Summary:

- We use the discounted cash flow method to evaluate Nvidia Corporation’s intrinsic value, considering all firm-specific variables.

- The DCF method helps determine if a company is undervalued or overvalued on an absolute basis, unlike relative valuation metrics, which can be flawed.

- Nvidia’s latest earnings report reveals strong growth in its Data Center business, leading in large part to a new, higher fair value estimate of $606 per share.

- We were wrong about Nvidia stock in November 2022, but we’re now constructive on shares given the AI boom, which drives the big delta in our fair value estimate change.

Justin Sullivan

By Brian Nelson, CFA.

The discounted cash flow (DCF) method is unique in that it uses an absolute approach to valuation. What does that mean? Well, instead of using relative valuation metrics, the DCF models the exact firm one is looking to value, taking into consideration all firm-specific variables, turning the qualitative into the quantitative. The DCF helps to cut through a lot of the noise, to put numbers to qualitative thoughts and opinions, while arriving at an outcome that can be compared to a company’s share price.

If a company’s shares trade below an estimated fair value, then the company could be viewed as being undervalued. If a company’s shares are trading above an estimated fair value estimate, it could be considered overvalued. To a large degree, investors like to communicate valuation via multiples – using relative measures or historical measures – but this process has flaws. What if the comp is overvalued to begin with, for example? Then using that company’s valuation multiple may lead to overvaluing the stock you are assessing. This is among the many reasons why the DCF is so important.

We last wrote about Nvidia Corporation (NASDAQ:NVDA) in November 2022 in this article, and we were embarrassingly wrong. We were only viewing artificial intelligence (AI) as an ancillary driver to its valuation, and frankly, it took OpenAI’s ChatGPT’s launch to really open our eyes to the potential of AI. We weren’t alone in our assessment of Nvidia at that time, with the high end of the fair value estimate range capturing where shares were trading, but for all intents and purposes, we missed this one. To be fair, though, new information has come to light since then.

In this article, we wanted to update readers on our new fair value estimate on the name, covering the stock from a financial (valuation) aspect, while talking about its latest earnings report, which was stellar. Almost in a complete 180, we now view Nvidia’s shares as trading below a reasonable fair value estimate, and we are now calling for upside potential in shares. Frankly, in November 2022, we flat-out underestimated the huge possibility that AI has now become, both for the firm and for large-cap growth and big-cap tech, more generally, even though we were bullish on the latter two.

Latest Earnings

Nvidia Corporation, on November 21, issued strong fiscal third quarter results for the period ending October 29 that revealed tremendous momentum behind the revolution in AI. The company’s revenue soared to a new record, increasing more than three-fold from the same period a year ago thanks to strength in its Data Center business. The company’s non-GAAP earnings were even more impressive; they advanced six-fold from the same period last year. The tech giant continues to generate copious amounts of free cash flow, and our new fair value estimate stands at $606 per share, well above the $460 price at which shares are currently trading.

Here’s what CEO Jensen Huang had to say in the press release:

Our strong growth reflects the broad industry platform transition from general-purpose to accelerated computing and generative AI…Large language model startups, consumer internet companies and global cloud service providers were the first movers, and the next waves are starting to build. Nations and regional CSPs are investing in AI clouds to serve local demand, enterprise software companies are adding AI copilots and assistants to their platforms, and enterprises are creating custom AI to automate the world’s largest industries…NVIDIA GPUs, CPUs, networking, AI foundry services and NVIDIA AI Enterprise software are all growth engines in full throttle. The era of generative AI is taking off.”

Nvidia’s outlook for the fourth quarter of its fiscal year calls for revenue of $20 billion (+/- 2%), while non-GAAP margins are targeted in the range of 75.5% (+/- 50 basis points). The company continues to generate strong levels of profitability as sales continue to ramp. It also holds a robust net cash position on its balance sheet, with the firm ending the quarter with $18.3 billion in cash and ~$1.2 billion and ~$8.5 billion in short- and long-term debt, respectively. Through the first nine months of its fiscal year, free cash flow totaled ~$15.8 billion, up from ~$2.1 billion in the year-ago period – that’s a huge increase! Nvidia can now be viewed as net-cash-rich, free-cash-flow generating secular growth powerhouse – the kind of business we like in the current market environment.

Updated Valuation Statistics

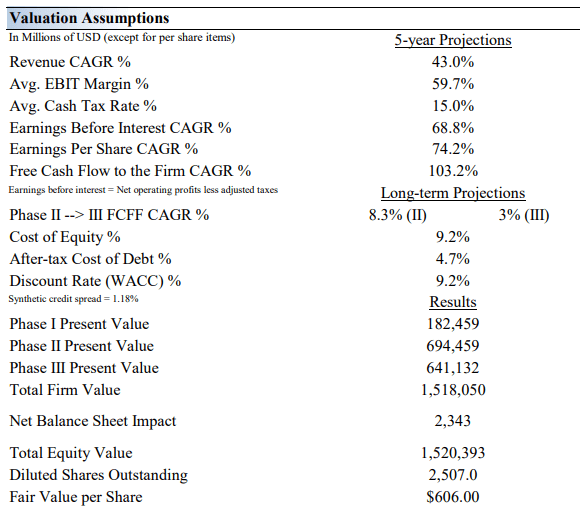

Valuation projections for Nvidia (Valuentum)

Needless to say, we have significantly increased our revenue growth assumptions from the prior update on Seeking Alpha to a 43% compound annual growth rate over the next five years (10.9%). This accounts for a good part of the delta in our new fair value estimate of $606 per share ($129 per share). We’re also modeling in significantly improved operating (EBIT) margins of 59.7% than before (44.1%). These two changes have resulted in significantly higher earnings growth and free cash flow growth over the next five years than what we had modeled in our prior update. Almost all of the delta is attributed to better expectations for Nvidia’s Data Center business, which is firing on all cylinders.

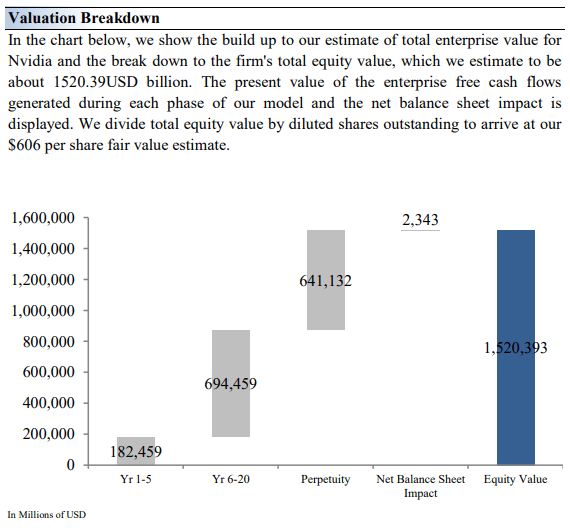

Valuation Breakdown of Nvidia (Valuentum)

Margin of Safety

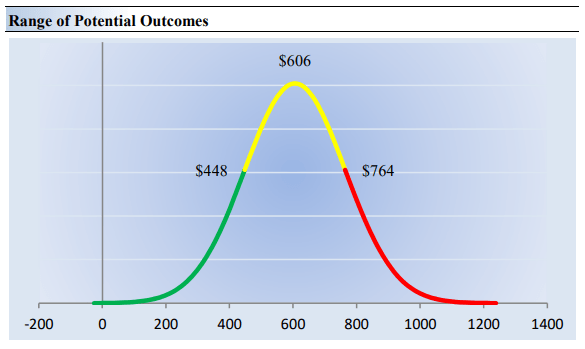

Though the DCF is better than using relative valuation techniques, the assumptions within a DCF are sensitive to future operating forecasts. A key part of implementing the DCF is deriving a fair value estimate range that can be used as a check and balance against the point fair value estimate. After all, if one has a stock that they think is worth $100, it is more appropriate to say that the $100 per share is the most likely fair value, but that the stock is worth, let’s say, somewhere between $80 and $100. In this context, for Nvidia, we think the stock is worth somewhere between $448 and $764, a large fair value range that captures the inherent risk in our forecasts, not the least of which is longevity risk.

We’re not sure how long the binge in AI spending will continue and how the competitive environment with Advanced Micro Devices (AMD) and others will evolve, even if we think AI initiatives are still at the top of the first inning.

Range of Potential Outcomes for Nvidia (Valuentum)

Concluding Thoughts

In this article, we’ve taken ownership of our prior article, where we drastically underestimated Nvidia’s long-term potential in AI. To be fair, though, we doubt the market, itself, was expecting such a big ramp in AI spending at that time. Our new fair value estimate for Nvidia Corporation includes much higher revenue and operating margin assumptions, resulting in considerably higher expectations of earnings and free cash flow growth. Our fair value estimate of Nvidia now stands at $606 per share, with the high end of our fair value estimate range coming in at $764. All told, Nvidia has humbled us quite a bit with its massive run, and we’re now constructive on shares.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson's household owns shares in HON, DIS, HAS, NKE, DIA, RSP, QQQ, VOO, and SCHG. Some of the securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies. This article and any links within are for informational and educational purposes only and should not be considered a solicitation to buy or sell any security. Valuentum is not responsible for any errors or omissions or for results obtained from the use of this article and accepts no liability for how readers may choose to utilize the content. Assumptions, opinions, and estimates are based on our judgment as of the date of the article and are subject to change without notice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.