Summary:

- Lucid Motors is losing hundreds of thousands of dollars for each vehicle delivered.

- Whilst the company holds significant near-term liquidity, free cash burn is material and could ramp up next year as the Gravity SUV goes into production.

- The Saudi PIF might not provide the liquidity the company needs, leaving Lucid to maintain the dilution of its shareholders to raise funds needed to extend its cash runway.

Khosrork

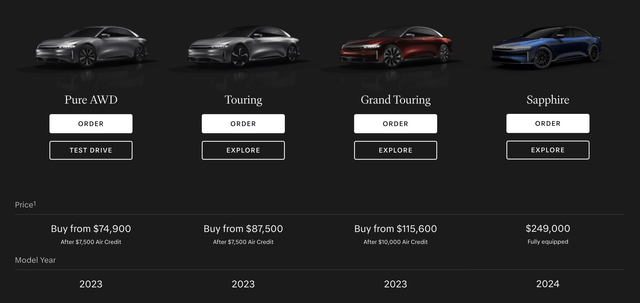

Lucid (NASDAQ:LCID) makes beautiful but expensive vehicles. Its Air Touring model retails from $87,500 and its Grand Touring model goes from $115,600. The cheapest model you can snag is the Air Pure RWD which is currently on sale from $74,900. These prices are after the $7,500 air credits Lucid is providing for its electric vehicles as it did not qualify for the 2022 Inflation Reduction Act subsidies. The Act excludes subsidies to EVs with batteries that contain minerals and materials sourced from countries the US deems foreign entities of concern. Lucid’s vehicles are designed in California and manufactured at its factory in Casa Grande, Arizona but likely source a substantial amount of their internal battery metals from a foreign entity of concern. The new IRA tax credit rules are somewhat brutal and hand a strong competitive advantage to fully domestic EV manufacturers. Popular EV brands like Ford’s (F) Mustang Mach-E EVs, which sold 35,908 vehicles in the first 11 months of this year, are set to fail qualification.

Lucid Motors

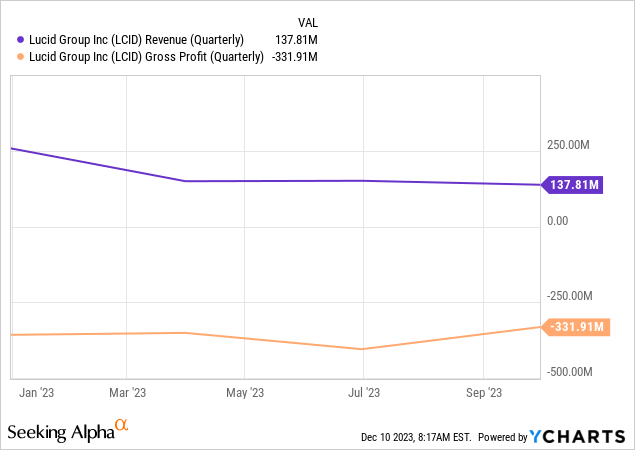

Lucid delivered 1,457 vehicles during its recent fiscal 2023 third quarter for revenue of $137.8 million, down roughly 30% from $195.5 million in the year-ago comp. The company has had to push through discounting this year to boost sales with the most recent limited time discounting instituted in November, just three months after its discounted prices due to lackluster demand. Lucid has also introduced a referral program for current Lucid Air owners that provides new vehicle purchase discounts to friends and family.

The situation for Lucid is not great with negative gross margins, high operating losses, and free cash burn driving what’s been a 23% decline of the common shares year-to-date. Critically, Lucid could find itself stuck in a scenario where its high performance cars simply don’t have significant and sustained market demand for brand fit. Third-quarter discounting in August was paired with what was a $6.4 million increase in sales and marketing expenses. The danger for bulls here is that Lucid continues to operate in this loss-making zone for the indefinite future, unable to meaningfully expand its orders to the scale required for more material efficiencies.

Gross Margins And Free Cash Burn Provide Reasons For Pause

I last covered Lucid last year in October to flag the promise of the EV rush in building a low-carbon architecture for passenger transport in the US and around the world. US EV sales during the recent third quarter were 313,086, a volume record and growth of 50% over its year-ago comp. Critically, US sales have surpassed one million units in a single year for the first time, a critical milestone that underlies the coming ramp in demand for these vehicles despite headwinds from higher interest rates, inflation, and the specter of a recession. The IRA set a goal of making half of all new cars sold in the US fully electric by 2030, roughly 7 million EV sales a year against current sales figures.

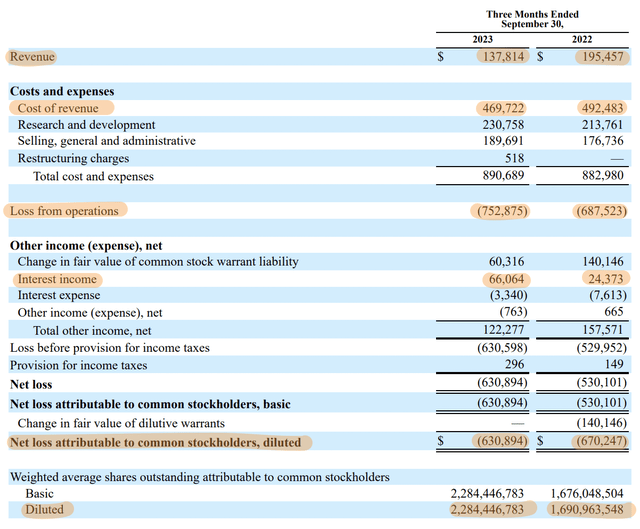

Lucid’s gross profit was negative at $331.91 million, a sequential improvement from a negative gross profit of $404.9 million in the second quarter but still an 11.7% deterioration over its year-ago comp. The struggling automaker is losing roughly $227,800 per car delivered. To place this roughly in context, Lucid would have to double the price of its Grand Touring and jack up the price of its other models just to break even on gross profit before other operating expenses. This is not sustainable with the vehicles already so pricey and the company leaning on discounting to boost orders. Lucid also operates a direct-to-consumer model with a network of 45 studio and service centers dotted around the world including Saudi Arabia, Canada, and the Netherlands.

Lucid Fiscal 2023 Third Quarter Form 10-Q

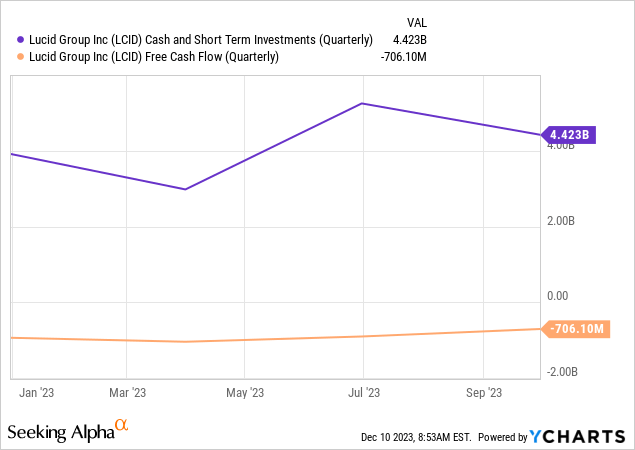

Losses from operations were $752.88 million, with interest income from a substantial $4.9 billion total cash and short and long-term investments at the end of the third quarter providing a salvo. Net loss for the period was $630 million, an improvement of $40 million from the year-ago comp. Free cash burn for the period came in at $706 million, continuing a trend of sequential cash burn improvement but still around $2.8 billion annualized.

Saudi PIF Involvement Does Not Mean A Lender Of Last Resort

Lucid’s current liquidity, excluding $480 million in long-term investments, provides a decent cash runway against its current free cash burn profile. Total debt that stood at just over $2 billion is also made up of cheap 1.25% convertible senior notes due in December 2026 and issued just before the Fed started hiking interest rates in December 2021. The $800 billion Saudi Public Investment Fund has been highlighted as a critical backstop for Lucid with the PIF owning a 60% stake in the company. However, this backstop is not guaranteed with the PIF already papering over a substantial capital loss from Lucid’s highs. Saudi Arabia was tapping the international debt market as recently as October due to deficit spending on the back of its voluntary oil output cut of one million barrels per day until the end of March 2024. This deficit amounts to 2% of gross domestic product this year, versus an earlier projected surplus. Lucid will need more funds with current liquidity not sufficient for the type of cash runway a company of its size requires.

Any capitalization effort for Lucid would have to be substantial with the EV upstart set to burn through at least half of its current cash and equivalents over the next four quarters. This is as Lucid pushed through a substantial 35% increase in its diluted weighted average shares outstanding to 2,284,446,783. The company is also set to begin the manufacturing of its Lucid Gravity SUV next year which will see cash burn likely ramp higher. Critically, Lucid faces an incredibly tough task to invert its negative gross margins and substantial operating losses. An investment in common shares is far too speculative with a still developing brand awareness set to form a headwind to material sales expansion for a while.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.