Summary:

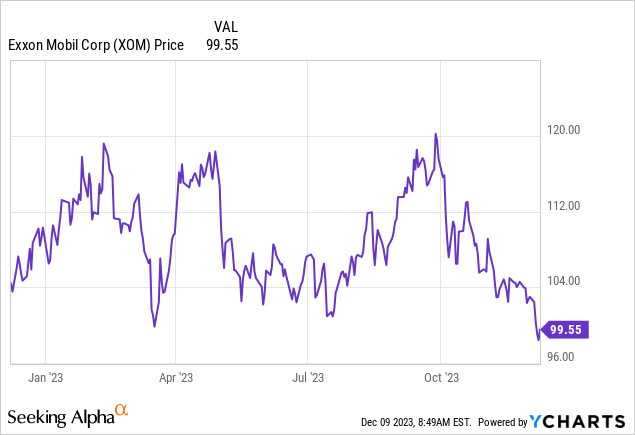

- Oil price weakness and the Guyana geopolitical concerns have pushed Exxon under $100 for the first time in over a year.

- Maduro’s “annexation” of 2/3 of Guyana’s territory is likely an empty threat meant for domestic political consumption and the oil traders have completely ignored the news.

- Equity investors should do so too and consider taking advantage of favorable entry point.

- The biggest short-term risk in my view would be how the market would react to another acquisition, for example of a large private.

Joe Raedle/Getty Images News

Note: The last closing price was $99.55 when the article was submitted to Seeking Alpha.

Exxon Mobil (NYSE:XOM) made new 52-week lows, following its peer Chevron (CVX), and is in the red now for the past year:

The headwinds have been the market’s negative reaction to the Pioneer (PXD) acquisition, the weakness in oil prices (CL1:COM) which touched again the high $60s, and now even the geopolitical trouble surrounding Guyana:

According to the linked article:

[Venezuela’s President Maduro] told a crowd of government officials and supporters that he would create the Venezuelan state Guyana Esequiba, grant Venezuelan citizenship to its Guyanese residents, license the state oil company PDVSA and state metal conglomerate CVG to search it for oil and order energy companies currently there, including Houston-based ExxonMobil, to leave in three months.

The Guyana news has finally opened up some opportunity by taking Exxon below the $100 level I previously wrote about so I am updating my view from “hold” to “buy”.

Should Exxon investors worry about Maduro’s annexation plans for Guyana?

The short answer is no. I see Maduro’s actions as diversion from his domestic political troubles as he is trying to cling onto power. Venezuela’s courts, likely under Maduro pressure, suspended recently the opposition’s presidential primary, which was part of the deal with the Biden Administration in exchange for the U.S. rolling back some its sanctions.

This probably signals that Maduro doesn’t feel comfortable with the general election, even with his regime possibly being able to influence the results. So bringing out an old territorial dispute now looks more like a play at some “rally around the flag” effect rather than a serious intention to wrestle from Guyana the oil-rich Essequibo.

Even if Maduro wants to escalate militarily, none of the big forces that constrain his capacity to act appear to be in favor:

- For the U.S., that would be a no-go. The Biden Administration has been making nice with Maduro to get more barrels on the market and keep in check the inflation problem in the U.S. Biden is ignoring for now Maduro already reneging on the election deal, but a Saddam Hussein style cross-border invasion won’t leave the U.S administration with many options.

- The regional actors who may counterbalance the U.S. are also against Maduro on this issue. The Organization of American States already called out as illegitimate Maduro’s referendum where Venezuelans allegedly supported the annexation of the neighboring territory.

- Brazil’s “leftist” Lula also made it clear he wants no war in the region and it’s been reported Brazil has mobilized troops along its borders with Venezuela and Guyana.

- Lastly, China, which has been the main buyer of Venezuelan crude oil, also has a 25% interest in the Stabroek block where it partners with Exxon and Hess (HES). It seems unlikely Venezuela will make a move against Chinese interests.

While Guyana has not yet been exporting huge amounts of oil – approximately 340,000 bpd for the first half of 2023 – Venezuela itself has been shipping out about 700,000 bpd. So a military conflict could potentially affect 1 million barrels daily. Yet, in contrast to the Israel-Gaza conflict where no oil exports were affected, this time oil prices haven’t moved at all on to the news. This tells me that the oil traders also see zero possibility of any meaningful escalation.

The recent oil price weakness doesn’t change the long-term thesis

The front-month oil contract has been testing the lows from April and June:

Yet, if we look at a long-dated 5-year contract, it is holding up much better:

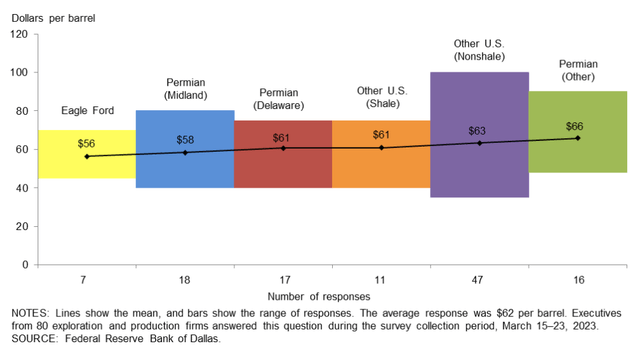

The Dallas Fed Survey from earlier this year reported breakevens as high as $66 for the Permian:

Things have likely not improved since Q1 given inflation and E&Ps prioritizing their highest yielding prospects first.

In my view, it has also become quite clear lately that oil prices are weak not on recession fears (i.e., too little demand) but rather on the unexpected production increases, particularly from U.S. shale (too much supply).

Drilling further into the shale production growth story, some of it may have to do with the EIA methodology changes that have been widely discussed in the public space. However, the EIA debate matters just for the optics – did 2023 production surpass the prior highs or were the prior highs understated. This may help scale future expectations but none of it affects the actual barrels put on the market today.

There have also been efficiency gains as I have pointed out in my oilfield services coverage, but a big part of it is likely the surge in private companies’ production. Apparently, just 9 privates added 400,000 bpd relative to 2019 levels. The speculation is that some of these companies are looking for potential buyers and are “goosing up” production to enter the deal negotiations with better numbers. This latter trend is probably not a sustained factor to worry about.

So long story short, $70 oil looks to be something of a floor nowadays, insofar the marginal global barrel still comes from U.S. shale. While oil prices have fallen, Exxon was still being valued at $70 oil last year, not at $100. So there is no reason for the valuation do go down now either, and we have to some extent seen that. Exxon has been in a $100-$120 range despite front-month oil varying in a broader $65-$120 band.

Valuation and risks

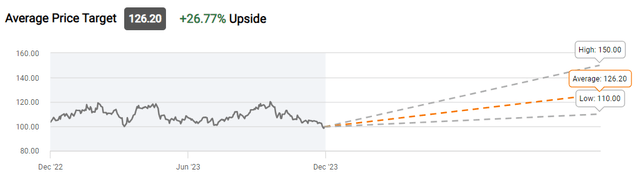

I estimated in my prior article a broad valuation range of $100 to $130 from a dividend perspective, but here I want to look at the prices targets from professional analysts. The average Wall Street target reported by Seeking Alpha is now about $126:

One of the latest calls was $127 from JPMorgan Chase. Based on consensus estimates, the estimated FCF yield on market cap for 2023 and 2024 appears to be 14.1% and 14.7%, respectively. This also suggests some room for multiple expansion if you have a 10% cost of equity in mind.

On the risks side, instead of the usual cliche about oil prices going lower, I want to point out something else. Seeking Alpha reported on Friday that one of the large private producers in the Permian, Endeavor Energy, was exploring a potential sale. Among the potential bidders, the article mentioned Exxon, Chevron and Conoco (COP). This, by the way, also relates to my point that some of the current weakness due to U.S. overproduction may indeed be because private operators are pumping up their numbers ahead of selling out.

Returning to the risk aspect, I don’t know enough to comment on merits of an Endeavor deal from Exxon’s perspective, but even if the deal is a good one, I am afraid the market would react negatively in the short term. We saw what happened after Pioneer was announced as well as what the Hess impact was on Chevron’ stock. Management of course have to think long-term, but from an entry point perspective another major announcement is probably something you could worry about.

Bottom line

Maduro’s territorial claims to Guyana may have finally pushed Exxon below $100, which is my buying zone for the stock. Given my take on the geopolitical concerns as vastly overstated, I am upgrading my rating from “hold” to “buy”.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of XOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

My articles, blog posts, and comments on this platform do not constitute investment recommendations, but rather express my personal opinions and are for informational purposes only. I am not a registered investment advisor and none of my writings should be considered as investment advice. While I do my best to ensure I present correct factual information, I cannot guarantee that my articles or posts are error-free. You should perform your own due diligence before acting upon any information contained therein.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.