Summary:

- Airbnb has recovered remarkably from its October 2023 lows, in line with the broad market recovery.

- The company is ready to embark on its global expansion phase as it looks to disrupt the legacy players as it invests to gain market share.

- Airbnb is well-positioned to capitalize on its network effect moat and has strong demand dynamics from value-seeking travelers.

- I argue why, while ABNB is priced at a premium, the market remains confident about its execution prowess, underpinned by robust profitability.

- My previous caution on ABNB panned out as it bottomed out in October. However, it looks poised to continue grinding higher from here, as its growth is “at an inflection point.”

Klaus Vedfelt

I updated Airbnb, Inc. (NASDAQ:ABNB) investors in early September, explaining that ABNB’s recovery seems robust, although the market had likely priced in its entry into the S&P 500 (SPX) (SPY). As a result, I urged investors to consider waiting for a steep pullback before considering the appropriate levels to add exposure.

That thesis played out as ABNB fell together with the broad market after topping out in mid-September, declining more than 25% before forming its October 2023 lows. Accordingly, astute dip buyers returned with conviction, given ABNB’s much-improved risk/reward profile, underpinning its prevailing medium-term uptrend.

I’ve already turned more constructive on ABNB since February 2023 when I assigned it a Sell rating, which panned out as ABNB then fell to its May lows. However, I also indicated in my September update that “bearish views on ABNB are no longer defensible, as buying sentiments point to an impending recovery.”

The company’s third-quarter or FQ3 earnings release in early November corroborated my conviction that it is on its way to a long-term cyclical recovery. In addition, the industry’s cyclical tailwinds are expected to drive growth further after digesting the surge from its summer travel season.

I have confidence that Airbnb is uniquely positioned to capitalize on its network effect moat, underpinned by the robust supply growth from individual hosts. In addition, management underscored that it has continued to observe strong demand dynamics from travelers seeking to capitalize on Airbnb’s value proposition. As a result, families looking for an affordable stay find the company’s offerings appealing, even though it “caters to a diverse range of travelers.”

Interestingly, management highlighted that the evolution of its average daily rate or ADR is expected to remain “more moderated compared to hotels, which are expected to continue increasing prices.” Therefore, Airbnb should continue to find value-seeking travelers looking to mitigate the impact of increased macroeconomic uncertainties and high inflation rates. The company has also enhanced its pricing tools to help its hosts have more control over their prices and potentially stimulate demand. Management indicated that “higher ADR tends to result in lower night growth, while lower ADR leads to higher night growth.” As a result, I believe investors shouldn’t expect a significant growth inflection in its ADR as Airbnb looks toward gaining market share in its next expansion phase.

Observant investors should know that Airbnb elevated its CFO, Dave Stephenson, to Chief Business Officer. CEO Brian Chesky stressed that Airbnb “is at an inflection point, having focused on perfecting its core service in 2023 and now being prepared to move forward.” The company was pretty clear about what “expand beyond the core” means when it updated investors in its Q3 shareholder letter. It highlighted its focus “on international expansion and building differentiated offerings.” In addition, management also indicated that Airbnb remains “under-penetrated in international markets,” as it saw robust results in Germany, Brazil, and Korea. Notably, Airbnb accentuated that in Korea, Airbnb posted a 54% increase in gross nights booked in Q3 compared to the same period in 2019.

Airbnb is expected to deliver an adjusted EBITDA margin of 36% for FY23. In addition, ABNB is expected to post a free cash flow or FCF margin of more than 44% this year. As a result, I concur with Chesky that the company should capitalize on its robust profitability to take on the legacy OTAs and hotel operators in international markets in this next growth phase, having validated its business model impressively in the US.

However, regulatory challenges would likely remain the main hindrance over a more aggressive global expansion phase. Therefore, hotel operators could trigger a more intense pushback against Airbnb. Stephenson’s appointment is expected to be pivotal as the company embarks on what could be a more intense investment phase, having guided Airbnb’s remarkable profitability inflection from its pandemic challenges. Notwithstanding the caution, management accentuated that “80% of their top 200 markets have regulations in place.” As a result, management is optimistic about “workable solutions for home sharing, supporting Airbnb’s growth.” Still, I believe regulatory challenges in international markets are expected to be a key growth impediment that investors must watch closely, as ABNB is priced at a premium.

ABNB last traded at a forward EBITDA multiple of 20.8x, well above its hospitality peers’ median of 12.1x (according to S&P Cap IQ data). As a result, the market continues to reflect a discernible growth premium on ABNB to maintain its growth profile.

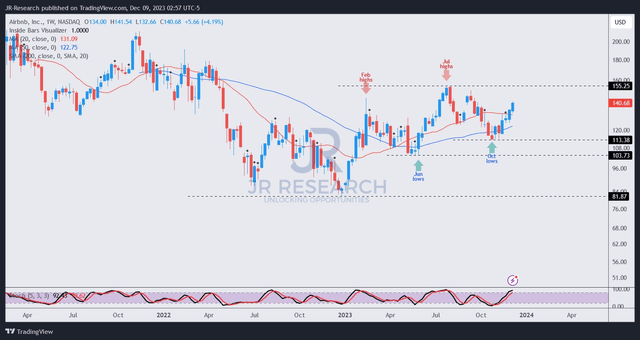

ABNB price chart (weekly) (TradingView)

ABNB’s price action is constructive, with dip-buyers returning to defend its October low ($113 level) aggressively. As a result, ABNB has maintained its uptrend bias, suggesting we could break above its July 2023 high ($155 level) to validate its uptrend continuation.

Notwithstanding my optimism, I must highlight that ABNB’s buy level is no longer in the optimal buy zone if investors didn’t manage to capitalize on the steep selloff to mark its October low.

Despite that, I’m increasingly confident that buying sentiments on ABNB remain constructive, suggesting the recovery in its uptrend is still in the earlier stages. As a result, ABNB holders looking to add more shares should consider taking advantage of potential near-term pullbacks to buy more aggressively.

Rating: Upgraded to Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!