Summary:

- Acadia’s Daybue, treating Rett syndrome, shows strong market entry with sales of $90.1 million in the first six months, indicating significant market potential.

- Acadia’s financials are robust with rising net product sales and a strong current ratio, but increasing operating expenses and net losses.

- Market confidence in Acadia is moderate, with high institutional ownership and insider buying, but mixed stock momentum.

- Recommend “Buy” for Acadia due to Daybue’s market potential, despite the need for careful financial management and market monitoring.

Gloria Parker

At a Glance

Reflecting on my previous assessment of Acadia Pharmaceuticals (NASDAQ:ACAD), where I changed my stance from “Hold” to “Buy,” the company’s progression, particularly with Daybue for Rett syndrome, remains intriguing. Daybue’s impressive Q3 sales of $66.9M, building upon the $23.2M in Q2, highlight its market promise in a specialized area. Despite a limited patient base, growing confidence is evident through analyst upgrades and optimistic sales forecasts. Acadia’s recent increased spending on milestones and operational costs for Daybue’s launch, along with its expanded partnership with Neuren Pharmaceuticals, showcases a deep commitment to the neurological sector. Financially, Acadia stands strong with a substantial cash reserve, yet the imperative for judicious capital management to balance investments and operational expenses is more crucial than ever.

Daybue’s Strong Market Entry

Acadia’s Daybue, the first FDA-approved oral treatment for Rett syndrome, marks a milestone in rare neurological disorders. Rett syndrome, predominantly affecting females, causes severe impairments, and the lack of alternative treatments creates a significant market opportunity for Daybue. Despite the small patient population, the unmet need in this sector allows for potential premium pricing. Daybue’s sales of $90.1M in the first six months post-launch underscore its success in this niche market.

Mizuho Securities’ upgrade of Acadia to “Buy” and their raised sales forecast for Daybue to around $1.1B by 2030 reflects confidence in the drug’s market potential. As of September 30, 2023, 800 patients were on Daybue treatment (slide 6), with 81% retention four months after initiation, supporting Mizuho’s positive outlook. Daybue’s orphan exclusivity (March 2030) as the only FDA-approved treatment for Rett syndrome, combined with strategic licensing expansions, points to sustained growth prospects.

However, the financial journey for Daybue is complex. Acadia’s substantial investment in its launch included a $40M milestone payment to Neuren and significant development, marketing, and commercialization costs. These investments led to increased R&D and SG&A expenses, vital for Daybue’s market entry and penetration.

Acadia’s expansion of its licensing agreement with Neuren, securing global rights for Daybue with an upfront payment of $100M, signals a long-term investment in this therapy and the broader neurological disorder field. This move demonstrates Acadia’s belief in Daybue’s market viability and its strategic importance to the company’s portfolio.

In summary, Daybue’s performance and market potential are a testament to Acadia’s strategy of meeting a high unmet medical need and executing effective commercialization. Despite financial challenges, Acadia’s focused investment in Daybue’s development and launch highlights its commitment to a niche but vital therapeutic area. The continued dedication to Daybue and the expansion of licensing agreements underline Acadia’s intention to cement its position in the market for rare neurological disorders.

Q3 Earnings

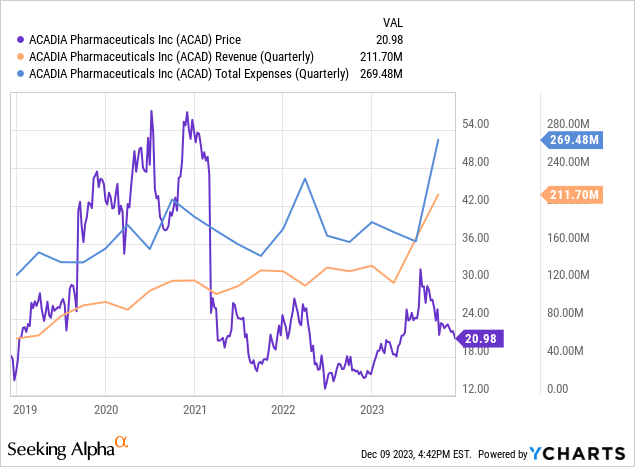

Looking at Acadia’s most recent earnings report, there’s a notable increase in net product sales, rising to $211.7M in Q3 2023 from $130.7M in Q3 2022. This growth is driven by sales of Daybue and Nuplazid, contributing $66.9M and $144.8M, respectively. However, operating expenses escalated significantly to $269.5M from $161.6M, primarily due to increased research and development costs. This led to a net loss of $65.2M, a substantial increase from the previous year’s $27.2M. Share dilution appears minimal, with only a slight increase in weighted average common shares from 161.9M to 164.2M.

Financial Health

Turning to Acadia’s balance sheet, the combined value of ‘cash and cash equivalents’ and ‘marketable securities’ as of September 30, 2023, is approximately $346M ($98.2M in cash and cash equivalents and $247.7M in investment securities). The current ratio, calculated as total current assets divided by total current liabilities, is approximately 2.38 ($499.2M in current assets against $209.6M in current liabilities), indicating a solid ability to cover short-term obligations. When comparing assets to debts, it’s noteworthy that total liabilities amount to $270.4M, suggesting a comfortable asset to liability ratio.

Regarding the monthly cash burn, Acadia reported a net cash used in operating activities of $68.7M over nine months, averaging about $7.6M per month. As operating net cash flow is negative, the cash runway can be estimated by dividing the liquid assets ($346M) by the monthly cash burn, resulting in approximately 45 months of runway. However, these values and estimates are based on past data and may not be indicative of future performance.

Given the substantial cash runway and current financial resources, the odds of Acadia requiring additional financing within the next twelve months seem low. However, this outlook could change based on the company’s operational efficiency and market dynamics.

In conclusion, Acadia’s short-term financial health is robust, supported by a strong current ratio and sufficient liquid assets to cover short-term obligations. The long-term financial health also appears robust, considering the substantial cash runway and manageable debt levels.

Market Sentiment

According to Seeking Alpha data, Acadia holds a market capitalization of $3.44B, reflecting moderate market confidence aligned with its specialized focus in neurological disorders. The growth prospects appear strong, with projected revenue growth from $719.82M in 2023 to $1.17B by 2025, indicating positive market expectations. However, the stock’s momentum is mixed, underperforming the SPY in most timeframes, except for a one-year period.

Short interest is notable at 7.14% with 7.79 million shares short, suggesting some bearish sentiment. Institutional ownership is high at 96.42%, with significant movements such as RTW Investments increasing their stake notably. Insider trades reveal a positive net activity over the past twelve months, with a net buy of 565,258 shares, showing insider confidence in the company’s prospects.

Overall, considering the market capitalization, growth prospects, stock momentum, short interest, institutional ownership dynamics, and insider trading patterns, Acadia’s market sentiment can be qualified as “Adequate.”

My Analysis & Recommendation

In conclusion, Acadia’s Daybue stands out as a significant development in treating Rett syndrome, an area previously lacking effective therapies. Its strong early market performance, reflected in notable sales and patient retention, suggests its potential to become a major therapy. Daybue’s unique market position and Acadia’s strategic initiatives paint it as an attractive investment prospect.

Investors, however, should be wary of Acadia’s increased operational costs. The substantial expenses in research, development, and marketing have led to increased net losses, necessitating a delicate balance between growth and cost management. For risk mitigation, a long-term investment perspective is advisable, recognizing that Daybue’s full market potential might take time to unfold. Diversification within the biotech sector and close monitoring of Acadia’s operational efficiency and cash burn are also prudent strategies. Additionally, staying informed about market and regulatory changes is key, given their potential impact on Acadia and Daybue’s market progression.

Given these considerations and Daybue’s promising role as a novel treatment in a specialized market, a “Buy” recommendation for Acadia remains justified. The company’s strong pipeline and focus on neurological disorders, coupled with Daybue’s potential, offer a compelling investment opportunity in the biotech sector. However, careful monitoring of the company’s financial management and market developments is crucial for informed investment decisions.

Risks to Thesis

In reassessing my “Buy” recommendation for Acadia, it’s important to scrutinize aspects that may have been overlooked or underestimated. Firstly, while Daybue’s sales performance is impressive, the sustainability of this momentum in the context of a small patient population for Rett syndrome is uncertain. The potential market size could be overestimated, especially considering the variability in disease prevalence and diagnosis rates. Additionally, side effects, like diarrhea, may limit its uptake.

Secondly, Acadia’s increased operational expenses, including milestone payments and marketing costs for Daybue, raise concerns about the company’s long-term profitability. While current sales are strong, the high R&D and SG&A expenses could outpace revenue growth, particularly if sales plateau.

Moreover, the optimistic sales forecast by analysts like Mizuho may be subject to confirmation bias, where positive developments are overemphasized. It’s crucial to maintain a critical perspective on such forecasts, acknowledging the inherent uncertainties in the biotech sector.

Another critical risk factor for Acadia is the impending patent expiry for Nuplazid in 2027. Nuplazid’s loss of patent protection exposes it to generic competition, which could substantially reduce its market share and revenue. This scenario is particularly concerning given Nuplazid’s significant contribution to Acadia’s current revenue stream.

Finally, the broader market dynamics, including shifts in healthcare policies, market sentiment towards biotech stocks, and economic factors, could impact Acadia’s performance. These external factors, often underemphasized in company-specific analyses, can significantly influence investor confidence and stock performance.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article aims to offer informational content and is not meant to be a comprehensive analysis of the company. It should not be interpreted as personalized investment advice with regard to "Buy/Sell/Hold/Short/Long" recommendations. The predictions and opinions expressed herein about clinical, regulatory, and market outcomes are those of the author and are rooted in probabilities rather than certainties. While efforts are made to ensure the accuracy of the information, there might be inadvertent errors. Therefore, readers are encouraged to independently verify the information. Investing in biotech comes with inherent volatility, risk, and speculation. Before making any investment decisions, readers should undertake their own research and evaluate their financial position. The author disclaims any liability for financial losses stemming from the use or reliance on the content of this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.