Summary:

- The VICI management has proven to be highly competent, attributed to profitable growth trend, despite the challenging macroeconomic outlook.

- It is apparent that the REIT has also dipped its toes into multiple non-gaming properties as a way to diversify its risks, with certain sectors expected to underperform the downturn.

- The same trend has also been observed with multiple REITs, such as AMT into Data Center, IIPR into mixed-development/self-storage, and O into resort/gaming properties.

- Despite the ambitious acquisitions thus far, VICI remains highly capitalized with a robust balance sheet, implying the safety of its dividend growth ahead.

- With the Fed unlikely to further hike interest rates and some already speculating a Fed pivot as soon as Q1’24, we believe that the worst may very well be behind us.

MicroStockHub/iStock via Getty Images

We previously covered VICI Properties Inc. (NYSE:VICI) in September 2023, discussing its outperformance over the REIT sector median, with the excellent top and bottom lines triggering the consistently raised quarterly dividends thus far.

Combined with CPI-tied rental escalator and robust gaming portfolio, we had rated the stock as a Buy then, with the REIT sell-off triggering its discounted valuation.

In this article, we shall discuss why VICI’s diversification into non-gaming properties has been highly strategic, with it being an interesting trend observed in multiple REITs over the past few quarters.

We maintain our buy rating on the stock, thanks to its profitable growth trend, healthy balance sheet, and dual-pronged potential capital returns.

The REIT Diversification Is An Interesting Phenomenon To Observe

For now, VICI reported an excellent FQ3’23 earnings call, with overall revenues of $904.32M (+0.6% QoQ/+16.8% YoY), AFFO of $547.6M (+1.3% QoQ/+16.3% YoY), and AFFO per share of $0.54 (inline QoQ/+10.2% YoY).

It is apparent that the management’s diversification away from gaming properties since early 2022 has paid off extremely well, triggering the REIT’s well-rounded gaming and non-gaming portfolios.

Then again, it appears that diversification is a common trait recently observed with multiple REITs, with:

- American Tower (AMT), a REIT specializing in wireless and broadcast communications infrastructure, acquiring Data Center assets just in time for the Generative AI boom.

- Innovative Industrial Properties (IIPR), a REIT specializing in cannabis real estate, opting to convert part of its existing property to a mixed-use/self-storage development.

- Realty Income (O), a REIT specializing in single-tenant commercial properties, acquiring resort/gaming properties.

It is apparent that as the sell-off occurred in 2022 and early 2023, some REITs have been punished for being overly focused in certain sectors that struggle with the uncertain macroeconomic outlook.

Perhaps this is why we are seeing some rather unusual diversification occurring during this difficult period, at a time when the debt-laden business model is put to the test.

However, we are not overly concerned, since the Bowlero (BOWL) deal only comprises a rather small portion of VICI’s annual rental revenue at $31.6M, compared to its FY2022 revenues of $2.66B (+77.3% YoY) and its FQ3’23 annualized revenues of $3.61B (+0.6% QoQ/+16.8% YoY).

Most importantly, Bowlero is immediately accretive to the REIT’s AFFO, with the management already raising the FY2023 AFFO guidance range to $2.17B – $2.18B (+27.9% YoY at the midpoint) and AFFO per share guidance range to $2.14 – $2.15 (+11.1% YoY at the midpoint).

This is compared to the previous midpoint guidance of $2.135B (+25.5% YoY) and $2.115 (+9.5% YoY) offered in the FQ4’22 earnings call.

VICI’s rate of AFFO per share growth is impressive indeed, despite the dilutive nature of the REIT business model, with its share count growing by +48.29M to 1.01B shares over the past three quarters.

If anything, Bowlero has been decently profitable as well, implying its ability to service its obligations, especially after the sale-leaseback deal.

We also believe that VICI’s choice has been relatively prudent, given BOWL’s global leadership position in the revolutionized bowling alley market.

For example, BOWL has consistently delivered growth by acquiring independent bowling houses and chains during the pandemic, while also upscaling its “entertainment center” offerings through multiple marketing strategies.

The list includes arcade offerings, “black-light bowling with glow-in-the-dark balls,” upscale food/bar lists, and the pizza/beer pitcher specials, amongst others, naturally enhancing its experience proposition.

As a result, we believe that BOWL will be accretive to VICI’s increasingly family-friendly portfolio, building upon its previous investments in Great Wolf Resorts’ indoor water parks, Canyon Ranch’s destination health spa resorts, and Cabot’s golf resorts, amongst others.

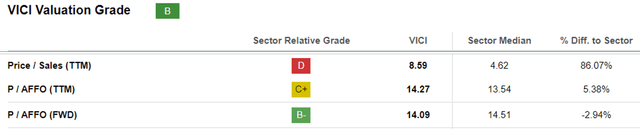

VICI Valuations

For now, VICI’s valuations appear to be fair, based on its TTM Price/Sales of 8.59x and FWD Price/AFFO of 14.09x, compared to its 1Y mean of 9.22x/14.82x, pre-pandemic mean of 9.39x/14.04x, and sector median of 4.62x/14.51x, respectively.

The Consensus Forward Estimates

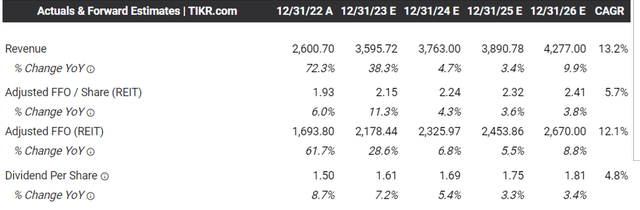

This is especially since the consensus forward estimates that VICI may deliver an excellent profitable growth trend at a CAGR of +13.2% and +5.7% through FY2026, compared to its historical CAGR of +30.5% and +7.8% between FY2018.

This is despite the potential impact of the cooling inflation, with all of its lease agreements coming with annual base rental escalations, which are subject to both CPI and/or asset value adjustments.

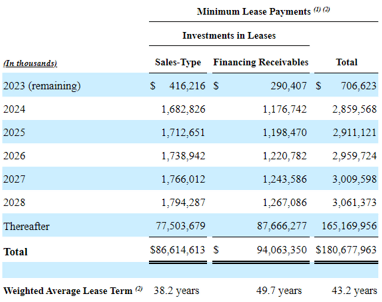

VICI Sales/Financing Receivables

Seeking Alpha

Perhaps this is attributed to VICI’s long-term lease agreements, with a weighted average term of 43.2 years, almost guaranteeing its top/bottom line prospects barring any extenuating events.

Despite its growing long-term debts to $16.69B (inline QoQ/+21.5% YoY) and annualized interest expenses of $819.72M (inline QoQ/+21% YoY), there is no real impact to its profitability metrics, attributed to the excellent Dividend Coverage Ratio of 4.10x and AFFO Payout Ratio of 74.76%.

This is compared to the REIT sector median of 1.77x and 74.55%, respectively, implying that the management continues to execute a well-balanced growth while maintaining a healthy balance sheet.

As a result, it is unsurprising that VICI’s dividend investment thesis continues to be robust, with the Seeking Alpha Quant rewarding the stock with a B+ Dividend Safety Grade.

So, Is VICI Stock A Buy, Sell, Or Hold?

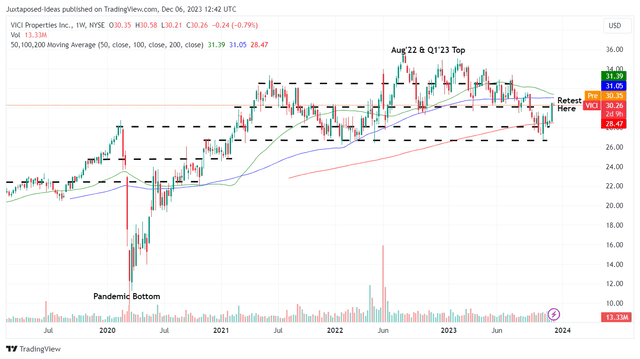

VICI 5Y Stock Price

We also believe that VICI is currently fairly valued to our estimate of $30.22, based on the management’s FY2023 AFFO per share guidance of $2.145 and its FWD Price/AFFO valuation of 14.09x. Based on the consensus FY2026 AFFO per share estimates of $2.41, the stock may also enjoy a moderate upside to $33.90.

Combined with its excellent forward dividend yield of 5.49% at FQ3’23 annualized dividends of $1.66 (expected to expand at a CAGR of +4.8% through FY2026 to $1.81), it appears that the stock offers a relatively attractive dual-pronged capital returns in the long-term, despite the +13.6% recovery from the October 2023 bottom.

As a result of the attractive risk/reward ratio, we continue to rate the VICI stock as a Buy. This rating does not come with a specific entry point, since it depends on an individual investor’s dollar cost average and risk appetite.

However, with the Fed unlikely to further hike interest rates and some already speculating a Fed pivot as soon as Q1’24, we believe that the worst may very well be behind us.

Investors may continue to moderate at any dips for an improved margin of safety.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.