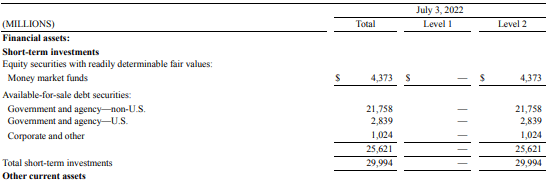

Against the backdrop of rising rates Pfizer is in a good position to absorb the increased interest expenses on its $40bn of total debt with proceeds from its circa $30bn of short-term investments:

Figure 5. Pfizer Short-term Investments Breakdown

Pfizer Form 10-Q for Q2 2022

Highlights from the conference call include CEO Albert Bourla’s assessment that the recently enacted Inflation Reduction Act will impact industry R&D spending by as much as $270bn over 10 years. Furthermore, going forward Paxlovid will move more towards a commercial distribution model as opposed to government-centred approach, which will, on the one hand, expand product availability, but on the other, reduce the government contracts share of Paxlovid sales:

But I think what happens in a full commercial launch is that you will have multiple distributors and multiple points of distribution throughout the entire country. You will have stocking by every pharmacy and pharmacists and various points of use. And so I think that in a commercial setting, actually you’ll be able to reach a much broader set of channels that we currently even do today.

Source: Pfizer Q2 2022 Earnings Transcript

Pfizer’s Q2 2022 Government Sales Revenue

As disclosed in Pfizer’s 10-Q Form for Q2 2022, revenues from the U.S. government represented 26% and 22% of total revenues for the three and six months ended July 3, 2022, respectively, and primarily represent sales of Comirnaty and Paxlovid. This is up from the 13% U.S. government share reported for the whole of 2021 when the main driver was Comirnaty.

While no data is disclosed for exposures to other governments, taking the Comirnaty/Paxlovid exposure as a low point of the government exposure range, Pfizer will mark upwards of 55% of its 2022 sales from government orders. Should the current trend in Comirnaty/Paxlovid sales persist into 2023, the government revenue share should drop to 40%, or even lower if we take out Paxlovid sales as the commercial procurement model should take hold going into 2023.

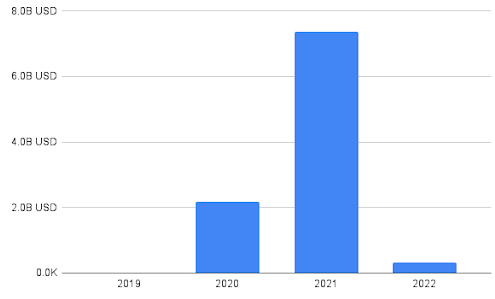

Looking at Y/Y growth, the 2021 fiscal year which started on October 1st 2020 clearly captures the growth in government procurement orders relative to the pre-COVID-19 period:

Figure 6. Pfizer Government Procurement Orders per Year in USD Billion

TenderAlpha.com

Moderna Company Overview

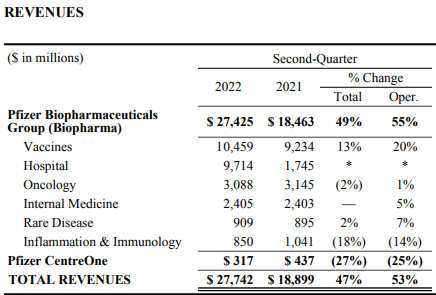

Moderna has only one commercially-approved product, namely its COVID-19 vaccine under the name Spikevax, with Q2 2022 sales split roughly equally between the U.S., Europe and the rest of the world:

Figure 7. Moderna Product Sales by Geographic Location

Moderna Q2 2022 Operational Overview

Q2 revenues were up 9% Y/Y to $4.7bn but net income was down 21% Y/Y as higher cost of sales and a larger effective tax rate weighed on the bottom line. More detail on cost of sales was disclosed at the conference call:

Cost of sales was $1.4 billion or 30% of product sales in the second quarter of 2022 compared to 18% of product sales for the same period in 2021. This includes a charge of $499 million for inventory write-downs related to excess and obsolete COVID-19 products, a loss on firm purchase commitments of $184 million and an expense for unutilized external manufacturing capacity of $131 million.

These charges are driven by a substantial reduction of our expected deliveries to COVAX as indicated as a potential variable impacting our advanced purchase agreements in our last call and, to a lesser extent, by deferral of deliveries to other customers, particularly to the European Union in light of the expected upcoming launch of our updated bivalent vaccines.

Source: Moderna Q2 2022 Analyst Call

Moderna reiterated its circa $21bn advance purchase agreements outlook for 2022, implying H2 2022 sales on par with H1 2022 results. The company also announced a $3bn buyback.

On September 28th Moderna’s Omicron-containing bivalent COVID booster candidate was approved for use in the EU. As per the company’s disclosure, “the vaccine targets both the original strain of SARS-CoV-2 as well as the BA.4/BA.5 subvariants of the Omicron strain. Moderna has received authorizations for Omicron-targeting bivalent boosters in the United States, Australia, Canada, Europe, Japan, South Korea, Switzerland, Singapore, Taiwan, and the UK to date and has submitted regulatory applications worldwide.

Turning to the capital structure, Moderna is even more conservative than Pfizer, with no debt and a net cash position of circa $18bn:

Figure 8. Moderna Cash and Cash Equivalents Breakdown

When you factor in that stockholders’ equity was $17.985bn at the end of Q2, you see that it was largely covered by cash and conservative fixed income investments. However, it is important to note that Moderna has a substantial deferred revenue exposure:

As of June 30, 2022 and December 31, 2021, we had deferred revenue of $4.3 billion and $6.7 billion, respectively, related to customer deposits. We expect $4.0 billion of our deferred revenue related to customer deposits as of June 30, 2022 to be realized in less than one year. Timing of product manufacturing, delivery, and receipt of marketing approval will determine the period in which product sales are recognized.

Source: Moderna Form 10-Q for Q2 2022

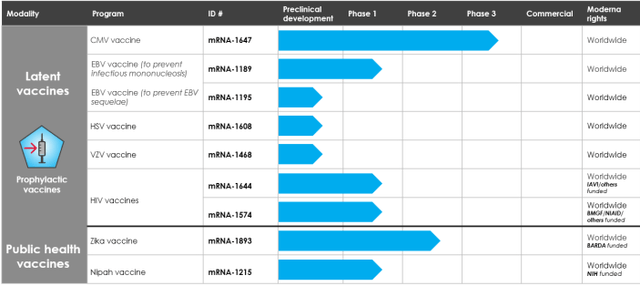

As far as progress on non-COVID-19 vaccines is concerned, Moderna is most advanced with its CMV vaccine which targets the cytomegalovirus, a virus which is generally inconsequential for healthy people but can be lethal for immunocompromised individuals:

Figure 9. Moderna Non-Covid-19 Product Development

Moderna Q2 2022 Earnings Presentation

Highlights from the conference call include a shift away from 100% government funding for vaccine purchases. Instead, some of the doses may be procured via commercial channels starting in 2023:

And to close, as we look to 2023, we are prepared for a shift to the commercial market in the U.S. for COVID boosters where the market will be more fragmented than it was during the pandemic where the U.S. government was the sole purchaser of vaccines. The commercial organization has already engaged with commercial payers and the channel, both channel distributors as well as key pharmacies, in anticipation of this shift. Internationally, we expect public health authorities to remain key purchasers of vaccines, but we are also identifying markets where there may be a private commercial market as well. All in all, we are well prepped for the transition as we have invested in building our commercial infrastructure, both in the U.S. and globally.

Source: Moderna Q2 2022 Analyst Call

Moderna’s Q2 2022 Government Sales Revenue

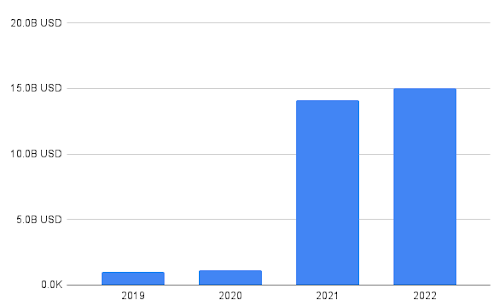

Moderna has essentially a 100% government exposure, but as mentioned above this will start to change as more commercial partners get involved in vaccine procurement. Furthermore, Moderna is currently entirely dependent on its Spikevax vaccine, notwithstanding promising developments across its pipeline. This is evidenced by the substantial rise in government procurement awards in 2020 and 2021 relative to 2019.

Figure 10. Moderna Government Procurement Orders per Year in USD Billion

TenderAlpha.com

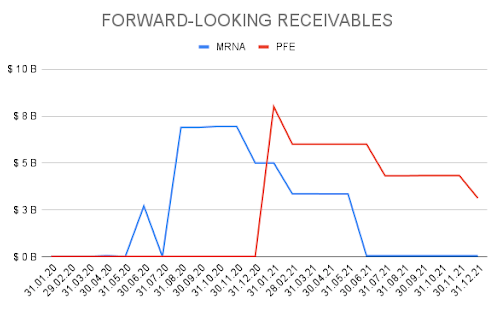

Forward-Looking Government Receivables for Pfizer and Moderna

Figure 11 shows clearly the movement of the forward-looking government receivables trajectory for the two companies examined in this article.

For Moderna, a spike in receivables is evident in the summer of 2020, which begins to drop slowly throughout 2021.

In contrast, a quiet 2020 is followed by a sharp rise in government receivables for Pfizer in early 2021 – a trend that remains strong during the year, albeit slowing down in its second half.

Figure 11: Pfizer and Moderna’s 2020-2021 Government Receivables

TenderAlpha.com

Key Takeaways

Comparing Pfizer and Moderna, the former will likely fare better thanks to its Paxlovid pill and will show greater earnings resilience in the coming years, notwithstanding the coming headwinds related to the Inflation Reduction Act.

On the other hand, Moderna comes out ahead in terms of financial health and current earnings but will likely face a steeper drop in sales in 2023 and beyond. It can be viewed as an option on future vaccine developments or a respiratory virus outbreak down the road.

In terms of government sales, both Pfizer and Moderna have been going strong in the domain in the last few years, compared to pre-Covid times, but their commercial business promises to flourish in the coming years.

Nevertheless, monitoring the public procurement activity of these and other players in the pharmaceutical sector remains a smart, yet lesser-known move that can give an advantage when predicting the companies’ future performance.

Continued partnership with the government indicates that a business may enjoy the predictability of its own cash flow, which, in turn, will improve its prospects in the market as well as potentially increase its share price.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.